On October 8, 2020 Earthrenew (ERTH.C) entered into a financing facility for up to $10-million with Alumina Partners (Ontario), an affiliate of New York-based private equity firm Alumina Partners LLC.

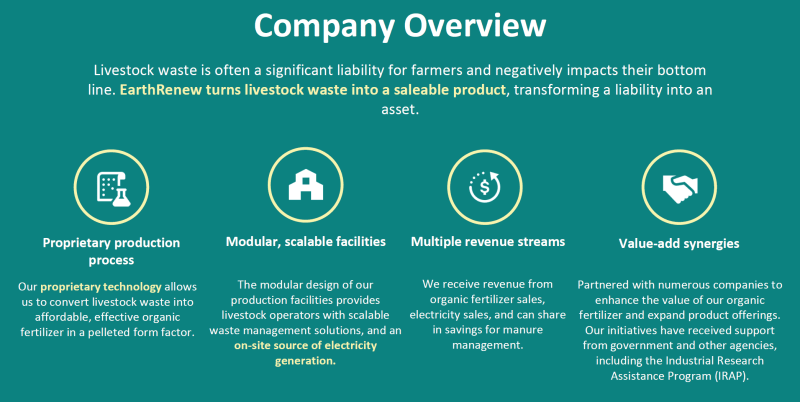

Earthrenew is a technology company that transforms livestock waste into a high-performance organic fertilizer for the North American market.

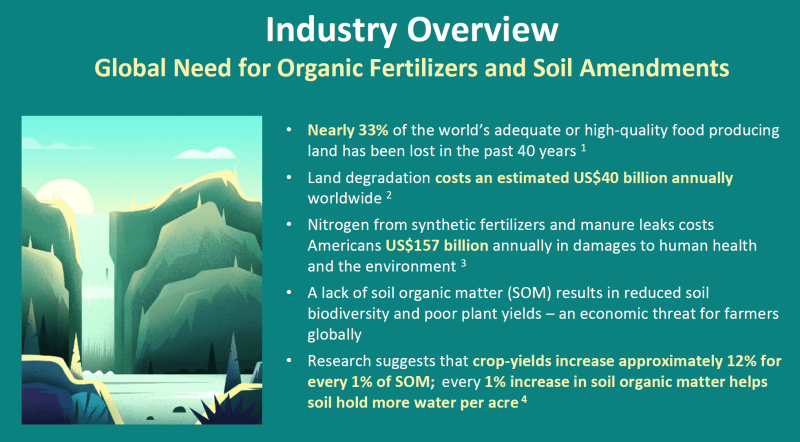

The demand-drivers for ERTH’s products are there: due to the encroachment of suburbs, arable land is being lost at the rate of over 38,000 square miles per year.

Land devoted to organic farming however is increasing. “The U.S. organic sector posted a banner year in 2019, with organic sales in the food and non-food markets totaling a record $55.1 billion, up 5% from the previous year”.

Possible uses for Alumina financing:

- Capital equipment purchases

- Engineering and construction costs

- Redevelopment of Earthrenew’s Strathmore facility

- Feasibility studies on future projects

- Field and research trials

- Market development activities

- Working capital for the ramp-up at Strathmore facility

- General corporate purposes.

The investment agreement provides Earthrenew with an “at-will financing facility over a period of 24 months during which the company can draw down, at its sole discretion, equity private placement tranches of up to $500,000”.

Each tranche units will consist of one common share of Earthrenew and one warrant, at discounts between 15-25% of the closing price of the common shares on the day prior to Earthrenew’s drawdown notice to Alumina.

The exercise price of the warrants will be at a 25% premium over market at the time of the issuance, and the warrants will have a term of 60 months.

Each drawdown from the facility may be subject to approval of the CSE. All securities issued pursuant to a will have a statutory hold period of four months and one day from issuance.

Alumina Partners is a New York-based private investment partnership aiming to bring “non-predatory and non-disruptive institutional investment back to the emerging growth arena.”

“We make non-control investments because, at the end of the day, we are investing in the ability and integrity of each management team,” states Alumina, “We know enough to step back and let officers do their job.”

On September 8, 2020, EarthRenew announced that it has submitted an expression of interest (EOI) to Emissions Reduction Alberta (ERA) on behalf of a larger consortium of project partners, which includes one of the largest power producers in Alberta, one of the province’s largest fertilizer producers, CCm Technology, Western Ranchlands and EarthRenew.

The total cost of the project that is the subject of the EOI is estimated to be approximately $4.8 million.

ERA’s call for proposals is focused on agriculture, agri-food, and forestry. Alberta now produces over 40% of Canada’s total cattle inventory, 33% of the country’s wheat, 32% of its canola, and half of its barley.

EarthRenew has been working with CCm to incorporate its carbon capture and utilization technology to improve the nutrient profile of EarthRenew’s organic fertilizer.

If selected, EarthRenew could receive up to $1 million in funding to support the expansion of its Strathmore facility and implementation of CCm’s technology.

On August 26, 2020 ERTH announced results from its germination trial with Lethbridge College.

During the germination phase, the first 7-10 days of growth, the different fertilizer formulations showed a 169-207% improvement over the control in plant growth for barley and 10-49% improvement over the control in plant growth for peas.

Over the entire trial, both the 25% frass formulation and the 50% frass formulation showed a 72% improvement over the control in plant growth for barley.

The 4% biochar formulation showed a 40% improvement over the control in plant growth for peas.

“The early results of our germination trial confirmed our expectation that various formulations will have a positive effect on different crop species,” stated Keith Driver, CEO of Earthrenew.

“The data are expected to help us to refine our product offerings as we move towards restarting production,” continued Driver, “We intend to use the results to demonstrate the value add of Earthrenew fertilizer to our customers this Fall as they look to make purchase decisions for next year’s planting.”

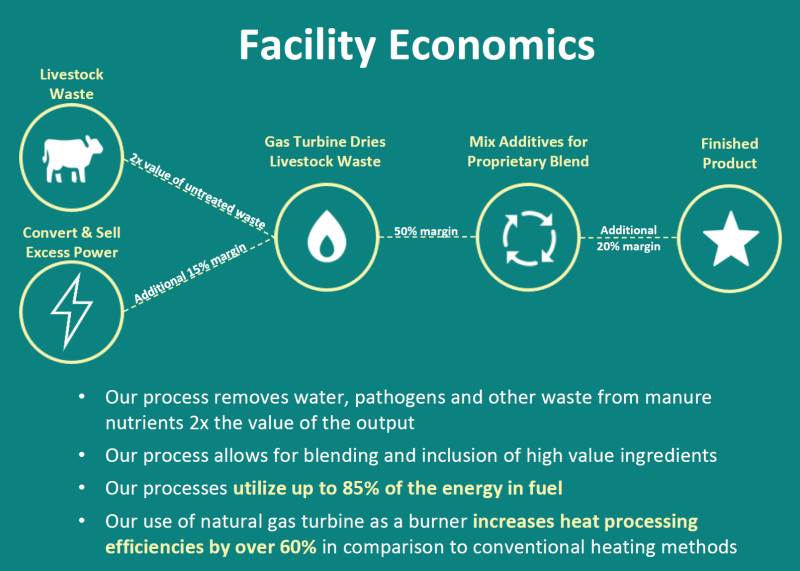

Located on a 25,000 head cattle feedlot, ERTH’s flagship Strathmore plant in Alberta is capable of producing up to four megawatts (MW) per hour of low-cost electricity powered by a natural gas fired turbine.

The exhausted heat from the turbine is used to convert manure into certified organic fertilizer.

On August 19, 2020 ERTH published preliminary results of a feasibility study involving one of the largest feedlots in the southwestern U.S. which could provide ERTH with a strategic operational location in “one of the world’s largest organic farming markets”.

Alumina’s terms with Earthrenew were not negotiated ad hoc. They are similar to terms Alumina struck with Otso Gold (OTSO.V) on May 12, 2020.

“The facility provides us with comfort that we have an option to secure the capital necessary to accelerate the Strathmore facility recommissioning and pursue U.S. expansion opportunities over the next 12 months,” stated Driver.

No finders’ fees were paid in connection with the Alumina financing facility.

- Lukas Kane

Full Disclosure: Earthrenew is an Equity Guru marketing client.