In the movie, “I Feel Pretty” (2018) – the dowdy Amy Schumer character has a brain injury and wakes up astonished to discover that she is stunningly beautiful.

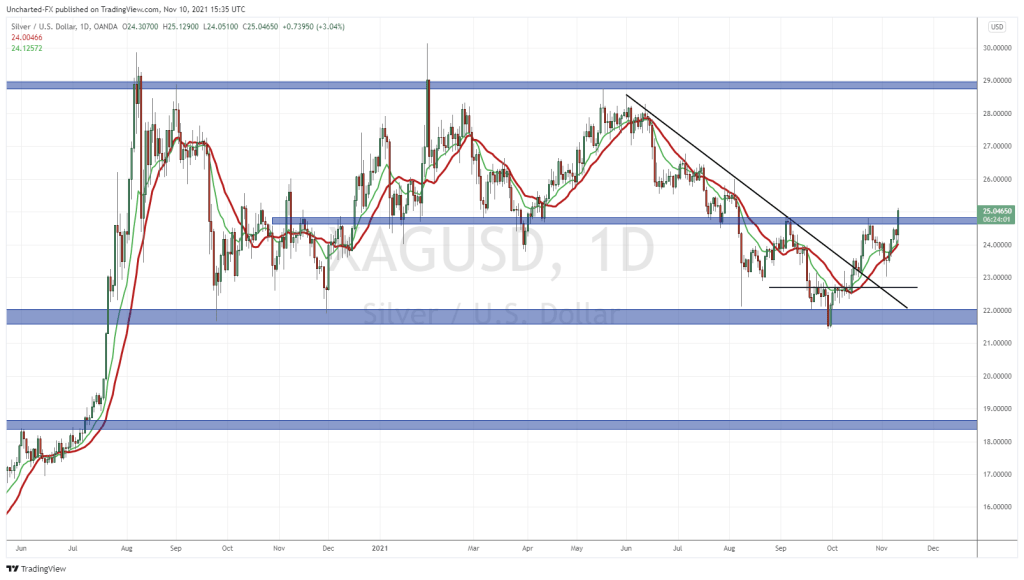

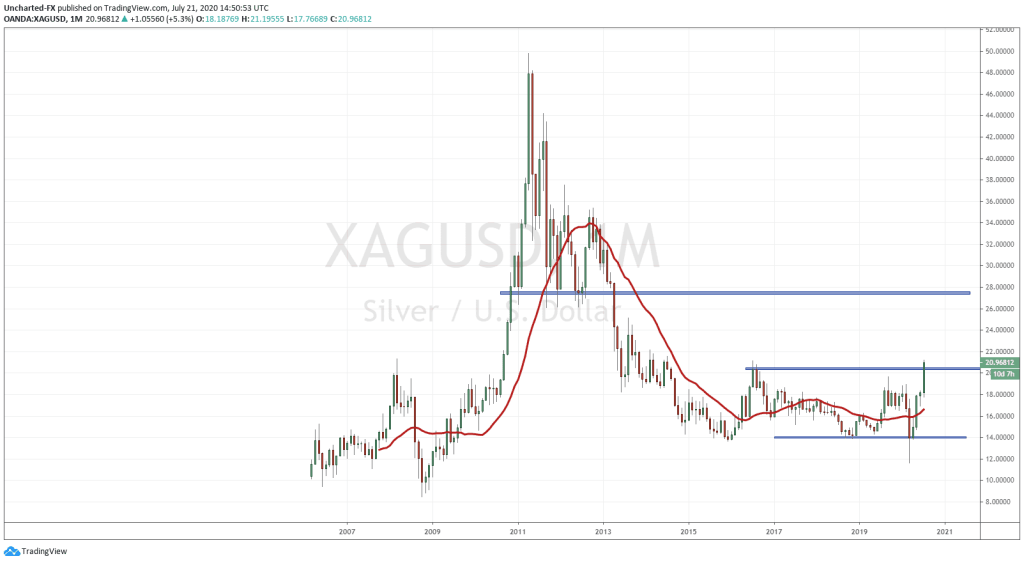

Silver may be experiencing a similar disorienting sensation.

Three months ago, silver couldn’t get a date on tinder.

Now it is an object of mass desire.

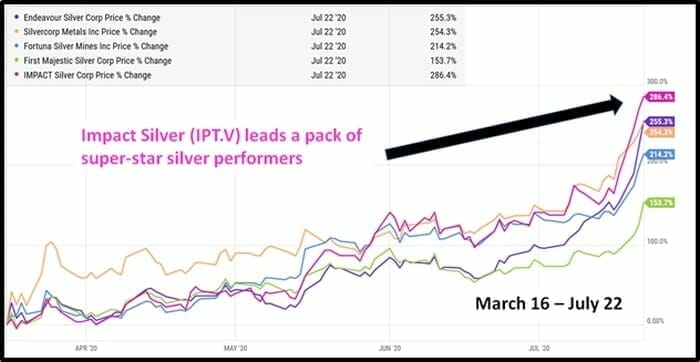

This is confirmed by the 3-month share price performance of Endeavor Silver (EXK.NYSE), Silvercorp (SVM.T), Fortuna Silver (FSM.NYSE), First Majestic Silver (AG.NYSE) and Impact Silver (IPT.V).

September Comex silver is trading at $23, up 6% today on safe-haven and industrial demand, and “green energy” stimulus.

September Comex silver is trading at $23, up 6% today on safe-haven and industrial demand, and “green energy” stimulus.

Silver is used as conductive layer in solar panels.

“More than $50 billion of green stimulus has been approved by governments thus far this year,” states BMO Capital Markets. 75% of this has come from in Europe. “The recent Biden campaign Clean Energy plan, most notably a zero-carbon power grid by 2035 would see new wind and solar capacity built to displace thermal generation.”

“Silver’s potential exposure to green stimulus is now an important tool in its armory, and should we see the same velocity of ETF flows evidenced in recent months continue through Q3, 2020.” continued BMO.

The green sector consumed 105 million ounces of silver last year, as solar gained market share from fossil fuels.

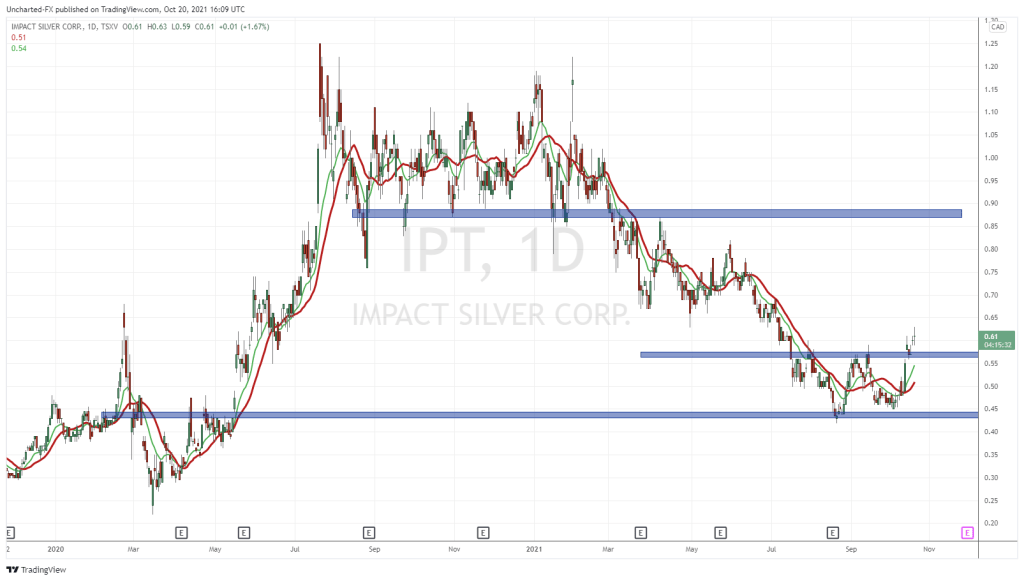

Impact Silver (IPT.V) – the biggest gainer in the above chart – is an example of a small silver miner well positioned to gain from these macro tailwinds.

In February 2020, Equity Guru’s Greg Nolan and Lukas Kane visited IPT’s Mexico mine site.

During the mine site visit, we spoke to boots-on-the-ground CFO Jerry Huang about the investment opportunity at IPT.

Some of the details about the purchasing agreement with Samsung may have changed, but the big story [the investment opportunity] has not changed.

As Mr. Huang states, silver has many industrial uses which account for more than 50% of annual world-wide demand.

Industrial applications use silver’s conductivity (the highest of any element for electricity and heat) as well as its sensitivity to light and anti-bacterial qualities.

In 2020, silver is used in brazing alloys, batteries, dentistry, glass coatings, LED chips, medicine, nuclear reactors, photography, solar energy, semiconductors, touch screens, water purification etc.

The countries that consume the most silver are the US, Canada, China, India, Japan, South Korea, Germany and Russia.

“Impact Silver controls two contiguous mineral districts in south-central Mexico—the Royal Mines of Zacualpan Silver District and the Capire-Mamatla Silver District, together covering 357 square kilometers,” wrote Greg Nolan.

“With centuries of historical production and the pervasive-predictable orientation of the epithermal veins occupying the districts subsurface layers, 43-101 reserves or resources, for the most part, are unnecessary.

Miners have been following these high-grade epithermal veins for literally hundreds of years as they demonstrate good continuity.

95% of the company’s current revenue is derived from Ag production. This may be THE purest silver producing company sporting a ticker symbol.” – End of Nolan.

“It seems the precious metal [silver] has been caught up in the perfect storm,” stated Jeroen Blokland, senior portfolio manager at Robeco Asset Management.

“Much of what’s driving silver also is driving gold – aggressive monetary policy financing of fiscal spending, which limits the ability of bond yields to rise,” states Market Watch, “That is sending inflation-adjusted, or real, yields lower, which tends to boost precious metals”.

The long-neglected metal is suddenly very popular.

- Lukas Kane

Full Disclosure: Equity Guru has no financial relationship with the companies mentioned in this article.