As Bitcoin closes in on the USD$12,000 mark, it almost becomes hard to remember where it was pre-halving, when it tanked during the coronavirus and what that meant for companies either directly or peripherally attached to the coin’s fortunes.

Even as they were preparing for the fallout from the halving, cryptocurrency mining companies like Hut 8 Mining (HUT.T) found themselves in a jam when the virus hit and the bottom fell out of Bitcoin.

Bitcoin recovered from US$6,439 on March 31, 2020 to $8,602 on halving day, before reaching $9,138 by June 30, alleviating some of the concerns, but not all of them by far. The bitcoin mining difficulty decreased post-halving by 15%, but quickly rebounded to pre-halving levels. The post-halving price shock was in full swing as the bitcoin block reward dropped 50% but the price didn’t necessarily go with it. Now, though, it’s three months post-halving, and the full benefit of hindsight lets us look back over that time to get an idea of the company’s trajectory post-halving and during COVID-19.

The second quarter of 2020 brought the coronavirus pandemic and the shelter in place orders which shook capital markets, and sent Bitcoin’s price plummeting, the effects of which are still being felt on a global scale. Meanwhile, the cryptocurrency industry braced itself for the bitcoin halving, which happened on May 11.

For awhile, it was touch and go as to whether mining was going to be a profitable business arrangement for companies like Hut 8 with a business model that didn’t include a cheaper backup coin to mine (like Ethereum), or without having adequately prepared for this eventuality through the acquisition of better equipment or a better electricity deal. But they had been working to keep a lean, flexible operation, and cut costs where required.

That’s something, I guess.

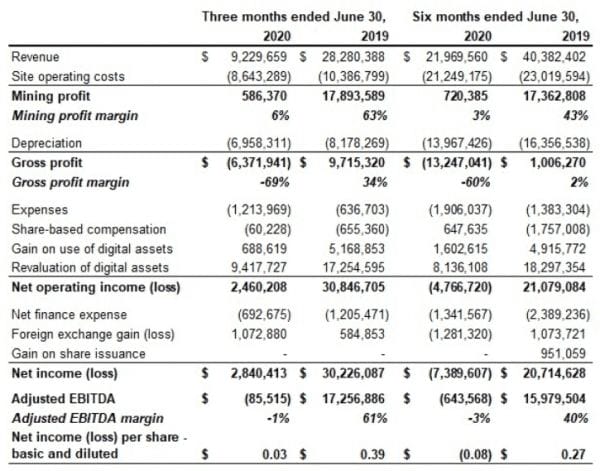

They kept their Q2, 2020, site operating costs to $8.6 million, which was a 17% reduction from Q2, 2019, at $10.4 million. They also took over the full management of their operations in Medicine Hat, Alberta, and the operating costs are expected to continue to fall.

Here’s how they compare to last year:

The company’s strategy has been to mine and hold bitcoin, and it paid off with a $9.4 million gain on the re-measurement of bitcoin holdings in Q2. Then by waiting for peak prices to sell their holdings, they pulled in a $0.7 million gain. Overall, the company recorded a net income of $2.8 million and a negative adjusted EBITDA of $86,000.

Hut 8 is a relatively unique case among the public cryptocurrency mining companies in that they literally did the least to prepare for the halving. Whereas companies like Cryptostar (CSTR.V) and Riot Blockchain (RIOT.Q) secured low-cost electricity deals and brought in next-generation mining equipment to offset costs, and Hive Blockchain Technologies (HIVE.V) not only found low cost electricity, new equipment but also diversified their cryptocurrency holdings to include Ethereum and a number of other cryptocurrency offerings.

Unfortunately, even in terms of equipment, Hut 8 came late to the game.

They closed the first prospectus offering by a cryptocurrency mining company in Canada, raising over $8.3 million, all of which went to upgrading their mining equipment with the latest tech on the market. Equipment which some of the other companies on this list had been using for six months prior to the halving.

Granted, they’re not wrong when they say it’s a big step towards modernizing the company’s equipment and increasing the overall efficiency of their bitcoin mining endeavours, but getting an engine into a racecar while the other cars are already on the fourth lap isn’t exactly the best strategy.

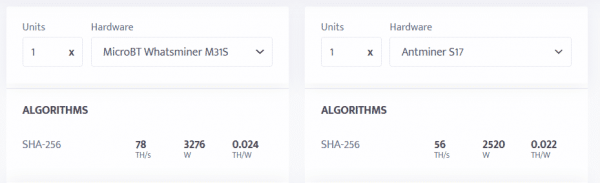

At least the engine they’re running is top notch. They received 2,000 bitcoin miners from MicroBT, including 1,000 units from M31S and 1,000 from M31S+ from MicroBT, both of which mark a better performance level than BitMain’s Antminer 17, which is considered the standard for Bitcoin mining right now.

They have also signed their first client for hosting at its Medicine Hat facility for six full BlockBoxes. This lets other companies use their electrical output, offering another source of recurring revenue that isn’t dependent on Bitcoin’s price. Hosting is an extension of the self mining business, has access to competitive electricity pricing and operates in a jurisdiction that’s conducive to this kind of business.

Hut 8 may have come late to the party, but they’re up and running now. Even though they’re riding somewhere roughly in the middle of the pack, to continue our speedway analogy, they’re only a few twists and turns away from being a true contender.

—Joseph Morton