The price of nickel—Ni on the periodic table—has been surging, taking out multi-year highs in recent sessions.

Cell phones, laptops, large scale energy storage systems, and EV batteries rely on nickel. It’s also a key ingredient in high-quality stainless steel—a popular commodity in booming economies.

Where EV batteries are concerned, nickel offers numerous advantages as it helps deliver high energy-density coupled with superior storage capacity.

The economic recovery in China and impressive growth in European EV sales in H2 of 2020 have heightened expectations for increasing demand in 2021.

According to EVvolumes.com:

“What started with an unprecedented economic downturn during the 1st COVID-19 wave became a success story for EVs in Europe. Nearly 1,4 million BEVs and PHEVs were registered in Europe during 2020, 137 % more than in 2019, in a vehicle market that was down by 20 % year-on-year.”

That’s quite a stat.

Without a doubt, junior ExplorerCos tagging significant Ni discoveries at this point in the cycle will attract a lot of interest from the market, not to mention Producers looking to bulk up their mineral inventory.

- 33.69 million shares outstanding

- $10.61M market cap based on its recent $0.315 close

Huntsman, formerly Bluebird Battery Metals Inc, is a standout in the Ni exploration arena IMO.

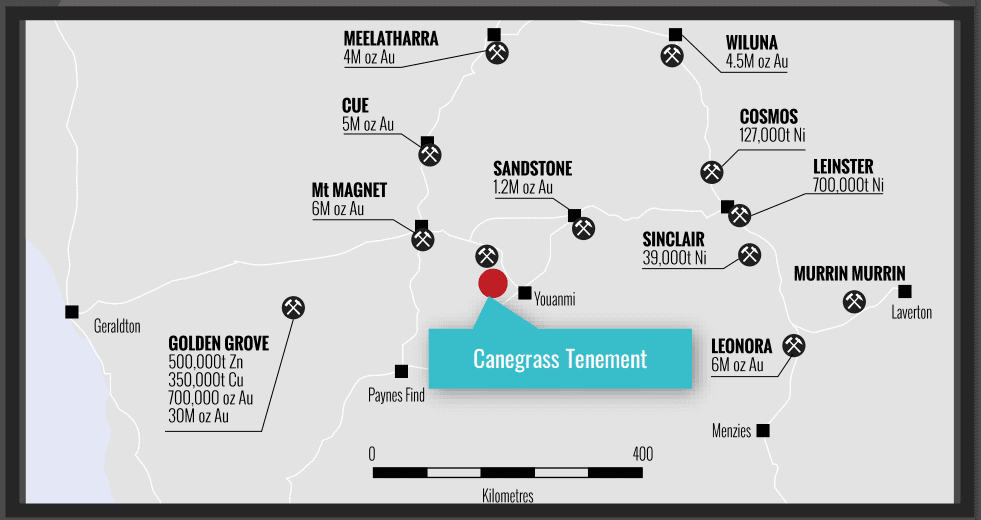

After consolidating its share structure and adding several prospective properties to its project pipeline, the Company’s Canegrass project maintains its flagship status.

Canegrass overview

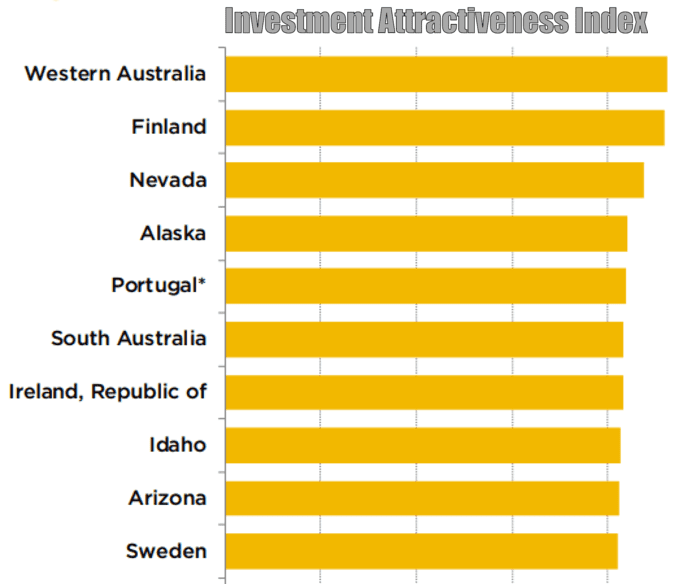

Canegrass is located in Western Australia. As a mining destination, a more friendly jurisdiction does not exist, not on this planet anyway.

According to the Fraser Institute’s most recent investment attractiveness survey, Western Australia reigns supreme.

This is a huge advantage for ExploreCos like Huntsman. As long as the company operates within the rules, and a sense of fairness and respect (for the environment and local population), permitting is a walk in the park.

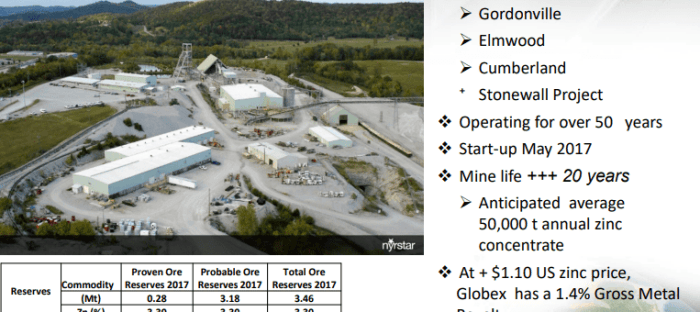

The Canegrass project covers 4,200 hectares of geologically prospective terrain. It’s positioned in a prolific geological setting—the Windimurra Intrusive Complex—and is surrounded by world-class deposits.

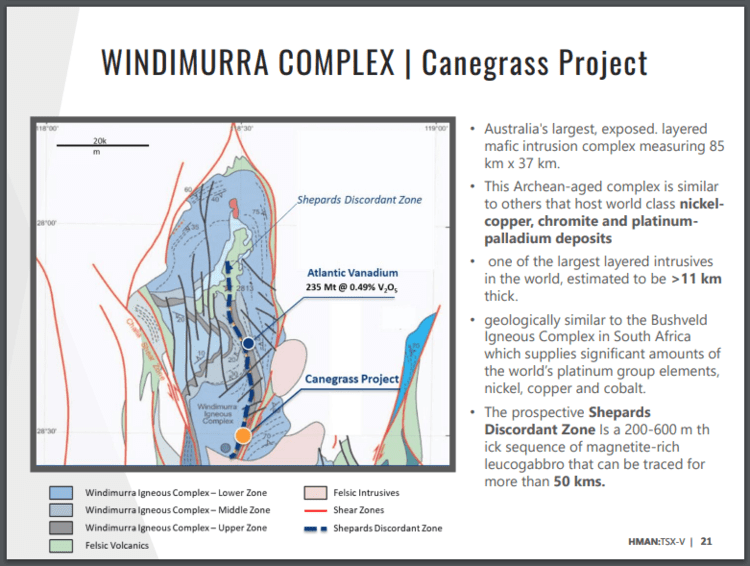

Windimurra is Australia’s largest, exposed, layered mafic intrusion complex measuring some 85 kilometers x 37 kilometers by some 11 kilometers thick.

This Archean-aged complex is geologically similar to the Bushveld Igneous Complex in South Africa, the source of much our planet’s nickel, copper, cobalt, and platinum group elements.

Within the Windimurra Complex, the prospective Shepards Discordant Zone—a 600 meter thick sequence of magnetite-rich leucogabbro—can be traced for more than 50 kilometers. And it trends directly onto Huntsman’s Canegrass ground.

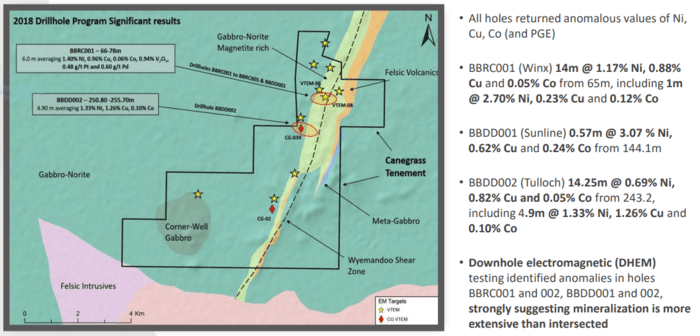

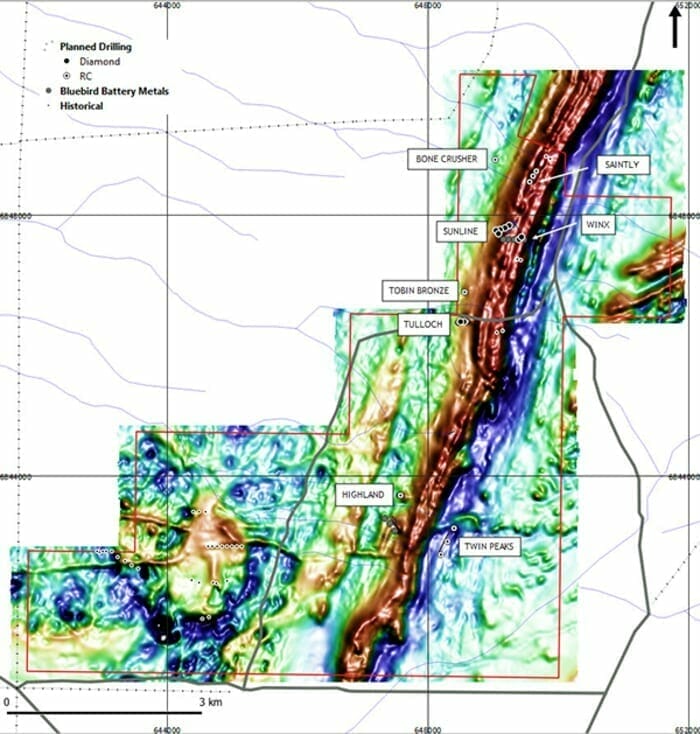

The next map shows an 8.5-kilometer magnetite rich-gabbro-norite structure trending parallel to a shear zone, a potential trap for mineralization.

Geologically, this is a fertile setting for a high-grade discovery.

Note the highlight hits from a 2018 drill campaign on the above slide.

Note the yellow stars and red diamonds distributed along this 8.5-kilometer trend. These symbols represent no less than twelve geophysical anomalies, several of which correlate well with the more significant hits from the 2018 drilling campaign.

Also, note the yellow star and the grey circular anomaly in the southwest corner on the above map—the Corner-Well Gabbro (note the map’s scale). The company is excited about the potential of this large zone. It could see multiple probes with the drill bit in the not-too-distant future.

Again, the Company is targeting high-grade nickel at Canegrass—Nickel Sulphide specifically—a key ingredient in the new generation of EV batteries.

Western Australian nickel deposits often have two components: a disseminated zone (low-grade bulk tonnage material), and a higher grade component (a zonally confined structure).

Nickel deposits in this corner of the world also have tremendous (mother-lode) potential at depth—the intervals highlighted during the 2018 campaign (above map) may represent only ‘fingers‘ of a much larger (richer) ‘hand‘ buried below.

With the market anticipating an aggressive drilling campaign at Canegrss, on Jan. 5th, Huntsman dropped the following headline:

Huntsman to Commence 18-hole Drill Program at Canegrass High-Grade Nickel Project, Western Australia

Huntsman, with a Programme of Work (POW) permit in hand, is on the cusp of an 18-hole (3,160 meter) drill program at Canegrass.

The Company highlighted the following points in the body of this press release:

- High-grade nickel, copper, PGE, and vanadium mineralization;

- Multiple, high-grade, near-surface drill results;

- Drilling success to date has been following up EM survey anomalies. More anomalies remain to be drill tested;

- Attractive Chemistry: Multi-element rock and soil sampling (historical);

- Located in the Windimurra Intrusive Complex, road accessible and 500 kilometers from tidewater.

This program, designed to follow up on the success of the 2018 campaign, will drill untested conductors identified in surface geophysics and will assess the extent of the Ni-Cu (Co) mineralization intersected, targeting the off-hole DHEM anomalies.

“All 2018 drill holes returned anomalous values of Ni, Cu, Co (and PGE) and were open along strike and at depth. Downhole electromagnetic (DHEM) testing identified anomalies in several holes, strongly suggesting mineralization is more extensive than intersected, which will be tested in the upcoming drill program.”

“In addition, the Company has also engaged AHA Logic to undertake a Heritage study of the area to confirm compliance with the Company’s knowledge of the property, and to ensure compliance with the Australian Aboriginal Heritage Act 1972. Huntsman’s Australian Consultants, Newexco Exploration Pty Ltd. (“Newexco”), will be accompanying representatives from AHA Logic as they perform a site visit this week.”

Peter Dickie, Huntsman’s CEO:

“With permits in hand, and contractors confirmed, we anticipate the commencement of drilling at Canegrass within the next two weeks. We will be following up on strong initial drill results, as well as testing a number of additional survey anomalies. Currently rated as the world’s top mining jurisdiction by The Fraser Institute, Western Australia’s mining sector is booming, and we are very pleased to be advancing our high-grade nickel project at this time.”

Baxter Springs

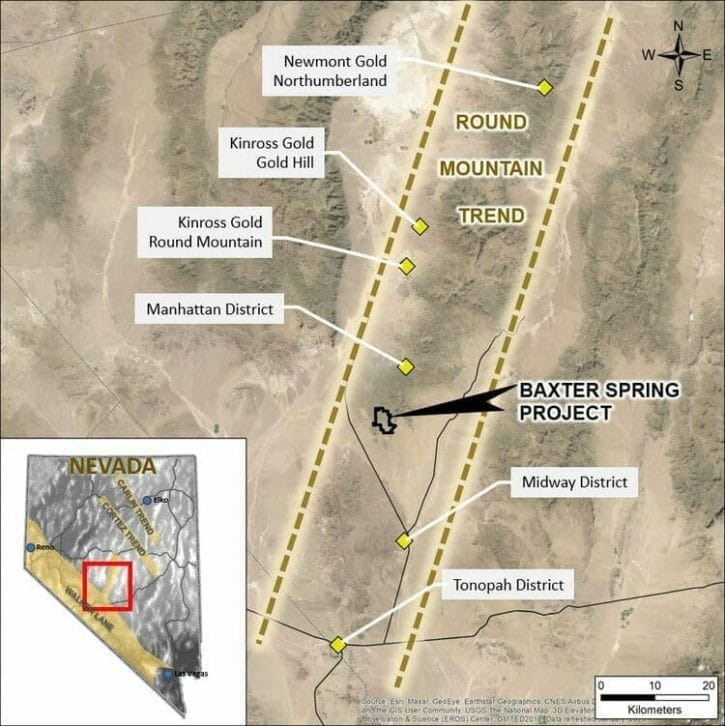

Acquired last August from Liberty Gold (LGD.T), the Baxter Spring Property is located in mining-friendly Nevada, a jurisdiction ranked 3rd on the Fraser Top Ten list.

The price of admission for this strategically positioned project: a one-time payment of US$500k and the issuance of 19.5% of the outstanding (post-consolidation) shares in the Company.

Baxter Spring is an intermediate-stage gold exploration project in Nye County, Nevada. The Property consists of 132 unpatented federal lode claims covering 1,040 hectares.

Project highlights:

- Widespread surface gold anomalies in rocks and soils;

- Drill tested gold mineralization with 128 historical RC and core holes, and a number of previously identified, untested targets;

- Historically, only drill tested with shallow holes, with potential to find additional mineralization at depth;

- Located within a regional N-S trending belt of mineralization that includes Northumberland (3.5 Moz Au), Round Mountain (15 Moz Au), Manhattan (1.5 Moz Au), and Goldfield (5 Moz Au);

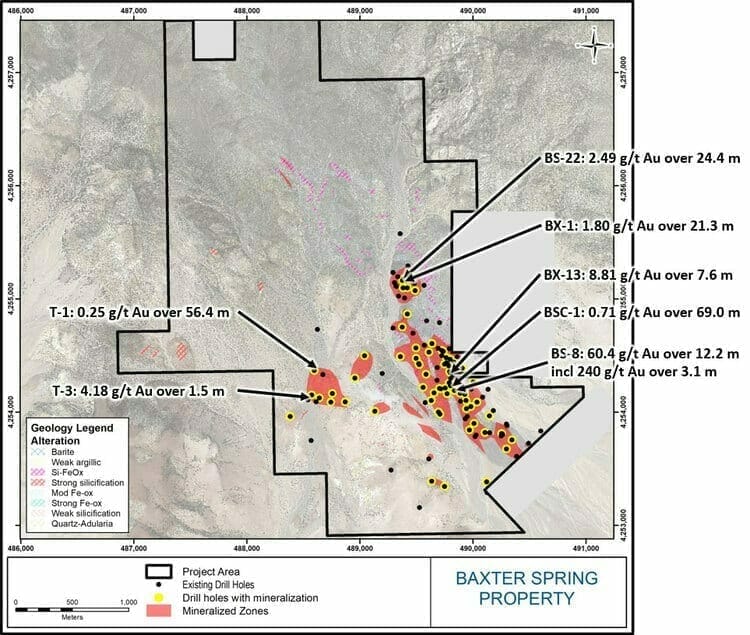

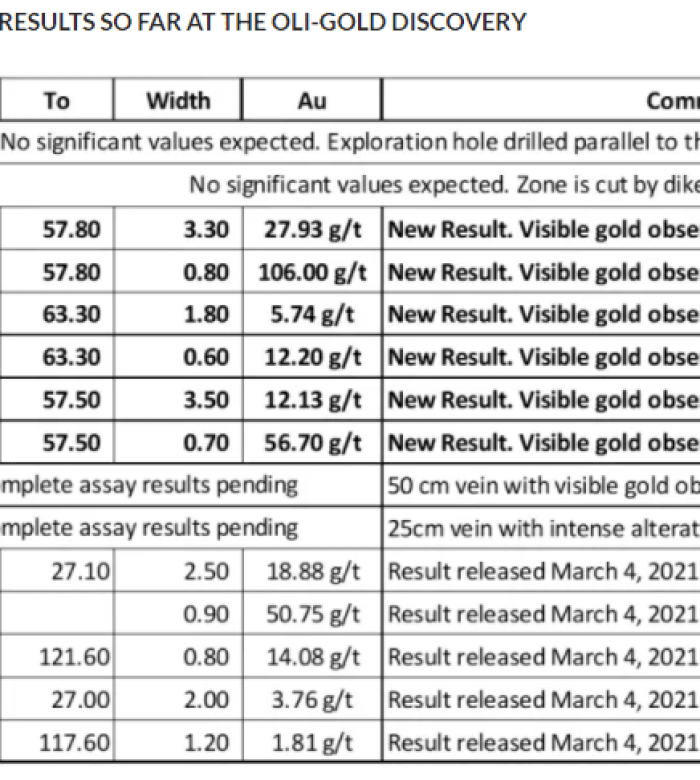

- Low sulphidation epithermal gold veins with bonanza grades (3.1 meters grading 240 g/t Au in drill hole BS-8) and stockwork overprinting calcareous sedimentary rocks that could host a bulk-tonnage gold target (69.0 meters grading 0.71 g/t Au in drill hole BSC-1);

- The mineralization is oxidized;

- Several drill-tested gold mineralized zones are open for expansion and several soil-rock anomalies require a proper probe with the drill bit;

- Located primarily on BLM-https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered land – lower priority targets are located on US Forest Service (USFS)-https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered land;

- Excellent road access, nearby power, and other amenities.

Historic drill results include:

- 2.49 g/t Au over 24.4 meters (BS-22);

- 60.4 g/t Au over 12.2 meters incl 240 g/t Au over 3.1 meters (BS-8).

On Jan. 12th, Huntsman dropped the following headline with respect to Baxter Springs.

Huntsman Outlines Plan for Multi-Phase Drill Program at Baxter Spring Gold Project, Nevada

The Company is currently in the process of permitting the first of a multi-phase drill campaign at the project.

The Company is reviewing historic data from the previous operator—including 128 (historic) drill holes—and has identified a number of high priority drill targets.

“The review is ongoing and onsite activities at Baxter Spring will proceed shortly. Phase I drilling is anticipated to commence in the latter half of Q1, 2020 with an emphasis placed on confirmation of several known structures.

During a recent chat with CEO Dickie, I learned that phase-1 will test a 5-hectare chunk of ground where historical drilling tagged significant mineralization.

Once the phase-1 results are in hand, expect to see the application of good, stackable science—a round of geophysics and geochem.

Data stacking: the combination of phase-1 assays, geophysics, and geochem will help prioritize targets for what should be a greatly expanded drilling campaign over a much larger area of the property in phase-2.

CEO Dickie:

“We are excited to commence activities at Baxter Spring in Nevada – a project that has shown evidence of both moderate-grade, disseminated gold and high-grade structure. Field work at Baxter Spring will mean Huntsman will be operating on two fronts, with further drilling at the Canegrass high-grade nickel project in Western Australia set to commence this month.”

Flint Property

If you check that index of top-shelf mining jurisdictions at the top of the page, you’ll see Idaho ranking number eight in Fraser’s Top Ten.

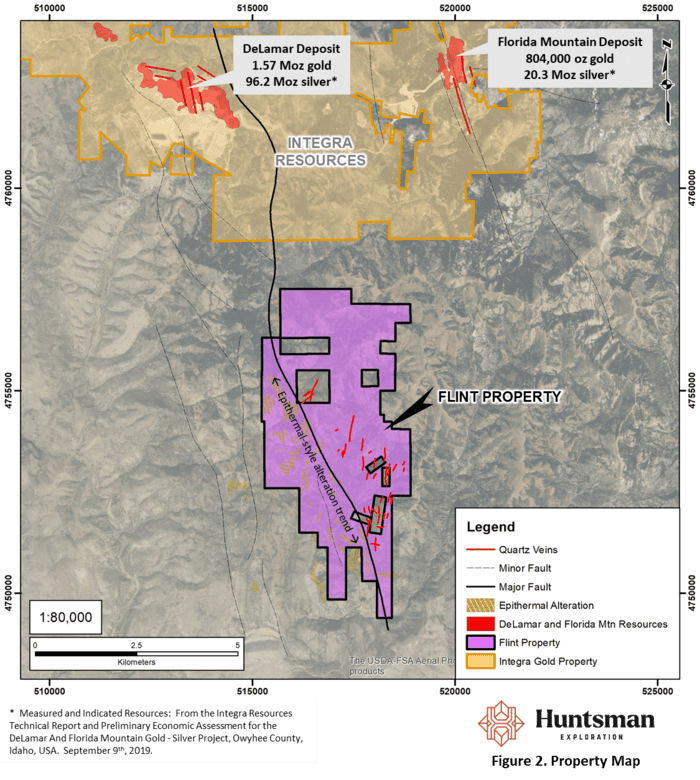

This 1,845-hectare chunk of prospective Idaho terra firma lies on trend roughly 1.2 kilometers south of the historically producing DeLamar and Florida Mountain camps where Integra Gold recently defined resources totaling 2.1 Moz of gold and 116 Moz of silver (see Integra Resources technical report dated Sept-9, 2019).

Historical records show more than 1.5 million ounces of silver production from two veins in the Flint camp (private land, not part of the package). Due to the antiquity of this historical production, few records remain.

Generally, the veins at Flint contained 20 to 30 ounces of silver per ton (686 to 1,029 g/t Ag), with gold values ranging between 0.04 and 0.1 ounces per ton (1.25 to 3.13 g/t Au).***

Potential for Bulk Mineable and High-Grade Mineralization at Flint

The Flint Property represents an opportunity to apply modern exploration techniques with the goal of defining bulk-mineable gold and silver mineralization near already defined high-grade silver-gold veins. Potential for high-level gold mineralization at Flint, in a geologic setting analogous to the DeLamar deposit, has been recognized but never tested. Of note, high-level epithermal alteration has been mapped over a 4 km-long strike length in the same rhyolitic host rocks as the DeLamar Deposit. Tertiary volcanic rocks overlying the Flint vein system are preserved in the hanging wall of the Flint Creek fault and host widespread silica and clay alteration. The volcanic package comprises rhyolitic flows, vent facies, and basalts that are equivalent to the major ore-hosting units at DeLamar.

CEO Dickie:

“The acquisition of the Flint gold-silver project in Idaho directly supports our goal of diversified value creation in low-risk jurisdictions. We are also continuing to prep for our exploration programs in Nevada and Western Australia and look forward to providing further updates as we proceed.”

Final thought

There are a handful of standouts showing significant price strength in the junior exploration arena right now. Price strength, when accompanied with above-average volume, takes on greater meaning.

Huntsman is showing signs of accumulation in advance of Canegrass drilling. The question is… is this ‘smart money’ accumulation?

We stand to watch.

END

—Greg Nolan

Full disclosure: Huntsman is an Equity Guru marketing client.

*** All historical exploration details and resource estimates quoted herein are based on reports obtained and prepared by adjacent property operators. The Company has not completed the work necessary to verify results and the figures should not be relied upon, as they have not been verified by a Qualified Person. They are also not necessarily indicative of the mineralization hosted on the Company’s Property.