There’s a lot of bullish commentary out there re precious metals all of a sudden. We’ve certainly been pounding the table, but for more than a few months, insisting that gold and silver have only one direction to travel—North.

An example of our bullish-bias, from mid-December 2019—Gold – the time is nigh:

From a fundamental point of view, the backdrop for the metal couldn’t be more favorable: plummeting bond yields, negative interest rates, pervasive geopolitical risk, equity valuations stretched waaaay too far, are all gold friendly.

It’s difficult to imagine a scenario where gold won’t outperform most other asset classes in 2020.

More recently, in mid-April of this year, we took a bold stance in Money rain, fighting the Fed, and precious metals, declaring:

With interest rates at zero and the dollar printing presses stacked waaay high (think stacks of Marshal’s and a packed arena full of metal heads), it would appear the Fed is out of moves.

With all this new money sloshing around the system—trillions in just the last few weeks alone—I would argue that gold is as cheap as its ever been. This bull run is just getting started and the price trajectory we’ll witness over the next few years may shock even the most fervent bull. That’s my best guess.

Sifting through the bullish commentary today—most of it is crap IMO—I came across this intriguing quote by one Adrian Day:

“The risk in a bull market is tilted towards missing out rather than overpaying“.

Too true. People get hung up in attempting to extract the lowest possible price, be it a gold stock or the metal itself, not realizing that the market can run away—far away and fast—from one’s desired entry point.

Be Willing to Pay up for Quality Gold Stocks in This Bull Market says Adrian Day

I like these veteran gold bugs—those that have experienced more than one bull cycle in their day. They don’t rattle easy, and their insights can be rather thought-provoking.

The royalty and streaming space

For those of you who are new to the precious metals arena and are looking for exposure but don’t know where to begin—for those reluctant to toss bids at a Jr ExplorerCo that has just tripled in price—a good royalty play can offer you very decent leverage, as well as a modicum of safety.

Royalty and streaming plays have no direct exposure to a mining asset itself—there’s no operating risk.

But not all royalty and streaming companies are treated equally. For shareholders to experience maximum joy, the underlying portfolio of projects needs to be producing, or at the very least, in the ramp-up or development stage.

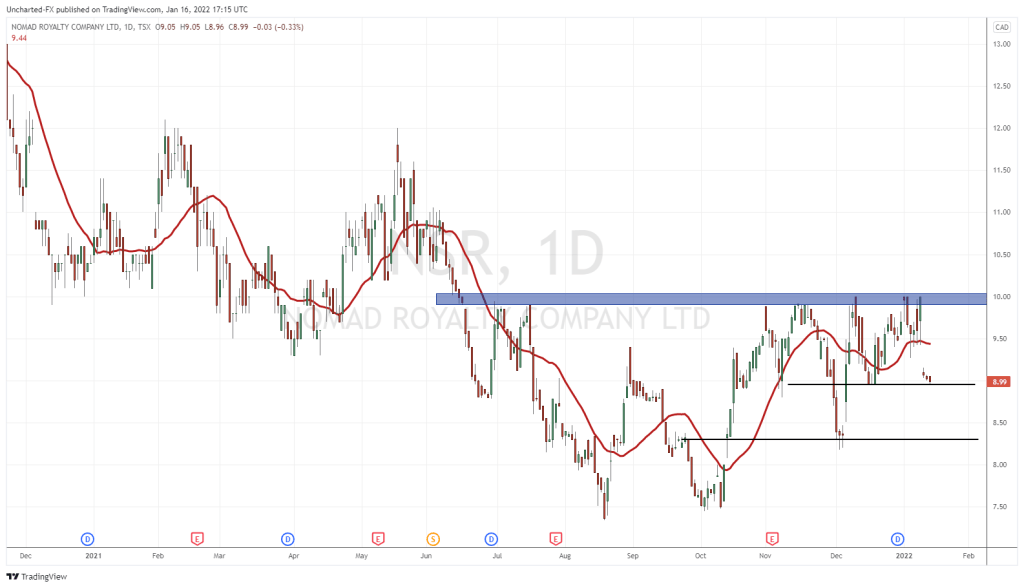

A little over a month back, we covered the premiere of a brand new precious metals royalty and streaming outfit—NOMAD Royalty Company (NSR.T). Great ticker symbol, btw.

NOMAD Royalty Co (NSR.T) makes a shining debut on the TSX

NOMAD is simply top-shelf in every respect.

The team that was the driving force behind Osisko Gold Royalties (OR.TO) since day one—Vincent Metcalfe, Joseph de la Plante, and Elif Lévesque—are now at the helm of NOMAD.

This crew is the real deal. Check out their resumes (scroll down).

This is also an approachable crew. I don’t think I’ve ever seen an offer like this before—certainly not in the junior exploration arena…

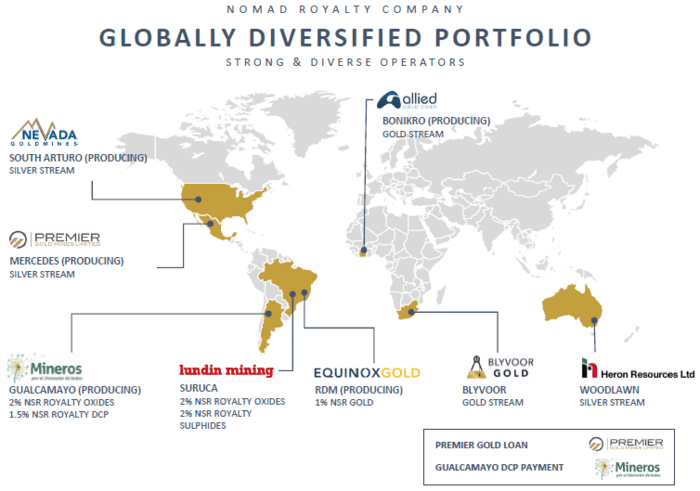

Considerable connections and business savvy in the mining arena led to the acquisition of an extensive, high-quality portfolio of producing and advanced stage development assets from Yamana Gold (YRI.TO) and Orion Resource Partners.

Considerable connections and business savvy in the mining arena led to the acquisition of an extensive, high-quality portfolio of producing and advanced stage development assets from Yamana Gold (YRI.TO) and Orion Resource Partners.

Orion owns 77.6% of NOMAD’s outstanding common shares, Yamana owns 13%. Both entities can be characterized as ‘strong hands’ with a long term bias (Yamana held a large block of Equinox Gold (EQX.T) for over four years before cashing in recently).

Further up the page, we highlighted the importance of a portfolio consisting of a combination of producing and or near-producing deposits. Of the ten assets in NOMAD’s portfolio, five are currently cash flowing while two are in construction and ramp-up phase.

Further up the page, we highlighted the importance of a portfolio consisting of a combination of producing and or near-producing deposits. Of the ten assets in NOMAD’s portfolio, five are currently cash flowing while two are in construction and ramp-up phase.

To peruse these assets, check out the company’s i-deck—the tour begins on slide 18.

Estimated deliveries for 2021 are 17,000 ounces of gold and 675,000 ounces of silver (25,000 AuEq ounces).

At current spot prices (~$1,800 gold), 2021 operating cash margin will ring in at roughly US$35M (or C$47M).

When we first explored the company roughly two months back, we noted the following:

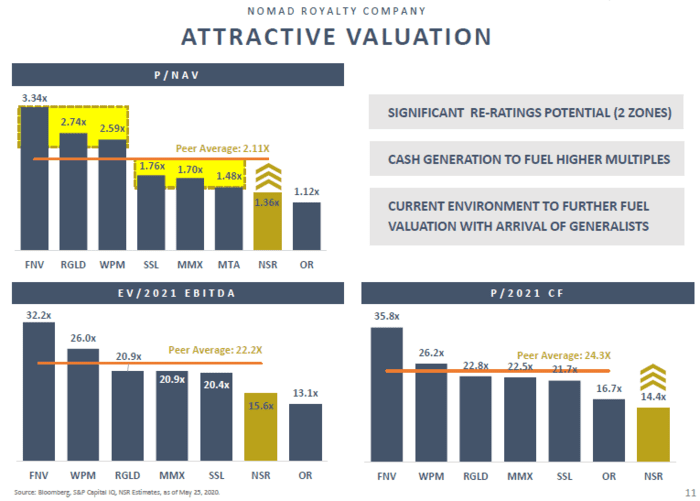

This deal was priced at C$0.90 per share, at 11.5x P/2021 Cash Flow or a 1.05x Net Asset Value. Peers in the royalty space are currently trading around 18.0x P/2021 Cash Flow or roughly 1.8x Net Asset Value.

Translation: there’s potential for a significant re-rating as these shares commence trading and the market homes in on this anomaly.

With NSR common currently trading in the buck-fifty range, significant re-rating potential remains (tick-tock y’all).

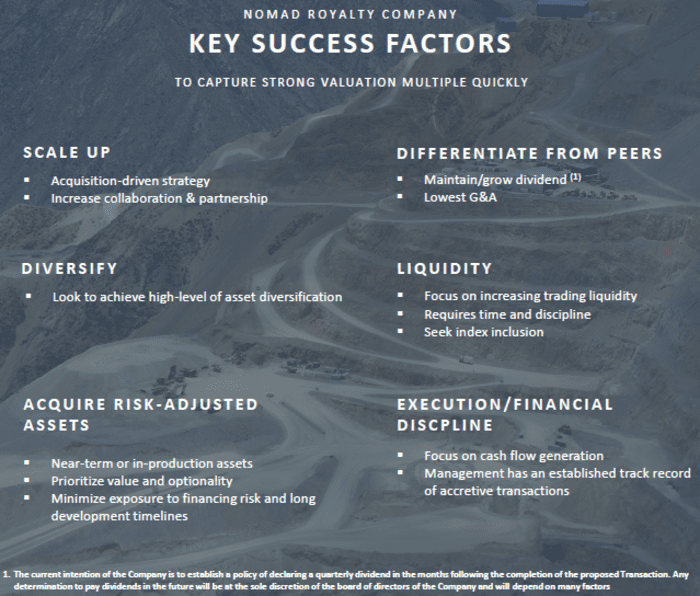

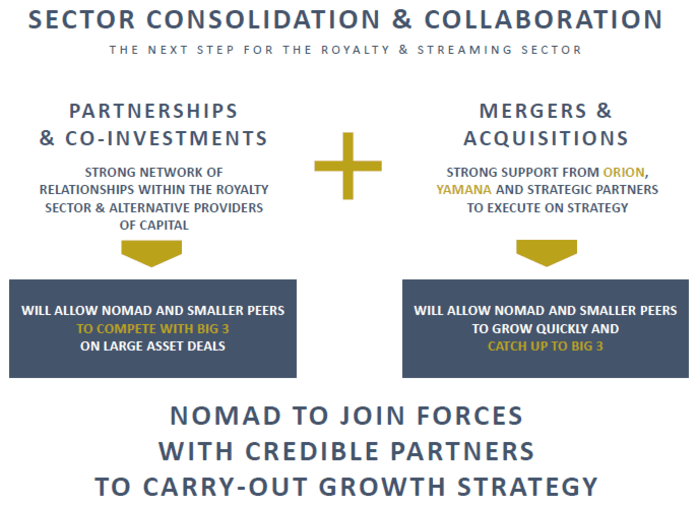

This is only the first inning of play. The company is looking to scale… to bulk up its royalty portfolio.

This is only the first inning of play. The company is looking to scale… to bulk up its royalty portfolio.

As the market becomes more familiar with its current asset base, and more deals are pulled into the fray—they currently have a number of actionable opportunities in their crosshairs—the re-rating process will continue.

The acquisition strategy centers on long-life precious metals deposits, but management’s not ruling out a decent copper-gold acquisition.

The goal is to maintain a balanced, diversified portfolio. This includes looking at jurisdictions outside the Fraser Institute’s top ten list.

I’m guessing we won’t have long to wait before a new acquisition(s) comes into play.

Committed to low G&A (they think like owners), management is aiming to return 1/3rd of operating cash flow via a favorable dividend policy (a >2% yield), one that sets it apart from its peers.

Committed to low G&A (they think like owners), management is aiming to return 1/3rd of operating cash flow via a favorable dividend policy (a >2% yield), one that sets it apart from its peers.

The July 7 headline…

Nomad Royalty Company Announces Strong 2020 Second Quarter Gold and Silver Deliveries

The above headline represents NOMAD’s first public quarterly results for deliveries.

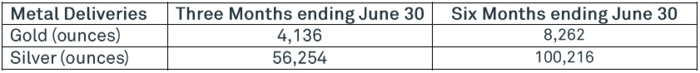

Here, we get preliminary gold and silver deliveries from its royalties, streams and gold loan for the three and six month period ended June 30, 2020:

The gold came primarily from the Bonikro mine on the Ivory Coast, operated by Allied Gold (slide 19).

The gold came primarily from the Bonikro mine on the Ivory Coast, operated by Allied Gold (slide 19).

The Premier Gold (PG.TO) Loan involves their Mercedes mine in Nevada and their South Arturo mine in Mexico (slide 21).

“The gold deliveries during the second quarter and year to date included 2,450 and 4,900 gold ounces respectively from its gold loan with Premier Gold Mines. Nomad expects to receive 1,000 gold ounces on a quarterly basis from the Premier gold loan over the next twelve quarters.”

Applying simple math to the terms of this gold loan shows quarterly deliveries worth US ~$1.8M, based on current spot prices.

This gold loan is a corporate contract, and it works like a dividend. Premier is legally obligated to deliver these ounces, whether they are producing gold or not. If Premier were to suddenly shutter operations for whatever reason, they’d be forced to source (buy) the precious metal elsewhere.

The silver deliveries came from the Premier operations, as well as the Woodlawn mine in Australia, operated by Heron Resources. (slide 20).

The company had factored in zero (0) deliverable silver ounces from the Woodlawn mine in their 2020 forecast—Woodlawn is currently on care and maintenance awaiting higher zinc prices—but they received roughly 29k ounces of the metal so far this year. That’s a nice unexpected bonus.

Final thought

The royalty sector is a no-brainer for the generalist investor. Once again, a company with a high-quality portfolio of royalty and streaming deals—deals that are in or near production—can offer investors a low risk/high reward vehicle to ride this next wave in precious metals higher.

Stay tuned. I suspect strong newsflow out of NOMAD from hereon.

END

—Greg Nolan

Full disclosure: NOMAD is an Equity Guru marketing client.