All too often, we write a story about a company, the company does well, stock goes up, people make money and then we move on without celebrating our wins. Today I figured it was worth going the other way and doing a ‘success forensic,’ because when you manage to pick an 8-bagger, it makes sense to learn how it happened.

Arizona Metals (AMC.V), a gold explorer anchored in the US, is a massive win.

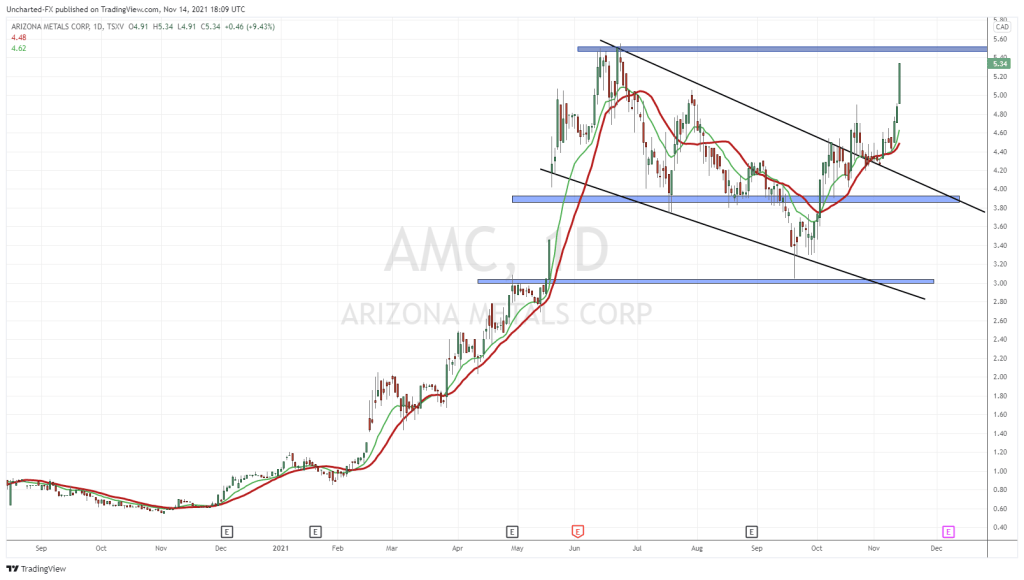

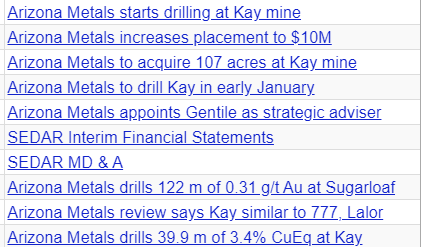

Check it out.

That’s a beauty.

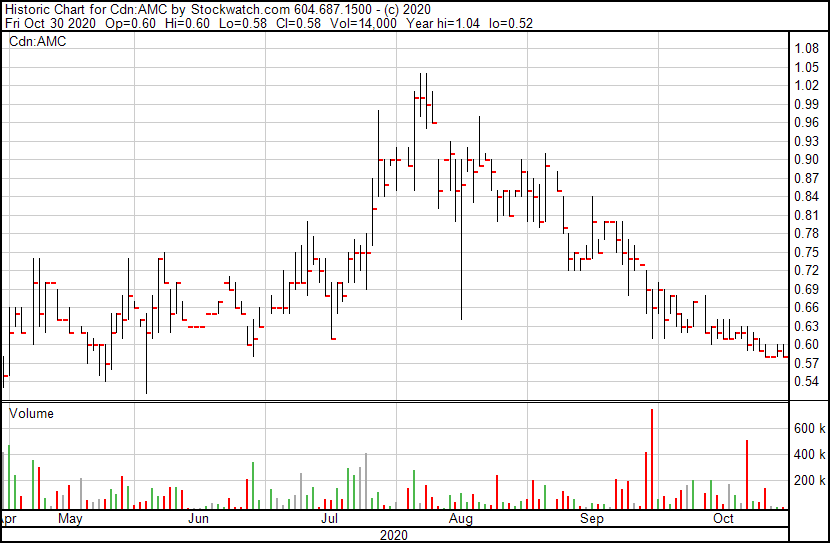

But when we first told you about it, it was not a beauty at all. Things were on a knife edge.

Our Greg Nolan first unearthed the Arizona Metals story, back when it was headed downward, nearly halving inside two months. Greg liked the outlook but the company had it all to do.

In a long, detailed, technical-heavy analysis piece, Nolan focused on three things:

- The people – the AMC team had runs on the board

- The property – surrounded by interesting projects, there was much to like

- The potential – if all came together as planned, there would be massive upside

His conclusion in that debut piece:

The company’s recent success with the drill bit is geological sleuthing at its very best.

The two geophysical anomalies at the Kay Mine project, should the company hit during the upcoming drilling campaign, could really move the needle for this play.

The goal at the Kay Mine project is achieving scale. If the company can delineate, say, 20-plus million tonnes of Au-Cu rich material… this could turn into a serious home run for the company, and its shareholders.

With the roadmap and credentials established, it was now up to the Arizona Metals team to achieve what they said they would achieve.

A month later, another piece of the puzzle dropped.

SRK’s review concluded that there is sufficient evidence from historic records and recent exploration drilling and structural geological mapping by Arizona Metals to conclude that “the Kay Mine has similar metallurgical characteristics and similar grades to the likes of Hudbay’s 777 and Lalor Mines, and Glencore’s Kidd Creek Mine”.

Similar style as other successes, and similar ground too:

“This particular region played host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of the Kay Mine Project.”

Closeology is no guarantee of success, but it sure as hell doesn’t hurt to be digging near others who have achieved success in their digging.

Nolan had set the table by exposing audiences to AMC’s potential, now it was up to the company to show it was serious about unearthing that potential. Boy howdy, did they.

In short: Drill, baby, drill.

In mineral exploration, there are three ways a drill program can go.

- You can hit paydirt, in which you’ll have no trouble raising more money and drilling more in expectation of more great results.

- You can miss entirely, in which case you quietly sublet the office, put the office furniture on craigslist, and the next time anyone sees a news release from the company it says something like ‘delisted for not filing financials..’

- Or you can kinda hit. You get a little of what you want but not enough, just enough maybe to go get a little less money than last time in your next financing, and take another shot at it. This can repeat a few times before you’re down to raising 5-digit-dollar amounts and guilting insiders into showing their continued faith by begrudgingly cutting more cheques.

By far, the worst result is the third result because a slow death is many times worse than a sudden death.

Arizona Metals has managed to fire off good results on the regular, and by January was raising an eight-digit amount to ramp things up.

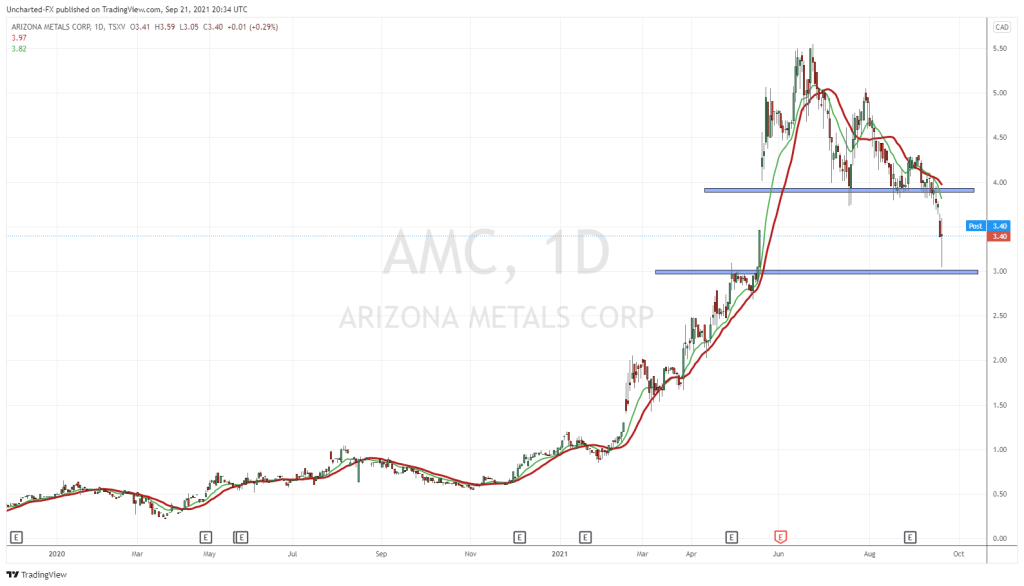

and while that was reflected in a stronger stock price (the company had reclaimed the stock price that had halved a few month earlier), it was still a LONG way from the promised land.

At this point, some folks may have figured they’d missed the run. But that’s small time thinking. There was still a lot of room to move, and move it did.

So what happened to take AMC from a credible high in January to an incredible high today?

“The acquisition of the Property is another significant de-risking step in moving the Kay Mine closer to a production decision,” stated Marc Pais, CEO of Arizona Metals, “Including the 71 acres of patented land that host our Kay Mine deposit, this acquisition will increase our total holdings of patented land to 178 acres”.

This VMS district is credited with roughly 4 billion pounds of copper production over its century-long run. Grades typically ran 3.5%. [AMC has a rich dose of copper, alongside the gold]

PHASE II DRILLING BEGINS:

“We are pleased to have commenced the Phase 2 drill program, which we believe has the potential to significantly expand the scope and scale of the Kay project, well beyond the boundaries of the 5.8 million tonne historic estimate* outlined by Exxon Minerals in 1982. Our successful Phase 1 drill program greatly increased our confidence in the model. Drilling encountered massive sulphides in 19 of 20 holes.”

By April, AMC was not just ramping up drilling, but having money shoved at it at a furious rate by people in the know who control enough capital to seriously move stock prices.

A $5m raise quickly oversubscribed and shot to $10m, and was followed by a $15m at double the price of the previous raise that, before it could be closed, had moved up to $21m. The $3 warrant attached to that has since been blown right by, meaning the company has brought in millions more in cash since.

https://equity.guru/2021/04/06/arizona-metals-amc-v-upsizes-significant-bought-deal-pp-within-hours-of-announcement-triples-the-size-of-kay-mine-project-drill-program-to-75000-meters/

Bonkers.

At this point, some would look at the stock chart and think, well, it’s tripled in value in six months.. what possible reason could I have to get in now, when all the value has been had?

Oh honey.

From $0.60 to $2.70 is a good run, but what do you think the company was going to do with all that money if not build more value?

Arizona Metals Corp. has discovered a new gold-rich zone of open-ended mineralization at the Kay mine, in an area previously untested by historic drilling or exploration. In addition, all seven recently completed holes at the Kay mine project in Yavapai county, Arizona, intersected massive sulphide mineralization.

That’d be what caused the massive price jump from $3 to $4.80 in a single week.

The stock touched $5.60 before settling a little in typical summer fashion to $4.80, a price where just about everyone associated with the company can say, “I’m on a big win here.”

AMC still has plenty to do. If the intention is to build a producing mine or two, they’re on their way, but more drilling and discovering and executing will certainly put more upward pressure on that stock price.

You may have missed it at $0.60 when we first mentioned it. You may not have been so into resources when it for to a double. You may not have been convinced there was room to run when it hit a triple.

It’s an 8-bagger now. Convinced yet?

— Chris Parry

FULL DISCLOSURE: Arizona Metals is an Equity.Guru marketing client, and we own stock in the company