Predictmedix (PMED.CN) was halted at the open yesterday morning. Investors and traders were rewarded with the news that the company is working with Kingswood Capital Markets in preparation to becoming a NASDAQ-listed company.

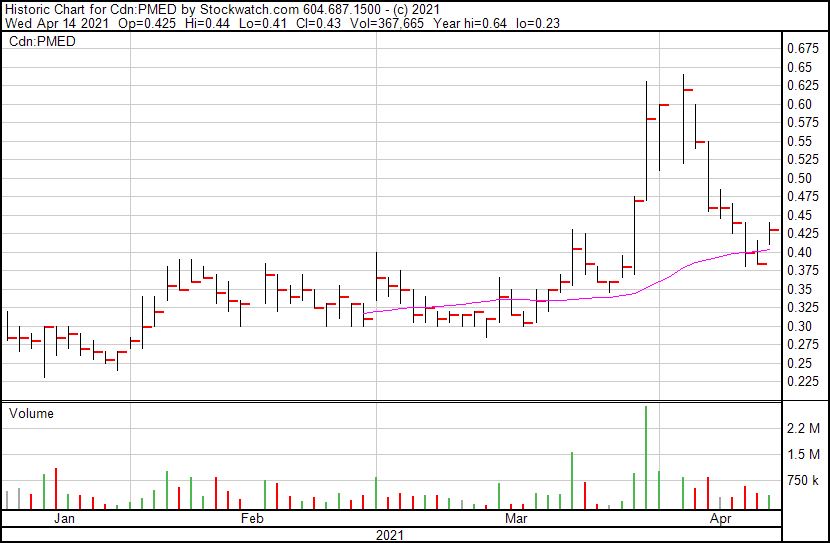

At time of writing, Predictmedix is up 12% on the day, and is breaking above an important technical level. Hinting at a move higher. More on this under Technical Tactics.

First of all, let’s cover what a NASDAQ listing means. The obvious benefit is the possibility to attract a set of new institutional and retail investors.

Lukas Kane covered the benefits in his piece yesterday. Check it out here.

To meet the criteria of being a NASDAQ listed company, PMED would need:

-

Shareholders Equity of at least $2 million.

-

At least 100,000 shares of public float.

-

A minimum of 300+ shareholders.

-

Total assets of $4 million.

-

At least two market makers.

-

Public float market value of $1 million

-

$3 minimum bid price of the company stock.

Predictmedix’ current market cap is CAD $37 million, with 104 million shares outstanding, shares trading at .35.

To meet the USD $3 share price minimum, PMED will have to consolidate shares about 10 to 1.

I think the major take away for many will be the fact that the share price will have to increase…and by a lot.

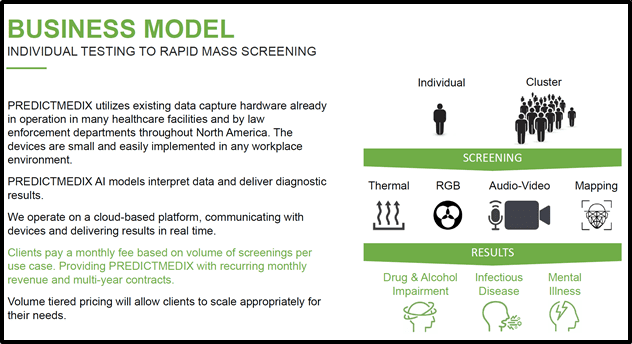

The company is in the right space, as Predictmedix develops disruptive AI technologies for health and safety in workplaces and healthcare. AI-powered healthcare solutions including cannabis and alcohol impairment detection tools and screening for infectious diseases including COVID-19.

Chris Parry has said, “Predictmedix’ solution involves multispectral imaging, which captures image information along specific wavelengths on the electromagnetic spectrum. There is no need for any bodily fluids and there is no human exposure, as the screening is carried out using multispectral cameras, which can be installed at any facility”.

In other recent news, Predictmedix signed a letter of intent to acquire AI and IoT tech suite, Symp2Pass.

Our very own Joseph Morton says:

“The acquisition will help bolster PMED’s growth prospects and will align the product’s company sales with their stated goal of being the first line of defense in improving workplace health and safety,”

The product suite brought in $2.27 million in generated revenues for the fiscal year ending December 31, 2020 with earnings before taxes of $205,000. Their present clients include an agency within the Canadian government and a large US utility provider. That’s what they have right now, but the ability to screen individuals at entrances and from a distance has considerable utility anywhere large populations gather—including universities, large institutional organizations, as well as government agencies. The acquisition invites certain future customer contracts based on a reoccurring revenue model, which will push PMED to profitability and therefore stakeholder value.

“There is one word that encapsulates our decision to acquire the Symp2Pass product suite from SmartCone – synergy. From a technology to business development, the acquisition will lead to function improvements in product offerings for both companies. Not only does this mean that all of our existing technologies become better, but also that we’re ramping up revenue generation and building toward sustained, growing profitability with a broader, more robust client base and product offerings,” said Dr. Rahul Kushwah, COO of Predictmedix.

Technical Tactics

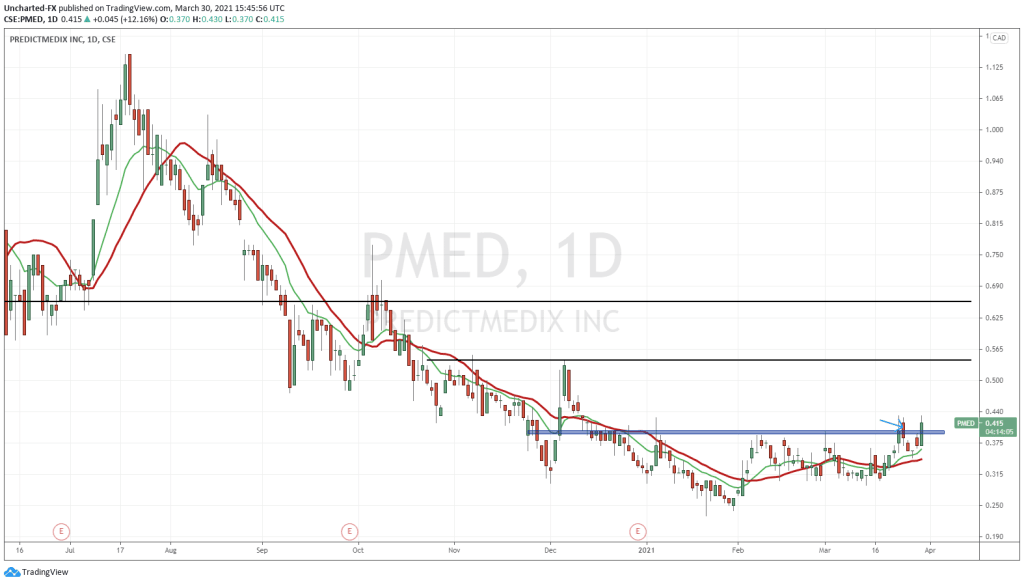

Market Moment readers know there are three ways ALL markets move: downtrend, range and an uptrend. We had a downtrend, price then began to range for a few months, and we could be braking out above this range by close today.

Before we discuss that, I want to focus your attention to the arrow I drew. This is why candle closes for triggers are very important. PMED appeared to have been breaking out, but it failed. The candle closed back below our resistance zone indicating a fake out. These type of traps are common, especially now. Lot of experienced Wall Street traders know there is a lot of new retail money in markets. They know the retail crowd is very emotional to price slips and not very patient. Hence why a lot of these type of fake out traps have appeared in many markets I follow.

Traps are being set, and it is best to await the trigger instead of being whipsawed out of a trade.

Now the other case: we get the breakout confirmed with today’s daily close above. The $0.395 zone becomes the support we work with for further momentum to the upside. We must remain above, and we can use the lows of the breakout candle to determine if momentum fails.

To the upside I would initially target $0.55 and then $0.65 as the resistance zones. We should expect some profit taking at those levels. Longer term recall that $3.00 price required to meet the NASDAQ listing requirements. This breakout could just be the beginning of a much longer uptrend.

Full Disclosure: Predictmedix is an Equity Guru marketing client.