If one was to stand in the middle of the tiny aldea surrounding Impact Silver’s (IPT.V) Guadalupe Production Center and lob a stone in any direction, chances are you’d hit silver-rich rock—that was my impression anyway, having recently visited the company’s district-scale foothold in a region with an epic history of silver mining.

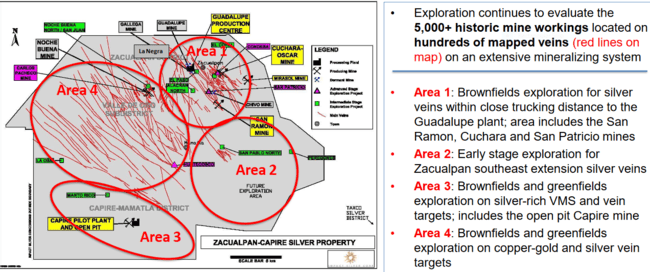

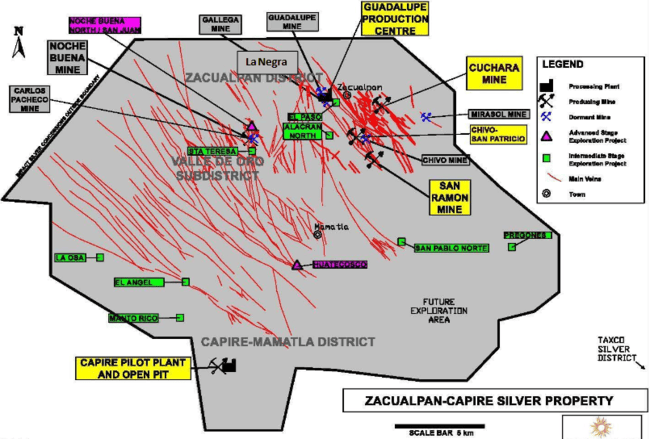

Impact controls two contiguous mineral districts in south-central Mexico—the Royal Mines of Zacualpan Silver District and the Capire-Mamatla Silver District, together covering 357 square kilometers.

An interesting aside: Cortes is rumored to have hidden out in the area way back in the day.

No less than 5,000 historical mine workings and 50 historical mills (haciendas) have been identified on the property to date.

In a nutshell, Impact is a silver producer with significant untapped production, development, and exploration upside.

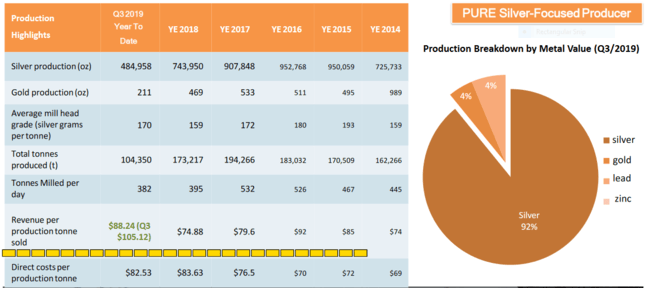

95% of the company’s current revenue is derived from Ag production. This may be THE purest silver producing company sporting a ticker symbol.

The people

I find that with some development and production scenarios involving locals in foreign countries, there’s often an artificial peace, sometimes tenuous, depending on how the surrounding community feels they are being treated at any given time.

At Guadalupe, there’s a certain definable harmony in the air.

Local’s from the nearby town of Zacualpan (pop. 5,000) arrive by car and motorcycle, eager to toss a friendly wave when paths are crossed. The entrance to the Guadalupe Production Center is lined with vehicles of all shapes and sizes as miners and support staff head off on foot to begin their day.

Here, 99% of the Impact’s labor force is Mexican where four generations of a single-family can be encountered on any given day.

There are homes surrounding the production facility—the 24/7 turning of the ball mill, like wind or flowing H2O in the distance, lulls one to sleep at night, interrupted only by bird songs in the morning, the laughter of children in the afternoon, or the grating of crickets in the evening.

No kidding, the Guadalupe Production Center and surrounding community really can be that easy.

Regarding company management, there is depth and experience. In chatting with CEO Fred Davidson, I was struck by his passion and commitment to Impact’s operations in the region.

The Setting

As noted further up the page, Impact is a producing silver company.

With centuries of historical production and the pervasive-predictable orientation of the epithermal veins occupying the districts subsurface layers, 43-101 reserves or resources, for the most part, are unnecessary.

Miners have been following these high-grade epithermal veins for literally hundreds of years as they demonstrate good continuity.

The above image shows the veins the company has mapped… thus far. New vein structures seem to turn up as a matter of routine, causing the company to rethink its mine plan.

The company will drill, but often only ahead of what it plans to mine the following week.

And get this: Historic production in the region targeted only the highest-grade rock. A roughly one kilogram (1000 g/t Ag) cut off was employed, leaving huge volumes of sub-kilo mineralized rock untouched—rock that will fair exceedingly well in a $19-plus silver environment.

It’s conceivable that at current production rates, mining will continue for decades, if not centuries.

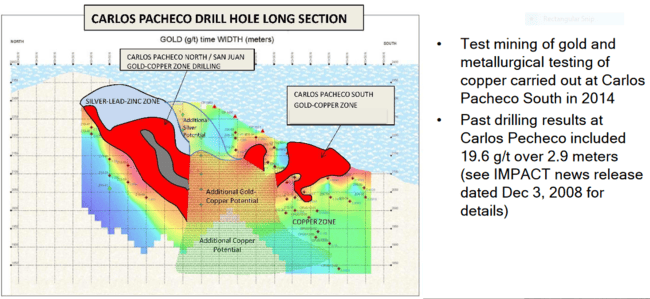

Interesting to note, as the company probes the subsurface layers at depth, there’s a whole new horizon of gold and copper—a dimension the company is only beginning to explore.

The Mills

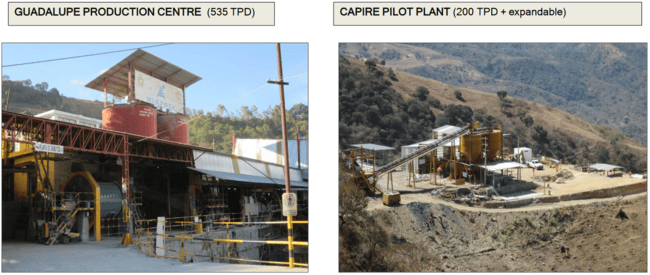

There are two mills on the property:

The Capire Pilot Plant currently sits idle, waiting for silver to assert itself with a little more conviction (we’ll revisit Capire a little further down the page).

The Guadalupe Production Center has a capacity of 535 tonnes per day that can be increased to 600 t/d.

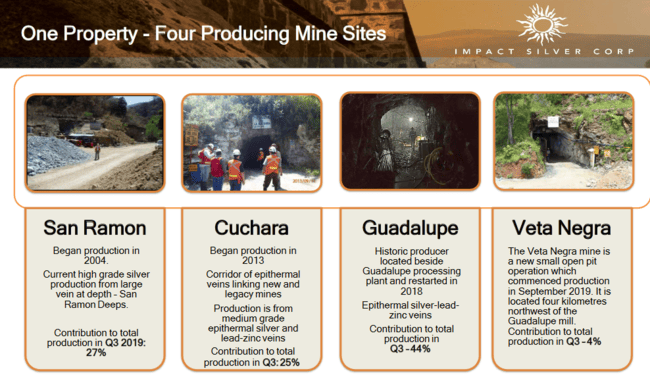

Three nearby mines, all within easy trucking distance, feed this mill—San Ramon, Cuchara, and Guadalupe.

All three of these mines have different cost characteristics.

Guadalupe has produced over 10 million ounces of silver in its day—a testament to the prolific nature of these epithermal veins. It continues to deliver the lions share of Impact’s current silver production.

There are actually four mines contributing to Impact’s current production—we’ll talk about Veta Negra a little further down the page as well.

The company is currently running Guadalupe at 75% capacity (400 TPD) in response to the silver price chopping lower in H1 of 2019.

If you look at back at production between 2015 and 2017 (revenue per production tonne sold), the company was cranking out > 900k ounces during that period.

The current range of 650-700k oz allows the company to focus on profitable ounces, rather than pure top-line production numbers. Smart.

When management is ready—when the price of silver stabilizes at a level that will guarantee a desired return (USD $19.00-plus)—they’ll begin ramping things up to full capacity. This puts the company in an enviable position.

Should silver spike to levels witnessed in 2011… fugget about it.

Worth noting, Impact produces an exceedingly high-quality silver concentrate. Samsung, one of the more recognizable brands in the electronics and consumer products arena, was sufficiently impressed, prompting them to negotiate a concentrate sales partnership with Impact.

The Code

Reluctant to take on debt to develop its latent subsurface riches, the company funds the majority of exploration and development internally via production revenue.

When I asked CEO Davidson if he would ever consider locking in (hedge) silver prices, should they spike to a level deemed lofty by today’s standards, his unwavering response was along the lines of, “we prefer to offer shareholders full leverage to rising silver prices.” Good answer.

What I find rather extraordinary is Impact’s share count—110 million shares with only three equity raises in the past decade. This kind of cap structure is almost unprecedented for a producer with so many moving parts. Management’s values appear to be aligned right alongside those of its shareholder base (management and insiders own 10% of IPT’s outstanding common).

The Mines and Exploration upside

CEO Davidson figures they’ve tapped only 15% of the districts upside potential.

The following slide from the company’s i-deck speaks volumes…

Area 1, where all of the production activity is currently taking place, continues to produce compelling exploration results.

At San Ramon, a new zone 100 meters south of current mine operations was tagged back in July 2018. The zone returned 345.4 g/t Ag over 4.97 meters and 661.2 g/t Ag over 2.04 meters.

Last September, San Ramon returned values as high as 1,393 g/t Ag over 1.58 meters and 418 g/t Ag over 2.14 meters extending the mine to depth. This zone remains open for expansion to the north, down-dip, and up-dip. Follow up drilling is planned.

At Guadalupe, at 2018 drilling campaign produced 1,263 g/t Ag over 2.61 meters and 306 g/t Ag over 8.82 meters.

There are multiple high-priority drill targets between Guadalupe and the Alacran Mine to the south, a historic mine marked by extensive underground workings with reports of high-grade silver and gold mining dating back to 1527.

Along the San Filipe Corridor, a number of drill targets have been developed on veins between the Guadalupe Mill and the Chivo Mine. Initial drilling at the San Felipe Mine itself intersected high-grade silver values that included 834 g/t Ag over 3.34 meters.

Still in Area 1, Veta Negra, a recent discovery that contributes roughly 4% to total production, we have an open-pit scenario running grades in the 200 g/t range.

The beauty of this deposit is its simplicity. It’s a quarry scenario. No drilling. No blasting. The mineralized rock crumbles under minor pressure (it was actually sloughing as we were viewing the area).

A backhoe and gravity liberate Veta Negra’s ore where it’s then scooped up and trucked off to the Guadalupe mill.

Though the zone is small, holding roughly four months of production potential as is, the company believes it can expand the zone (we arrived on-site as a six-pack crew were headed up the hill to sample the immediate area around the deposit).

Veta Negra’s low-cost ore blends well with ore from other sites.

Area 2, as you can probably ascertain from the map above, is wide open for new discoveries. Impact’s property boundary is within a stones throw of Taxco, THE oldest silver mine in Mexico—a mine that produced over 300 million ounces of silver in its day.

Considered early stage, this is where the company will likely home in on the southeastern extensions of Zacualpan’s vein structures.

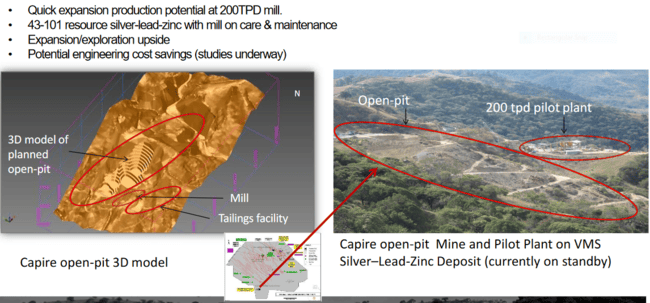

Area 3 is largely a VMS (Volcanogenic Massive Sulfide) type setting where the Capire 200 TPD Mill sits idle, waiting for a sufficient uptick in silver prices to put the adjacent Capire open pit deposit, and two other nearby deposits, into production.

This deposit does have a 43-101 compliant resource estimate: At a US$30 per tonne cut off, Capire has 1,786,000 tonnes grading 79.49 g/t silver, 1.22% zinc, and 0.54% lead for 4,563,000 ounces of Ag, 47,975,000 lbs of zinc, and 21,423,000 lbs of lead.

During a test phase, this 200 t/d mill achieved recoveries of around 80%, 50%, and 65% for silver, zinc, and lead, respectively.

The Capire deposit will need silver north of $20 to make economic sense, but the company isn’t waiting on the market. They’ve been experimenting with a process called DMS—Dense Media Separation.

Last August, the company reported that crushed samples of lightly-diluted mineralization from the Capire deposit showed that 25% of the sample mass could be rejected while retaining over 99% of silver, lead and zinc. This was round #1. This could reduce mill running costs by up to 30% but the company will need to test this process on a larger scale before it can start developing a proper flowsheet.

Importantly, the Capire mill is expandable to 500 TPD—expect the green light for expansion when silver rips significantly higher as this bull market in precious metals gains traction.

Area 4 is where things could get very interesting for loyal shareholders. Here we have a 2 km x 2 km geophysical (high magnetic) anomaly and multiple gold-copper targets with bulk tonnage potential.

There are two high priority targets with considerable scale in area 4:

Carlos Pacheco is a gold-copper discovery located 4.5 kilometers southwest of the Guadalupe Mill and 180 meters east of the Noche Buena Mine (yet another mine of the property). This is a west-dipping structure running parallel to Noche Buena’s vein structures.

Carlos Pacheco is one of many zones within the central part of the Zacualpan project area that represents a deeper part of the mineralizing system enriched in gold and copper.

Systematic mapping and rock sampling began back in 2007. This was followed by a maiden drill program that cut high-grade gold values of up to 19.6 g/t gold across 2.9 meters (including 49.7 g/t gold across 1.0 meter) and 11.3 g/t gold over 2.1 meters (inc 53.6 g/t gold over 0.3 meters).

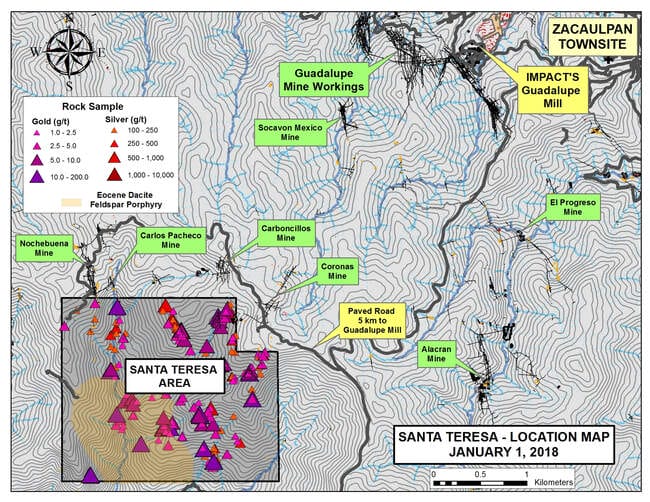

Santa Teresa is located four kilometers southwest of the Guadalupe Mill in the Valle de Oro sub-district, a region rich with gold.

Roughly half of the known gold veins in the area fall into the class of occurrences known as low-sulfidation epithermal Au deposits.

According to the company:

Numerous north-south striking veins similar to the Nochebuena or Carlos Pacheco veins transect the Santa Teresa area. Elsewhere in the Zacualpan district veins of this orientation have the greatest degree of structural and grade continuity, producing many of the district’s better mines historically. In addition, there are number of northeast trending, northwest dipping veins that resemble the historic Coronas mine in structural style. Rock sampling by IMPACT has produced gold grades ranging up to 114.5 g/t, with 15 samples having more than 10.0 g/t, and 214 greater than 1.0 g/t gold. In proximity to the historic Coronas Mine some sizable old underground workings exist. However elsewhere in the Santa Teresa area there is little evidence of historical exploration or mine development, which the low sulphide content of these auriferous veins may have caused these veins to be overlooked by the historical prospecting.

Interestingly, fifty-two Eocene Feldspar porphyry outcrops have been mapped over a one-kilometer area with possible extensions to the south and west.

These Eocene Feldspar Porphyries are thought to be similar to the Tilzapotla Rhyolite, an enigmatic intrusive stock located midway between the Taxco and Zacualpan Districts that is considered to be the heat source responsible for the formation of the Zacualpan Southeast and Taxco veins.

Systematically pushing both Carlos Pacheco and Santa Teresa further along the development curve may require a joint venture partner to do the majority of the heavy lifting.

Alternatively, in order to unlock the areas latent value, the company may ultimately decide to spin the projects off to current shareholders as a ‘NewCo’. That’s what I meant earlier by “things could get very interesting for loyal shareholders“.

Impact’s Leverage to Silver

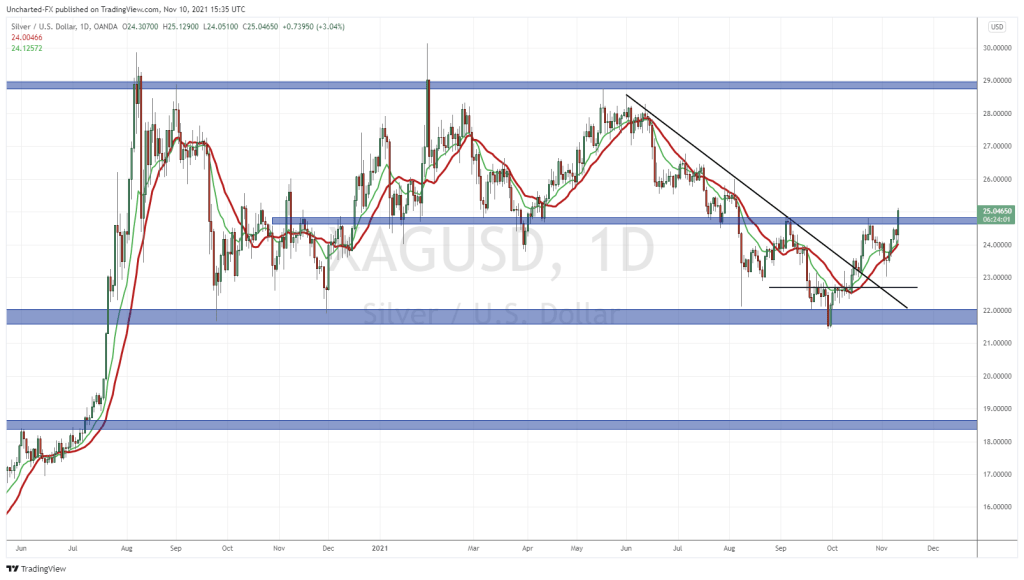

In recent sessions, it would appear the market is tearing a page outta Bill Shakespeare’s playbook (volatility now hath made its masterpiece).

That is especially true where silver is concerned.

It’s not often you see a major commodity blow through its 50 and 200 period moving averages in a single session.

This latest rout was across-the-board. The selling was indiscriminate. I suspect the weakness in the precious metals space is waaaay overdone and a rebound is in the offing, though the next month or two could see violent swings in either direction.

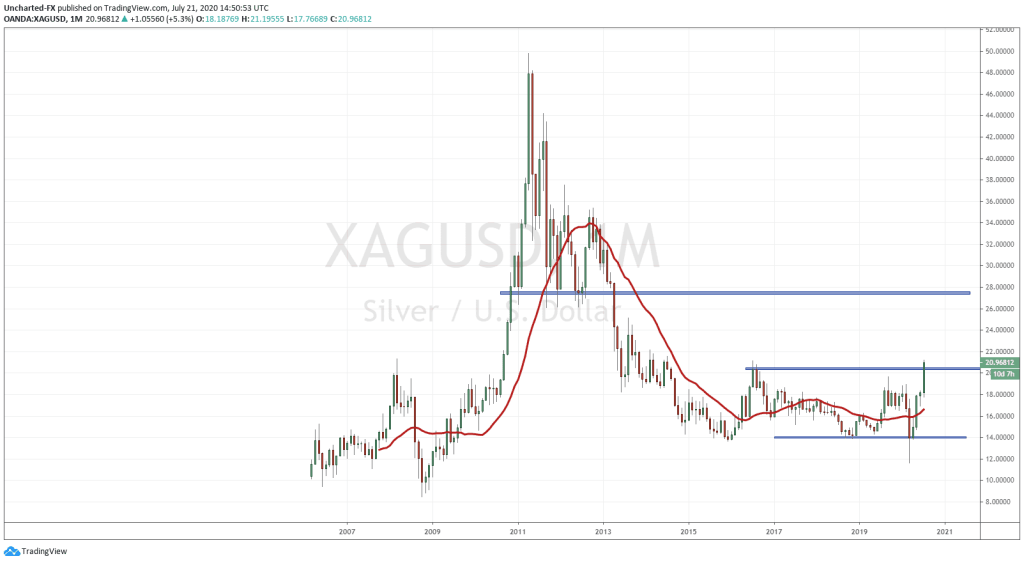

If you believe we are in a bull market in precious metals, silver stocks offer good leverage to rising metal prices.

Better leverage can be gained by carefully choosing silver producers.

Even greater leverage can be realized by choosing a marginal silver producer—a producer that is working on breaking even in this current silver price environment.

Though Impact currently resides in the marginal producer category, it will see tremendous torque in earnings as the metal claims higher ground. At break-even, every dollar silver rises will go straight to Impact’s bottom line.

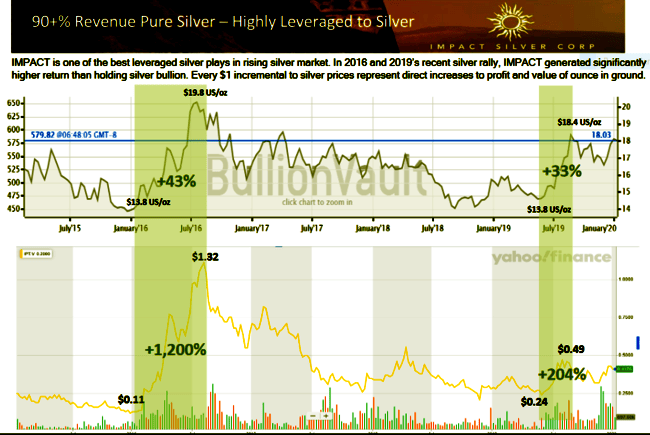

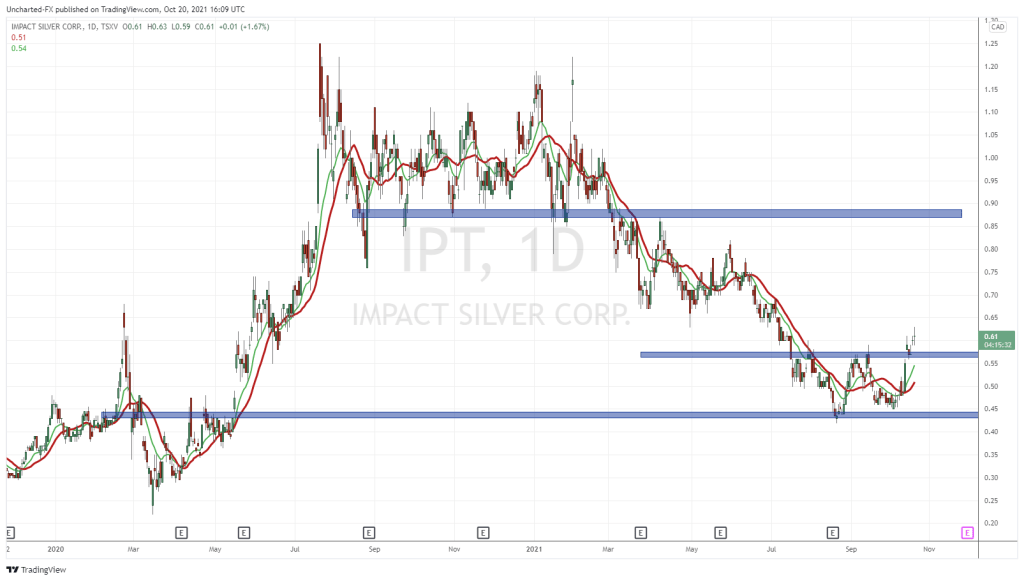

The following chart shows the positive correlation between IPT common and rising silver prices:

Impact was a solid 12-bagger in the first six months of 2016, the last time silver challenged $20.

With 95% of current revenues derived from silver production, Impact has the best leverage to the metal I know of.

Final thoughts

I view Impact as a train slowly pulling away from the station—there’s no waiting on the platform for the company to get its permits straight. There’s no time-consuming construction phase. There’s no ramp-up to test rock, machine, and design. Impact has been in production for over a decade producing some 9.5M ounces of the metal, equal to roughly $175M in revenue. The company has these epithermal vein structures dialed in.

Though the short term is uncertain, keep in mind that these broad market shakeouts can be a catalyst for the mobilization of funds back into the junior arena.

Before signing off, I’d like to thank Jerry Huang for taking care of our every whim and need along the way. I’ve never seen a CFO with such breadth of knowledge for all things geological. I’ve also never seen a CFO put boots to the ground as enthusiastically as Jerry. He was with us above ground, below ground, every step along the way.

END

Postscript: On Feb. 26, Impact dropped the following headline:

We didn’t even mention the Chapanial Gold-Silver Project in this piece, a further testament to the geological prospectivity of this district.

CEO Davidson:

“Our Royal Mines of Zacualpan property covers a large mineral district with over 5,400 prospects and 88,000 rock and drill core samples all catalogued in our database, many of which we have yet to explore. This extensive data set has provided industry leading success rate in identifying and developing tonnages for small scale cashflow positive production. With rising gold and silver prices, our greenfield crews have turned their attention to the prospective Chapanial area which is providing some excellent initial results in gold as well as silver. We plan on continuing sampling at Chapanial toward generating targets for future drilling. With our producing Guadalupe processing plant in the area, the process of discovery to production is very streamlined.”

END (seriously this time)

—Greg Nolan

Full disclosure: Impact Silver is not an Equity Guru marketing client.