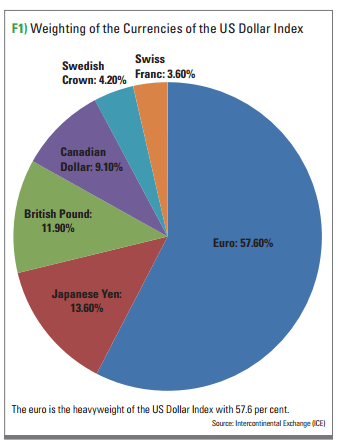

The US Dollar (DXY) was up 0.73% on Friday after Fed President Kaplan’s comments, putting some fear in Stock Markets and Precious Metals. As we open this week, the US Dollar has given up half of those gains. Technical Tactics will discuss what I am looking at for this week.

The rising Dollar tends to put pressure on US Stock Markets. Some see it in inflation terms: if the US Dollar is weak, it takes more weaker Dollars to buy US Stocks (bullish Stocks). If the US Dollar is strong, then we get the opposite (bearish Stocks). But the predominant thinking is the safe haven/fear trade. Money runs into the US Dollar for safety, so when it pops, the Stock Markets gets the jitters.

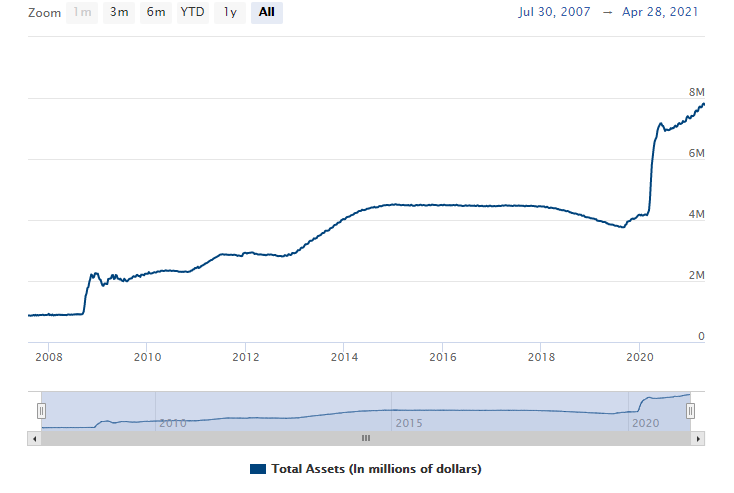

After the Fed meeting last week, analysts and strategists are already talking about when the Fed begins to hike interest rates. Tapering, or the unwinding of the balance sheet, being the key word.

The Fed used stronger diction pointing to a recovery and “strengthening” of the economy. BUT Powell still managed to convince markets that a recovery is far away. One good month of jobs data is not enough for any sort of tapering. I covered the Fed meeting and what was said here, what I enjoyed was the last question someone asked the Fed, “Why is the Fed not thinking about tapering?”

The answer was that inflation is still ‘transitory’ and we need more data to support a recovery. The journalist did ask if it was because the Fed was afraid of a taper tantrum. If the Fed stops buying, will markets drop? Who would step in to buy the bonds also? Just adds to the drama going forward.

And also why many retail traders do believe the Fed cannot taper. That they must continue to buy forever and will not be able to raise interest rates due to all the debt out there. A lot to unpack on this statement, but my readers know that I fear this could be true. Confidence plays a large role in sustaining central banks and the fiat money. The Fed can never just tell people things in plain English, they have to take you for a ride. Fed-speak as some call it.

Fed-speak spooked markets on Friday. Fed President Robert Kaplan said something contrary to Fed chair Jerome Powell, Kaplan stated that there ARE imbalances and excesses in financial markets. Both in stocks and real estate. Enter shocked face here.

Furthermore, Kaplan said its time for the Fed to start talking about tapering, or reducing their $120 Billion Bond purchases.

“We are now at a point where I’m observing excesses and imbalances in financial markets,” Kaplan told the Montgomery Area Chamber of Commerce in a virtual appearance in front of a live audience, pointing to “historically” elevated stock prices, tight credit spreads, and surging house prices.

“I do think, at the earliest opportunity, I think it would be appropriate for us to start talking about adjusting those purchases,” referring to the Fed’s $120 billion in monthly bond buys that, along with near-zero interest rates, are aimed at keeping financial conditions super-easy and bolstering the recovery.

“I think we’re going to reach that benchmark sooner than I would have expected in January and others would have expected,” he said. “I think the U.S. economy will be far healthier when we have the ability to start weaning off those purchases.”

“We’ve got real excesses in the housing market,” Kaplan said. “It’s not yet the speculative situation that we had back in ‘07, ‘08 and ‘09, but I think it bears watching and keeping a close eye on.”

He is definitely on the hawkish side, as many do not expect the Fed to begin tapering discussions until after Summer of this year. It should also be noted that even though Kaplan is a hawk, he is not a voter this year on the policy setting Federal Open Market Committee (FOMC).

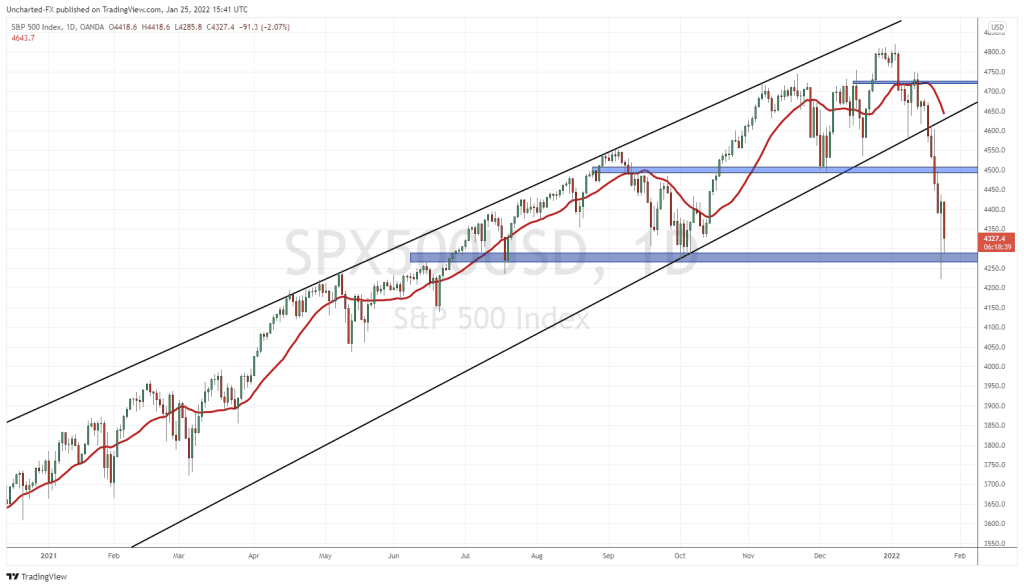

Technical Tactics

As I am writing this, we have had a wild day on the Stock Markets. The Dow Jones remains the strongest, and is set to print a record close by the end of the day. The Nasdaq is the one I am worried on… I will give my thoughts sometime this week, but if you cannot wait, join us over on Equity Guru’s Discord Trading Room.

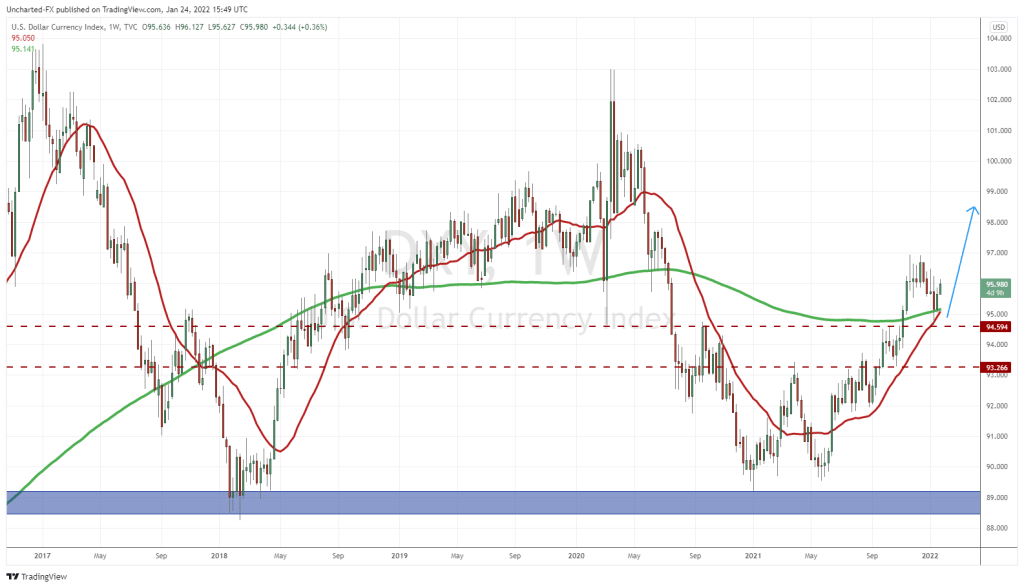

The US Dollar will be the one to watch. The action on the Dollar will tell us if the Market even buys Fed talk of tapering. So far not at all. And with Gold getting a pop too, the precious metal is laughing at Powell just like Zerohedge stated today.

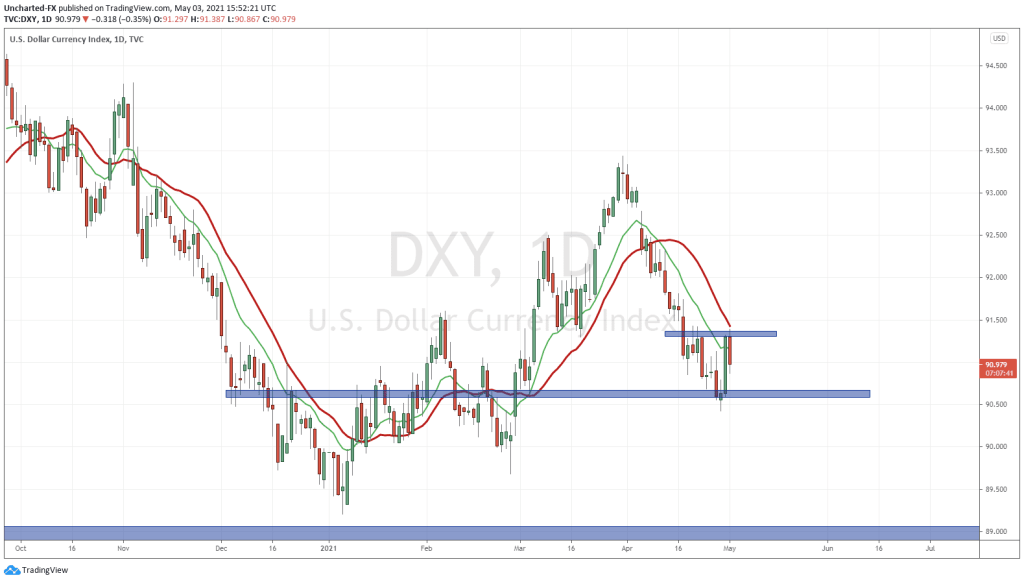

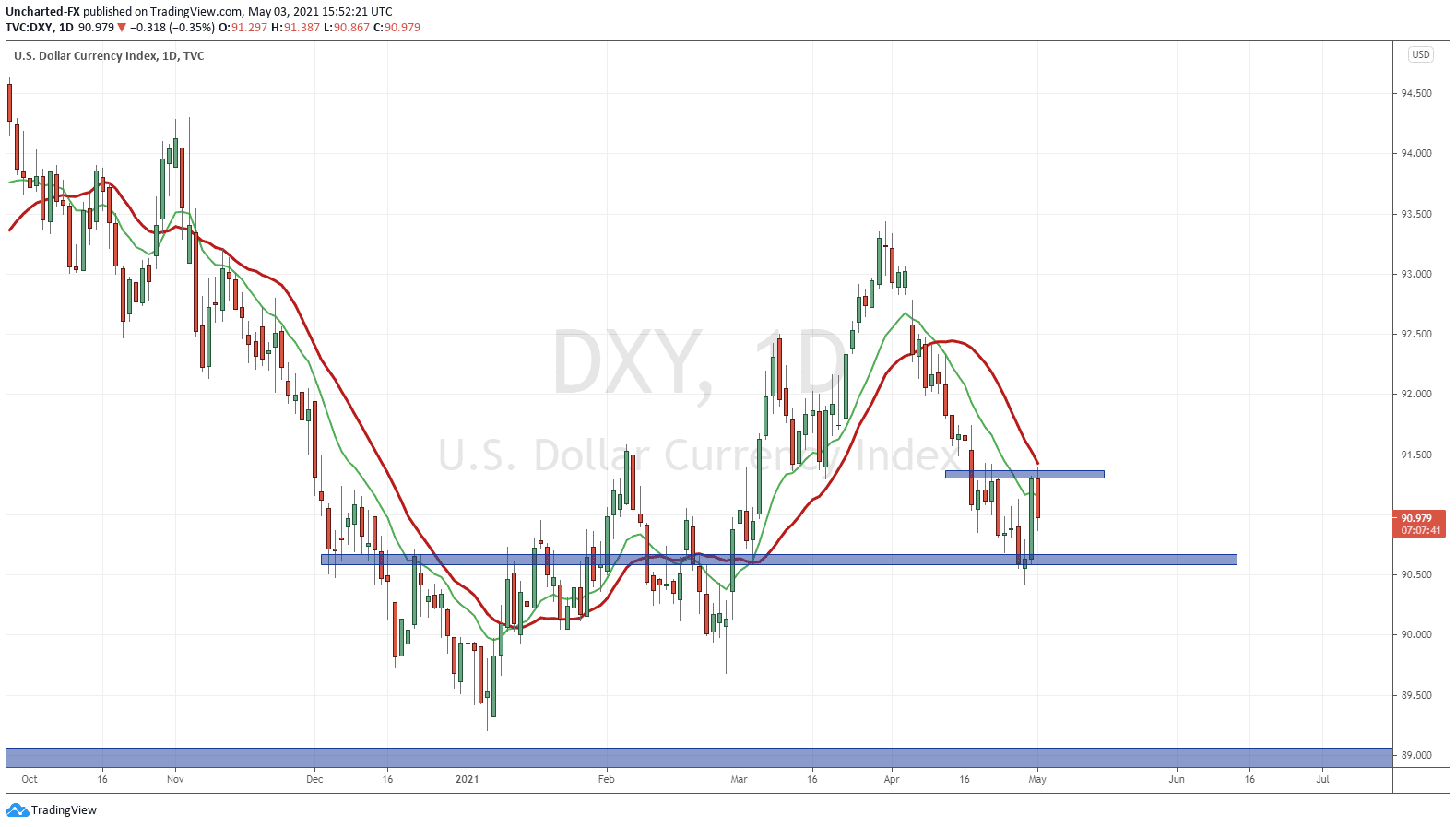

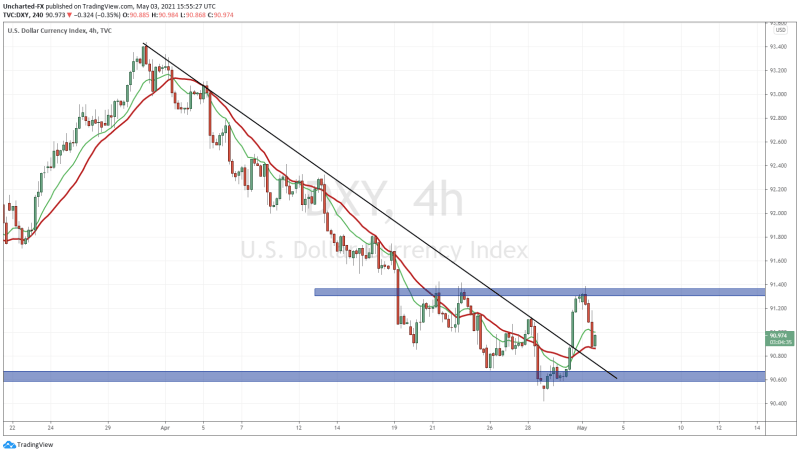

The DXY found support at 90.50, and then bounced on Friday from Kaplan’s comments. No follow through on trading today, just a sell off. But to be honest, the Dollar pop may not be over just yet. A close back below 90.50 would ease any Dollar pop fears, but going down to the 4 hour chart…

There is a case to be made regarding a new uptrend wave beginning. Seeing some bids right now, but this does not mean a higher low gets printed right now. What I will do is wait for a close above the 91.30 zone (highlighted in blue above). That triggers the long and the Dollar runs believing the Fed begins tapering sooner rather than later.

The former case means that Stock Markets will be impacted. It now is all about the Markets and traders calling the Feds bluff.