In yesterday’s Market Moment Post, I discussed some obvious Covid play candidates. I published the post before the President announced he was going to be discharged later that day. To be honest, it was something we were discussing over on our Equity Guru Discord Trading Room. It seemed like a good way for the President to tell America that we do have therapeutics, while being the poster boy for big pharma at the same time. Gilead, Regeneron, XPH and PPH were the stocks which were discussed. Regeneron had a monster move back above $600 per share, and Gilead is still in play. However, there is another Covid play which caught my attention on an important technical break. PredictMedix (PMED.C).

PredictMedix is a company which describes its value as: Disruptive AI technology that is leading the future in healthcare screenings and impairment detection.

The Covid play is their Covid screening technology utilizing its AI-powered technology that allows mass screening and rapid testing. PredictMedix has partnered with UK-based Taurus Medical Solutions for the execution of a sales contract for Predict’s COVID-19 screening technology. The company then partnered with Indian Oil Corporation (IOC.NS), which is an Indian Fortune 500 Company. In the US, there is a joint venture with Juiceworks, which has seen Predict’s safe entry solutions deployed in Texas.

Just recently PredictMedix announced a partnership with Versus Systems Inc. (VS.CN) to bring tools for clinical trial to the market.

PredictMedix will be working with Versus to integrate Versus’ proprietary rewards platform with it’s proprietary remote patient monitoring platform to the healthcare vertical – allowing healthcare providers, Contract Research Organizations (CROs), and life science companies to use rewards to recruit and retain a broader range of patients, and to promote compliance in testing medical therapies. This will allow PredictMedix to enter a new industry vertical of clinical trials which is a $40 billion market opportunity as estimated by Fortune Business Insights.

Clinical trials traditionally require on-site monitoring to ensure human subject protection, data integrity, and quality. During the current pandemic, however, clinical research sites have reduced and restricted on-site monitoring. Travel restrictions and the safety issues further compound the challenges of monitoring on-site.

The FDA guidance for conducting clinical trials during COVID-19 restrictions supports remote monitoring for oversight of clinical sites

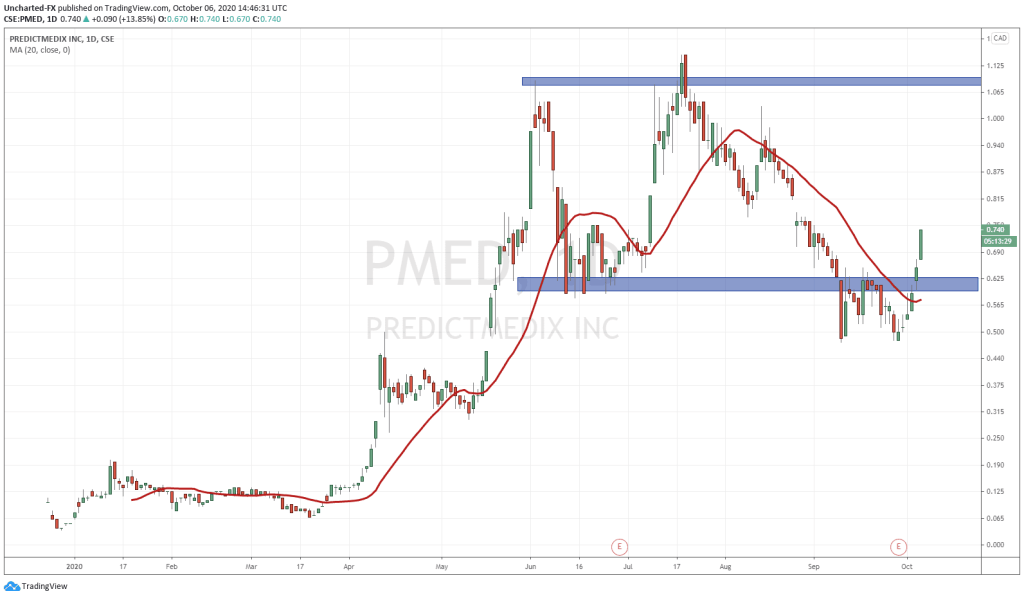

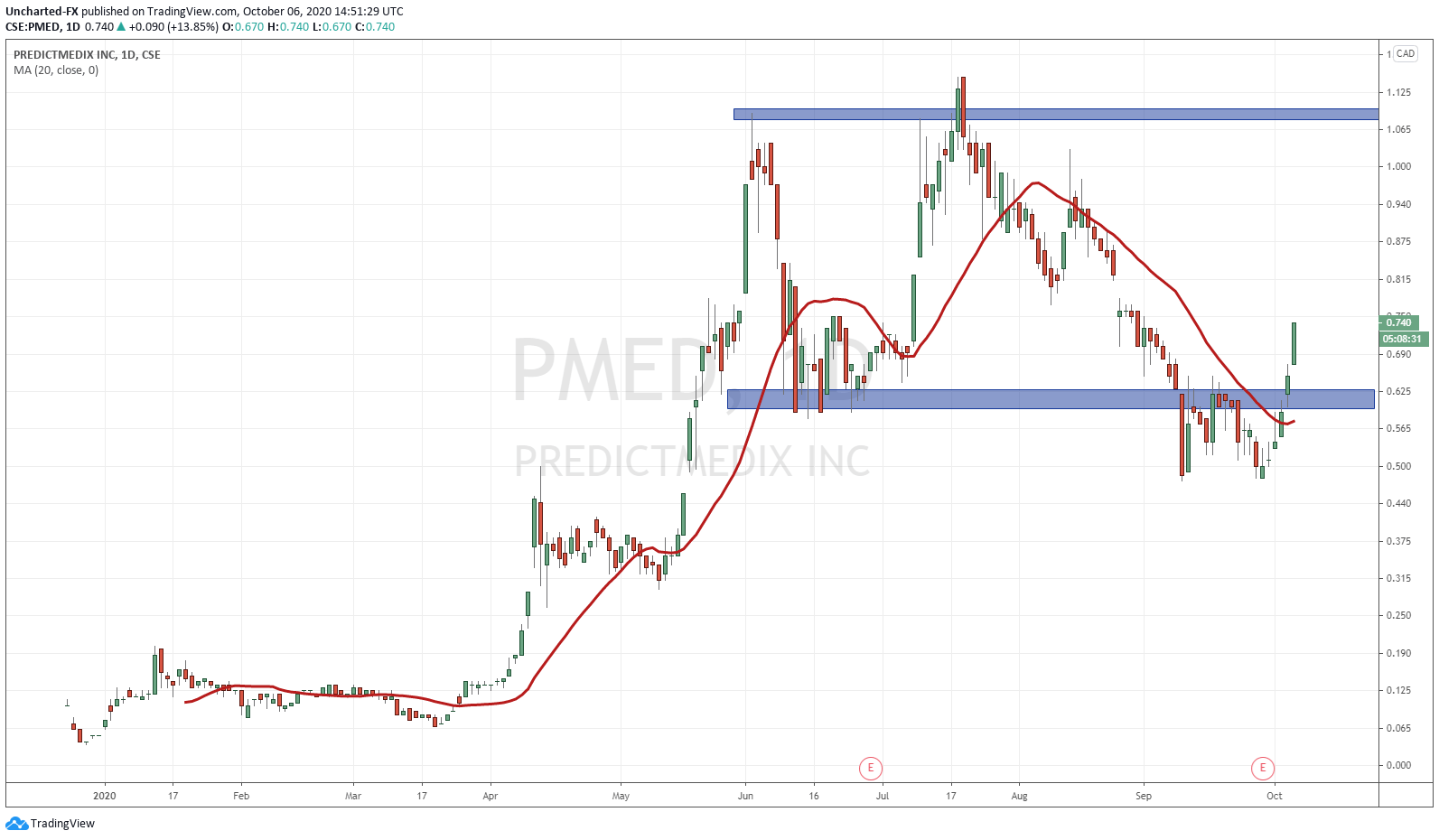

On to the important technical break.

Chart wise, PMED did break below a major support zone of 0.625. As long as price was under this zone, we had the chance to make new lower lows. The crucial period was when price pulled up to retest this zone as resistance. As you can see, the sellers rejected this zone at first. However, news of the partnership with Versus, along with the Covid theme which occurred yesterday, saw price move over 10% and confirm a close back above the 0.625 resistance zone! This means that the risk of the downtrend we had while we remained below is now nullified. 0.625 now becomes new support (price floor).

We have another over 10% pop today, and we are approaching a gap zone here. Gaps tend to be resistance, but a fill is powerful. If we see price close above the gap, let’s say above 0.815, the momentum to take the price back to all time highs will be real.

So in summary, the downtrend is now nullified with the break and close back above 0.625, where a pullback to said zone would be seen as a retest of a support zone (price floor). The gap may provide some resistance which could lead to a bit of a pullback, but with a gap fill, the momentum continues. The technicals are there and the fundamentals of the company in addition to the market environment means PredictMedix is one to keep on the radar.