Earlier this morn, Gold Mountain (GMTN.V), a Company well on its way to distinguishing itself as BC’s Next Gold producer, released highly anticipated assays from a set of drill holes designed to test the down dip, high-grade vein extensions below the current resource envelope of its 100% owned Elk Gold Project near Merritt, B.C.

When I say “highly anticipated”, I’m referring to a March 11th exploration update where the Company observed some rather striking visual features in its drill core…

“Phase 1 drilling includes nine (9) holes totalling approximately 2,850m targeting down dip high-grade extensions of the 1300 and 2500 veins below the current lower extent of the resource model in areas that display robust gold grades. Visual observations thus far indicate strong sulphide vein intercepts in these holes.”

Today’s headline:

Gold Mountain Encounters High-Grade Gold Intercepts in Down Dip Drill Program

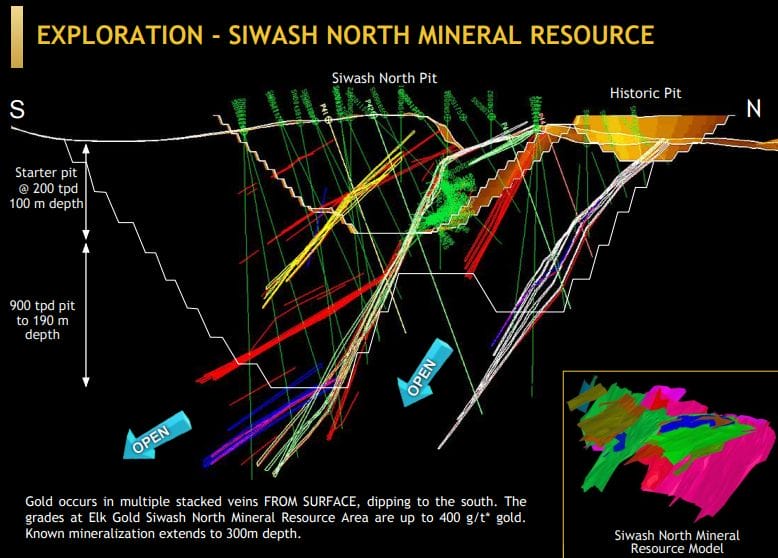

These high-grade hits at depth set the stage for scale— adding bulk to a (pit constrained) resource that currently stands at 454,000 ounces Measured and Indicated (95,000 ounces Inferred). The grade for this (Siwash North) resource runs 5.33 AuEq ounces per tonne. Impressive for open-pittable ounces.

Assay results from this down dip probe with the drill-bit confirm the presence of high-grade vein extensions:

- SND20-029 intercepted 1.42m averaging 37.00 g/t Au (including 0.42m averaging 124.00 g/t Au);

- SND20-032 intercepted 1.22m averaging 16.23 g/t Au (including 0.30m averaging 62.20 g/t Au);

- SND20-032 intercepted 1.30m averaging 7.95 g/t Au (including 0.30m averaging 31.30 g/t Au).

These are solid hits.

100% of the holes in this Phase-1 campaign hit their mark. This establishes good continuity in the mineralization and increases confidence as the Company probes these vein structures for further extensions at depth.

The high-grade character of these veins will lead to an intensive study with respect to an underground mining scenario at Elk (note the JDS Energy and Mining joint effort further down the page).

The map below gives you the lay of Elk’s subsurface stratum (note the light blue arrows pointing down)…

Phase 1 – Drill Program Update

Phase 1 – Drill Program Update

Assay Results for the Down Dip Drilling Targeting the 2500 and 1300 Veins

The Company received assay results for the nine (9) holes totaling approximately 2,850m of down-dip drilling that targeted the 1300 and 2500 veins. The assay results show the continuity of the two veins below the current resource area. The results show robust grades and thickness at depth which the Company anticipates will be incorporated into an updated resource estimate.

The Mother Shoot zone

In 1992, previous operators mined a 2,040-tonne bulk sample from a zone along the 1300 vein called the Mother Shoot—a zone that averaged a hefty 97g/t Au, a portion of which carried a grade of 137 g/t Au.

This current deep drilling phase was designed to tap the latent potential of this high-grade zone. Having tagged a weighty 1.42m averaging 37.00 g/t Au (including 0.42m averaging 124.00 g/t Au), the test was a resounding success—Mother Shoot’s bonanza grades could add a whole new gear to the current mine plan.

“The initial assay results support the Company’s theory that the Mother Shoot zone extends at depth and maintains its high grade under the resource constraining pit-shell.”

Drilling complete on Phase 1

The Company has now completed the drilling portion of the Phase 1 exploration program which consisted of 43 drill holes totaling 8,739m of drilling. The Company has received assay results for 36 of those holes, all of which struck gold mineralization. Five of the holes yet to be assayed drilled the 2600 and 2700 veins located in the resource pit shell while the remaining two holes are from geotechnical drilling.

Transitioning to Phase 2

Planning for a Phase-2 campaign, one consisting of both drilling and re-logging of historic core, is currently underway.

“Based on the predictability of the deposit confirmed by the Phase 1 drill program and initial core re-logging data, the Company is bullish that the Phase 2 exploration program will result in an increase to the resource estimate. To kick off Phase 2, HEG and Associates is focusing on relogging historic core, digitizing historic data and updating the geological interpretation. The Company anticipates the re-logging to continue throughout the spring and summer with drilling to commence in May.”

Regarding this re-logging effort: With over 127 kilometers of historic drilling, the Company is employing the latest technology to home in on additional veins missed by previous operators. As per the March 11th exploration update, that effort is paying off in spades—a new vein was discovered in this historic core, one which yielded 1.2 meters averaging 52.3 g/t Au (including 0.30m averaging 216 g/t Au).

Commenting on today’s high-grade (depth extension) assays…

Kevin Smith, Gold Mountain’s CEO:

“We’re thrilled to be sharing these results with the market further confirming our thesis that the veins at the Elk are getting higher grade the deeper we chase them.” Kevin Smith further discusses, “All 36 drill holes for which assays have been received to date have encountered significant gold vein intercepts, a testament to our project’s scalability. Gold Mountain is confidently going to continue to chase these high-grade veins throughout the property with the focus of adding ounces to our resource and making Elk Gold BC’s next million-ounce producing mine.”

Quinton Hennigh, Gold Mountain’s technical advisor:

“The Elk Gold Project hosts one of the most predictable vein systems I have seen. Continuity is excellent, and these holes indicate this characteristic persists at depth. Gold Mountain has a well-designed drill program to exploit this predictability, thus allowing high confidence in the ability to progressively grow the deposit.”

Those who have been following the Company’s progress over the past few months are well aware of the lofty goals management has set for itself.

Sadly, over-promising and under-delivering appear to be a code of conduct for the vast majority of executive directors in the junior exploration arena. When a CEO tells you he plans to mobilize a drill rig to a project within a few months, that can mean anywhere from six months to a year.

When a company says it’s targeting near-term production, that usually means YEARS, what with economic studies, permitting, financing, construction, etc.

But every once in a while, a company comes along with towering goals and aggressive timelines… and actually meets them.

There’s a palpable momentum behind Gold Mountain’s aggressive push along the development curve. With milestones and progress registered on multiple fronts, its goal of establishing “BC’s Next Gold Producer” status, within a matter of months, appears very doable.

Earlier this year, the Company signed a mining contract with Nhwelmen-Lake LP, one that “lays out a partnership that gives Gold Mountain certainty in its mining and ore haulage capital and operating costs.”

Earlier this year, the Company signed a mining contract with Nhwelmen-Lake LP, one that “lays out a partnership that gives Gold Mountain certainty in its mining and ore haulage capital and operating costs.”

Shortly after, the Company engaged a world-class toll milling partner—New Gold—locking in a key component that adds validity to its fast-track-to-production objective.

With these milestones reached, the Company engaged JDS Energy & Mining to complete a pre-feasibility study (PFS), with designs on a new mine plan. Today’s high-grade results open up new avenues to further explore the underground mining potential at Elk.

This PFS will generate the near-term cost certainty required to delineate a maiden reserve for the Elk project.

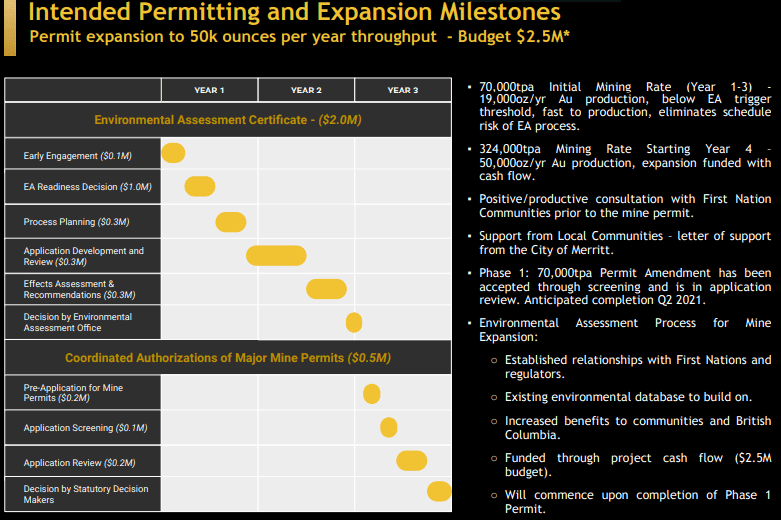

On the permitting front, the Company is in the final lap, targeting late June for the final mining and environmental permits.

The Company has filed a Notice of Departure to begin construction in early June. This will keep the Company on schedule to commence waste rock mining in July/August… ore mining in September.

To summarize, the Company is targeting 70,000 tonnes per year for the first 3 years, with the intent—after completing an Environmental Assessment—of ramping up to 324,000 tonnes per annum.

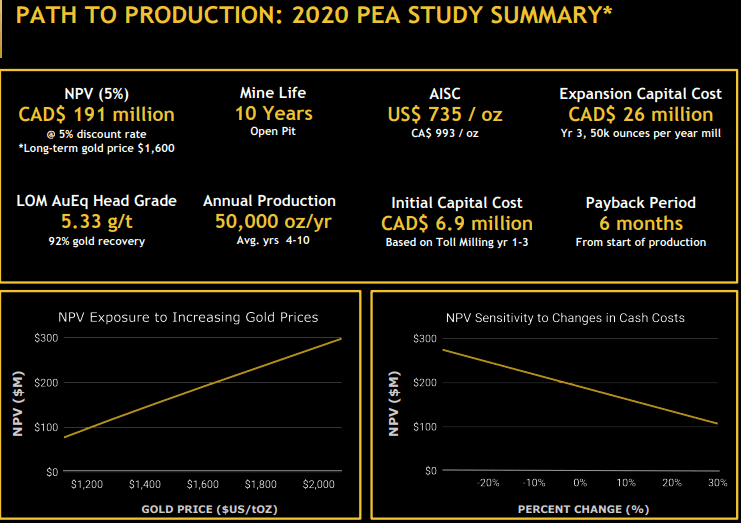

The following slide from the Company’s i-deck gives us a look at Elk’s preliminary economics…

Scalability of production, and increasing the size of the high-grade resource, remain the key areas of focus.

Scalability of production, and increasing the size of the high-grade resource, remain the key areas of focus.

A recent Guru offering (link below) offers a deeper delve into recent activity surrounding this near-term production (and high-grade exploration) play.

Final thoughts

With the pace the Company has set for itself as it pushes toward production, expect robust newsflow over the balance of 2021. Near-term catalysts include news on the permitting front and assay-related newsflow as the Company kicks off a Phase-2 drilling campaign in May.

END

—Greg Nolan

Full disclosure: Gold Mountain is an Equity Guru marketing client. We own stock.