On June 14, 2021 Globex Mining (GMX.T) agreed to sell its Francoeur/Arntfield/Lac Fortune gold property to Yamana Gold for +$15 million.

This sale does not leave Globex’s cupboard bare.

GMX is so pregnant with inventory – the asset could’ve evaporated overnight without most shareholders realising it was gone.

“With a total of 192 properties in the Globex project pipeline, 96 of which are prospective for precious metals, 60 for base and polymetallic metals, 36 for specialty metal metals (lithium, manganese, scandium, etc), there’s a lot of potential to incubate here,” wrote Equity Guru’s Greg Nolan on April 1, 2021.

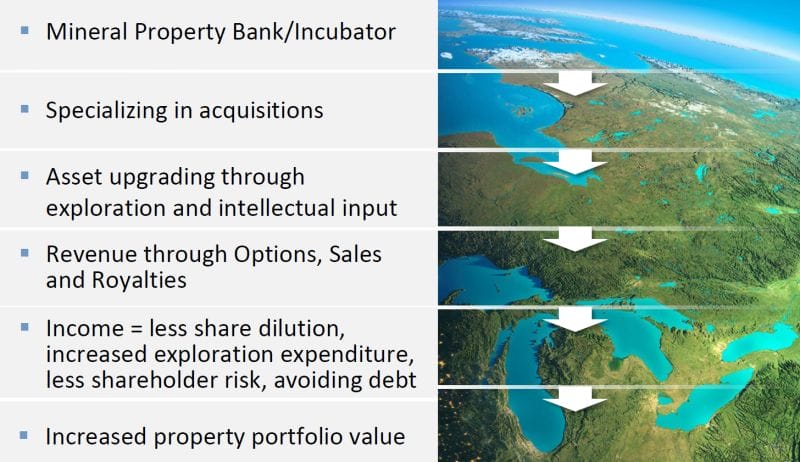

“Management’s specialty is acquiring high-quality assets in well established mining-friendly jurisdictions, upgrading the asset by way of exploration and intellectual input, and monetizing said asset via options, outright sales, and royalties,” stated Nolan on September 12, 2020.

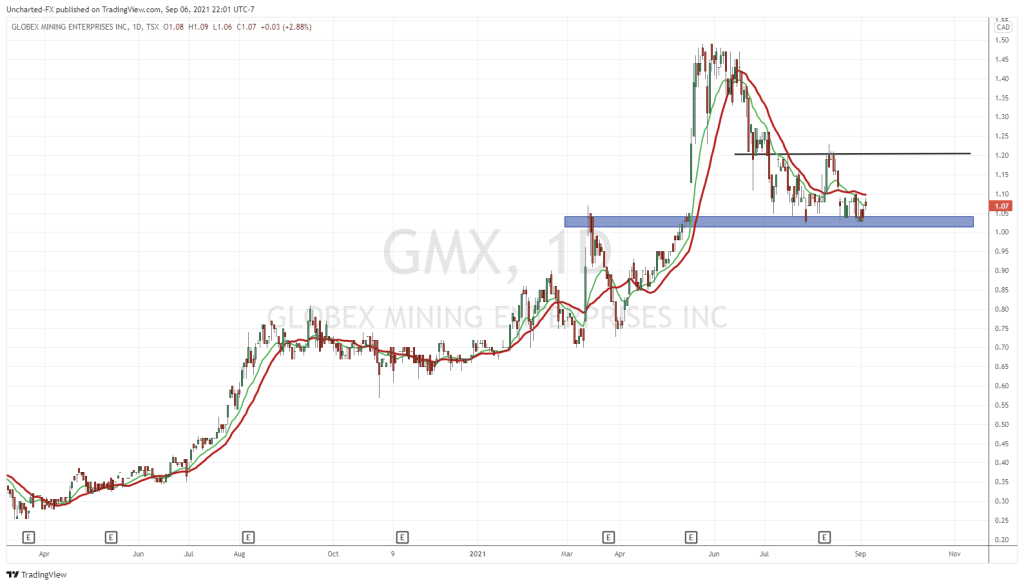

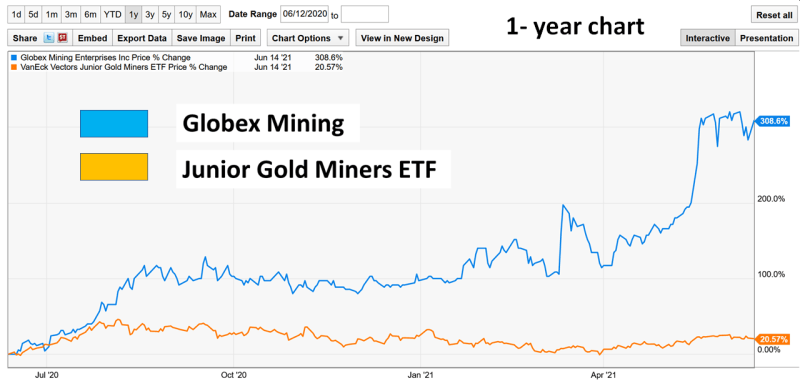

In a time when many resource juniors drift up and down in tandem with underlying market sentiment, in the last year, GMX has bucked the trend – surging from .30 to $1.43.

When a company owns subsurface rights to a mineral asset, one of the most likely buyers is an operator on adjacent or proximal claims.

That operator may be sitting on geological data that amplifies the value of its neighbour’s property (veins of gold don’t respect property lines).

From a messaging perspective, expanding the geographic footprint of an existing claim is an efficient way up-size, without changing the company’s branding or introducing new sub-plots.

Globex’s property, located in Abitibi, Quebec, adjoins Yamana’s Wasamac Gold Mine project on which Yamana is currently working in order to advance to production.

The property includes a number of former gold mines and areas of excellent gold exploration potential.

Exploration by Globex has demonstrated the potential for finding additional areas of significant gold mineralization.

In addition to the Francoeur/Arntfield/Lac Fortune property, as part of the transaction Yamana will acquire 30 claims in Beauchastel township to the east of the Wasamac Gold Mine property and three claims in Malartic township from Globex.

Under the Purchase Agreement, Globex will receive the following cash and share payments from Yamana:

Upon closing of the transaction: $4,000,000, which will be satisfied by Yamana issuing 706,714 shares to Globex at a deemed price of $5.66 per share. Based on the closing price of Yamana’s shares on the Toronto Stock Exchange on Friday, June 11, 2021 of $6.22, the 706,714 Yamana shares have a current market value of $4,395,761.08; On:

- first anniversary of closing: $3,000,000 in cash

- second anniversary of closing: $2,000,000 in cash

- third anniversary of closing: $3,000,000 in cash

- fourth anniversary of closing: $3,000,000 in cash

Based on Yamana’s current trading price, the total cash and share consideration is $15,395,761.08, of which Globex will receive $7,395,761.08 in cash and shares within the first year.

Globex may elect to receive one or more of the four anniversary payments in Yamana shares. If Globex so elects, the number of shares issued by Yamana will be based on the volume weighted average trading price of Yamana’s shares for the five trading days immediately preceding the date of payment.

In addition, Globex will retain a 2% Gross Metal Royalty on all mineral production from the Francoeur/Arntfield/Lac Fortune property and the 30 Beauchastel and three Malartic township claims, of which 0.5% may be purchased by Yamana for $1,500,000.

Yamana has agreed to assume payment of the three underlying royalties on the properties and will make a final environmental bond payment of $223,633.50 currently due by Globex on the Francoeur Mine in July 2021, after which Globex will transfer the bond to Yamana.

The Purchase Agreement with Yamana will provide Globex with revenue for the next four years as well as a significant royalty stream should a mineral deposit on the property package enter into production.

Closing of the sale, which is expected to take place on June 21, 2021, is conditional upon regulatory approval and standard closing conditions.

Knowing when to buy, and when to sell (and for what price) are three fundamental business skills.

Globex CEO Jack Stoch has these skills down pat.

The Yamana Gold deal is another example of GMX adding to its treasury without dilution, by selling mineral assets at a profit.

– Lukas Kane

Full Disclosure: Globex Mining is an Equity Guru marketing client.