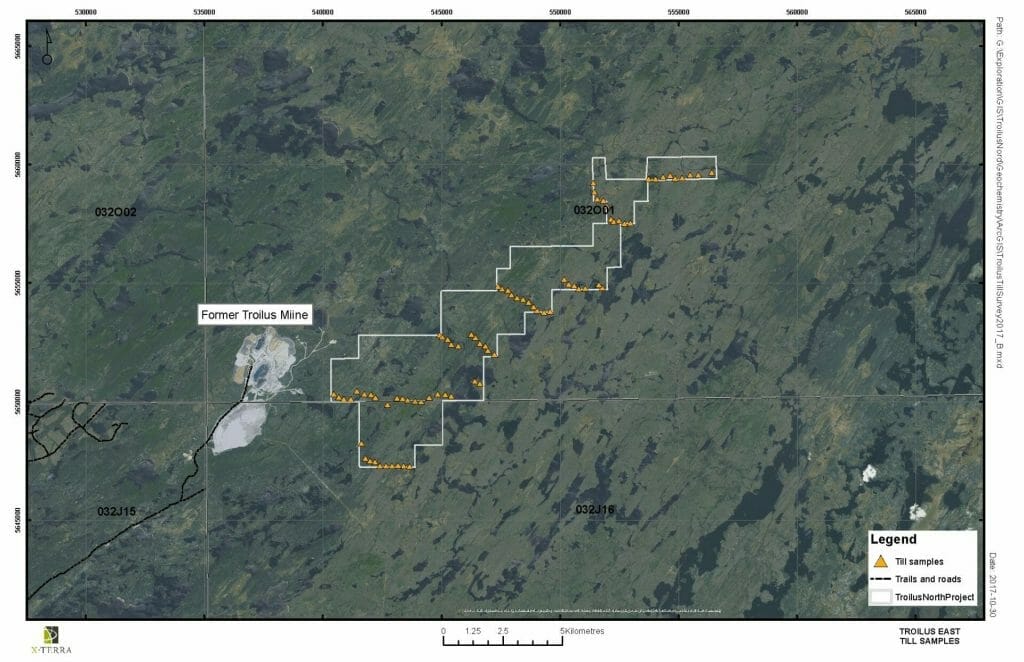

On January 25, 2021 X-Terra Resources (XTT.V) announced that it has officially started drilling the Rim Vein Target on the Northwest property located in Restigouche county, New Brunswick.

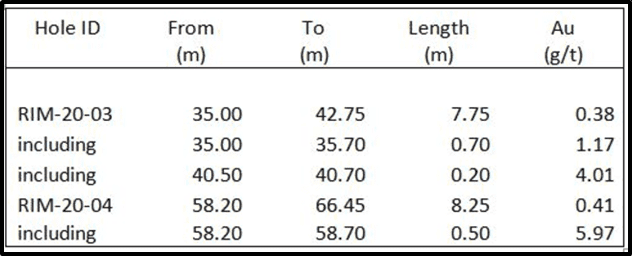

“The Company reported drill results (and metallurgy) from its Rim vein target,” stated Greg Nolan on December 18, 2020, “This maiden drill program tagged a 9.5-meter cluster of gold-bearing veins 50 meters under the RIM surface vein showing.

“The drill program consisted of 472.5 meters over four holes to test a 400-meter section of isolated gold-bearing anomalies. This included the Rim vein surface discovery, where two holes, RIM-20-03 and RIM-20-04, targeted the Rim vein structure at depth and intersected multiple quartz veins in succession ranging from 10 cm to 1 meter in width.”

Visible gold was noted in the core of Hole RM-20-04.”

“The veins all exhibited crack and seal and breccia with thicknesses varying from a few millimetres to 0.5 metre inside a stockwork style structure. The gold results are closely associated with fine disseminated sulphides along with stylolites throughout the quartz veins. Hole RIM-20-02 located about 200 metres northwest of the Rim vein also intersected a group of quartz veins and stockworks over the last 20 metres of the hole at a depth of 80 metres.

The structure is interpreted to be related to a parasitic fold hinge of kilometric influence trending north which has been identified via the regional magnetic survey. This north-east structure flank was cross-cut by drilling where quartz veining and gold values are associated with a siltstone-sandstone contact. It is noteworthy that the largest part of the fold hinge is located approximately 500 metres north of the drill area which is not outcropping and has never been subjected to any type of exploration. X-Terra plans to follow up in this area as soon as possible.” – End of Nolan

“The program announced January 25, 2020 will consist of a minimum of 1,000 metres with holes ranging from 100 to 200 metres in depth,” stated Baru.

“The recently received drone magnetic survey results have highlighted with extreme detail numerous subtle structures that were non-existent when compared with the regional magnetic survey.

The goal of this drill program is to follow up on previous drill results and bulk sampling done on the Rim vein where a five- to 10-metre cluster of gold bearing veins were intersected at approximately 50 metres under the Rim vein surface showing.

In addition, the bench scale bulk sample on 129 kilograms and metallurgical recovery test done on the vein material at surface returned an average grade of 79 grams per tonne gold (see X-Terra press release, Dec. 15, 2020). The first drill campaign comprising four holes was completed in the fourth quarter of 2020. It is important to note that there has only been four holes totalling 440 metres completed at this target.

The Rim high-grade vein system is now strongly believed to be associated with a kilometric fold hinge developed along a regional north to northeast shear system which is developed in sediments.

The current program will cover approximately 600 metres of strike length inside a north to northeast kilometric fold hinge.

Eight new holes are currently planned over high-priority targets hosting magnetic contrasts and with trends highlighting similarities with the Rim high-grade showing environment.”

“X-Terra’s exploration team and drilling crews are excited to commence the second phase of drilling at the Rim vein target,” stated Michael Ferreira, President and CEO of X-Terra, stated: “but this time equipped with very precise magnetic data. Utilizing the detail from this magnetic survey, our geological team has been able to better pinpoint the fold hinge and potential associated faults and shear zones, which is believed to be controlling the high-grade gold mineralization of the Rim veins.”

Two Equity Guru clients, Arizona Metals (AMC.V) and Baru Gold (BARU.V) just began trading on the U.S. OTC markets. This is a good move as many U.S. investors are not able to buy stock on Toronto-based exchanges.

“Most Americans don’t have a clue where they can go to buy and sell Canadian equities,” confirms Wealth Daily. “The majority of U.S. citizens trade stocks online through brokers like AmeriTrade, Fidelity, and Scottrade. And for the most part, these brokers won’t allow Americans to trade Canadian stocks”.

“If a Canadian company has a U.S. listing, then buying and selling it are no problem,” added Wealth Daily.

“More than 10,000 U.S. and global equities, ranging from large international companies to community banks, trade on the over-the-counter market,” states Yahoo Finance.

The OTC Markets Group is organized into a tiered system based on the quality and timeliness of disclosed information.

OTC Tier system:

The OTCQX Market is the top tier, with the most stringent entry requirements, “meeting high financial standards, follow best practice corporate governance, demonstrate compliance with U.S. securities laws.”

Over 400 companies trade on OTCQX, including Swiss pharmaceutical conglomerate Roche (OTCQX: RHHBY), the French global communications company Publicis Groupe (OTCQX: PUBGY) and Grayscale’s Investment the Bitcoin Investment Trust (OTCQX: GBTC).

The OTCQB is the middle tier – is known as The Venture Market. Companies that trade on this tier are in their early stages, and therefore, may not be able to meet the financial or regulatory requirements required by the exchanges or OTCQX. Over 900 companies trade on the OTCQB Market.

The Pink Open Market is the 3rd tier, including companies that are bankrupt or not current in their disclosures with the SEC or their home country exchange.

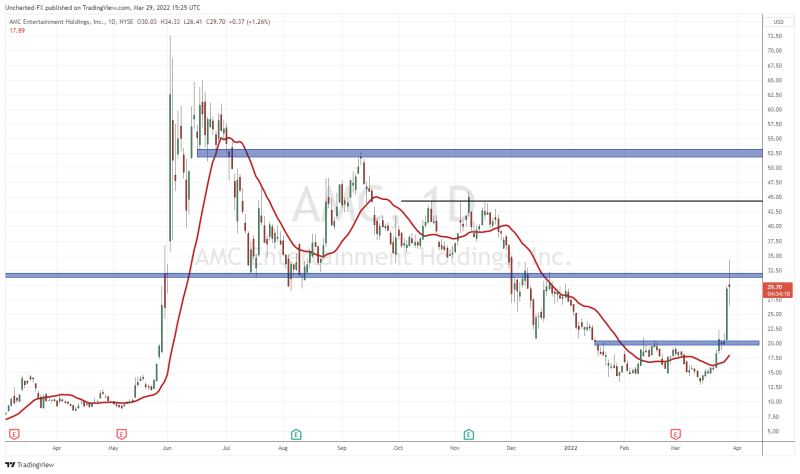

On January 25, 2021 Arizona Metals (AMC.V) announced that it has upgraded from the OTCQB Venture Market to OTCQX.

AMC begins trading today on OTCQX under the symbol “AZMCF.” U.S. investors can find current financial disclosure and Real-Time Level 2 quotes for the company on www.otcmarkets.com.

“The OTCQX Market is designed for established, investor-focused U.S. and international companies,” explained AMC, “To qualify for OTCQX, companies must meet high financial standards, follow best practice corporate governance, and demonstrate compliance with applicable securities laws.

“Graduating to the OTCQX Market from the OTCQB Market marks an important milestone for companies, enabling them to demonstrate their qualifications and build visibility among U.S. investors”.

“The timing coincides well with our Phase 2 drill program at the Kay Mine, which began two weeks ago,” stated Marc Pais, CEO of Arizona Metals, “We expect to release a steady flow of drill results over the coming months.”

“We are expecting to close an over-subscribed private placement of CDN$10 million later this week,” added Pais, “which will put us in a very strong financial position to complete an aggressive drill program. We will issue another press release on closing of the financing.”

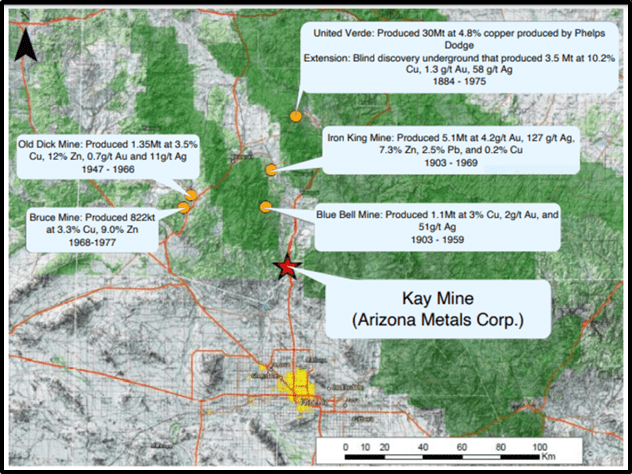

“The Kay Mine Project is AMCs flagship,” confirmed Equity Guru’s Greg Nolan on January 8, 2021, “Kay is located in a prolific volcanogenic massive sulphide (VMS) district—a region host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of this highly prospective asset”.

On January 22, 2021 Baru Gold (BARU.V) announce that it has received approval from the OTC Markets Group to begin trading on the “middle-tier” OTCQB Venture Market under the ticker symbol “BARUF”.

The Company currently trades on the TSX Venture Exchange under the ticker symbol “BARU” and on the Frankfurt Exchange under the symbol WG3N.

“Baru controls two highly prospective Indonesian based properties in its project portfolio—Sangihe and Miwah,” reported Equity Guru’s Greg Nolan on January 14, 2021.

“The Sangihe Gold Project consists of 42,000 hectares covering the southern half of Sangihe Island, located between the northern tip of Sulawesi Island (Indonesia) and the southern tip of Mindanao (Philippines).

Baru has a 70% working interest in the project—three Indonesian companies hold the remaining 30%. Baru, with its seasoned team of mine builders and rock kickers, is the project operator.

Sangihe is being fast-tracked to production and could begin cash-flowing as early as Q2 of 2021.

Indonesia Mining Jurisdiction Highlights:

- Stable multi-party democracy

- World-class gold deposits

- Grasberg the world’s largest gold deposit with 67.4 million ounces

- Improving climate for gold mining

- renewed exploration activity and investment

- In 2016 Martabe Mine in Sumatra bought for $775 million from G-Resources

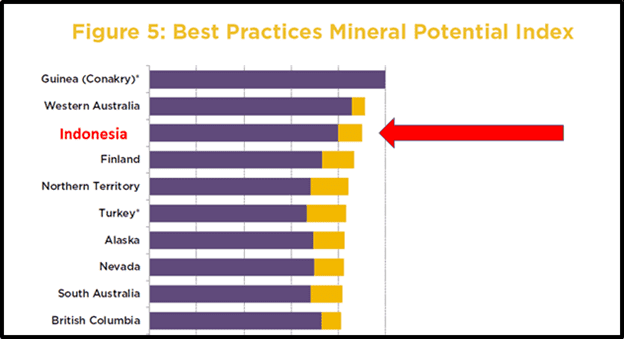

The Fraser Institute’s 2019 Mining Survey Best Practices Mineral Potential Index ranks the jurisdictions based on which region’s geology “encourages exploration investment” or is “not a deterrent to investment.”

Indonesia sits #3 in that category.

This new listing on the OTCQB broadens the market to include investors in the United States. BARU has prioritised listing on the OTCQB, given that it is embarking on a new phase of growth and development.

- Lukas Kane

Full Disclosure: XTT, AMC and BARU are Equity Guru marketing clients.