Do you ever get that feeling that you’ve written a story before? Weeks before and months before, and five times before and eight times before that?

Whenever I see a Gold Mountain Mining (GMTN.V) news release come out, I get that sinking feeling in the base of my heart because I’ve got to do this story all over again, and that story is always the same; Gold Mountain continues to demonstrate that they’re serious about moving to gold production in the short term, not the long term, with a small project zeroing in on where they already know gold is and getting there as quickly and inexpensively as possible to take advantage of the surging global gold price.

That’s it. That’s the story. They’re always the same, only the fine detail changes. The challenge to me is to find new ways to say that in ways that you haven’t already read because, really, the only thing that’s different from the first to the second to the third is the most recent daily evidence that they’re legit.

Today, we’ve got the company announcing it is kicking off a pre-feasibility study.

Gold Mountain Mining Corp. has engaged JDS Energy & Mining Inc. to complete the prefeasibility study at the Elk gold project located in British Columbia.

The PFS was commissioned to reflect the recent advancements the Company has made to the Elk Gold Project, most notably, the signing of both the Contract Mining Agreement and the Ore Purchase Agreement. These key inputs provide Gold Mountain with the near-term cost certainty required to delineate a maiden reserve at the Elk Gold Project. It is anticipated that the PFS will also update the Company’s resource estimate at the Siwash North Zone based on the results of its Phase 1 drill program.

For those who don’t know a pre feasibility study is, here’s the 101: Prefeasibility studies are an analysis of a potential mining project designed to demonstrate to shareholders and financiers an overview of what it will take, cost, and need to move a mining project forward to production. Capital requirements, political risks, sector performance, timelines, geographic obstacles, community uptake, permits, mine models, blah blah blah.

Most of this the company already knows and has used to begin the process of developing what they have. But to get a third party sign off on it makes it bankable.

Gold mountain has got to the pre feasibility stage quicker than just about anyone I can remember, because of the things outlined above in this story (and all the other stories), where they’ve decided to burst through the barriers to production rather than work around them.

They want to go to production. This is not a gold explorer that continually circles moose paddocks in the middle of nowhere with a helicopter and says, “yep, we think we’re pretty sure there’s some shiny stuff down there somewhere.” They’re not guys sending geos out to pick over rocks and send them to a lab and, maybe in six months, there’ll be some targets to talk about and pick more rocks off. They’re not even guys continually raising money to drill, drill, drill in the hope that they can expand their resource estimate out to a place where it becomes a gimme.

They just want to dig gold out of the ground. They’re determined to do it. And the things they need to do to make that happen are being done on a regular basis, including today’s news.

Our Greg Nolan has done some good work on this crew, but here’s some important info that relates to the pre-feas.

- A 2020 Preliminary Economic Study (PEA)—factoring in a US$1,600 Au price—shows:

- A Post-Tax NPV of $191M;

- A low OPEX – AISC of US$735 per oz;

- A low start-up CAPEX at CA$6.9M;

- An expansion CAPEX of CA$26M once the Company decides to scale the project;

- A 50,000 ounce per year mine plan by Year 4;

- A payback period of 6 months, from the start of production

As I’ve said before, I can’t say enough about this team. I can’t say enough about the plan. I like the idea of going in cheap, zeroing in on exactly where you know there is gold because you had drill results before. I like the idea of doing it in a place where you could literally send a cab to pick up the gold and bring it to town, I like being in a place where employees can order a pizza after they finish their shift and not have to fight grizzly bears for it.

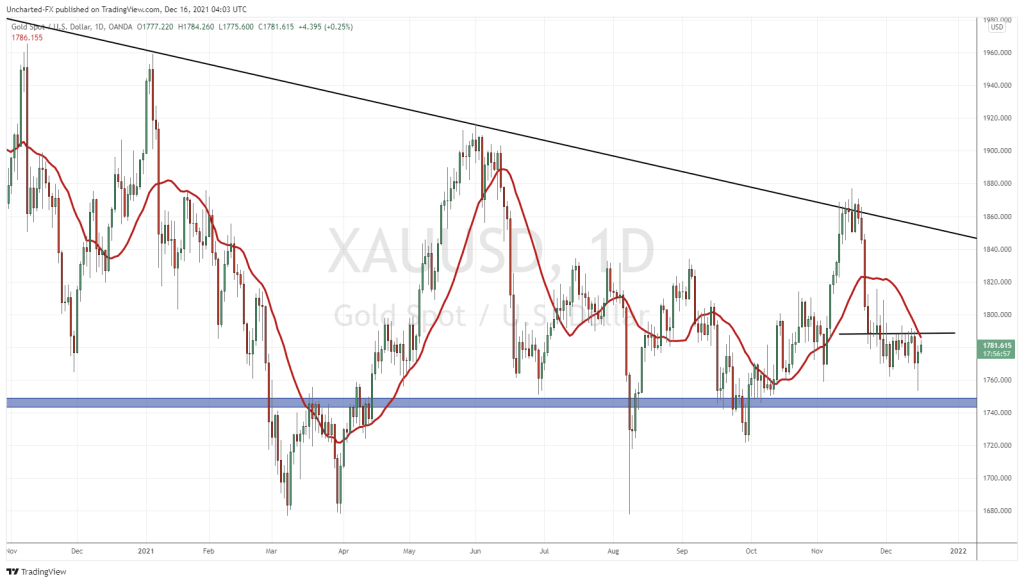

I like the idea of being a decent little producer at a time when we’re pretty sure that gold is going to be in vogue for at least a few years, and not having to wait five to 10 years where someone can start pouring bars.

I want to see gold stuff coming out of the camp and I want to see money coming back for it, because there’s no indicator that there’s gold under the ground better than actually pulling gold out of the ground.

Excelsior, Gold mountain.

–Chris Parry

FULL DISCLOSURE: Gold Mountain is an Equity.Guru marketing client