Gold has performed exceedingly well in recent sessions, taking out the US $2,000 level as if it was just a minor speed bump.

We’ve been calling for a major breakout in the metal for well over a year now. As 2019 was drawing to a close, when the metal was consolidating in the $1,500 range, we opined:

From a fundamental point of view, the backdrop for the metal couldn’t be more favorable: plummeting bond yields, negative interest rates, debt levels taking on a life of their own, pervasive geopolitical risk, and equity valuations stretched waaaay beyond reason.

It’s difficult to imagine a scenario where gold won’t go on a serious tear as we stagger into the next decade.

I’ve been perusing market headlines over the past 24-hours and it’s your standard, predictable fare—some analysts are doubling down, calling for a $4k price target long-term. Some are calling for imminent price exhaustion and a gut-wrenching correction. There’s not much between those two camps. It’s difficult being neutral in a market like this—you either hate the metal, or you worship it. Personally, I don’t really care what happens in the short-term. I’m convinced we’re in the very early innings of a powerful bull phase, one that will play out over a period of years.

We’ll start off this round-up with an undervalued REE play, and then move on down our (goldie) client list (note that the companies featured in this round-up have generated news in recent sessions).

Corporate Presentation (middle left of page)

- 50.68 million shares outstanding

- $8.36M market cap based on its recent $0.165 close

If you’re new to the mining arena, you might be wondering why… Why REEs?

Well, they’re everywhere.

Quoting a previous Guru offering on the subject:

Hailed as the “vitamins of chemistry”, they exhibit a broad range of electronic, optical, and magnetic properties. They make our TV screens glow brighter, our batteries last longer, our electronic gadgets more mesmerizing (sigh), our electric motors, generators, and appliances more efficient. They can even make our paper money less prone to forgery. They are an essential ingredient in everything from night vision camera lenses, to medical imagining technologies, to control rods in nuclear reactors.’

In a world that is turning increasingly green, the electric vehicle (EV) industry is the primary driver for REE demand—electric motors, generators, catalytic converters, component sensors, LCD screens… even the polishing powder for the windshields and mirrors.

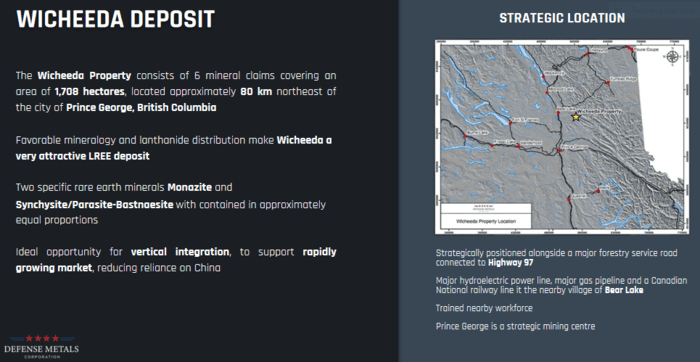

We’ve been following Defense for over a year now. We’ve monitored developments closely, inspired by the pace the company has set for itself as it pushes its wholly-owned Wicheeda REE Project further along the curve.

Wicheeda is located in the Prince George region of mining-friendly British Columbia. The project enjoys easy road access and ample, omnipresent infrastructure.

Wicheeda holds an abundance of high-grade, highly desirable, highly strategic REEs in its subsurface layers:

Wicheeda holds an abundance of high-grade, highly desirable, highly strategic REEs in its subsurface layers:

- An Indicated Mineral Resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements);

- An Inferred Mineral Resource of 12,100,000 tonnes averaging 2.52% LREE;

- All reported at a cut-off grade of 1.5% LREE (sum of cerium (Ce), lanthanum (La), neodymium (Nd), praseodymium (Pr), and samarium (Sm); in addition to niobium (Nb) percentages).

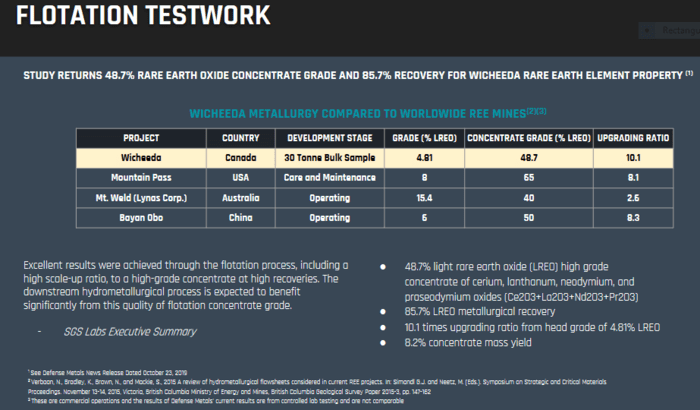

The project’s metallurgy—a major concern for the vast majority of REE deposits around the world—is about as good as it gets:

- a TREO metallurgical recovery rate of 85.7%;

- a 48.7% TREO high-grade concentrate of cerium, lanthanum neodymium, and praseodymium oxides (Ce2O3+La2O3+Nd2O3+ Pr2O3).

In previous Guru offerings, we’ve discussed the chessboard that is the current REE market.

In previous Guru offerings, we’ve discussed the chessboard that is the current REE market.

China controls the REE refining market, and tensions between East and West are escalating—making this REE play the most strategic out of all the deposits we follow. But the market is a little slow on the uptake.

The West is currently scrambling to secure REE supply in its own backyard.

Our very own Lukas Kane chimed in on this wayward dynamic in recent weeks:

Defense Metals (DEFN.V) in focus as U.S. de-couples from China REE supply chain

Kane:

“As US-China relations hit new lows, Washington is redoubling efforts to address a major Achilles’ heel: its dependence on Beijing for rare earth elements – essential materials in various hi-tech products from smartphones and electric car batteries to Javelin missiles and F-35 fighter aircraft,” confirms The South China Morning Post.

The U.S objective to de-couple from the China supply chain creates a strong tailwind for North American REE companies like Defense Metals (DEFN.V)… “

Just a few days ago—August 4th—the company dropped the following headline:

Defense Metals Flotation Pilot Plant Achieves Initial Positive Results

Here, we’re getting a better feel for the company’s pilot-plant-stage processing of a 30-tonne bulk sample currently underway at SGS Canada’s metallurgical test facility.

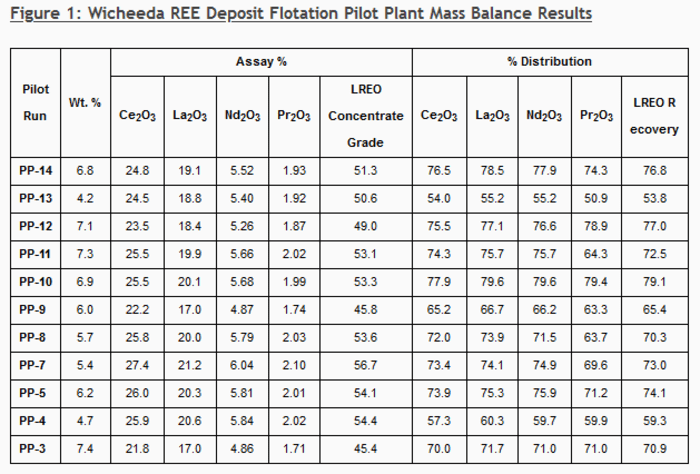

A total of 14 pilot plant processing runs have been completed since the testwork began on June 11, 2020.

Highlights of this recent run:

- 16 tonnes bulk sample feed processed over 118 hours of operation to date;

- Approximately 750 kg of flotation concentrate produced (dry weight at ~15% moisture content);

- Process run concentrate grades ranging from 45.4% up to 56.7% (averaging 51.6%) LREO (light rare earth oxide expressed as the sum of light rare earth elements expressed as oxides Ce2O3+La2O3+Nd2O3+Pr2O3);

- Process recovery ranging from 53.8% up to 79.1% (averaging 70.2%) LREO;

- Low average 6.2% mass yield to concentrate.

The mass balance results for completed runs are as follows:

“Scaled-up flotation pilot plant results to date compare very favourably, and with respect to concentrated grade exceed, benchmark locked-cycle flotation tests that produced a high grade 48.7% LREO flotation concentrate at 85.7% LREO recovery (See Defense Metals News Release dated October 23, 2019). The results demonstrate progressive LREO recovery improvement with successive tests conducted under varying process conditions designed to improve the circuit stability and metallurgical performance.

“Scaled-up flotation pilot plant results to date compare very favourably, and with respect to concentrated grade exceed, benchmark locked-cycle flotation tests that produced a high grade 48.7% LREO flotation concentrate at 85.7% LREO recovery (See Defense Metals News Release dated October 23, 2019). The results demonstrate progressive LREO recovery improvement with successive tests conducted under varying process conditions designed to improve the circuit stability and metallurgical performance.

A long 30 hour continuous operation test run (PP-15) was completed last week based on PP-14, and mass balance results are currently pending. SGS has informed Defense Metals that the balance of the bulk sample material will be processed this week during a final 30 hour continuous operation run designed to test circuit stability at lower temperature.”

Craig Taylor, Defense Metals CEO

“We are exceedingly pleased with these initial flotation pilot plant test results. The Wicheeda REE Deposit mineralization continues to deliver exceptional metallurgical performance. We have shown that in a pilot plant setting we are able to exceed concentrate grades achieved during bench-scale flowsheet development. Defense Metals believes the results released today demonstrate the viability of large-scale bulk sample flotation processing of Wicheeda REE Deposit material. We look forward to completion of the balance of flotation pilot plant testwork this week. We expect to release the final results and a summary of all the testwork in the coming months.”

- 104.96 million shares outstanding

- $19.94M market cap based on its recent $0.19 close

In a recent offering, we stated that East Asia’s Indonesian ounces-in-the-ground are beginning to attract a much broader audience. The audience here continues to grow…

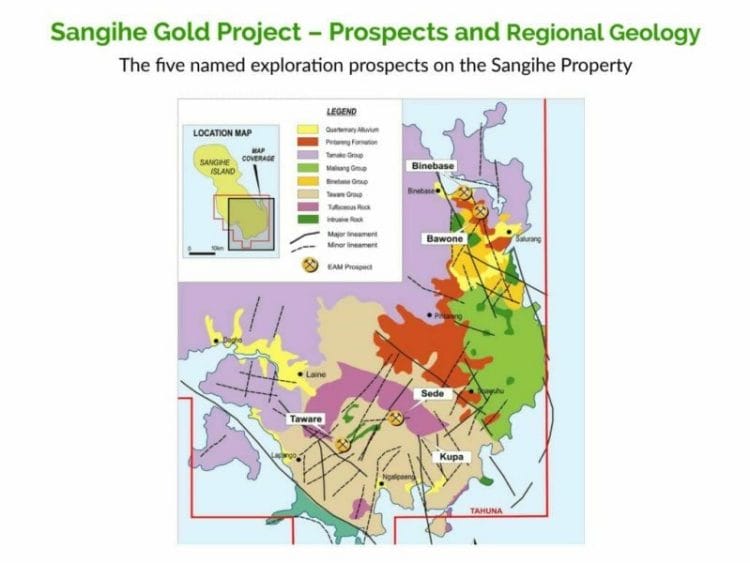

The company’s 42,000-hectare Sangihe Gold Project—two blocks covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—is on a fast track to production.

The company’s 42,000-hectare Sangihe Gold Project—two blocks covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—is on a fast track to production.

The company has its sights set on a modest heap leach production scenario and three weeks back, we received the following update:

The company announced that the final environmental assessment study (AMDAL) had been submitted to the relevant gov’t authorities and that FINAL approval was only weeks away.

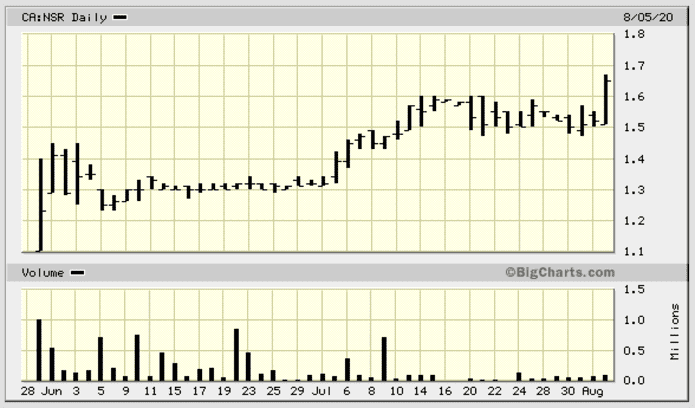

If you line-up the date of this press release—July 16th—and compare it to the price chart above, you’ll see that it triggered a high-volume tear, one that carved out multi-year highs.

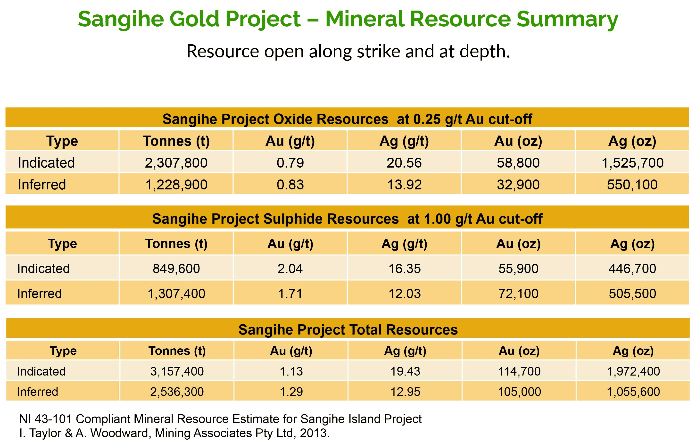

Sangihe’s near-surface, easily exploitable resources are as follows:

Stage One of Sangihe’s mine plan will see the extraction of roughly 1,000 ounces of gold per month when the production facility is fully operational (approx 12 months from gov’t approval and project funding).

Stage One of Sangihe’s mine plan will see the extraction of roughly 1,000 ounces of gold per month when the production facility is fully operational (approx 12 months from gov’t approval and project funding).

Estimated all-in costs = roughly $700 per ounce.

If you factor in current gold prices, now north of $2,000, we could see free cashflow of $1,350 per ounce or $1.35M per month.

That flow of funds would expedite the company’s plans to self-fund exploration across its extensive land base and add to the ounce count.

The company has 25,000 hectares of prospective terrain to scour where geologist Frank Rocca—a former Barrick man—estimates the potential for at least 2,000,000 ounces of Au.

Three phases of exploration are anticipated:

- A phase one drilling campaign to upgrade the 835,000 Inferred ounces along the Binebase-Bawone Corridor;

- A phase two drilling program to test the mineralization potential from Bawone to the south of Salurang;

- A phase three exploration and drilling campaign designed to test the remaining 20,000-plus hectares of geologically prospective terrain surrounding Taware, Sede, and Kupe.

Since our last coverage on July 30th, the company issued another Sangihe project update, announcing a minor delay in the final (AMDAL) approval, and a key hire.

Since our last coverage on July 30th, the company issued another Sangihe project update, announcing a minor delay in the final (AMDAL) approval, and a key hire.

East Asia Minerals Appoints Chief Financial Officer & Updates AMDAL Progress

Terry Filbert, East Asia’s CEO, commenting on said hire:

“We are glad to finally have Ms. Dyczkowski on board officially in the CFO capacity as she has been assisting in this role and has been instrumental in keeping the Company upright throughout the tumultuous years since 2017. Ms. Dyczkowski has displayed her commitment to the Company over the years and she continues to lead us on various financial fronts. We are pleased to have her in this new role and are confident she will be an effective member of our management team as we work towards our stated goals.”

AMDAL ENVIRONMENTAL PERMITS UPDATE

On July 16th, 2020, the Company updated investors about the AMDAL environmental assessment study (AMDAL) originally anticipated to be completed by the end of July 2020.

The Company has received an update this week that due to COVID-19 and the global pandemic spreading throughout Southeast Asia and central Indonesia, a quarantine period is now mandatory between islands. As a result of these quarantines, completion of the Sangihe meeting has been delayed but is expected to be held by mid August.

If you examine the above chart again, you’ll see a knee-jerk reaction from the contingent of weak hands, those who failed to understand the concept that success delayed is NOT success denied.

Without a doubt, this final (AMDAL) approval is the next potential catalyst. With gold carving out new all-time highs, these shares stand to benefit from a powerful tailwind.

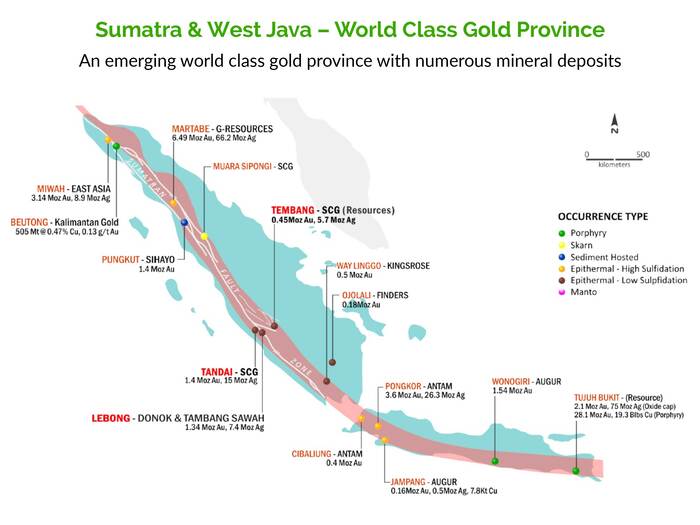

And don’t forget the company’s other asset at the northern tip of Sumatra Island in Aceh Province—Miwah.

The Miwah Gold Project is a high-level, high sulphidation epithermal gold prospect boasting a resource of 3,140,000 ounces of gold. In 2011, Miwah pushed EAS to a lofty market cap of $600M. It’d be a mistake to underestimate the significance of this asset.

The Miwah Gold Project is a high-level, high sulphidation epithermal gold prospect boasting a resource of 3,140,000 ounces of gold. In 2011, Miwah pushed EAS to a lofty market cap of $600M. It’d be a mistake to underestimate the significance of this asset.

Though Miwah is idle at the moment, we could see movement in the not-too-distant future (just a guess on my part).

The following is a recent GoldSilver Pros interview with CEO Filbert:

- 60.44 million shares outstanding

- $15.11M market cap based on its recent $0.25 close

Falcon is a good example of the possibilities that abound in the junior exploration arena.

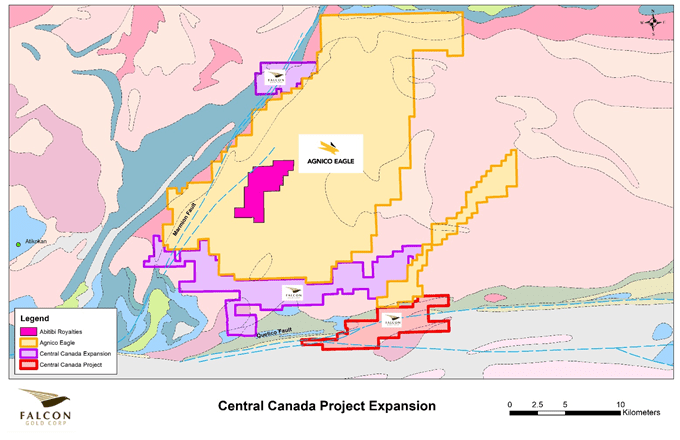

The company’s flagship asset is its Central Canada Gold Project (CCGP), located roughly 160 kilometers west of Thunder Bay Ontario (in proximity to Aginco Eagle’s Hammond Reef deposit).

The company’s flagship asset is its Central Canada Gold Project (CCGP), located roughly 160 kilometers west of Thunder Bay Ontario (in proximity to Aginco Eagle’s Hammond Reef deposit).

On July 16th, the company announced the conclusion of its summer drilling campaign at CCGP.

On July 16th, the company announced the conclusion of its summer drilling campaign at CCGP.

Falcon Completes Summer 2020 Drill Program on the Historic Central Canada Gold Mine Project

Highlights from the final two holes:

- CC20-06 intersected the mine trend @ 30.36 meters to 40.89 meters and intersected the potentially gold-bearing second zone @ 113.0 meters to 139.68 meters.

- CC20-07 intersected the mine trend at 80.10 meters to 103.88 meters and discovered a new mineralized shear zone from 142 meters to 177.46 meters with sulphide bearing veins intersected throughout the interval and continued through until 200.86 meters of depth.

“The Company is awaiting results of the re-analysis of core samples with visible gold and expanded sample intervals from holes 1 through 3 and will be released as they are made available.”

On July 23rd, the company announced the acquisition of additional acres in the region…

Falcon Triples Central Canada Gold Project in Size

Falcon’s CEO, Karim Rayani, on the significance of this acquisition:

“Our Company now controls a combined 51 kilometers of strike length along the Quetico Fault Zone and its major northeast trending splays such as the Marmion Fault zone. Our original Central Canada optioned ground and the new staking combine to make Falcon one of the largest land holders in the mining camp second only to Agnico Eagle Mines. We fully intend to continue to aggressively identify lands worth staking where our technical team identifies high potential gold targets and solid gold occurrences in Atikokan area.”

In more recent news, on August 4th, the company dropped the following headline regarding its Merritt area project:

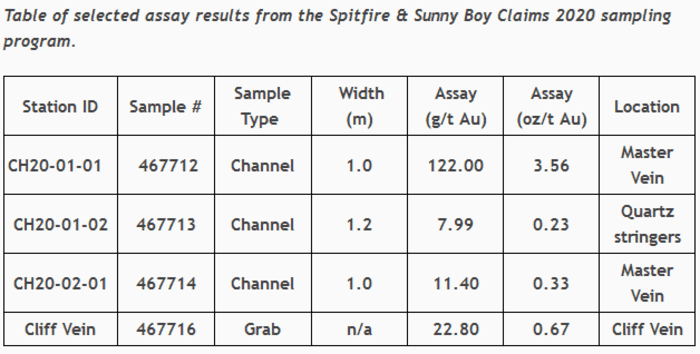

Falcon Strikes High-Grade Gold at Its Spitfire & Sunny Boy Claims, Merritt, B.C.

The current focus here is the past producing Master Vein.

The company blasted a trench along strike of the Master Vein and collected samples. The highlight averaged 59.8 g/t Au over 2.2 meters which included a one meter interval assaying 122 g/t Au.

Roughly 125 meters further to the southeast, another channel sample tagged 11.4 g/t Au over one meter.

A new (potential) vein structure—they’re calling it the Cliff Vein—was discovered down slope from the Master Vein, roughly 25 meters lower in elevation where a grab sample assayed 22.8 g/t Au.

“In addition to the vein and mineralized rock sampling, the geological team conducted a sampling of outcrops throughout the claims. These samples are undergoing whole rock geochemical analyses. These results are pending but will give further insight into the deposit scale and potential for more gold occurrences yet to be discovered.”

“The Merritt area has a long history of exploration and gold discoveries. Explorers focused on narrow high-grade veins while not seeing the less obvious geological indications of broader mining widths. The Company’s field crew has dedicated their work this season to studying the structure and geochemistry. The project continues to impress us as results come in. We believe the Nicola Lake area hosts the makings of a significant new gold camp,”

- 81.45 million shares outstanding

- $11.00M market cap based on its recent $0.135 close

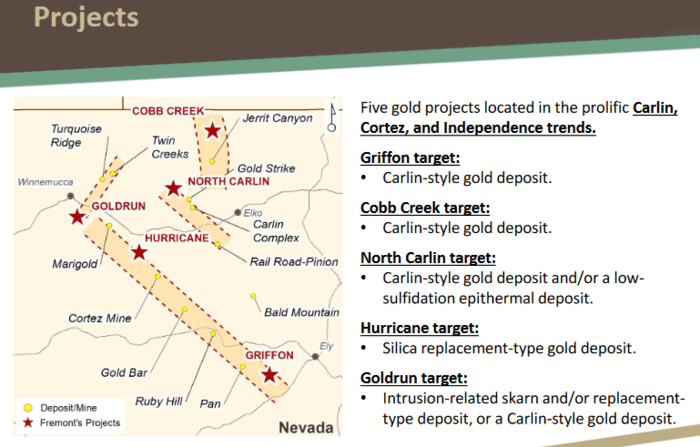

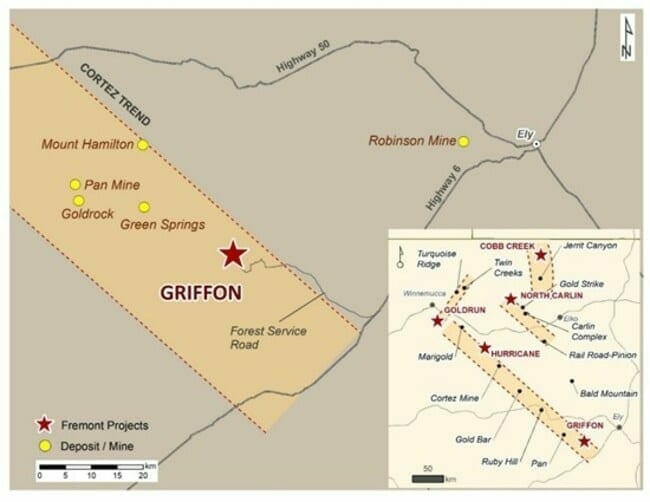

“Fremont’s advanced-stage gold projects include Griffon, a past-producing gold mine located at the southern end of the Cortez Trend, Cobb Creek, which hosts a historical resource, and Hurricane, where past operators intersected near-surface gold mineralization in a number of drill holes. Fremont’s early-stage gold projects include Goldrun and North Carlin. Fremont is particularly excited by North Carlin, located at the northern end of the Carlin Trend, where several drill targets have been outlined.”

Griffon hasn’t been tested with the drill bit since the 1990s. This represents a compelling speculation.

Griffon hasn’t been tested with the drill bit since the 1990s. This represents a compelling speculation.

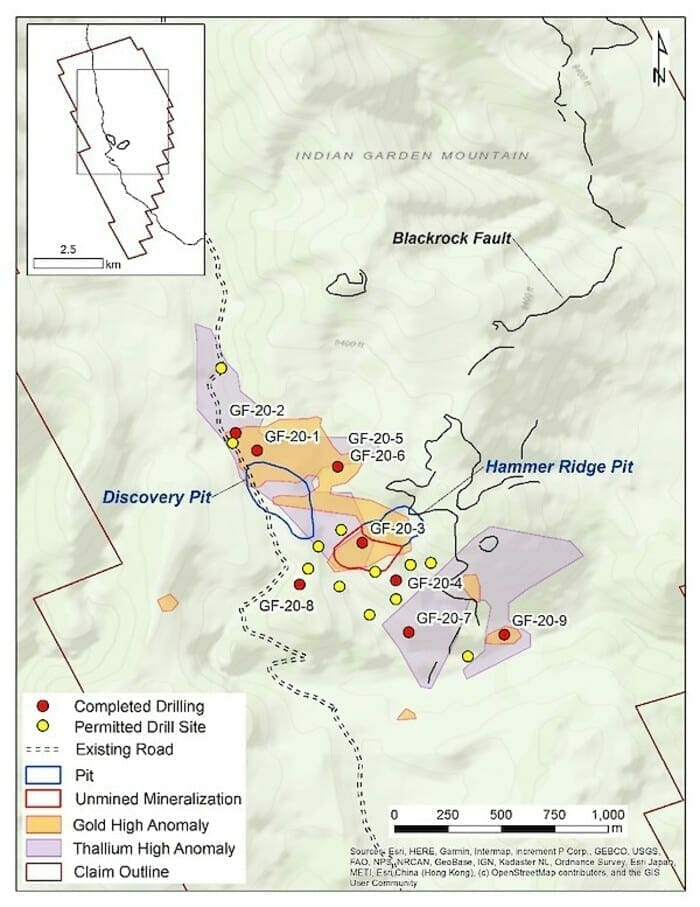

In Fremont’s crosshairs… a Carlin-type gold deposit.

In Nevada, Carlin-type gold deposits have a combined mineral endowment of more than 250 million ounces, all concentrated along four main trends: Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon.

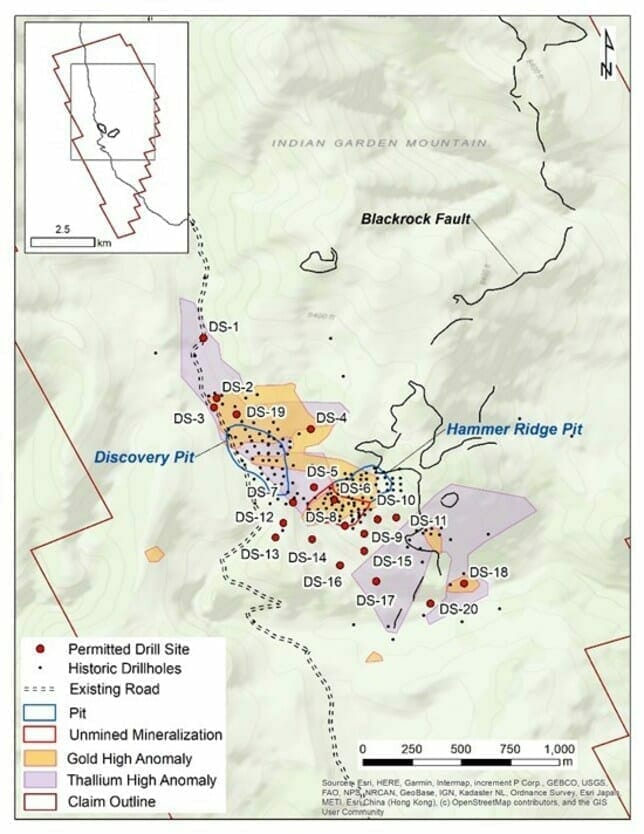

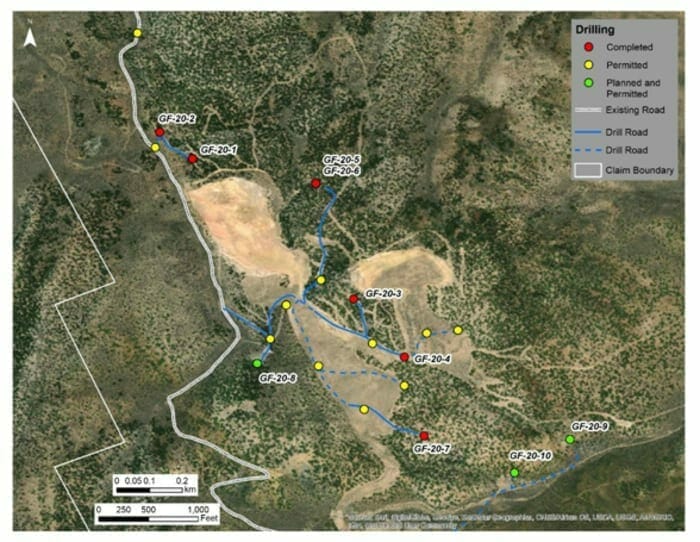

On June 25th, the company mobilized a drill rig for a phase-one, 2,000 meter drilling campaign to test a number of gold-in-soil anomalies along an unmined area to the southwest of the Hammer Ridge pit.

On June 25th, the company mobilized a drill rig for a phase-one, 2,000 meter drilling campaign to test a number of gold-in-soil anomalies along an unmined area to the southwest of the Hammer Ridge pit.

On July 8th, the company reported news—Fremont Intersects Thick, Near-Surface Oxide Gold Mineralization at Griffon Gold Project; Phase 1 Drill Program Continues—a development we covered in a recent round-up.

On July 8th, the company reported news—Fremont Intersects Thick, Near-Surface Oxide Gold Mineralization at Griffon Gold Project; Phase 1 Drill Program Continues—a development we covered in a recent round-up.

Then, on July 21st, the company dropped the following headline:

The highlight from this press release was drill hole GF-20-3 which intersected 1.05 g/t near-surface oxide gold mineralization over 50.3 meters, starting at 29 meters.

Below is a description of the first three drill holes completed at Griffon:

Drill hole GF-20-1: A vertical drill hole drilled to a depth of 165 metres. GF-20-1 did not return anomalous gold values.

Drill hole GF-20-2: A 45-degree angle drill hole drilled to a depth of 170 metres. GF-20-2 intersected 30 metres of 0.30 g/t gold, including 8 metres of 0.71 g/t gold, starting at 15 metres in jasperoidal decalcified Lower Joana Limestone.

Drill hole GF-20-3: A vertical drill hole drilled to a depth of 280 metres. GF-20-3 intersected 50.3 metres of 1.05 g/t gold starting at 29 metres in interbedded thin-bedded limestone and brown decalcified shale of the Upper Joana Limestone. Located in an area of historically identified mineralization, southwest of the Hammer Ridge Pit, hole GF20-3 was designed with three objectives in mind: 1) to confirm the historically identified mineralization for a future NI 43-101 report, 2) to characterize the host rock and alteration in the gold intercept, and 3) to intersect the Pilot Shale at depth. All three objectives were satisfied.

On August 5th, the company released the following update:

On August 5th, the company released the following update:

Fremont Completes Phase 1 Drill Program at Griffon Gold Project; Assays Pending

The phase one drilling campaign at Griffon is now complete.

The program, increased to 2,275 meters from the originally planned 2k, managed to stay on budget.

Holes four through nine have been sent to the lab and will be reported once the assays are received, compiled, and interpreted.

Blaine Monaghan, Fremont’s CEO:

“We eagerly await the results from holes four through nine. I’m confident that the results will demonstrate the potential for additional Carlin-type deposits at Griffon and set the stage for an expanded phase II drill program.”

This phase one drill program tested a number of gold-in-soil anomalies, an area of unmined mineralization to the southwest of the Hammer Ridge pit, permissive stratigraphic targets, and the Blackrock fault.

Below is a description of holes GF-20-4 through GF-20-9, as per the August 5 press release:

- Drill hole GF-20-4: A vertical hole to test for the continuation of mineralization southeast of the Hammer Ridge pit.

- Drill holes GF-20-5 and 6: A vertical and angled drill hole targeted an untested gold-in-soil anomaly to the east of the Discovery Ridge pit.

- Drill GF-20-7: A vertical hole, approximately 375 metres south of the Hammer Ridge pit, tested a coincident gold and thallium in soil anomaly south of the Hammer Ridge pit.

- Drill GF-20-8: A vertical hole to test for Joana Limestone (a major gold host at Griffon). The drill site is located on a ridge covered by post-mineral alluvium and volcanics. A shallow historic hole penetrated the alluvium but failed to reach bedrock, which is expected to be Joana Limestone.

- Drill hole GF-20-9: A vertical hole, approximately 625 metres southeast of the Hammer Ridge pit, tested a coincident gold and thallium soil anomaly hosted in the Chainman Formation. The hole was also designed to penetrate the Blackrock fault, the underlying Joana Limestone, and the Pilot Shale (a gold host at other deposits and mines in the area, including Fiore Gold Ltd.’s Pan mine).

Golden Lake Exploration (GLM.C)

Golden Lake Exploration (GLM.C)

- 27.8 million shares outstanding

- $6.39M market cap based on its recent $0.23 close

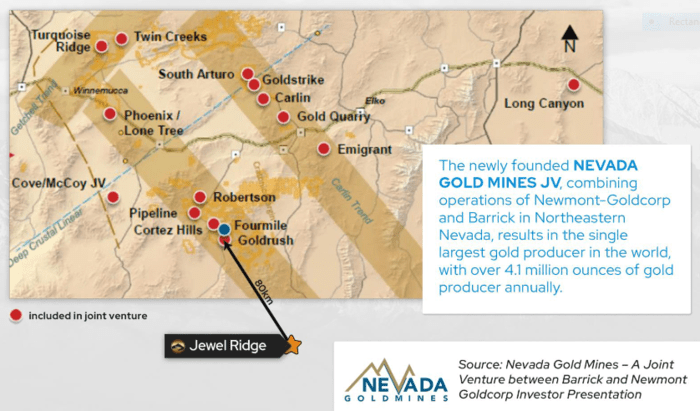

Golden Lake’s flagship Jewel Ridge Project is located at the south end of Nevada’s prolific Battle Mountain–Eureka trend, strategically along strike and contiguous to the Barrick Gold’s (former) two million ounce Archimedes/Ruby Hill mine to the north, and Timberline Resources’ advanced-stage Lookout Mountain project to the south.

The project is located within close proximity to Nevada Gold Mines’ (NGM) Pipeline, Cortez Hills, and Goldrush deposits.

The project is located within close proximity to Nevada Gold Mines’ (NGM) Pipeline, Cortez Hills, and Goldrush deposits.

Nevada Gold Mines (NGM) is a partnership between mining behemoths Barrick Gold (61.5%) and Newmont-Goldcorp (38.5%).

Pipeline, Cortez Hills and Goldrush represent three of the largest Carlin-type gold deposits in the world. They make up NGM’s lowest-cost assets with over 50 million ounces of gold reserves & resources.

“The deposit types of interest at Jewel Ridge are Carlin-type, sedimentary rock-hosted, gold deposits and carbonate replacement deposits. Carlin-type deposits include many deposits that occur in the Battle Mountain-Eureka Trend, Carlin Trend and other well-known mineral trends in north central Nevada. Jewel Ridge is located adjacent to, and south of, the former Ruby Hill gold property, which was operated by Homestake Mining Company from 1997 until 2002 and produced about 680,000 ounces of gold from the Archimedes open pit. In February 2007, Barrick Gold Corp. commenced production on a 1.1-million-ounce gold resource from the adjoining East Archimedes deposit. From 1976–2012, production from these Carlin-type deposits in the Eureka district was approximately 44.9 tonnes (1.38 million ounces) of gold (NBMG, 2014).”

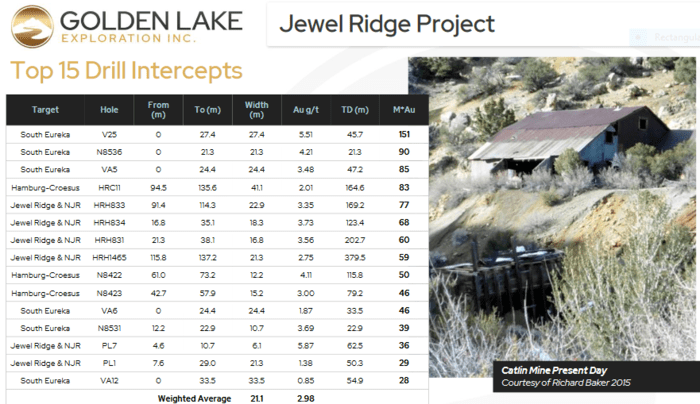

The property has produced a number of high-grade intercepts in its day:

In a recent Guru round-up piece, we covered recent developments on the geochemical front, particularly at the high-priority Radio Tower target.

In a recent Guru round-up piece, we covered recent developments on the geochemical front, particularly at the high-priority Radio Tower target.

Just last week, Equity Guru’s Lukas Kane reported additional progress at Jewel Ridge as the company prepares to drill – Golden Lake (GLM.C) maiden drill program is about to begin

Then on July 29th, the company dropped the following headline

Site Preparations Complete for Drill Program on the Jewel Ridge Property, NV

In this one, the company reports that site preparations are complete for a minimum 1,500 meter RC drilling campaign.

The company’s maiden drill program on the property should be underway by now.

Mike England, Golden Lake CEO:

“The commencement of our first drill program on the Jewel Ridge property marks an important milestone for the Company. We are excited to advance this marquee gold and silver property in this strong precious metals market.”

This is quite the tailwind the company has. Solid hits from Jewel Ridge should trigger a solid response from the market.

This just in…

Jewel Ridge Property Drill Program Under Way, Soil Geochemistry Highlights

The company says the 1st hole was completed on the weekend on the Hamburg Mine target.

The drill program has been expanded from 1,500 meters to 2,050 meters on targets located on patented mineral claims on the South Eureka and Hamburg zones, both directed at Carlin-type, oxide-gold mineralization.

Highlights from a recent soil geochemical survey include:

Magnet Ridge Zone – this target, previously known from limited rock chip sampling, was significantly expanded and enhanced by the recent soil geochemistry program. The Magnet Ridge is a prominent north-east trending topographic feature, where limited historic mining has occurred on CRD (carbonate replacement deposits) silver-gold-lead-zinc mineralization. The soil survey indicated a strong anomaly over the ridge and west flanks, defined by 22 samples on six traverse lines, the anomaly is over 2,800 ft long (850 m) in a north-south trend (open to the north), varying from 600 ft (180 m) to 1,000 ft (305 m) wide, averaging 132 parts per billion (“ppb Au) gold and 2.33 parts per million silver (ppm Ag), with associated arsenic, copper, and lead values. Peak gold values in this anomaly are 408 ppb Au, peak silver values are 12.60 ppm Ag. To date, only 6 drill holes have been drilled on the east flank of the Magnet Ridge anomaly with 4 holes returned low grade gold values. Additional drilling is planned following additional geological and structural mapping.

North Dunderberg Target – A new target has been defined approximately 600 ft (180 m) due north of the Dunderberg mine area. The anomaly trends roughly north-south, is approximately 1,600 ft (490 m) long and varies from 600 to 800 ft wide (180 to 245 m) and The proposed soil chemical survey will comprise sampling on 200-foot (61-metre) intervals, and it averages 129 ppb Au and 0.59 ppm Ag, defined by 9 samples.

Valley Target – a narrow gold and silver anomaly trends northeast-southwest through the central portion of the property for a strike length of approximately 3,000 ft (915 m). Additional sampling and geological mapping is required to confirm the nature and significance of this anomaly.

Corporate Presentation (middle right of page)

- 19.87 million shares outstanding

- $10.13M market cap based on its recent $0.51 close

We last updated Goldseek in our enormously popular July 24th round-up piece titled Equity.Guru’s sub-$20m ExploreCo shortlist: mining microcaps that are fit to follow (part 2 of 2).

We last updated Goldseek in our enormously popular July 24th round-up piece titled Equity.Guru’s sub-$20m ExploreCo shortlist: mining microcaps that are fit to follow (part 2 of 2).

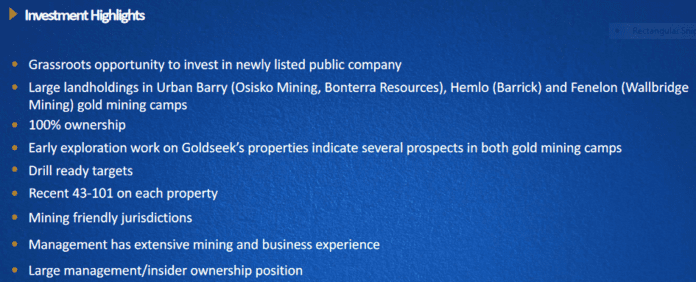

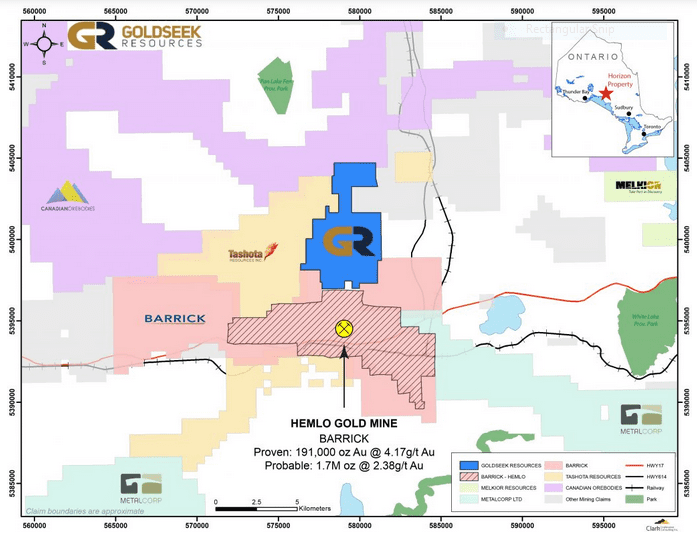

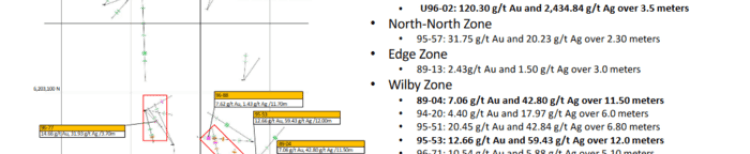

Goldseek holds large, geologically prospective land positions in the storied Hemlo Gold Camp of Ontario (Barrick Gold), the Urban Barry Gold Camp of Quebec (Osisko Mining, Bonterra Resources), and the Fenelon Gold Camp of Quebec (Wallbridge Mining).

The first project in line for a proper probe with the drill bit is the company’s Horizon Project in the storied Hemlo Gold camp.

Mines in the Hemlo camp have produced in excess of 21 million ounces of gold over the past three-plus-decades of continuous production.

Mines in the Hemlo camp have produced in excess of 21 million ounces of gold over the past three-plus-decades of continuous production.

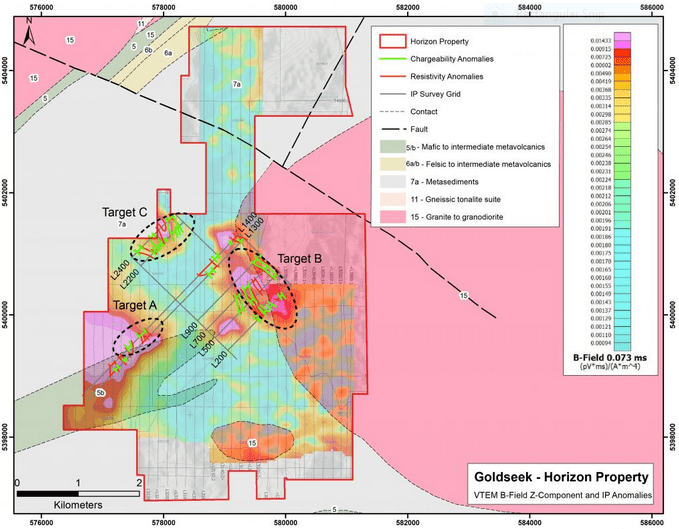

There are three geophysical anomalies (VTEM and IP) Goldseek is teeing-up this year (four if you count the unnamed anomaly along the bottom of the map below).

The company announced the commencement of drilling just last week.

The company announced the commencement of drilling just last week.

Goldseek Commences Maiden Drill Program at Horizon (Hemlo) and Property Addition

Target C (above map) will see 1,000 meters.

This first initial probe will follow up on a geophysical target identified from a VTEM airborne survey—a 250-meter radius “bulls-eye” anomaly with over 600 meters of depth extent.”

“This target, identified through strong RDI’S (resistivity depth images), was further supported with a 2019 IP survey, which outlined a well defined IP anomaly with a strong chargeability response and direct resistivity low correlation suggesting it is a highly conductive bedrock feature and relatively close to surface.”

“This target, identified through strong RDI’S (resistivity depth images), was further supported with a 2019 IP survey, which outlined a well defined IP anomaly with a strong chargeability response and direct resistivity low correlation suggesting it is a highly conductive bedrock feature and relatively close to surface.”

Jon Deluce, Goldseek CEO:

“We are excited for our maiden drill program at the Horizon (Hemlo) Property which has commenced. There was only one historical drill hole in the entire northern portion of the Property, which was drilled during the original Hemlo rush in 1984. We look forward to shedding some light on an area of the Hemlo district that is very underexplored.”

Regarding targets A and B (above map), this news release went on to state:

In addition, two areas of EM anomalous activity, referred to as GS-1 and GS-2 are attributed to bedrock sources and were modelled using Maxwell EM modelling software. The GS-1 revealed 4 plates, the fourth of which coincided with the target C conductor. These anomalies occur within metasedimentary rocks.

The GS-2 Maxwell anomalies lie to the south of the broad location of target A which lies on the southwestern portion of the property and shows a potential for an extended strike length that increases the chances of this target being formational in nature. The target A anomaly is further supported by the IP data, which shows coincident low resistivity and high chargeability. In addition, 15 overburden drill holes drilled in 2007 by Kaminak Gold Inc. within this broad anomaly returned values as high as .18% nickel, .17% copper, and .16 g/t gold, which may be more suggestive of a massive sulphide environment. In conjunction with the drilling proposed on Target C, it is proposed that the grid lines be expanded on Target A and a soil sampling program be initiated both on targets A and B to focus on more preferential targets within this larger system.

Goldseek plans to utilize MMI technology for soil geochemistry on these broader targets A and B as the technology aids in more focused sharp anomalies that may correspond to the broader IP targets and in the detection of deeply buried mineralization and definition of metalliferous zones and associations.

With a rig turning on a viable Hemlo target, this play should begin attracting a wider audience in the days/ weeks to come.

The company’s super-tight share structure—currently 19.87 million outstanding—should help trigger positive price trajectory on any measurable success with the drill bit.

- 516.79 million shares outstanding

- $852.7M market cap based on its recent $1.65 close

Briefly…

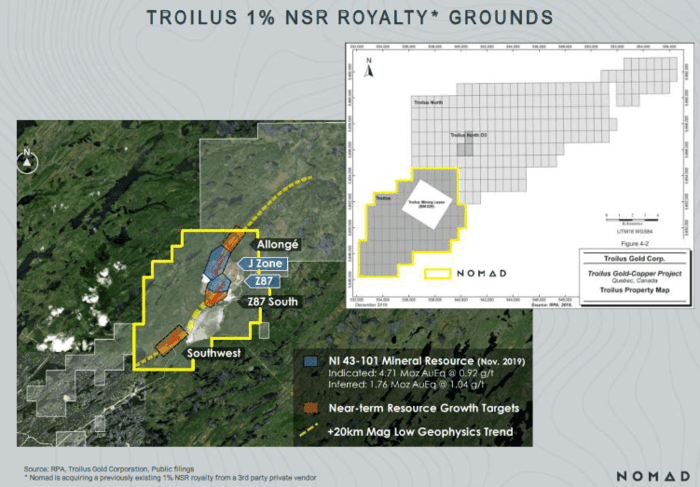

Last week we covered Nomad’s NSR acquisition of the Troilus Gold Project in a piece titled Nomad Royalty (NSR.T) acquires NSR on 8.11 million AuEq oz Troilus Gold project in mining-friendly Quebec. This was a real heads-up move on management’s part.

The Troilus Gold Project, operated by Troilus Gold (TLG.T), boasts a current resource of 8.11 million gold equivalent ounces (AuEq)—4.96 million ounces of Indicated AuEq and 3.15 million ounces of Inferred AuEq.

This week, on August 4th, the company announced the closing of said acquisition via the following headline:

Nomad Closes Troilus Royalty Acquisition

In our introduction to the company on May 5, 2020, we stated:

In our introduction to the company on May 5, 2020, we stated:

This deal was priced at C$0.90 per share, at 11.5x P/2021 Cash Flow or a 1.05x Net Asset Value. Peers in the royalty space are currently trading around 18.0x P/2021 Cash Flow or roughly 1.8x Net Asset Value.

Translation: there’s potential for a significant re-rating as these shares commence trading and the market homes in on this anomaly.

Since its debut on the TSX, the company’s shares have been grinding higher and consolidating. Yesterday—August 5th—saw the highs taken out.

—Greg Nolan

Full disclosure: We have a marketing relationship with all of the companies featured above.