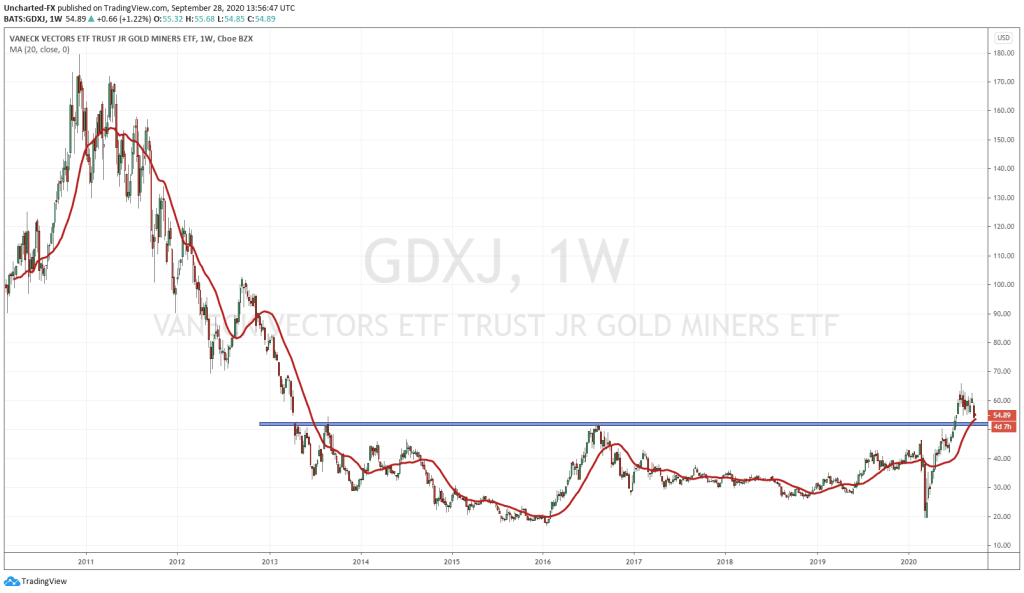

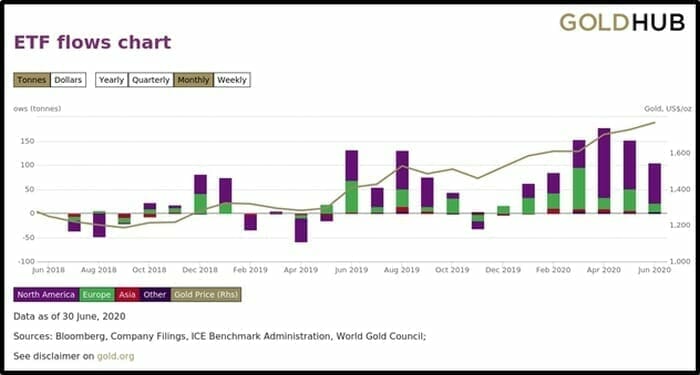

According to a July 6, 2020 report by the World Gold Council (WGC) gold-backed ETFs recorded their 7th consecutive month of positive flows, adding 104 tonnes in June, 2020 alone.

The talented crew at Visual Capitalist shows us what one tonne of gold looks like (based optimistically on USD $2,000 per oz). “Gold is so heavy that the suspension of an average truck would break if it held anymore than pictured above,” stated the Visual Capitalist, pointing out that, “the gold depicted could buy 2,660 brand new trucks at an MSRP of $40,000 per truck.

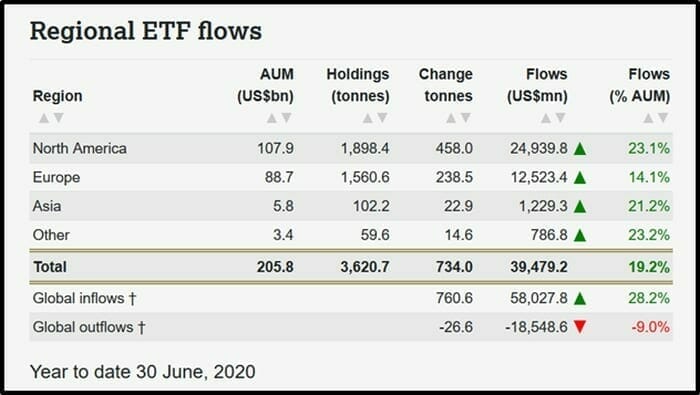

Global ETF holdings are at a new all-time highs of 3,621 tonnes.

Global ETF holdings are at a new all-time highs of 3,621 tonnes.

This brings H1 global net inflows (the first 6 months of 2020) to 734 tonnes (USD $39.5 billion).

H1 ETF inflows are higher than the record-setting central bank net purchases seen in 2018 and 2019, and “could absorb a comparable amount of about 45% of global gold production.”

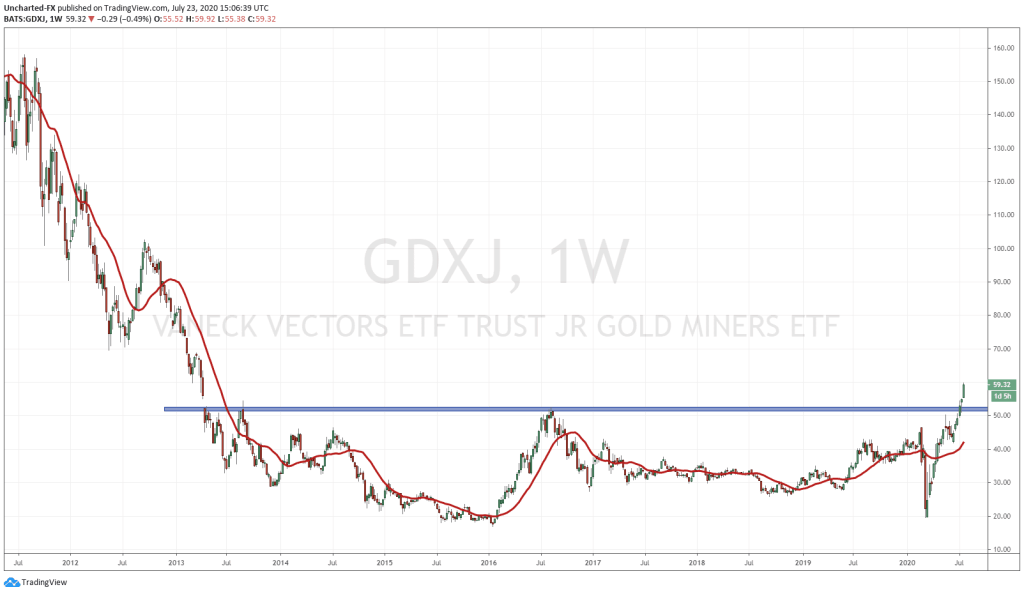

“North American funds dominated activity in June, accounting for 80% of global net inflows,” stated the WGC, “The region added 83 tonnes, while European-listed funds added 18 tonnes and Asian-listed fund holdings rose .4 tonnes.”

“North American funds dominated activity in June, accounting for 80% of global net inflows,” stated the WGC, “The region added 83 tonnes, while European-listed funds added 18 tonnes and Asian-listed fund holdings rose .4 tonnes.”

Despite the better-than-expected US jobs report for May, and emerging signs of recovery in the US economy following the COVID-19 lockdown, Federal Reserve Chairman Powell remained cautious.

“Speculation over the potential impact of a second wave of COVID-19 infections on an already fragile global economy caused a renewed wave of fear and uncertainty,” stated the WGC, “These factors continued to drive gold investment demand, with gold ETFs a key beneficiary of this momentum”.

The World Gold Council (WGC) is a research and advocacy group based in the UK with branch offices in New York City, Shanghai, Singapore, Mumbai and Beijing.

The World Gold Council (WGC) is a research and advocacy group based in the UK with branch offices in New York City, Shanghai, Singapore, Mumbai and Beijing.

According to the WGC website its members “are the world’s largest and most forward-thinking gold mining companies.”

We can not vouch for the direction of the WGC members’ thinking – but “large” they most certainly are.

A murderer’s row of gold giants, with a combined market cap of more than a $120 billion.

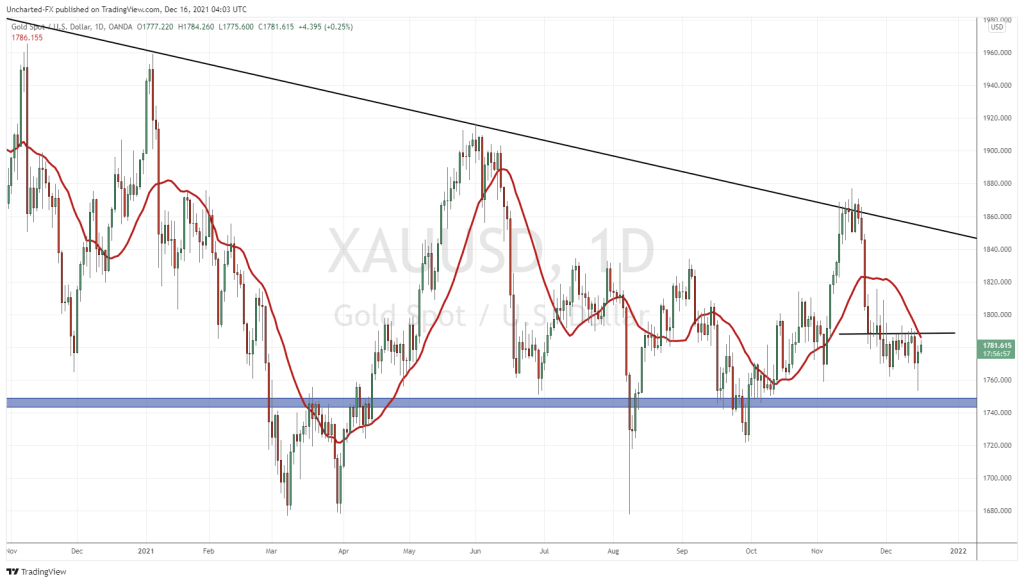

The economic and geopolitical environment remains supportive for gold investment, with most of the existing gold demand drivers still relevant. The opportunity cost of holding gold remains low, as continued central bank activity keeps interest rates low or negative.

The economic and geopolitical environment remains supportive for gold investment, with most of the existing gold demand drivers still relevant. The opportunity cost of holding gold remains low, as continued central bank activity keeps interest rates low or negative.

The WHO warned that: “Although many countries have made some progress, globally the pandemic is actually speeding up”, meaning that investors will continue to use gold as a counter-bet against blue-chip stocks.

Kitco Gold’s Vladimir Basov provided a list of lowest-cost gold mines in Canada in 2019.

The shining star was the Macassa underground gold mine ($463/oz.) located in the Town of Kirkland Lake, 580 km north of Toronto, Ontario, Canada.

“A number of companies have been busy completing private placement financings to fund their exploration programs,” reports Resource World in June 2020, who then provide a summary of drill rigs on the move.

The WGC is very good at macro-data collection. Despite the fact that it is funded by major gold producers, the information is reliable and non-promotional.

Reading the report on gold ETF inflows confirms that the gold sector is hot, but doesn’t give you any advice of which gold stocks to invest in.

For the detailed, micro-picture on individual stocks, we recommend Equity Guru’s own Greg Nolan.

“Many of the junior ExploreCo stocks we follow here at Guru Central are popping,” reported Nolan on June 30, 2020, “If it’s a gold or silver company with ounces in the ground, or a geologically prospective exploration project getting a proper probe with the drill bit, chances are it’s pushing higher”.

Nolan also reports that “Blackrock Gold (BRC.V) is drilling for high-grade in the Queen of all silver camps.”

“The company’s stock traded aimlessly, with minor flourishes here n there,” stated Nolan, “until one Andrew Pollard entered the fray”.

“Gold has gained more than 17% over the first half of 2020,” states the WGC, “Global stocks remain below the level they started the year, and broader commodities – represented by the S&P GSCI – which are down 25% year to date.

“Gold has gained more than 17% over the first half of 2020,” states the WGC, “Global stocks remain below the level they started the year, and broader commodities – represented by the S&P GSCI – which are down 25% year to date.

Today, August gold futures were up $14 an ounce at $1,808 while September silver futures were up $.07 to $18.66 an ounce.

– Lukas Kane

Full Disclosure: Equity Guru has a marketing relationship with all of the companies featured in Nolan’s June 30, 2020 round-up article.