On January 21, 2021 Delta Resources (DLTA.V) announced its 2021 winter drilling strategy at its Delta-2 property in Quebec.

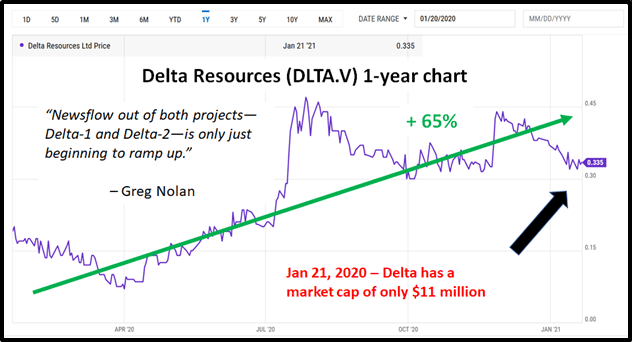

“Delta has two highly prospective properties in its project pipeline: Delta-1 and Delta-2,” wrote Equity Guru’s Greg Nolan a week ago.

From a wide-angle financial and political lens, this is good time to be developing gold (and poly-metallic) projects.

“There is a lot of optimism that Biden could pass additional stimulus measures, make it a priority,” Blue Line Futures chief market strategist Phillip Streible told Kitco News yesterday, “People do think that Biden and the Treasury Secretary nominee Janet Yellen are going to produce a lot more accommodative measures going forward.”

Side note: congratulations to all Bitcoin investors. Historical context: when something with no measurable value (other than its selling price) goes up sharply, it has always come down sharply. Today’s 9% Bitcoin price drop is based on nothing. Because everything about Bitcoin is based on nothing.

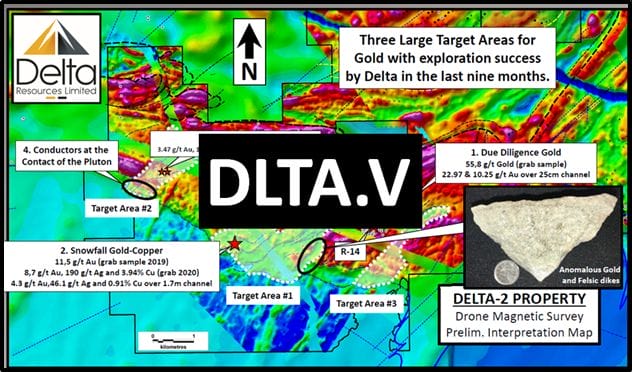

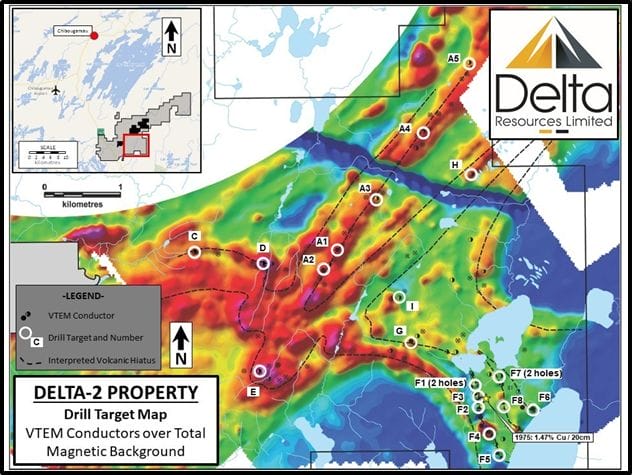

“The easily accessed 16,400-hectare Delta-2 project is located along the northeast end of the Abitibi Volcanic Belt, just to the southeast of Chibougamau,” continued Nolan.

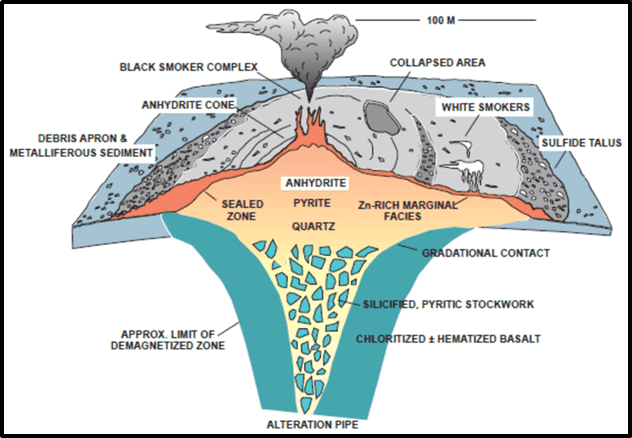

The Company is targeting two types of deposits in the region—Volcanogenic Massive Sulphide (VMS) deposits like the past-producing Lemoine mine (757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag), and Magmatic-hydrothermal Au deposits like the Chevrier Zone (43-101 Resource of 10.8Mt @ 1.22 g/t Indicated and 6.3Mt @ 1.27 g/t Au Inferred).

Interesting to note, the past-producing Lemoine Mine, just two kilometers to the north of Delta-2’s upper boundary, was one of the richest mines in Canadian history, not in terms of size, but in terms of metal content.

Lemoine is located at the top right of the map below, Chevrier on the bottom left (the Delta-2 property is outlined in red).” End of Nolan

On December 7, 2020, Andre Tessier, DLTA CEO and President – delivered a video-address to shareholders from the Quebec core shack.

“We drilled over 2,000 meters from Phase 1 on gold targets that had very similar geology as the Genesis Metals property just to the west of our property where they intersected 13 grams/tonne over 11 meters,” stated Tessier.

“Now we are moving onto phase 2 of our drill program where we are drilling VMS targets.”

Update: Genesis Metals’ drill results published today did not disappoint.

Delta has now resumed its drilling program at Delta-2.

The objective of the drilling program is to test a minimum of 18 targets deemed to have excellent potential for volcanogenic massive sulphide (VMS) mineralization similar to the Lemoine past producer which is located 1.5 kilometre north of the property boundary.

Delta is planning approximately 3,000 metres of drilling in this second phase of drilling, testing up to 18 isolated VTEM conductors that have never been drill tested.

For logistics purposes, the targets that will be tested during this phase of drilling are all located in the SE portion of the property (map below):

VMS drill target selection criteria

- Conductors are short, isolated and conformable to reflect the typical strike length of VMS deposits.

- Conductors are located near or immediately onto what is interpreted as the stratigraphic horizon that hosts the Lemoine Mine.

- Conductors are located in areas of structural complexity known to host massive sulphide deposits.

- Chert, iron formations and felsic volcaniclastic rocks were observed in the field near the conductors, indicating a hiatus in the volcanic sequence; the site where VMS deposits are typically deposited.

- Geological observations in the field, near the conductors have shown favourable indicators for VMS mineralization including: the presence of sulphide mineralization and garnet-sillimanite-andalusite-sericite-amphibole alteration typically associated with VMS deposits in high-grade metamorphic terranes.

“The combination of these criteria suggests an excellent potential for VMS mineralization and each target shown on the attached map is deemed very high priority for drill testing,” stated DLTA.

“There are 3 factors to remember about VMS deposits,” stated Greg Nolan on December 3, 2020.

“First, they typically occur on or near certain stratigraphic horizons. You may have heard of the Key-Tuffite in Mattagami or the C / Main Contact Tuff in Noranda. At delta-2, this horizon is the Waconichi and Delta-2 covers about 17 kilometers of it.

Second, there are many VMS deposits in the world and they almost invariably occur in clusters (Canadian examples include the districts of Noranda and Mattagami in Quebec, Flin Flon and Snow Lake in Manitoba, Bathurst in New Brunswick, and Buchans in Newfoundland). There’s a reason why we call them camps. so when we see Lemoine (757,585 tonnes of ore grading 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag) sitting there all by itself, we have to ask… wheres the rest of the cluster?

Third, within these VMS camps, there’s a very typical size distribution of these deposits, ranging from several small deposits in the one million ton range all the way to a single giant deposit in the range of 100 million tons. Lemoine, being at the smaller end of the spectrum, leaves us to believe the larger deposits remain to be found.

Very cool (editors note).

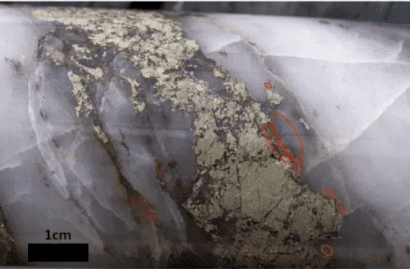

The real advantage in drilling off VMS targets is that visually, you know when you’re in the right rock. Massive sulphide drill core is conspicuous—often striking—even to the layperson.” – End of Nolan.

The Delta-2 property covers over 177 square kilometres, located 35 kilometres southeast of the town of Chibougamau, Quebec.

Delta is exploring for two distinct types of targets at the property: hydrothermal gold targets and gold-rich polymetallic VMS targets.

After a solid 1-year 65% gain, some explorers might be due for a pull back as momentum traders book profits.

With an aggressive on-going drill program in gold country, and a miniscule $11 million market cap, DLTA’s 2021 outlook is bright.

- Lukas Kane

Full Disclosure: Delta Resources is an Equity Guru marketing client.