The adults stumbled in from the garage reeking of booze and cannabis like they did every Friday night when I was a kid, and those were my favourite times because that’s where I was first exposed to the miraculous untapped geopolitical superpowers of cannabis. Shit yes. If only the government would extricate their heads from their asses, and stop taking their marching orders from the anti-weed ninnys in Washington, we could finally legalize and tax weed and the surplus tax dollars would save everything from drug crime (by wiping out organized crime) to the national debt (because cannabis bucks were going to be huge).

Fast forward ten or eleven years. Now it’s October 17, 2017, and holy shit, the government has finally detached itself from the United States political and economic teat long enough to have an independent thought. We’re all catching a contact high from all the hope and promise in the air. Any moment now we’re going to meet the last bit of resistance and then everyone is going to get on board and we’re going to save the world from debt, and crime and maybe there will be a unicorn.

We’re three days out from the third anniversary of weed legalization day, October 17, and I’m still waiting for my damn unicorn.

Actually, that’s a lie. It showed up, but it turned out to be some drunk asshole in a cheap suit with a rubber dildo stuck to its forehead, giving out free bong hits for first timers and then hitting them up for $45 a hit if they want more.

And if you think about it—there’s not really much of a better analogy for the weed industry over the past three years.

What? With the manbun era, MedMen’s (MMEN.C) supervoting shares and racist asshole CEO’s.

About two years ago, the above notion would have been ridiculous instead of absurd. The manbun was giving his weekly prayer session, MedMen weren’t yet outed as the assclowns they are, and the weed industry was riding high. Big names had emerged and market caps were growing. Investors were getting rich. Some stupidly rich. And if you didn’t look too closely then could delude yourself into thinking it was going to go on forever.

We don’t hear much from Canopy Growth (WEED.T) anymore. They had their moment in the sun, riding a superstar high on the back of media hype and the promise of quick gains on a rapidly inflating market. Naturally, their waxy wings dripped away the higher they flew, and the enduring effects of their hubris can still be seen echoing on its balance sheet and the balance sheets of the companies that rode their coat-tails. Meanwhile, Bruce Linton, the T-shirt clad loose-talking CEO responsible for Canopy’s rise and fall floated away in a golden parachute, bolstered perpetually by the occasional consultancy gig secured by his status as weedco-superstar emeritus.

Meanwhile, the company he left behind exists literally as a fraction of its former self—hovering at the time of writing around $9 billion whereas they peaked somewhere around $45 billion—but may for the first time in their existence be closer to their actual worth. Or maybe not—their price to earnings ratio, a quicky metric for determining if a company is overvalued—has them at -$3.80. Still overvalued. They did say it was going to take years to get to profitability, if they ever did. But that’s the Faustian nature of hype.

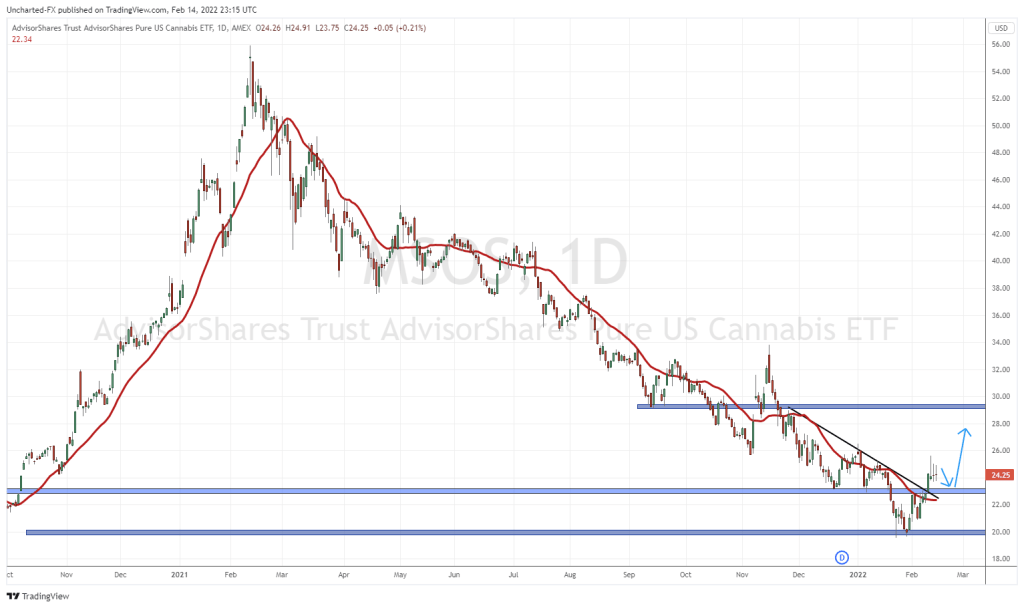

About last year about this time the industry was still scattered with bleeding weedcos, suffering in the mass implosion of the bellwether company at the heart of the industry. Charts for awhile looked like something that would make a novice skier nervous. There was some hope around this time last year. The grand poobahs in Ottawa sent their royal edict down to the plebs that they could have their edibles and eat them too, but with restrictions. So many restrictions. It became clear that we wouldn’t be seeing any real unicorns this year.

Now we can see clearly on the third anniversary of legalization day. Maybe. The bubble’s burst and the era of the fast money and the swiftly inflating market cap is gone. We still occasionally see doubles, especially in the small-cap sector, but those are often short lived. Mostly, it’s companies trying to expand their distribution net, attach another link to their supply chain, or diversify their product portfolio with cannabis 2.0 products.

You know – the boring stuff. Actual business.

Dispensaries

Curaleaf Holdings (CURA.C) wants to think of itself as the successor to Canopy Growth. They’ve taken to calling themselves the world’s biggest cannabis company. Not really. They’re still half of Canopy’s price at a $5 billion market cap, but they boast a wider distribution net, which grows every month. They’re also seemingly not making the same mistakes Canopy did by buying up smaller weedcos whenever they get themselves into some financial hot water for a little positive press and a bump to both their price and cap.

Instead they’re buying dispensaries and potentially making their own mistakes.

Today, they announced that they’re opening two new dispensaries in the Florida Panhandle region. They’re going to be selling medical cannabis, flower, and cannabis 2.0 products like Nano Drops, and next month, they’ll debut some cartridges. Part of their promotional material has them “dedicated to serving over 420,000 registered medical patients in Florida.” Verbatim from the press release.

These openings bring Curaleaf’s total to 33 dispensaries in Florida and 95 nationwide.

Here’s where we come to the reason why we never got our unicorn. Because the revolution we were expecting never came. People in my neighbourhood look at cannabis shops the same way they look at massage parlours. They’re there and it’s a huge market so clearly someone’s using them, but they carry the same stigma. And for those of us that don’t buy into the cannabis stigma—there’s no way we’re buying government weed when our buddy at work can get us primo shit for half the price. CURA’s promising to put out their financials later on in the week, and their revenue statements from August show decent revenue for this industry especially post-bubble and post-COVID, but it’ll be curious to see if the race to get the most dispensaries blows up in their faces.

In contrast, let’s consider the Canadian markets with Wildflower Brands (SUN.C).

Wildflower is the complete opposite of Curaleaf in most ways. Curaleaf’s got a $5 billion market cap, and Wildflower’s tipping the scales at just shy of $30 million. Their recently acquired retail operator license for their City Cannabis subsidiary plays into the regulator’s plans to increase the number of legal cannabis stores in the province, giving the company the ability to open up to 30. They’ve got one, but potential for more. Curaleaf has 33 in Florida. Wildflower’s flagship store is opening up on Yonge Street in Toronto, a strong location with a heavy probability of good revenue. Curaleaf is spread thin over multiple states.

“The Ontario market only has a fraction of the number of storefronts it needs to service the entire market, and our Yonge Street location is on the busiest street in Canada. It sees an average of 70,000 to 100,000 pedestrians walk past this location daily,” said Krystian Wetulani, chief executive officer of City Cannabis Co.

And there’s the Canadian reason we’re never going to see any unicorns up here. Canada has grandfathered in rules from their historical flogging of Big Tobacco  and applied them to cannabis, where they don’t belong. And typical of the Federal government they downloaded the responsibilities of cannabis regulation onto the provinces, which usually came along with heavy internal restrictions on top of those imposed by the federal government. When Wetulani says that the Ontario market has only a fraction of the number of storefronts required to service the market, he’s referring to one of these limitations. There’s not enough revenue potential to help make this industry pop in Ontario, and if it’s going to take off in Canada, it’s going to start in the country’s richest province.

and applied them to cannabis, where they don’t belong. And typical of the Federal government they downloaded the responsibilities of cannabis regulation onto the provinces, which usually came along with heavy internal restrictions on top of those imposed by the federal government. When Wetulani says that the Ontario market has only a fraction of the number of storefronts required to service the market, he’s referring to one of these limitations. There’s not enough revenue potential to help make this industry pop in Ontario, and if it’s going to take off in Canada, it’s going to start in the country’s richest province.

Our second richest province, Alberta, and also ironically it’s most conservative province, has none of these problems.

They’re probably the best province to do business in if you’re looking to make money in cannabis in Canada and that might be because there’s nothing to do on the weekends when you’re not out working the rigs out in Fort McMurray except smoke pot, drink yourself into a stupor and take your chances with the girls (or guys) down at the bar. Or maybe it’s because Alberta’s cannabis regulations are halfways reasonable.

High Tide’s (HITI.C) Canna Cabana line is out there and well represented in Alberta. So is Fire and Flower (FAF.T), and plenty more.

Cannabis 2.0

A rundown with a sizeable update wouldn’t be complete without a mention of cannabis 2.0. We had hopes that it was going to be the saviour the cannabis industry needed after a disastrous first year, but there were a few of us who thought that was bullshit. The same problems that sank cannabis 1.0’s battleship would do the same, and they basically have.

Walk into any pot shop and look around for the edibles aisle. THC chocolate comes in this shapeless, featureless, airtight package. It’s got all of the necessary information on the front to properly educate yourself on proper usage, and it’s limited to 10 mg a package, so basically wrapped in bubble-wrap with the edges filed off and handled with kid gloves to make sure adults can’t make any decisions that might be bad for their health either intentionally or by accident.

It’s the opposite of good marketing. There’s no branding. No advertising dollars. No market recognition. The United States has no such problems in the states where such things are legalized, as California-based edibles firm Plus Products (PLUS.C) and The Tinley Beverage Company (TNY.C), purveyor of cannabinoid-infused non-alcoholic beverages can attest.

Still, there’s money to be made, despite the limitations and a handful of companies are down with doing it.

For example, CanadaBis Capital (CANB.V), a vertically integrated Canadian cannabis company that’s pumping out full-spectrum product lines involving live-resin concentrates through their subsidiary, Stigma Grow. They also offer bud-run, strain-specific shatters, live-rein vape cartridges, crumbles, diamonds and live-resin sauce.

They’re going mostly white label with these products, and they’re using CannMart, Namaste Technologies’ (N.V) online delivery portal, to handle their retail for them.

“Our ongoing mission as a Company is to align with cannabis growers, distributors and retailers to ensure the highest-quality cannabis concentrates are available wherever savvy consumers are looking for something exceptional. This agreement with CannMart is in perfect alignment with our promise to Canadians and builds on the success and momentum that we have already seen in the provinces where our product is sold. We’re excited to bring our unique live-resin, full-spectrum BHO products to as many stores across Canada as we can,” said Travis McIntyre, CEO of Stigma Grow.

They’re relatively new on my radar, but this company has a $20 million market cap and their chart looks like this:

Coming along part and parcel with the cannabis 2.0 revolution was CBD, or cannabidiol. It was everywhere for awhile as companies did their best to generate enough hype to drive sales. Celebrities sung its praises for everything from soothing your enraged pets to easing cancer to smoothing away unsightly wrinkles.

Yeah. There’s no science to back any of that up. But when has advertising ever let a little thing like facts get in the way of a good narrative?

Curaleaf above got in regulatory hot water for making unsubstantiated claims about its efficacy. It’s still there—in the regulatory hot water. Nothing’s been resolved there. Yeah, the FDA had their hands full sending out nastily worded letters to companies making exorbitant claims in both 2019 and 2020.

It didn’t necessarily stop the hype train from rolling. Instead, it’s made companies play it a little safer. For example, Cronos Group (CRON.T) launched Happy Dance, a CBD skin care brand it co-founded with Kristen Bell. She of House of Lies, The Good Place, fame. Included is a body butter, coconut melt and bath bomb, which is a far cry different than the standard cannabinoid product.

So different in fact that it raises an entirely different question.

How big is the CBD skincare market globally?

“The global CBD skin care market size was valued at $633.6 million in 2018 and is anticipated to reach $3,484.00 million by 2026, with a CAGR of 24.80% during the forecast period. The CBD skin care market exhibits an incremental revenue opportunity of $2,747.4 million from 2019 to 2026,” according to allied market research.

Maybe all of these cannabis companies should start taking notes? If you want to make money with cannabis products, you don’t appeal to the burnouts, the dropouts and the disaffected, you need to get the women on board.

So as it turns out my stoned uncle was wrong. Legalization of pot wouldn’t end organized crime or solve the national debt. No magic. No unicorns. We all kind of knew that all along, though, didn’t we? You’ve got to humour them when they get like that.

—Joseph Morton

Full disclosure: The Tinley Beverage Company, Plus Products are both equity guru marketing clients.