Modern Meat’s (MEAT.C) letter of intent today was to acquire brands from JDW Distributors, which the company is hoping will give them the inertia required to make the leap into the United States alternative meat products market.

JDW’s been in the business of selling healthy, gourmet food for 16 years, with its own line of vegan brands including potato crisps, sunflower chips and Sunsations fruit jellies. These two companies are both focused on providing healthy, quality food, so this combination works from a philosophical standpoint.

The question is are people buying it, and the answer apparently is yes.

“We continue to make great strides towards our growth strategy and see strong consumer demand for healthy vegan options. This acquisition marks our entry into the U.S. market and our first addition of a non-Modern product. Modern Meat is a lifestyle brand encompassing more than just our core plant-based meat alternatives and we see tremendous potential to bring other premium vegan brands into the fold. We’ve identified business synergies with JDW, which will allow us to accelerate our sales channels and propel the company to new heights,” said Tara Haddad, chief executive officer of Modern Meat.

Personally, I’m not a proponent of alternative meat. For me, nothing beats a greasy cheeseburger loaded to the brim with condiments and everything but tomatoes and mushrooms, and served with a plate of fries with a beer. There’s a bar across the street from where I’m presently shacked-up that does a $12 beer and burger special that suits all of my Saturday afternoon needs.

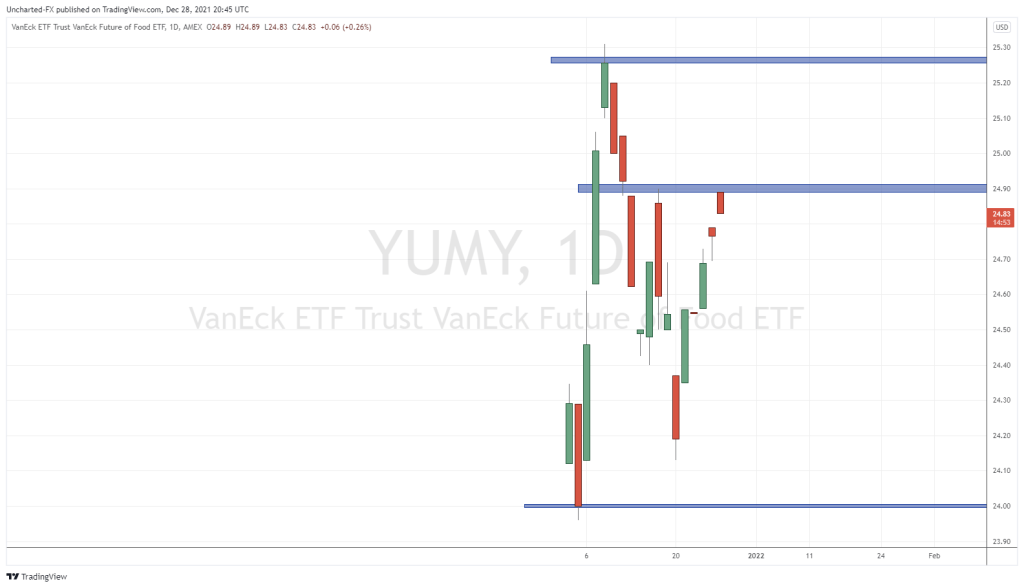

But as always, your mileage may vary. You may have some kind of condition or ethical quandary that keeps you from eating meat, and therefore companies like Modern Meat fill the bill. Good for you. If you bought into Beyond Meat (BYND.Q) shortly after its IPO last year when all the news all the time was about how great Beyond Meat’s offerings were, and ended up getting shafted in the dip in March, then getting back in with a competitor might be the way to go for you. The product is more or less the same—except now Modern Meat’s diversifying and we’ll get to that—but the prices and scale are vastly different.

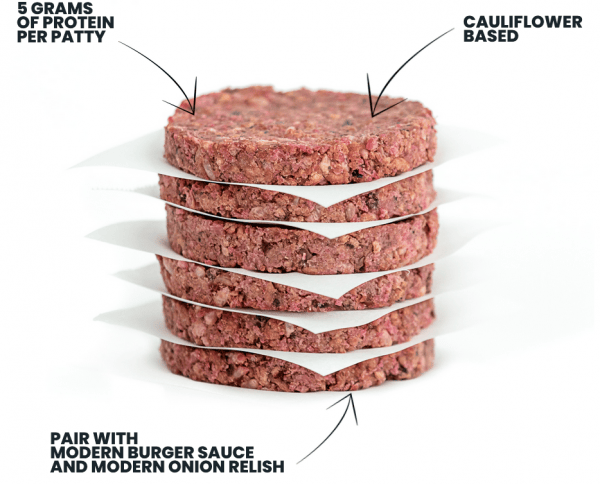

For example, Beyond Meat’s world class hype machine has boosted its market cap until it’s close to an $11 billion company. That’s relatively impressive for simulated meat with the consistency of rubber that tastes like vaguely salted plastic. In comparison, MEAT’s cap is $111 million and closed today at a little under $4, for essentially the same product.

With MEAT, though, you’re not going to find any deals with Restaurant Brands (QSR.NYSE) or A&W Modern Meat burgers going on sale here, but you’re going to have the chance to get in on a competitor to Beyond before they get a chance to ride on another updraft for meat simulations. But with diversification comes opportunity.

Take Sunsations – they’re fruit-based vegan candies, they’re kosher and gluten, fat and peanut free. They come in six different flavours: blueberry, grape, orange, apple, lemon and cherry. They’re also great for sneaking into the movies instead of paying the neck-stab concession prices. Ditto for MEAT’s chips—which are gluten, cholesterol and saturated free, and come in sour cream and onion, sea salt and cracked pepper, barbecue and original sea salt. The brand has store penetration totaling over 5,000 in the U.S. and Canada, at both food and non-food retailers.

“This acquisition provides another catalyst towards long-term shareholder value creation. As we continue to scale by acquiring these brands from JDW, we take on a collection of vegan products that have had explosive growth and proven success in a short period of time. Adding our back-end/finance capabilities we feel confident we can grow this platform significantly in the coming months. Furthermore, by adding its already robust distribution base throughout the U.S. it gives us a great foothold into our future M&A and expansion plans,” according to Campbell Becher, head of finance and mergers and acquisitions for Modern Meat.

The transaction will bring the distribution rights to the Sunsations brand to Modern Meat along with plants to work with the JDW and its team. This includes food scientists and research and development, manufacturing and distribution developments. The total price is USD$450,000 in two payments of $225,000, the first payable when the deal closes, and the second half payable after revenue targets are hit in the first year.

—Joseph Morton