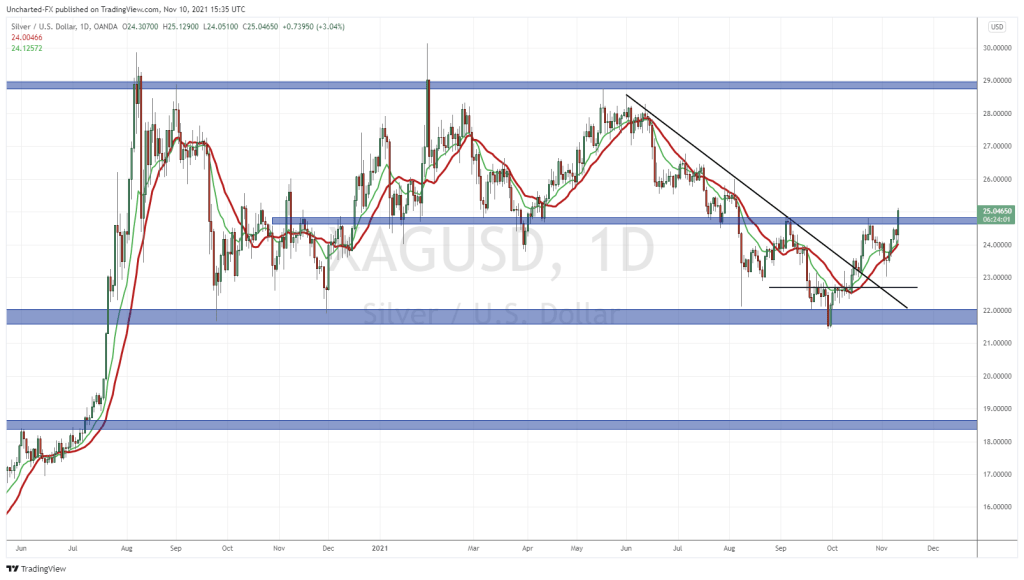

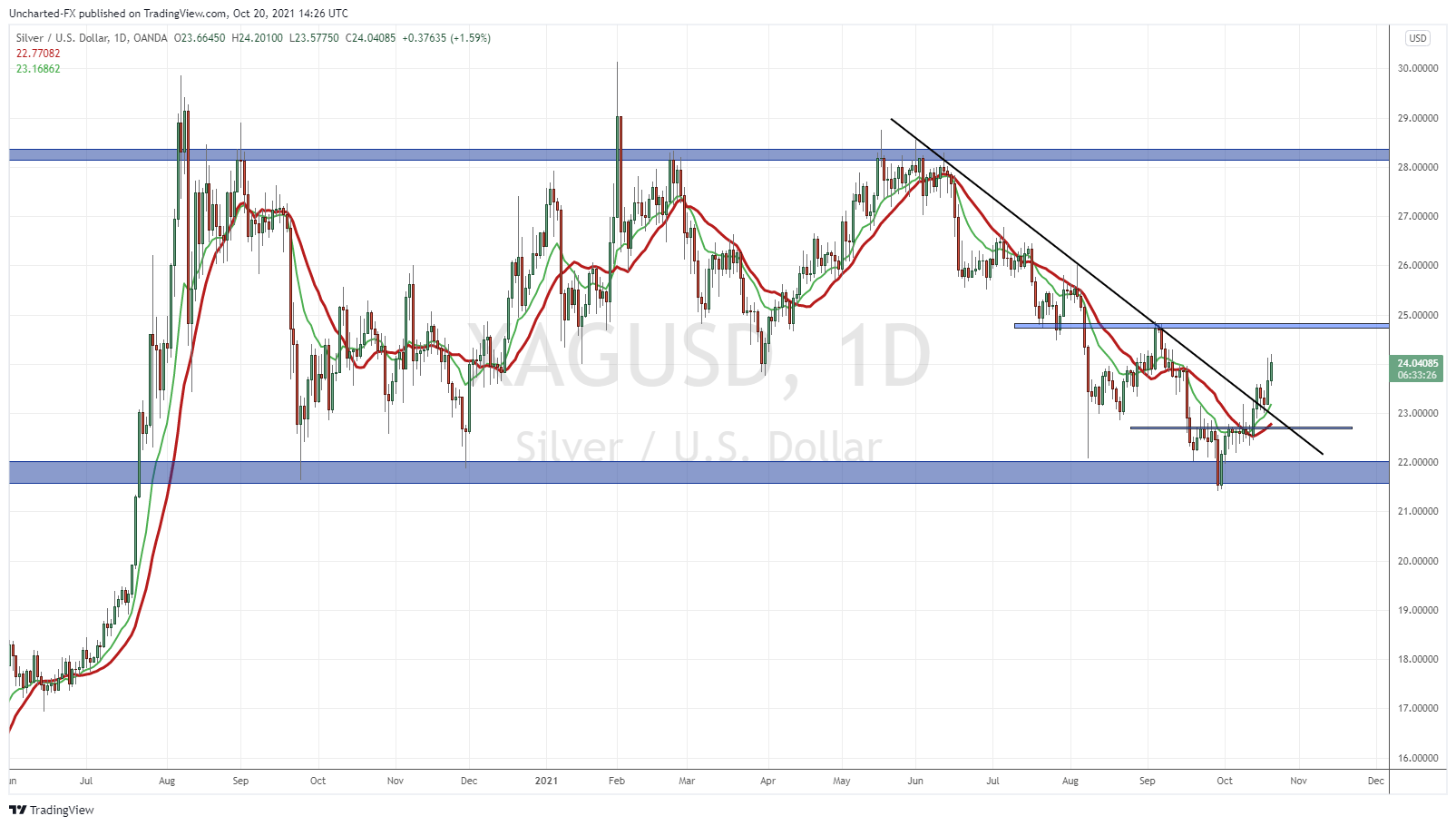

It has been awhile since I last spoke about Impact Silver (IPT.V). As Silver prices topped in May-June of 2021, Silver juniors and miners followed lower. But now Silver has bottomed. We picked up Silver positions on the break above $22.60, and added more on the trendline break (see below). Things are looking bullish for Silver as long as we remain above the $22.60 breakout candle. If Silver goes, so do the juniors and miners. They offer great leverage to the price of Silver. So now is a great time to add to your Silver stocks, or start new positions.

A downtrend has been broken, and we expect a new uptrend to play out going forward. Higher lows and higher highs. Will be keeping a close eye when Silver tags $25, but longer term, I believe we are going back to the $28-$30 zone. Then we can assess the next move from there. Below is also my video on the Silver breakout and technicals. A new updated one will be out this week on our Youtube channel.

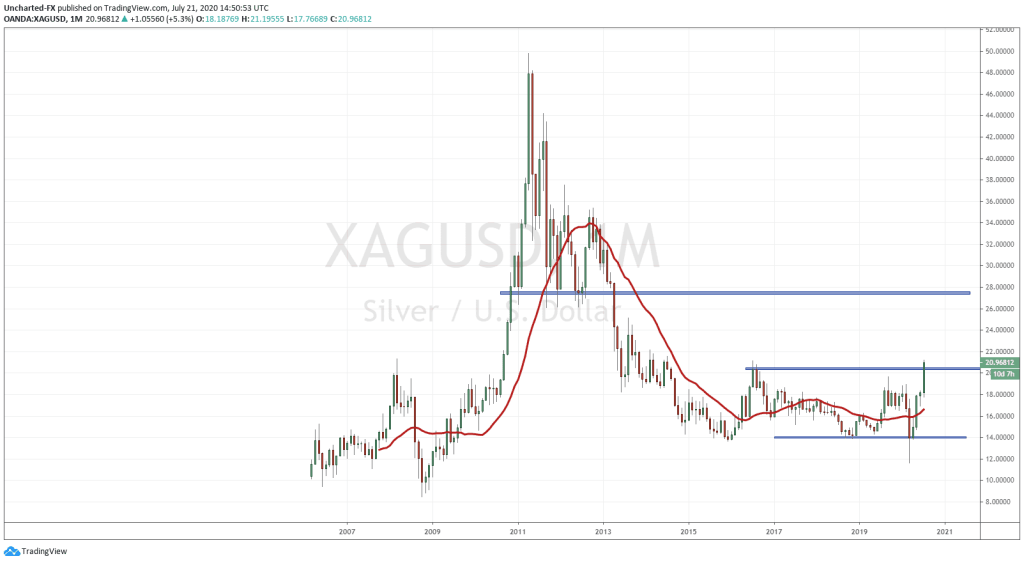

Both Gold and Silver popped last week on the inflation (CPI) data which showed inflation come in higher than expected. More importantly, energy and food had an uptick. The Gold and Silver bulls mainly hold the commodity due to a hedge against inflation. My definition of inflation has nothing to do with supply chain effects and shocks. It is all about the currency and monetary policy. Gold is seen as the anti-dollar and the premium monetary metal. Silver lost monetary status before Gold, and investors see it as an industrial metal. But when you compare Silver to Gold (the monetary metal) and to Copper (the industrial metal), Silver correlates more positively with the monetary metal.

Long time readers know my take on current central bank policy. We are already in a currency war, and it will get worse as nations want to keep weak currencies to boost the economy and keep assets propped. It is a mess. If there was one asset I would be holding going forward, it would be Silver.

Even Paul Tudor Jones is sounding the alarm bells on inflation. He was on CNBC’s Squawk Box this morning and said the number one threat to markets and society is inflation. He also said inflation hasn’t peaked at all. It could be worse than feared. I agree 100%. It’s going to be rough for the middle class, and I think picking up inflation hedges to protect your purchasing power is super important. Stock Markets will go up like they did in Weimar Germany, Venezuela, Zimbabwe etc, but that wealth isn’t worth much if the currency is inflated. Watch for a blow off top and stock markets to go vertical if the inflation trade is being priced in.

“I think to me the No. 1 issue facing Main Street investors is inflation, and it’s pretty clear to me that inflation is not transitory,” Jones said Wednesday on CNBC’s “Squawk Box.” “It’s probably the single biggest threat to certainly financial markets and I think to society just in general.”

If you remember, Paul Tudor Jones was among the group of Billionaires (alongside Stanley Druckenmiller, Ray Dalio and Sam Zell) who recommended buying Gold as an inflationary hedge. Some said so more than a year ago. Ray Dalio has been saying this for the past few years, comparing this period of history to the 1920’s. All about cycles for him. Well today Paul Tudor Jones said he believes cryptocurrency is an inflation hedge. And so far, it seems as the better hedge against inflation than Gold. I would just say the inflation trade is just picking up as more money begins pricing things in. but cryptocurrency definitely has the ‘it’ factor to it and more retail crowd fans.

“It would be my preferred one over gold at the moment,” Jones said in a “Squawk Box” interview. He added, “Clearly, there’s a place for crypto. Clearly, it’s winning the race against gold at the moment.”

There you have it. Gold, Silver and Crypto’s are all anti-dollar and anti-fiat assets. Some may disagree with crypto’s being labelled as such, and sure, there are projects that are crap, but buying good crypto’s provide a way out of the Dollar and fiat just like Gold and Silver. I like, and hold them all. Stop being divisive about Team Gold vs Team Bitcoin. Own them both.

Onto Impact Silver and the current chart opportunity.

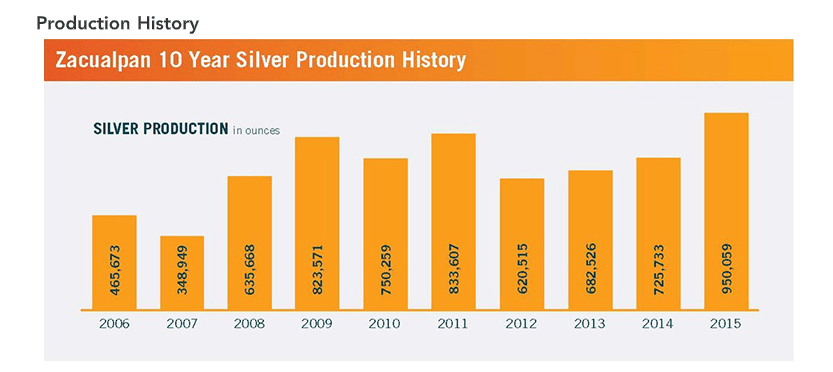

Impact Silver is a successful silver-gold explorer-producer with two processing plants on adjacent districts within its 100% owned mineral concessions covering 211km2 in central Mexico with excellent infrastructure and labor force. Over the past 15 years, IMPACT has produced over 10 million ounces of silver, generating revenues of over $200 million, with no long-term debt. At the Royal Mines of Zacualpan Silver District, three underground silver mines and one open pit mine feed the central Guadalupe processing plant. To the south, in the Mamatla District, the Capire Project includes a 200 tpd processing pilot plant adjacent to an open pit silver mine with a mineral resource of over 4.5 million oz silver, 48 million lbs zinc and 21 million lbs lead.

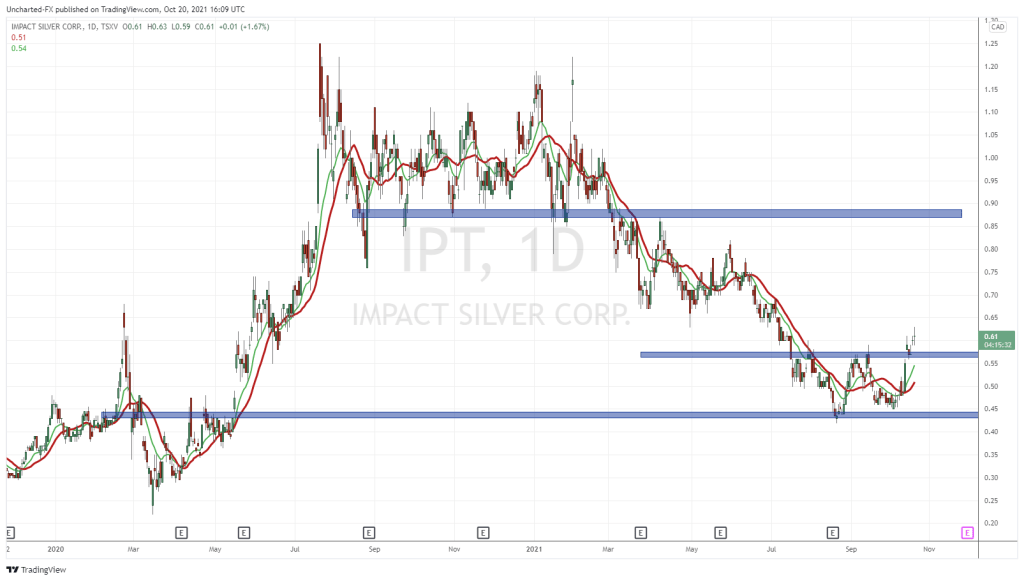

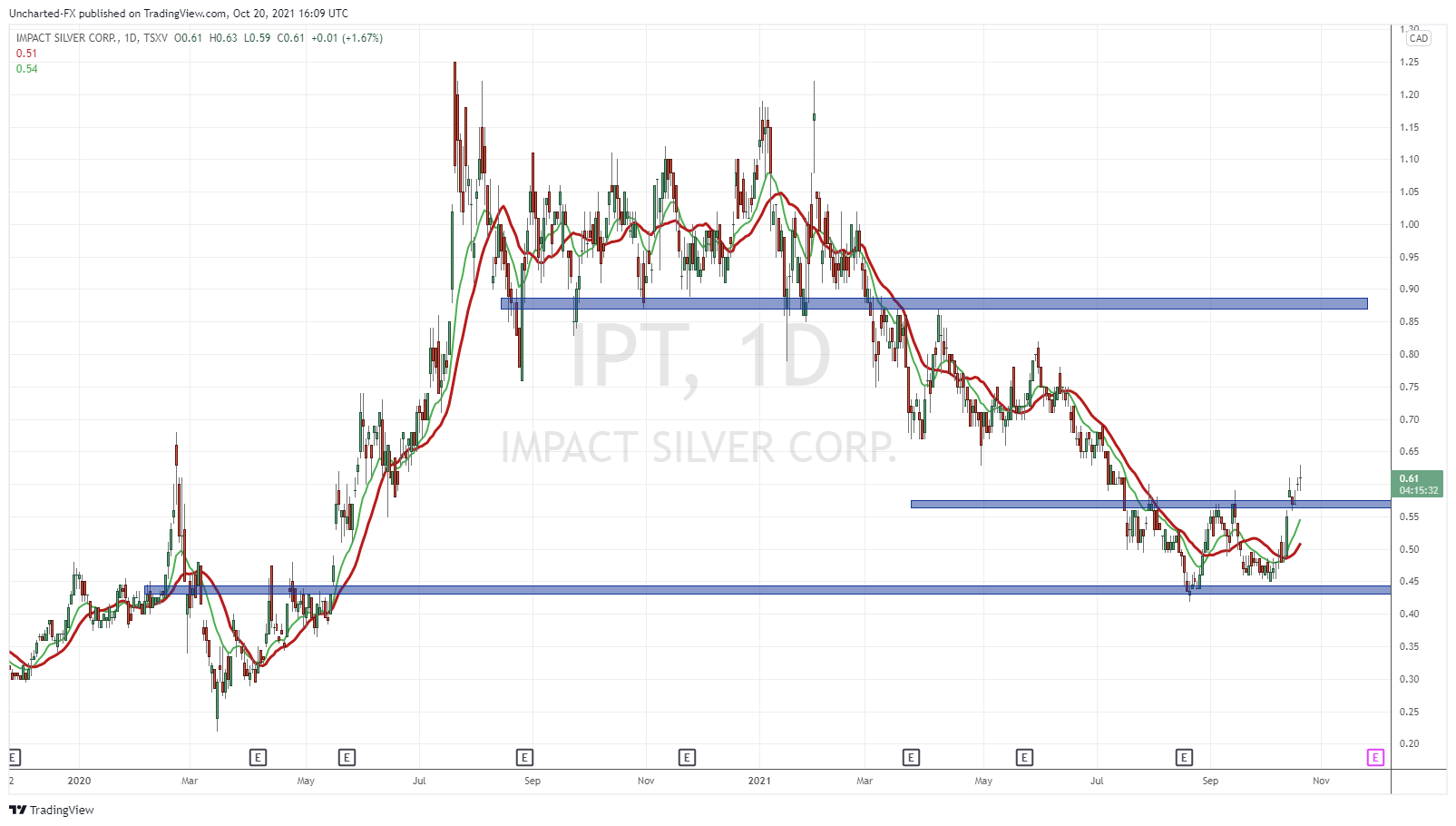

Chart wise what is not to like here Impact Silver? Tons of great looking mining charts out there, but Impact Silver meets so many of my market structure criteria. We caught bids at support ($0.45) and more importantly, formed a reversal pattern at previous support. I am talking about the double bottom pattern. And it gets better. The double bottom confirmed a breakout trigger with a retest the past week. We remain bullish above $0.55, and a new uptrend is just in its infant stage.

Some interim resistance at $0.70…just like our Silver trade hitting $25, but longer term I am watching for a run back to the $0.90 zone.

I should mention the latest drill holes put out by Impact Silver a few days ago: Impact Silver Drills 3.38 Meters Of 2,186 G/T Silver And 6.04 Meters Of 464 G/T Silver At Guadalupe Mine – Pachuqueno. The drill results press release can be read here. While you are there, take a look at the rest of the consistent news flow. Great for shareholders.

What’s not to like here? Silver is breaking out, Impact Silver confirmed a reversal pattern, the company produces Silver, the company puts out regular news…as the boys and gals over on WallStreetBets famously say: I like the stock.