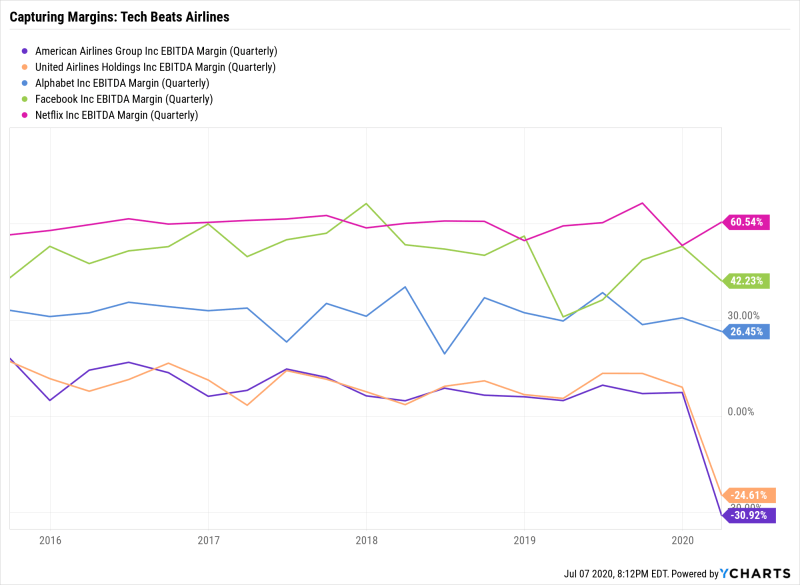

Technology is different from every other sector by virtue of one important factor – it scales. Because technology is scaleable, firms penetrate international markets easily, exercise greater pricing power, and capture bigger margins.

Businesses exist to solve problems. In solving problems, they create value. Capturing that value, on the other hand, is independent of how much value a business is able to create.

For instance, Airlines in the US create a lot of value, yet they capture almost none of it. Of the billions they bring in revenue, their margins are stagnant, if not continuously declining. In 2012, airlines brought $160 billion in revenue and charged an average of $178 per flight, but only made 37 cents of profit.

In contrast, you have Google, which brought in $50 billion in 2012 but kept 21% – over $10 billion – as profit. Over the last five years, tech growth stocks have outperformed established sectors like airlines because they’ve captured a greater proportion of the value they have created.

AAL EBITDA

Margin (Quarterly) data by YCharts

The simple reason tech captures bigger margins is because it is 1) asset-lite, and 2) scales easily. It’s an industry that doesn’t need billions in capital expenditure to exist in the first place. The low barrier to entry coupled with infinite scalability means that when tech companies get it right, they get it really right.

In small-caps, PredictMedix (PMED.C) is the prime contender for a solid technology company.

Previously, I’ve written about their value proposition, their strategic partnerships, and their team of talented advisors. They may have gotten the spotlight because of COVID, but the company and its technology are going to exist long after the virus is (hopefully) gone.

On Tuesday, the firm continued its demonstrated execution of strategy led by COO Rahul Kushwah. It partnered with a UK based firm to enter the European market and announced that it filed for two patents in the United States. Let’s dig in:

PredictMedix partnered with UK-based Taurus Medical Solutions for the execution of a sales contract for Predict’s COVID-19 screening technology.

A medical distributor and supplier to the UK National Health Service “NHS”, Taurus specializes in supplying diagnostic displays and medical monitors that are at the forefront of medical imaging technology. As a supplier to the NHS, their equipment has been deployed in hospitals throughout the UK, predominantly in operating theatres and X-ray departments.

Utilizing Predictmedix COVID-19 mass screening technology, Taurus will deploy modules to the healthcare, retail, and entertainment sectors in the UK. The contract is for a 12-month period beginning July 6, with an option for renewal following the onboarding of a certain number of clients.

Here, Predictmedix will first make money by charging an upfront customization fee for each camera and scanner installation, and then price it’s offering with a SaaS (software-as-a-service) model that brings in monthly revenue based on the number of screenings.

In business-speak, this is a simple, predictable, free-cash-flow generating pricing model.

“Predictmedix technology is a fantastic opportunity for us to add to our medical portfolio and it will also enable us to diversify and expand into untapped business sectors within the UK,” said Tomas Loftus, CEO of Taurus Medical Solutions.

The partnership marks Predict’s entry to the UK, a country with over 161,000 COVID-19 cases.

Here’s what that looks like:

When speaking of PredictMedix technology, I’ve spoken at length about the power of AI. The great thing about software is that it can be manipulated.

So while Predict’s technology can be deployed for:

- Impairment detection

- Mental illnesses, and

- Infectious disease diagnostics

That’s not the only thing it can do. The technology can be repurposed for different types of diagnostics or impairment detection. It means Predict’s AI product suite will exist long after COVID-19.

In this context, the partnership is only the beginning of the firm’s market entry into the UK. Given that Predict has a SaaS pricing model, it has created “sticky” customers, for whom the firm will be able to provide customized solutions.

So imagine a post-COVID world where a hospital (or an airport, or any place with a high volume of people) wishes to screen for possible symptoms of another infectious disease or impairment detection at large for patients/people entering a building/public space. All Predictmedix has to do then is to rewrite a piece of its software (code) for the diagnostic criteria at hand.

Artificial intelligence with respect to Predict’s operations means the following: the longer the software runs to perform some type of detection or diagnosis, the better it will become at detecting or diagnosing.

So the longer the AI-enabled software runs, the better it becomes, and the harder it is for any competitor to enter the same market and do things better. Add to that the fact that the technology solution can be customized for clients. No matter where in the world, these customized solutions can then be implemented almost instantly.

It should then come as no surprise that the company has filed for two patent applications with the US Patent and Trademark Office for its telehealth/telemedicine and remote patient monitoring platforms:

- Patent 1: A system and method to automatically recommend and adapt a treatment regimen for patients, and

- Patent 2: A system and method to manage a rewards program for patient treatment protocols

What’s revealing about these patents is PredictMedix’s vision. Their technology is already deployed in several parts of the world for impairment detection and diagnosis, but these patents say that COO Rahul Khushwah has his eyes set on the broader (and bigger) predictive analytics and telemedicine marketplace.

“The two patents are the key to further expand the offering of our telehealth/telemedicine, remote patient monitoring platform and these patents clearly help us distinguish ourselves in the telehealth space by providing cutting artificial intelligence-based tools which go beyond the traditional scope of telemedicine”, said Dr. Rahul Kushwah, COO of Predictmedix.

The scalability and asset-lite nature of a tech company coupled with the monopoly capture of big pharma, PredictMedix has the ability to not only capture a lot of the value it creates but also ensure that it is the only one doing so.

In the middle of a global pandemic where international travel is shut down, the company was able to enter its target market across the pond.

With solid leadership, partnerships with multi-billion dollar conglomerates like TechMahindra and Hindalco, and acquisitions, the firm is aggressively capturing new business.

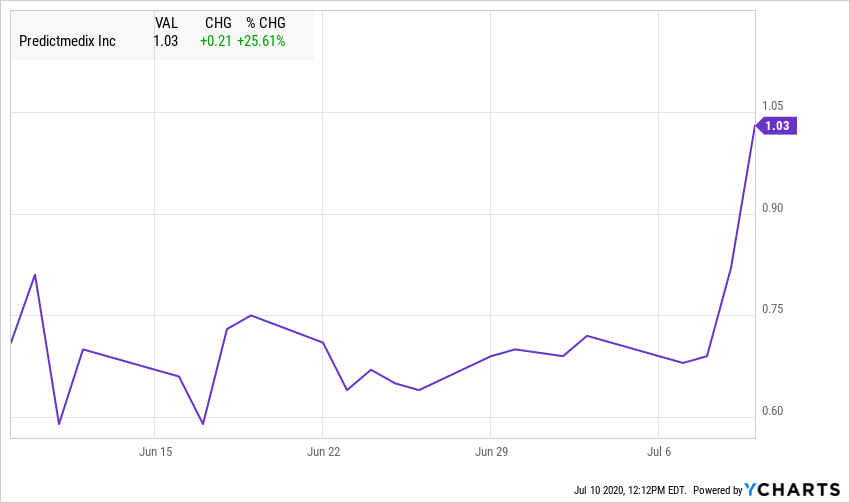

In the week before June 17, I explicitly wrote that the volatility in the stock’s price was nothing but the dumb money entry and exit (read: pump-and-dump), and that value investors need to recognize that the real payoffs come from patience.

Why? Because the stock price isn’t the company – but merely a reflection of its potential.

In life, or in markets, one’s potential is realized over time:

Full Disclosure: The firm owns stock in the company.

Pingback: PredictMedix (PMED.C) To Deploy Its COVID-19 Screening Tech in Texas - Predictmedix

Pingback: PredictMedix (PMED.CN) Catalysts and Covid Play to Create New All Time Highs? - Predictmedix