Harborside (HBOR.C), a California-focused and vertically integrated cannabis enterprise, announced that it will be transitioning from medical to adult-use retail sales at its San Leandro Wellness Solutions dispensary.

“We have carefully evaluated potential new retail locations that would enhance our profitability and allow us to more conveniently and effectively serve a larger potential customer base…I’m happy to have resolved our issues with our existing landlord and I am excited by the opportunity ahead for Harborside in the San Leandro area. Our new location will enable us to commence adult-use sales and introduce local consumers to the best-in-class service and unbeatable product selection that Harborside is known for. I look forward to announcing the new location in due course,” said Matt Hawkins, Chairman of Harborside.

California’s cannabis market is hot, with sales reaching $4.4 billion in 2020, up 57% from the year prior. Taking a closer look at the statistics, Oregon in particular surpassed $1 billion annually for the first year. With dispensary locations in Palm Springs, Oregon and the San Francisco Bay Area, Harborside has its roots deeply ingrained in the some of the most lucrative sectors of California’s cannabis market.

Harborside’s switch from medical to adult-use retail sales comes after reaching an agreement with the landlord of the San Leandro Wellness Solutions property. In addition to receiving authorization for adult-use sales, the Company was also given a six month lease extension. Harborside intends to use these six months to finalize the lease terms and built out of a new retail dispensary location in San Leandro. In doing so, Harborside hopes to increase its public visibility while lowering its overhead expenses.

Overall, Harborside’s latest news is intended to strengthen the Company’s financial position while minimizing its expenditures. By switching to adult-use retail sales, a reduction in rent costs is expected to reduce Harborside’s operating costs by over $2 million over the 10-year lease term. With this in mind, Harborside is no amateur when it comes to saving a buck. In fact, the Company’s total operating expenses for Q4 2020 were approximately $12.2 million, which represents a 73.9% year-over-year decrease compared to roughly $46.6 million in Q4 2019.

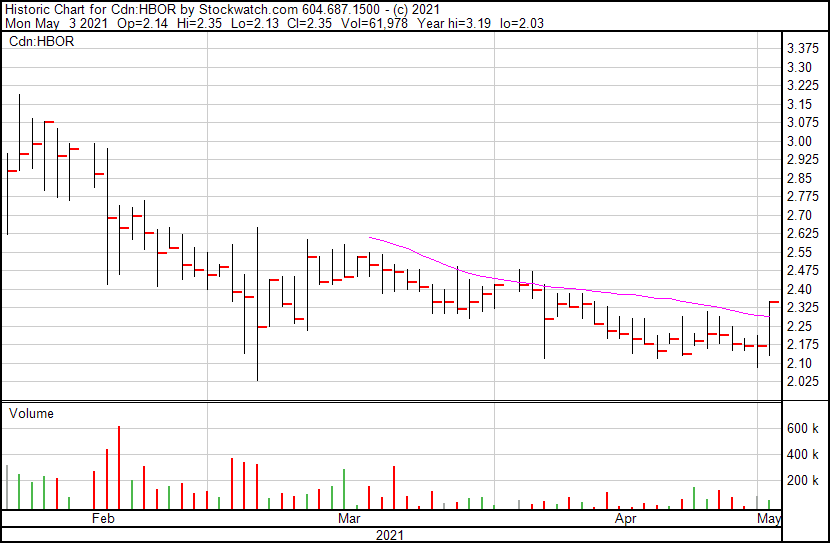

Harborside’s share price opened at $2.14 today and reached a high of $2.35 at 11:00AM ET. The Company’s shares are up 9.39% and are currently trading at $2.32 as of 11:11AM ET. This indicates that there has been notable change following the latest news.

Full Disclosure: Harborside is a marketing client of Equity Guru.