We have an impressive stable of resource clients here at Equity Guru, several of which produced significant gains in recent sessions.

Defense Metals’ (DEFN.V) is a standout, having captured high ground not seen since it made its debut two years back.

What’s really striking about this price trajectory is the accompanying volume.

Defense is a company we follow closely here at Guru Central.

Defense Metals (DEFN.V) casually gains $4 million in market cap

It’s also on my shortlist over at Highballer.

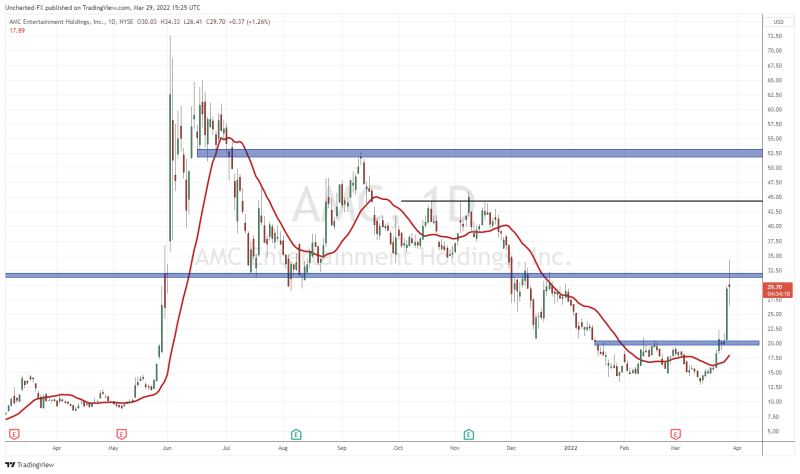

Another client company demonstrating some very satisfying share price trajectory of late is Arizona Metals (AMC.V).

The stock generated a flurry of activity since the calendar flipped over, more than doubling in price since its early November lows.

For those new to Arizona Metals (AMC from hereon), a quick sketch…

The Kay Mine Project is AMCs flagship.

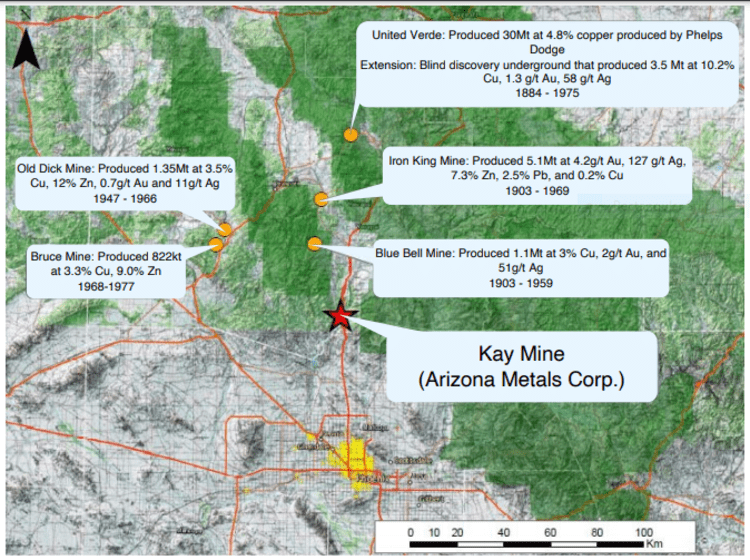

Kay is located in a prolific volcanogenic massive sulphide (VMS) district—a region host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of this highly prospective asset.

This VMS district is credited with roughly 4 billion pounds of copper production over its century-long run. Grades typically ran 3.5%.

In the early 1980s, Exxon Minerals worked Kay’s subsurface layers delineating 5.8 million tonnes of material grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and 2.8 g/t Au for a CuEq grade of 5.8% ***.

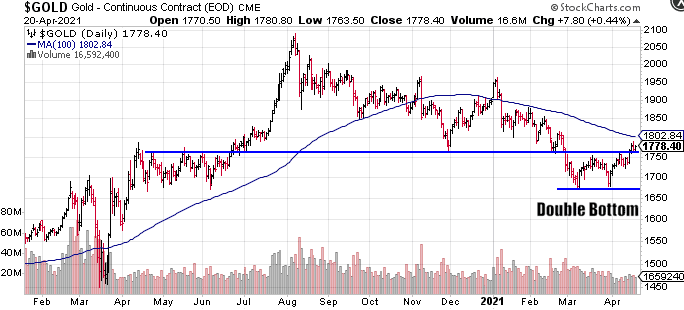

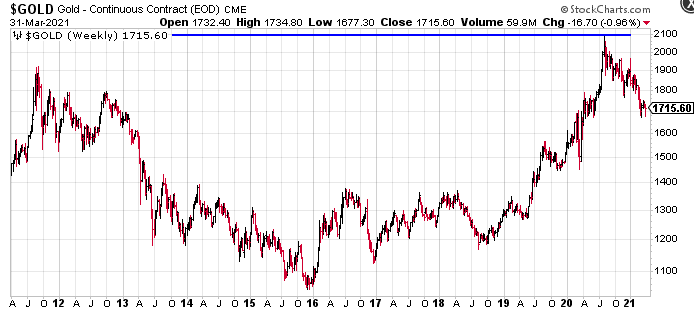

Most of us are well aware of gold and silvers buoyancy of late, which is a huge positive as precious metals account for roughly 52% of the total contained metals here.

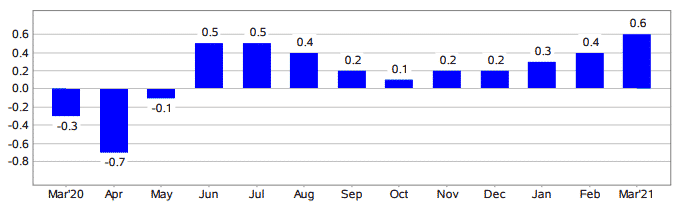

What some may not realize is that copper has been putting on quite a show in recent weeks…

… a really big show (Ed Sullivan voice).

Zinc has been strutting its stuff too.

ALL of the metal components making up this polymetallic (historical) resource have gone on a tear in recent months.

The following are highlights from a phase one drilling campaign completed last August—a campaign where 19 of the 20 holes drilled hit their (massive sulphide) mark.

- 43.1 meters grading 3.94% CuEq (incl. 15.2m of 6.7% CuEq), from a depth of 341 meters;

- 38.4 meters grading 2.9% CuEq (incl. 12.5m of 6.0% CuEq), from a depth of 385 meters;

- 39.9 meters grading 3.4% CuEq (incl. 3.5m of 11.6% CuEq, and 3.5m of 6.6% CuEq) from a depth of 314 meters;

- 22.5 meters grading 2.4% CuEq (incl. 0.8m of 14.0% CuEq and 4.1m of 5.2% CuEq);

- 27.6 meters grading 2.9% CuEq (incl. 3.5m of 6.7% CuEq) from a depth of 423 meters;

- 6.1 meters grading 7.8g/t AuEq (incl. 4.4m of 9.3g/t AuEq) from a depth of 570 meters;

- 6.8 meters grading 7.3g/t AuEq (incl. 4.3m of 10.1g/t AuEq) from a depth of 422 meters.

It’s no wonder AMC has the market’s undivided attention.

On Jan. 5th, AMC announced an upsizing to its recently tabled private placement. Without a doubt, the market has an appetite for this stock.

This raise will add a cool $10M to the Company coffers. And there are no dilutive bells and whistles attached—no warrants—a proviso only the highest-quality entities command in this space.

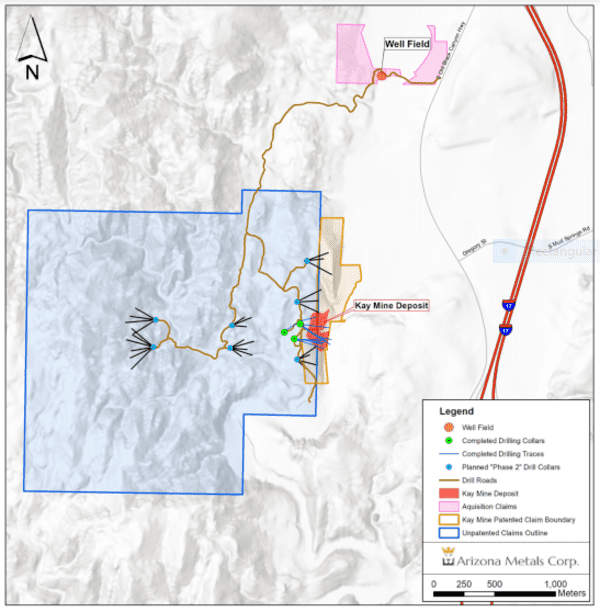

The proceeds from this PP will be used to push their flagship asset further along the exploration-development curve, as well as fund the recent purchase of a group of patented land claims 900 meters to the northeast of Kay.

Regarding this strategic acquisition, Marc Pais, CEO of Arizona Metals:

“The acquisition of the Property is another significant de-risking step in moving the Kay Mine closer to a production decision. Including the 71 acres of patented land that host our Kay Mine deposit, this acquisition will increase our total holdings of patented land to 178 acres. The Property will provide a base for the upcoming Phase 2 drill program, as well as a significant area of private land (including a number of operating water wells) for any future development or production scenarios.”

I know what some of you are wondering: “WTF is the difference between a patented and unpatented claim?”

Fair enough.

Very simply, in a patented claim, you own the land as well as the subsurface mineral wealth.

With an unpatented claim, you are in a lease relationship with the government for the right to extract minerals. You do NOT own the land.

Moving along…

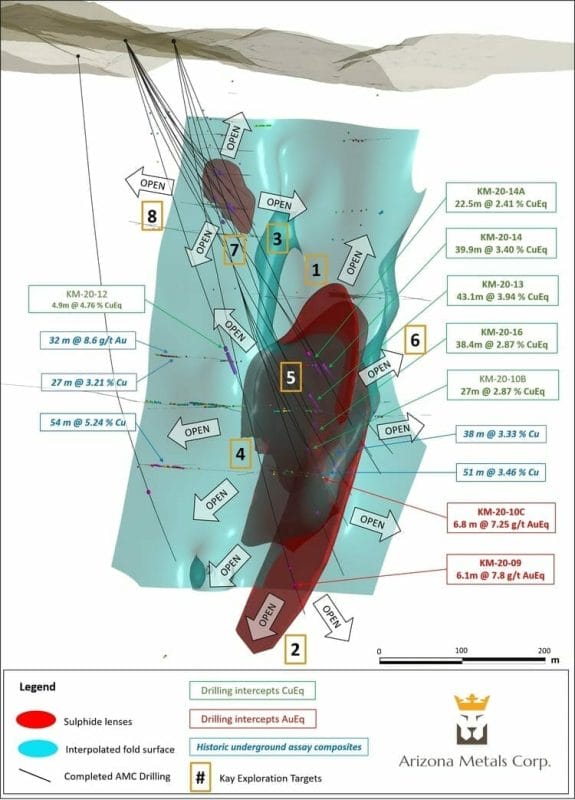

The above map has a lot of detail (note the scale, bottom left). It shows the precise location of the historical deposit, the anomalies representing Kay’s subsurface resource expansion and exploration upside, and the drill pad locations the Company will operate from.

Speaking of drilling, on Jan. 7th, the Company dropped the following headline:

Arizona Metals Corp Commences Kay Mine Phase 2 Expansion Drill Program

The Kay Mine phase-2 drilling campaign is currently underway.

This campaign—up to 11,000 meters in 29 core holes—is designed to test for new VMS lenses in the anticlinal hinge zones identified to the north and south of recent drilling, as well as the up-plunge and down-plunge extensions of known hinges (image below).

Drilling will tag the Kay Mine targets first, then progress to targets on strike to the north and south. Next in line are the Central and Western targets where permitting is currently underway.

CEO Pais again:

“We are pleased to have commenced the Phase 2 drill program, which we believe has the potential to significantly expand the scope and scale of the Kay project, well beyond the boundaries of the 5.8 million tonne historic estimate* outlined by Exxon Minerals in 1982. Our successful Phase 1 drill program greatly increased our confidence in the model. Drilling encountered massive sulphides in 19 of 20 holes. Recently completed spectral alteration analyses of the Kay Mine Phase 1 program drill core, along with downhole EM geophysical surveying, has given us an even stronger understanding of the folding of the Kay deposit at depth. This work has identified a number of high priority drill targets, which we believe have the potential to host additional VMS lenses, as well as wide mineralized hinge zones, similar to the 43 m of 3.9% CuEq (incl. 15 m of 6.7% CuEq) encountered in hole 13.”

This is one of the more exciting projects we’re following here at Guru Central. And this drilling campaign is an aggressive one.

We stand to watch.

END

—Greg Nolan

*** The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.