Batteries provided the main source of electricity before the development of electric generators and electrical grids around the end of the 19th century. Successive improvements in battery technology-facilitated major technological advances, from early scientific studies such as the potato battery to the rise of telegraphs and telephones, eventually leading to portable computers, mobile phones, electric cars.

Elon Musk CEO of Tesla motors just came off the back of a highly anticipated Annual Shareholders meeting where his main topic was the future of batteries specifically lithium batteries and how they are our future.

Who is Tesla?

Most people are aware of who Tesla is, their eccentric CEO and amazing brand loyalty have made sure of this, but there is definitely a misconception about what the business is actually doing and the promises being made by Mr. Musk and his wonderful team at Tesla have also caused the price of their stock to skyrocket.

Although Tesla needs no introduction, for our purposes we will reintroduce this business to gain a better perspective of what’s going on under the hood of this automobile manufacturer (pun not intended) but we will give their other business segment more of our attention and energy. (pun intended)

To start we need to understand the two segments in which they conduct business

Automotive – The automotive segment includes the design, development, manufacturing, sales, and leasing of electric vehicles as well as sales of automotive regulatory credits.

The sale and lease of electric vehicles is a simple and straightforward business to understand and as of Tesla’s most recent 10K or Annual report, this part of the business was generating about $20 Billion USD in business which is close to 80% of their Total revenue.

This very significant and by definition would make Tesla an automotive business as most of their business is from selling and leasing the Model S, Model 3, Model X, and Model Y. (this should go down in the books as the most expensive joke ever)

The industry is very capital intensive and large machinery is needed to stay competitive which can be a burden to the cash flow generated by the business. They currently have three functioning factories and one in the works in Germany, Berlin Gigafactory, but to meet the demand for their cars they will need a larger investment in factories.

The second part of the business is the;

Energy generation and storage – The energy generation and storage segment includes the design, manufacture, installation, sales, and leasing of solar energy generation and energy storage products, services related to such products, and sales of solar energy system incentives.

Energy generation and storage – The energy generation and storage segment includes the design, manufacture, installation, sales, and leasing of solar energy generation and energy storage products, services related to such products, and sales of solar energy system incentives.

This segment has three main products

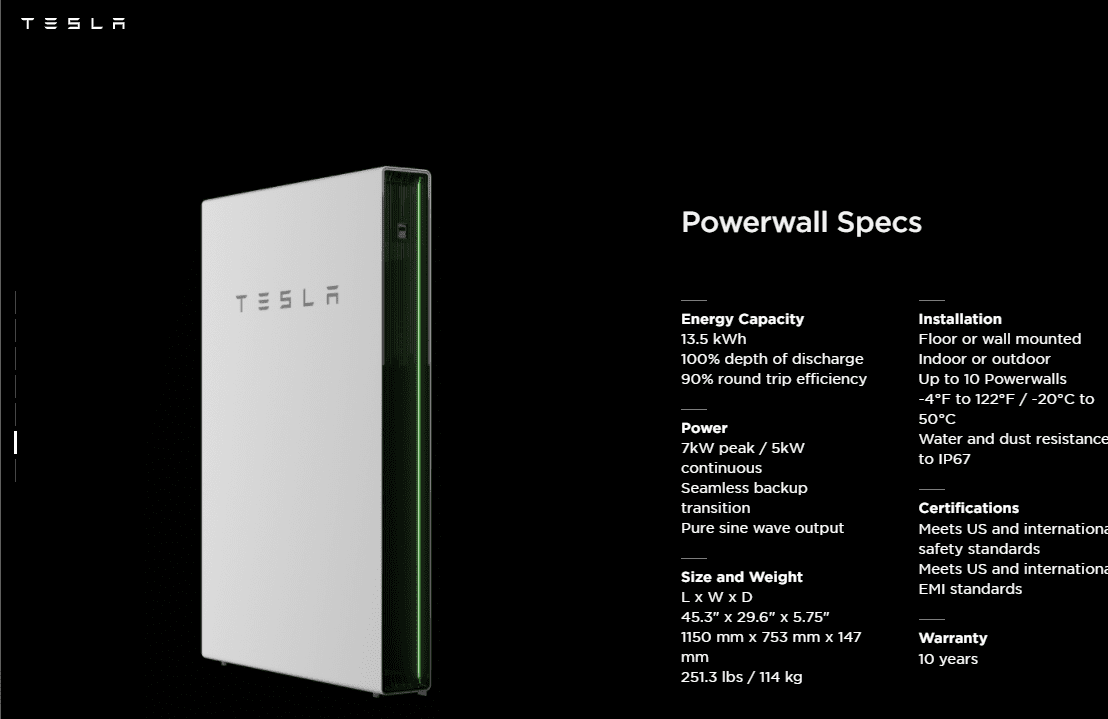

Powerwall for households.

Megapack and Power Pack for business and Utility companies.

And a Gigapack that is still in the production pipeline.

Elon Musk and many of his “followers” believe this is a misunderstood part of the business and should be given higher valuations when analyzing Tesla’s potential.

His argument is that the energy and storage sector lacks innovation and has been left to the whims of old mature businesses who lack creativity and foresight when it comes to the future of energy and power. Although billions of dollars are being invested in the industry most of this money is going to projects that possess a low “IRR” or a negative “NPV”.

IRR – Internal rate of return

NPV – Net Present Value

His claims are true but misleading to a certain extent, most projects in energy are done by large utilities and industrial businesses who have a legal regulatory requirement to invest in regulated capital projects. Most of these projects do have a negative return (IRR<0) for the industry but they maintain the property and equipment up to a certain standard.

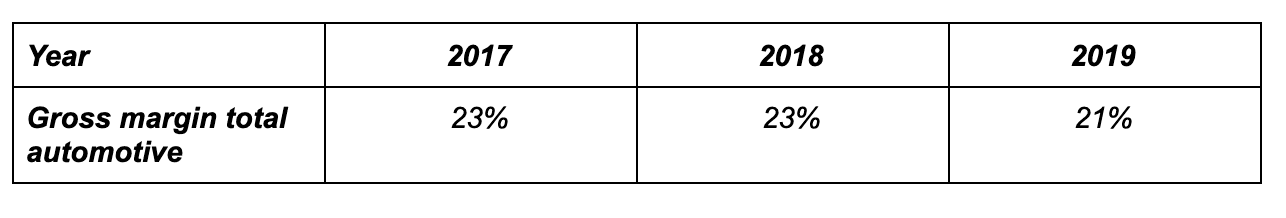

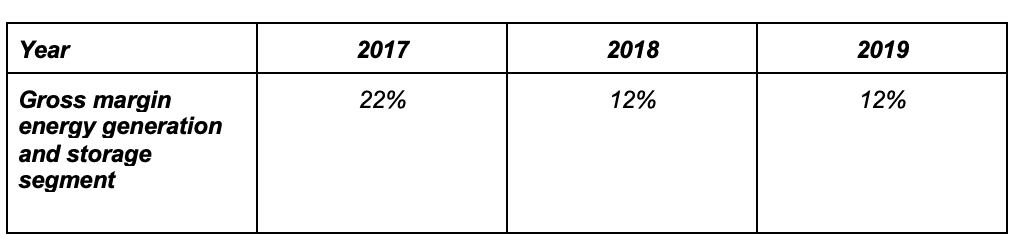

Currently, this very valuable segment provides $ 1 billion USD about 0.6% of the Teslas total revenues. This is not to say it is not important to the operations of the business but if it were closed Tesla would experience minor delays in production as it pivots its manufacturing plants to produce more electric vehicles. It is also growing at a slower rate than the other business segments, from 2017 till 2018 it grew 39% and negative 2% from 2018 to 2019 compared to 107% and 13% for the same period for the automobile segment.

Knowing this any rational market participant would start to wonder how true Mr. Musks’ claims are and what the other businesses in the industry are up to.

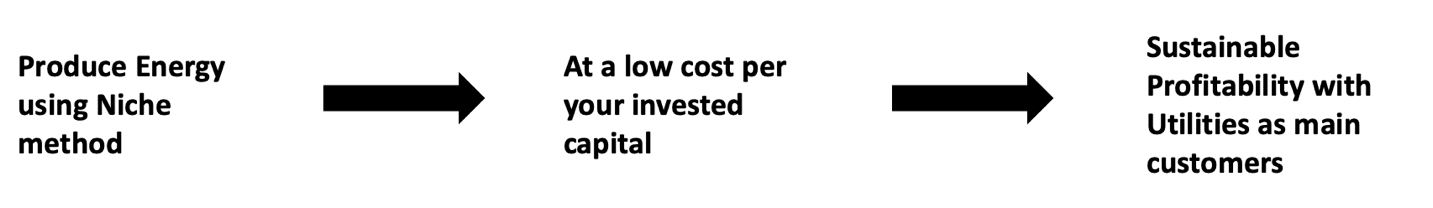

The energy storage and battery manufacturing sector is a very competitive and capital-intensive industry with many firms chasing profitability. The key difference between the energy sector from most competitive industries is that each energy producer is in a niche market and they have economies of scale in their respective niches.

To stay competitive each business has to produce energy at the lowest cost. Simply put:

We can look at some examples to clarify this business model a little more.

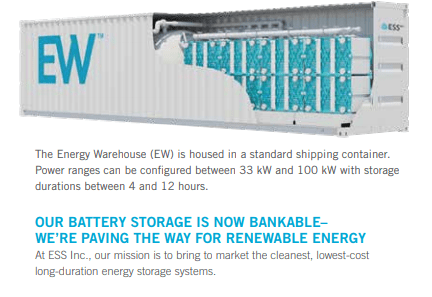

The first company is ESS inc. Established in 2011 it manufactures low-cost, long-duration iron flow batteries for commercial and utility-scale energy storage applications requiring 6+ hours of flexible energy capacity.

Their long-duration energy storage platforms, the Energy Warehouse(EW) and Energy Center(EC) use iron, salt, and water for the electrolyte, and deliver an environmentally safe, long-life energy storage solution for the world’s renewable energy infrastructure.

Their technology could potentially deliver environmentally cost-efficient technology. Specifically, their non-corrosive, non-toxic chemistry enables the use of off-the-shelf materials. Its non-flammable composition eliminates costly fire suppression systems. Combined with an innovative cell design, they expect their customers to benefit from increased power density and reduced O&M costs over their platform’s 20+ year lifespan.

Antora Energy is the second business we will look at briefly. They are building a low-cost thermal battery for grid-scale energy storage. They claim that by combining inexpensive thermal storage media at high temperatures with high-efficiency thermophotovoltaic energy conversion, they can support the widespread integration of renewable resources on the electricity grid.

They are currently developing an extremely inexpensive thermal energy storage system. With a marginal cost of the energy capacity of < $10/kWh, their thermal battery will take excess electricity from wind and solar power plants, store it for hours or days, and deliver it back to consumers when needed.

By storing energy as heat in extremely inexpensive raw materials and converting that heat back to electricity with a high-efficiency thermophotovoltaic heat engine, their energy storage system costs are low enough to make intermittent renewable energy, plus storage, cost-competitive with fossil fuels.

Energy Vault is the creator of gravity and kinetic energy-based, long-duration energy storage solutions that are transforming the world’s approach to delivering reliable and sustainable electricity. They have a great video that shows the process below.

The reader should notice the emphasis of low costs and long duration by all three of these firms. The industry is trying to improve the technology and reduce the costs financially and environmentally whilst being energy efficient.

Mr. Musk and his team have the same goals in mind, but they have the added constraint of running a capital intensive automotive business in a very competitive space going head to head with giants like GM(GM.NY) and Ford(F.MY) who have a combined age of 229 years, and revenue of $137 Billion & $155 Billion respectively and have spent $23 Billion & $7 Billion of capital expenditures for 2019. This is compared to Tesla’s 17 years of age, $24 Billion dollars in revenue, and $1 Billion in capital investments.

It can’t be ignored that compared to the three firms above Tesla does have, “more money to play with” than the smaller private businesses. This leads us perfectly to the next section on capital allocation where we will dive briefly into some of the financial management choices made by Mr. Musk and his team.

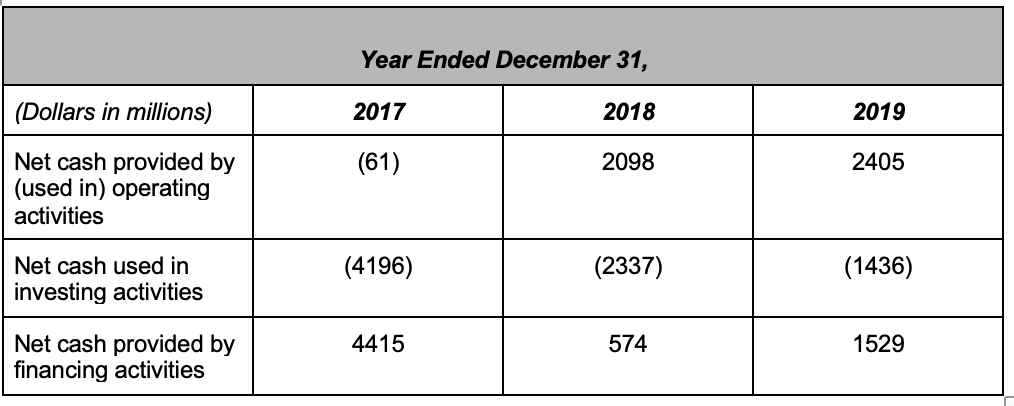

The table above is an extract of the cash flow statement from the Annual reports published by Tesla and is where we will be looking to judge how some of the past investments have translated into success for Tesla.

In 2017 they had net cash used in operating activities of 61 million, this means the business did not generate any cash from its normal day to day functions but instead was a cash drain. It has since recovered from this low point and is now producing cash, 2 billion in 2018, and 2019.

This is great news, it shows that fundamentally Tesla does have the potential to generate cash from selling and leasing cars to consumers at the same time managing their costs efficiently. But before we get ahead of ourselves we do need to look at net cash used in investing activities which shows us the capital expenditures made by the business in hopes that these investments will increase the efficiency and capacity of Tesla allowing them to provide higher-quality products to their loyal customers.

For the past three years, they have spent on average 2 Billion dollars to improve and maintain their competitive edge of this 2 billion used they generated on average 1 Billion from cash inflows from selling goods and services and 2 Billion from raising money in the form of debt or selling additional stock to the public.

This shows us how expensive it can be to run a “profitable” company in an industry that requires a lot of capital investments. Some of their older investments are now paying dividends but way more money will be needed by Tesla to get to a point where they do not need to raise debt and dilute shareholders’ ownership to keep the lights on and pay the bills.

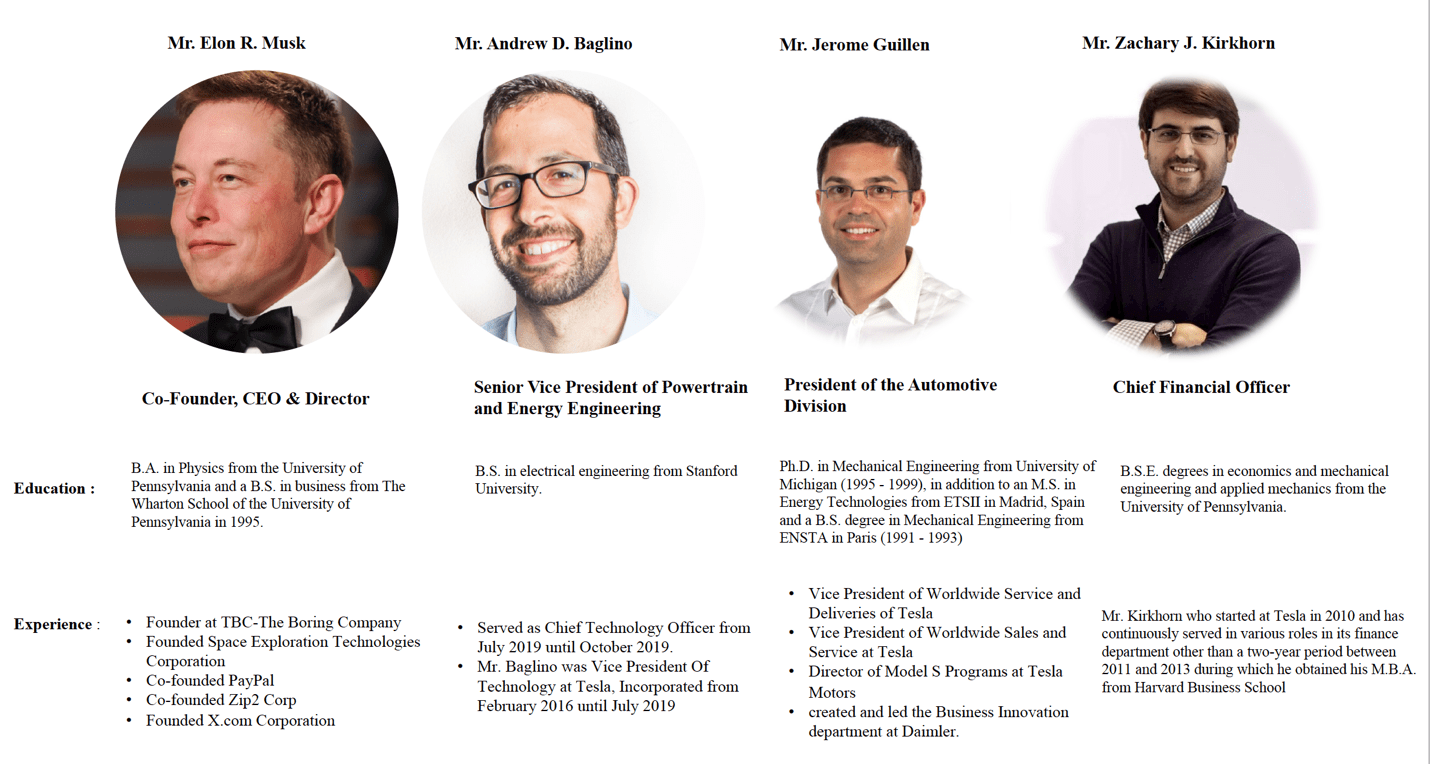

It goes without saying the team at Tesla does seem to have a wonderful roster of professionals with an abundance of experience and is well equipped to face these cash flow challenges.

Now that we have reintroduced Telsa and have a better understanding of what is actually going on we can continue with the main topic at hand; the economic history of batteries and the future of lithium cells. Riveting stuff!

The History of batteries

We know how difficult the battery industry can be, and have consolidated this information in a quick breakdown of the timeline from lead-acid battery cells to lithium cells in the video below.

The reader should take a moment here to grab refreshments as we dig deeper into this stimulating topic.

What is the future?

Now that we are all caught up and have looked at the progress we have made from having heavy batteries that could only be used in automobiles to batteries that fit in our pockets and power mini supercomputers. What does the team at Tesla have to say about the future of batteries?

During their Anual General Meeting, the team at Tesla stated their core goals going forward as follows:

1. Terawatt-hour Scale Battery Production

The goal is to go from talking in Gigawatt-hours to Terawatt-hours, meaning more battery capacity with the same battery cell.

2. More Affordable Cells

Goal two problem: EV Market share is Growing But EVs Still Aren’t Accessible to All

and they also have a 5 step plan set up to meet these goals:

- Cell Design

- Cell Factory

- Anode Materials

- Cathode Materials

- Cell Vehicle Integration

Essentially Mr. Musk believes that Tesla will eventually manufacture its own “tabless” batteries, which will improve its vehicles’ range and power. Since they will design the batteries in a new cathode plant(Eventually) for its batteries in North America it will reduce costs and bring the sale price of Tesla electric cars closer to gasoline-powered vehicles.

The tabless cells which Tesla is calling the 4680 cells, will make its batteries six times more powerful and increase range by 16 percent. They do however source their batteries from Panasonic and plan on keeping this strategic alliance for the foreseeable future as they begin the installation of the new cathode plant.

Tesla plans to eliminate the use of cobalt in its cathode cells. Musk’s mission in the past has been to eliminate it entirely in the past — even though Tesla’s existing batteries use very little. Cobalt is often mined under conditions that violate human rights, which was one of the main topics of discussion during the formal part of the Annual meeting. Different shareholder and activist groups are pushing for more transparency and reporting by Tesla on how they plan to manage their human rights relationships with suppliers.

Musk failed to offer a timeline for when the company will stop using cobalt but said it will make its batteries significantly cheaper and sidestepped the issue of human rights violations.

All this change in the hopes of reducing the cost of its battery cells and packs, with an end goal of building a $25,000 electric car.

It should be noted however that this is not the first time he has set a price target for the car at $25,000 but has done so in the past. Back in 2018, he made the same promise and predicted it would take about three years.

What does this mean for Tesla Stakeholders’ current and potential?

This part was the easiest to write and the best answer to the question posed(by the author I might add) above is that this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism including those that have infinite potential.

Happy Hunting!