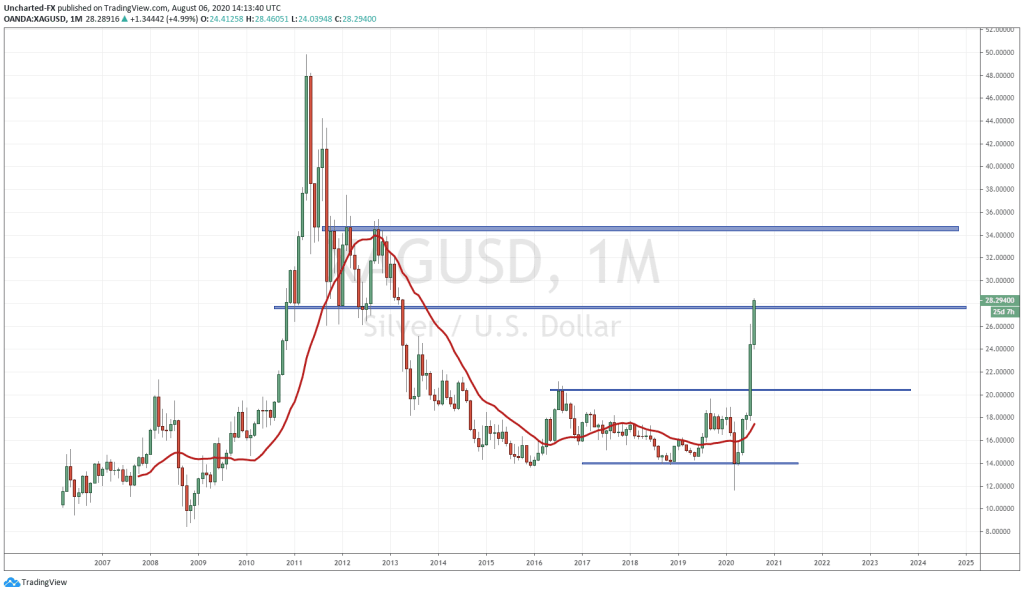

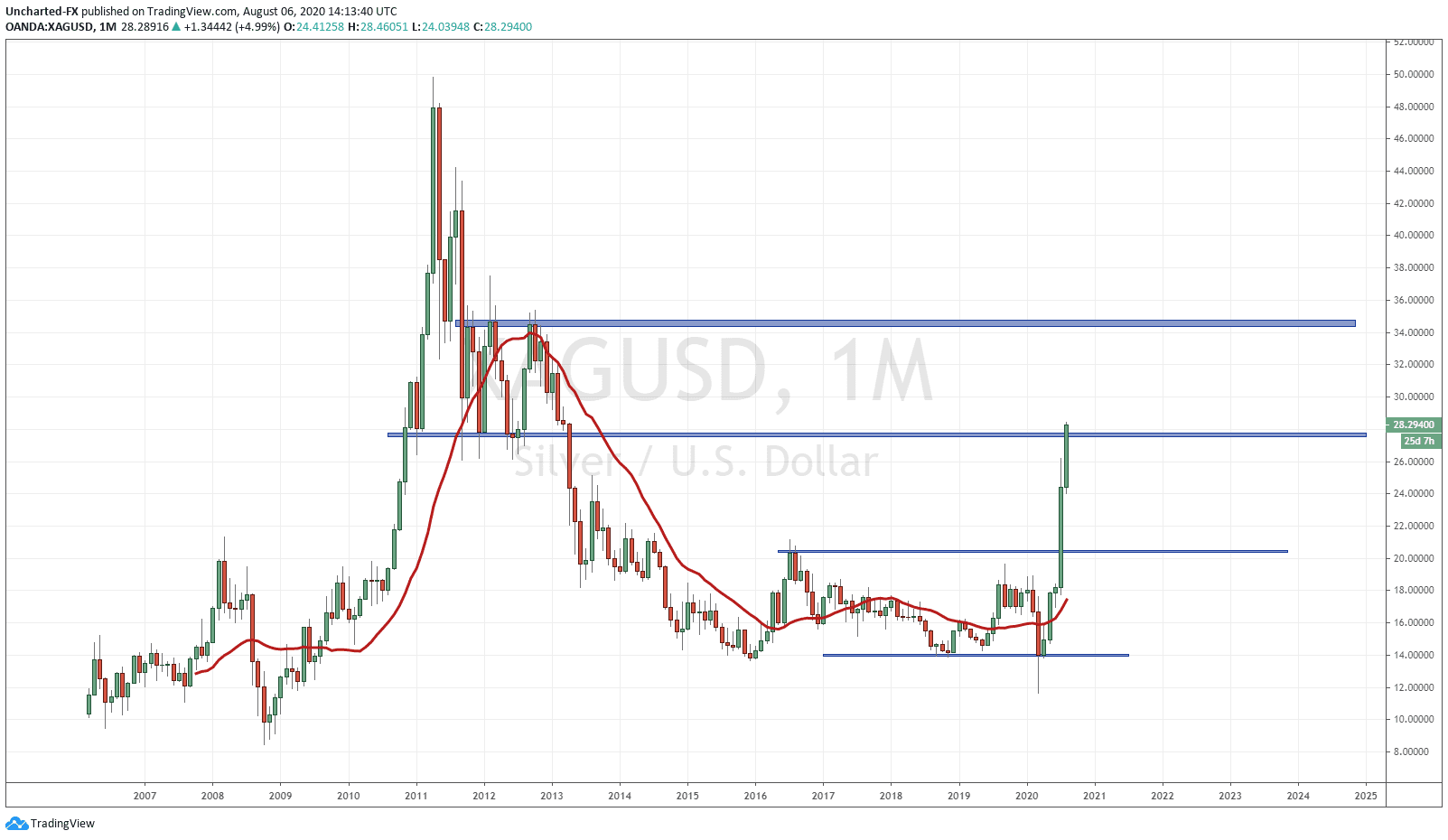

The move in Silver has been incredible. It is really true that Silver is Gold on steroids! Just a few weeks ago, I wrote a Market Moment post highlighting the monthly chart of Silver. A chart that had all the elements of market structure that I look for. A chart similar to my trades in Gold, GDX, GDXJ and plenty of other stocks including junior miners albeit on a longer (monthly) time frame. Highlighting the importance of the monthly candle close ABOVE 20.65 in order to be triggered with a first target at $27-28 an ounce. Well the monthly candle close was only 6 days ago, and we have already hit the $27-28 zone! Incredible move in Silver.

A bit of warning: Silver is very volatile. We have had multiple 6% a day runs recently, but Silver can just as quickly fall 6% in multiple days as well. This is why Gold is much more preferred by large funds over Silver. However, in this market and macro environment, anything other than fiat will be great. In yesterday’s Market Moment blog post I stressed the importance of the CNBC article stating the Fed is expected to announce a major commitment to ramping up inflation. This is bullish for Gold, Silver, other commodities and yes, stocks. If you have been a long time reader of my work, you know that this is what I have been forecasting. Inflation is the only way to keep assets and the system propped, and a way for governments to receive for taxation money that they desperately need. Inflation is taxation because it means more revenue for the government through the sales tax and property tax etc. Governments hate deflation because they have not found a way to tax it yet.

This macro environment is great for the precious metals and I expect higher prices in the future. I do think Silver will take out all time highs at 49.81 USD but I think that may happen in the long term. Although the way everything has been moving recently…anything is possible.

In terms of the monthly chart, Silver has sliced through our target zone. The next target zone is 34.50-35 which is highlighted above. Once this is breached, previous all time highs are in sight. I must confess, I was hoping for a pullback to 20.50, a retest of the breakout zone before continuing higher. Silver and Gold both seem due for a pullback…interestingly enough so does the US Dollar. When this occurs, I believe this will be the LAST TIME to purchase both precious metals at these low prices. Some levels of interest for the pullback are 27.50, 23.70 and if it is deep, 20.50. Remember this current monthly candle is only 6 days old. It is entirely possible for this candle to reverse by the end of the month so keep that in mind.

If a bearish pullback set up transpires, I will highlight on this blog. Or you can get real time updates by joining our Discord channel trading room with the link below.

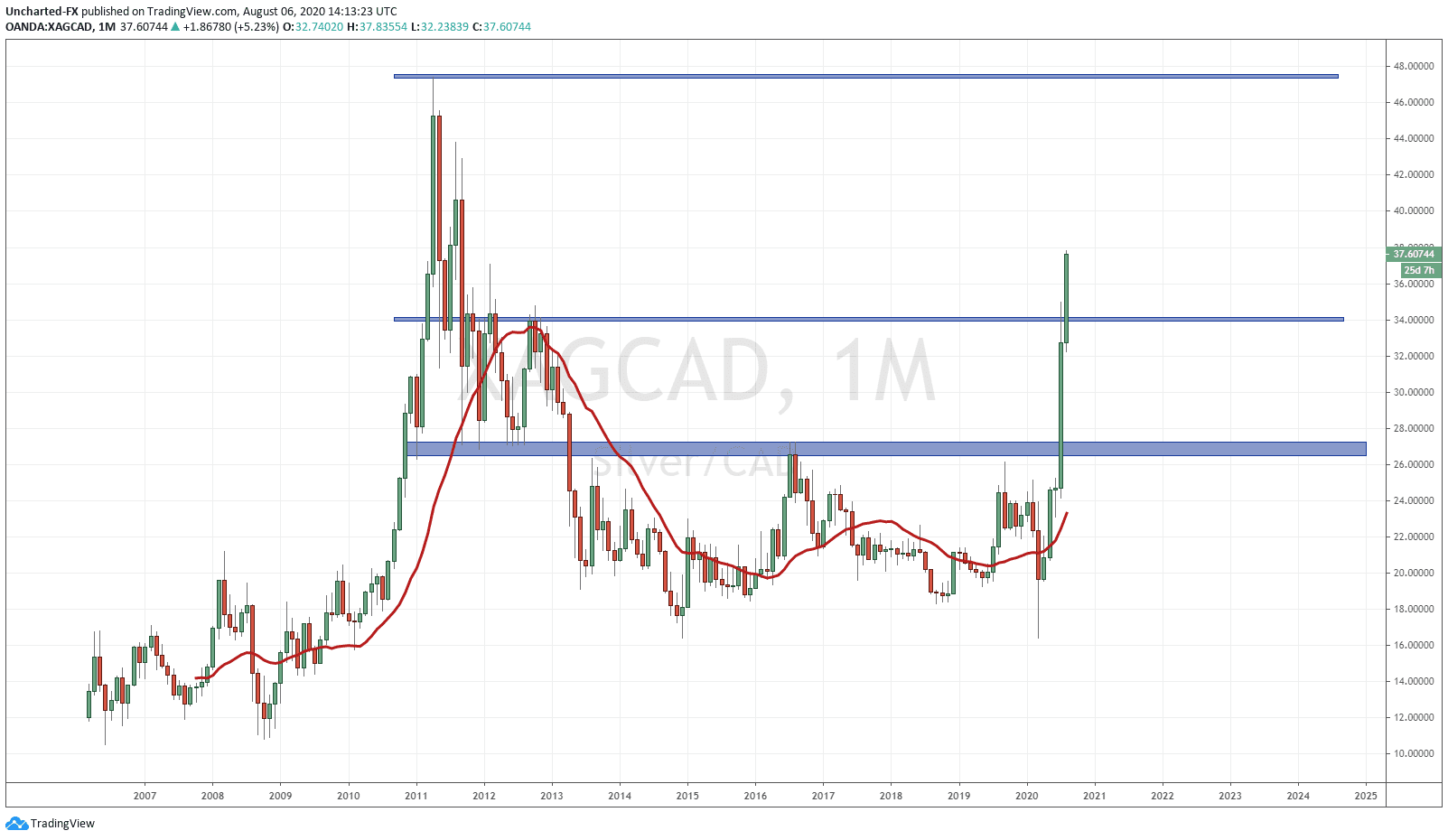

Silver in Canadian dollar terms looks much more bullish. A large part of this has to do with the currency difference between the Loonie and the US Dollar. But the monthly chart of Silver (XAG/CAD) has broken above 34.30 on the monthly chart! A major resistance zone! This zone is now support that we will be working with. Next target for Silver priced in Canadian dollars? Previous all time record highs at 47.31. By the way, if you want to buy silver from bullion dealers, Silver is priced with a high premium and going between $47-49 depending on your payment option…already higher than the spot price all time highs.

To summarize, we are still bullish on the precious metals, and the bull market in the miners and junior miners is just beginning! Take a look at our GDX and GDXJ charts! We are expecting a mania akin to the alt coins during the Bitcoin boom where many junior stocks will be rocketing. One surprise element will be the new retail traders (dubbed the Robinhood crowd) which might start looking at junior miners due to the highs created in Gold and Silver, and with hopes of making it big since mining stocks are generally cheap compared to other stocks. We have been taking metal positions since last year, and have added to our GDX position, and they are paying off well.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA