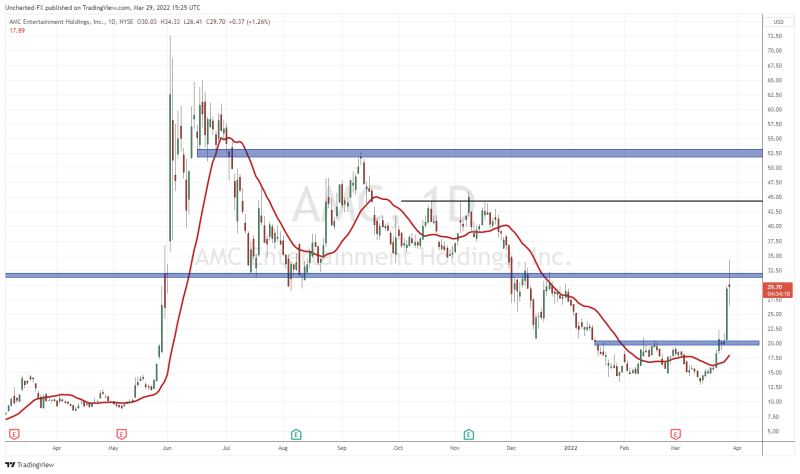

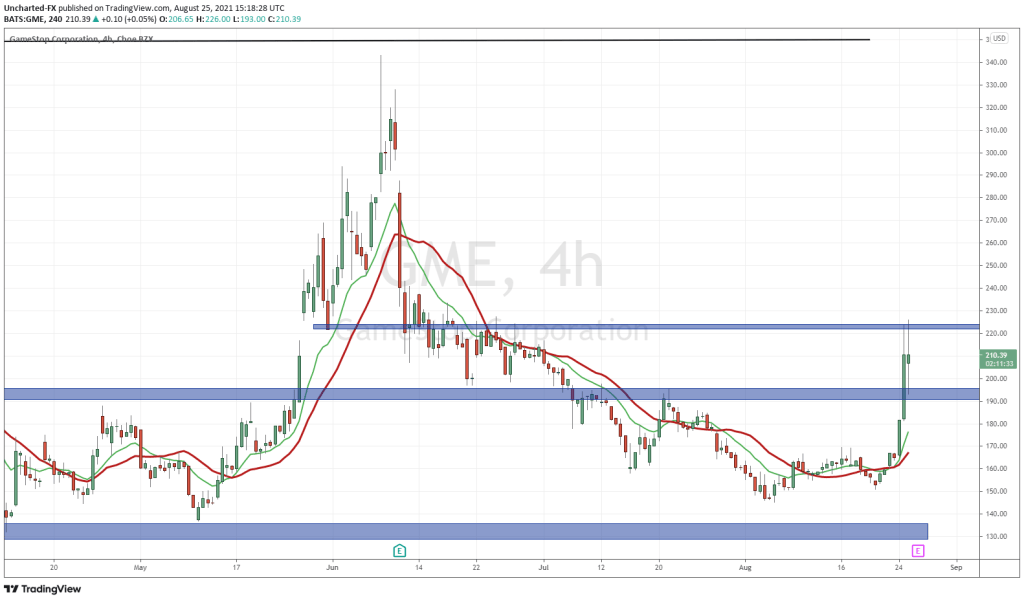

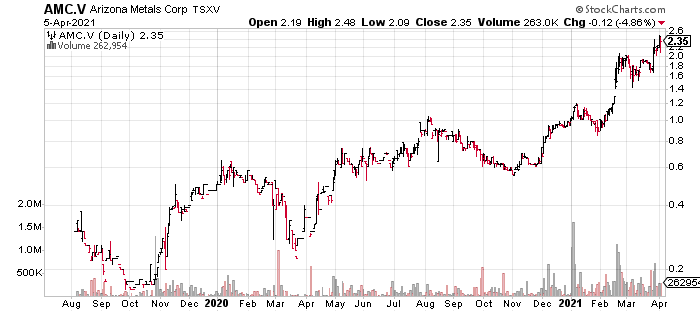

Arizona Metals (AMC.V) has been one of the better price performers in the junior exploration arena since it began trading in the summer-of-2019.

Over the past 5 months in particular, the stock has demonstrated some very decent price trajectory, heightened by a runaway gap in mid-February.

Over the past 5 months in particular, the stock has demonstrated some very decent price trajectory, heightened by a runaway gap in mid-February.

Clearly, the market sees the potential in this Company’s flagship asset.

I believe the market is (finally) beginning to understand that many Producers, both big and small, are mining deposits that are closer to the end of their life cycles than the beginning.

Last decade, a brutal 9-year bear market forced producing companies to dramatically scale back exploration spending. And every day that a Miner digs ore out of the ground—every day the company is in business—they reduce their metal inventory. For gold producers, these ounces are not easy to replace. For companies producing millions of ounces annually, adding to reserves in a meaningful way requires a steady stream of new discoveries.

It’s simple math: If you’re not proactive in your search for new sources of ore, you’re not replacing what you mine. And if you’re not replacing what you mine, your days as a Miner are numbered.

This dire predicament sets up an interesting dynamic for those junior ExplorerCos developing high-quality assets. Some of the better projects are, without a doubt, in the crosshairs of these resource-hungry predators.

Back in early February, Arizona Metals (AMC.V) accelerated a fully-funded Phase-2 drilling campaign at its flagship Kay Mine Project in mining-friendly Arizona.

First, a few words on jurisdictional risk or the “mining-friendliness” of a region. These are weighty considerations when shortlisting buy candidates for your investment portfolio.

The last thing you want is a twitchy landlord, one who suddenly develops a keen interest in your Company, visiting them with an armed escort only days after a watershed 43-101 drops.

The Fraser Institute, a think-tank that analyses jurisdictional risk, recently published its annual survey of mining jurisdictions.

Annual Survey of Mining Companies, 2020

This survey is one of the better shortcuts to getting a handle on the mining-friendliness of the region your company is operating in, be it a country, state, or province.

It also serves as a “report card” to governments re the attractiveness of their mining policies.

This report presents the results of the Fraser Institute’s 2020 annual survey of mining and exploration companies. The survey is an attempt to assess how mineral endowments and public policy factors such as taxation and regulatory uncertainty affect exploration investment. The survey was circulated electronically to approximately 2,200 individuals between August 6th to November 6th, 2020. Survey responses have been tallied to rank provinces, states, and countries according to the extent that public policy factors encourage or discourage mining investment.

We received a total of 276 responses for the survey, providing sufficient data to evaluate 77 jurisdictions. By way of comparison, 76 jurisdictions were evaluated in 2019, 83 in 2018, 91 in 2017, and 104 in 2016. The number of jurisdictions that can be included in the study tends to wax and wane as the mining sector grows or shrinks due to commodity prices and sectoral factors.

Like last year’s survey, this year’s survey also includes an analysis of permit times.

According to Elmira Aliakbari, director of the Institute’s Centre for Natural Resource Studies:

“The Fraser Institute’s mining survey is the most comprehensive report on government policies that either attract or discourage mining investors.”

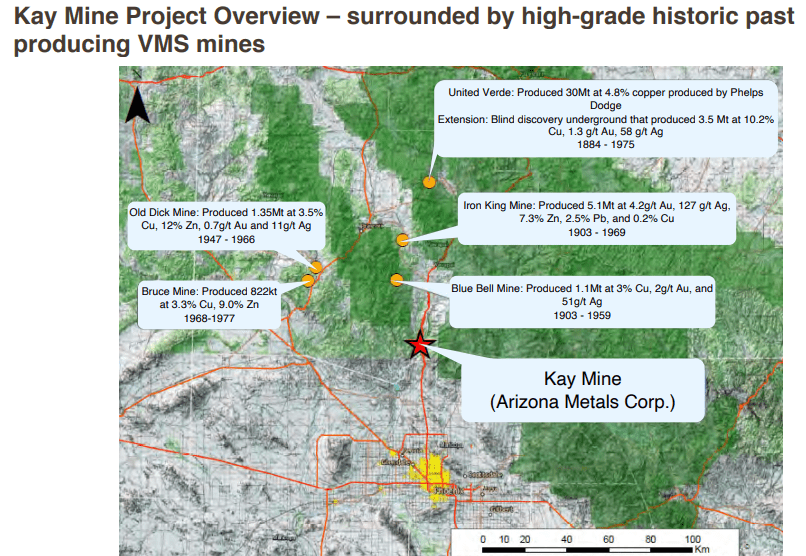

Arizona Metals’ Kay Mine Project is located in an upscale neighborhood.

Arizona is ranked #2 by Fraser.

For those sizing up Arizona Metals for the first time, it’s important to understand precisely where the Company’s flagship asset is positioned along this Fraser Top Three jurisdiction.

The Kay Mine Project is located in a prolific volcanic massive sulphide (VMS) setting—a region where roughly 4 billion pounds of copper was produced over its century-long run.

VMS settings are unique—where there’s one deposit or lens, there are often others.

This particular region played host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of the Kay Mine Project.

Back in the early 1980s, Exxon Minerals delineated 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and 2.8 g/t Au for a CuEq grade of 5.8% at the Kay Mine Project (note that this resource is currently classified as historical) ***

Note the copper grades—a metal boasting some of the more compelling supply-demand dynamics in our green energy revolution. Also note the precious metals values.

Without taking into account recovery rates, the precious metals component of this historic resource runs higher than your typical VMS deposit (or lense).

These polymetallic lenses, though often modest in size, can hold huge concentrations of metals, hence their allure to resource-hungry predators lurking about, their sights set on bulking up their mineral inventory (by now I’m sure you’ve guessed that I view Kay as a potential takeover target).

The resource expansion and discovery potential are wide open at Kay—one of the primary reasons for the steep share price trajectory (revisit the price chart at the top of the page).

The following are highlights from a Phase-1 drilling program completed last August—a campaign where 19 of the 20 holes drilled hit their mark.

- 43.1 meters grading 3.94% CuEq (incl. 15.2m of 6.7% CuEq), from a depth of 341 meters;

- 38.4 meters grading 2.9% CuEq (incl. 12.5m of 6.0% CuEq), from a depth of 385 meters;

- 39.9 meters grading 3.4% CuEq (incl. 3.5m of 11.6% CuEq, and 3.5m of 6.6% CuEq) from a depth of 314 meters;

- 22.5 meters grading 2.4% CuEq (incl. 0.8m of 14.0% CuEq and 4.1m of 5.2% CuEq);

- 27.6 meters grading 2.9% CuEq (incl. 3.5m of 6.7% CuEq) from a depth of 423 meters;

- 6.1 meters grading 7.8g/t AuEq (incl. 4.4m of 9.3g/t AuEq) from a depth of 570 meters;

- 6.8 meters grading 7.3g/t AuEq (incl. 4.3m of 10.1g/t AuEq) from a depth of 422 meters.

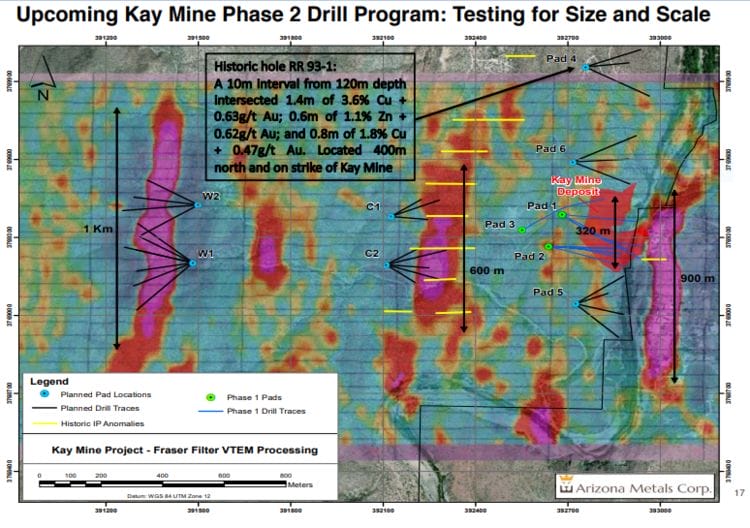

A thorough review of Phase-1 drilling set the stage for this current, ongoing Phase-2 campaign

This review, with the deep technical know-how and input of SRK Consulting (Canada), included 1,202 spectral alteration measurements combined with digitized historical data and structural mapping to “undertake sulphide lens modeling and fold modeling to identify new drill targets.”

“Arizona Metals completed spectral analyses to map alteration within and away from the mineralized zones. These data were used by SRK to define five alteration types, which can be used as vectors towards mineralization.”

The following map shows the location of the historic Kay deposit relative to the pad locations established for this current campaign. Note the number of untested (geophysical) drill targets throughout the project, particularly those further to the east—the Central and Western targets…

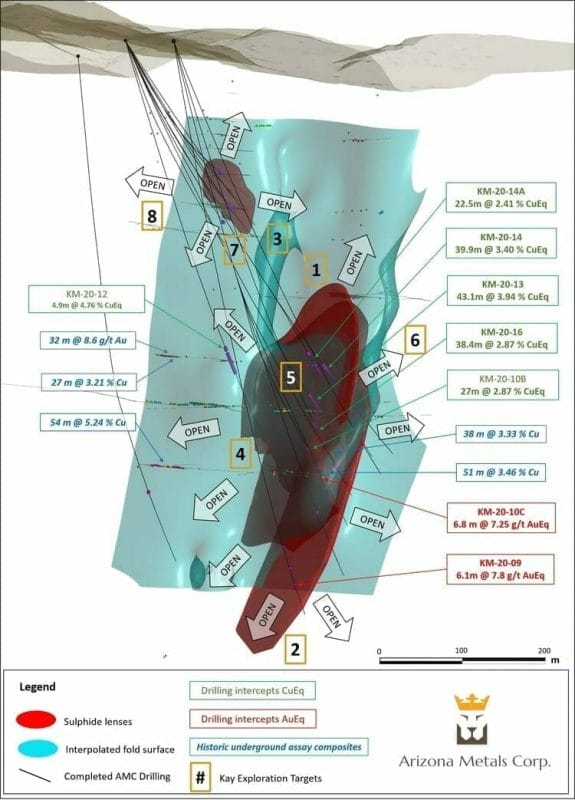

This next map homes in on the Kay deposit itself. Aside from showing a number of intercepts encountered both historically and from recent drilling, it reveals the anticlinal hinges that represent some of the highest priority targets in this current campaign (numbered 1 through 8)…

SRK determined that the thickest and most continuous sulphide lenses are located in the anticlinal hinges.

This excerpt from my maiden Arizona Metals piece last October will walk you through the significance of these “folded hinges” and why they represent such compelling targets to expand the historical resource…

The geological model at Kay is that of an isoclinal folded VMS deposit.

The analog here might be the uber-rich VMS deposits that straddle the provinces of Ontario and Quebec, along the prolific Abitibi Greenstone Belt. The world-class Kidd Creek mine in the Timmins Camp and the Horne mine in Rouyn-Noranda (Quebec), come to mind.

Previous Kay operator, Exxon Minerals, reported 18 vertically stacked lenses that range from 5 meters to 25 meters in thickness.

Exxon reported that Kay’s tightly folded hinges within these lenses demonstrate superior grades and widths.

One of the objectives of currently drilling is to delineate these unique (high-grade) geological features and grow Kay beyond its current 5.8M tonnes.

The Kay deposit starts at a depth of 120 meters. The company believes mineralization extends to depths greater than one kilometer.

The April 5, 2021 headline…

Here, Arizona Metals tables a raise where a syndicate of underwriters has agreed to purchase, on a bought deal private placement (PP) basis, 7,150,000 Special Warrants at C$2.10 for aggregate gross proceeds of C$15,015,000. There’s also an over-allotment grant for an additional 1,072,500 special warrants.

Each Special Warrant entitles the holder to receive one unit of the Company. Each Unit consists of one common share and one-half of a common share purchase Warrant. Each whole Warrant is exercisable at $3.00 for 12 months.

“This financing will allow the Company to increase the fully-funded Kay Mine Phase 2 expansion drill program, currently underway, from 25,000 to 75,000 metres.”

Tripling the size of the current program, from 25k meters to 75k meters, speaks volumes. Tripling the meterage will also triple the volume of newsflow from the Kay Mine Project.

Regarding the details of the offering itself, the 1/2 warrant, $3.00 strike price, and 12-months-to-expiry clause clearly stand out.

Those participating in this raise anticipate a number of significant (potential) price catalysts over the coming months.

Arizona Metals CEO, Marc Pais:

“We appreciate the continued support and confidence of current and new shareholders. This financing will allow us to triple the planned drilling at the Kay Mine Phase 2 Expansion program from 25,000m to 75,000m. We can now accelerate the testing of numerous satellite targets on strike and to the west of the Kay Mine, previously identified using a combination of structural mapping, helicopter electromagnetic (VTEM) surveys, borehole electromagnetic surveys (BHEM), and soil and rock geochemical sampling. A recently completed property-wide gravity survey has helped to refine the current drill targets, while also identifying new historically untested targets. We are currently scheduling a third and fourth drill rig to the Kay Mine, and will provide further details of the expanded program in a future release.”

The appetite

A second headline followed fast on the heels of the first—a headline that aptly demonstrates the market’s appetite for this stock.

Here, the Company entered into an amended agreement with the Underwriters triggering the over-allotment option to purchase an additional 1,400,000 Special Warrants of the PP announced only a few hours earlier.

Tripling the size of the program, a one-half ($3.00) warrant with a shelf life of only 12 months, and upsizing the PP like a shot… all of this says a lot about the quality of Company management, its flagship asset, and the potential for a significant producing deposit(s) in one of the most mining-friendly jurisdictions on the planet.

I’ll close this one out with a quote from Arizona State Senator Karen Fann after a meeting earlier this year:

“As the State Senator for this area, I am pleased to see the continued progress of Arizona Metals at its Kay Mine project since my first visit last year. I am very excited to have this company and project in my district, as Arizona Metals Corp. is the kind of company and operation we want to see in rural Arizona. The company continues to employ a thoughtful approach to doing things the right way, and this project has the potential to ultimately create hundreds of jobs and dynamic economic activity in the district.”

END

—Greg Nolan

Full disclosure: Arizona Metals is an Equity Guru client.

*** The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.