$1.2 trillion worth of corporate junk bond debt will mature in the next few years, leaving investors in a world of pain, as many of the bleeding corporations will be unable to repay the principle.

“The biggest boom in corporate credit since the Great Recession in 2008 has led to warnings from regulators that a bubble in business debt could end badly,” stated Market Watch.

Moody’s now has a “negative” outlook on nine industries where junk-rated companies have a collective $223 billion of debt maturing by the end of 2024.

“Demand for High-Yield (junk) bonds has rallied despite the lack of any observable broad-based acceleration of either business sales or corporate earnings,” warned Moody’s Investors Services.

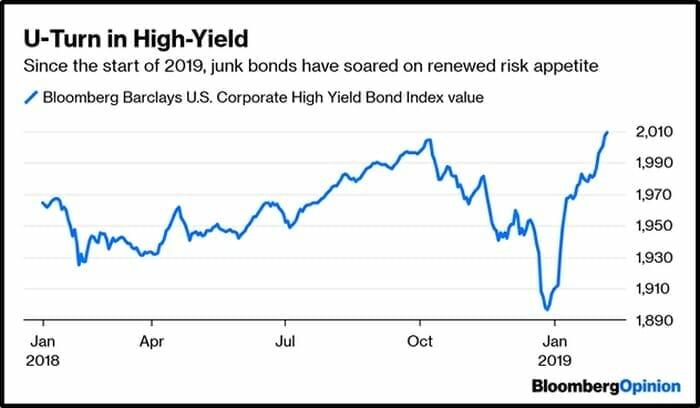

Financial analysts use the junk bond market as economic bellwether. If few investors buy junk bonds, it suggests wide-spread pessimism. If lots of investors buy junk bonds, that indicates wide-spread optimism.

Right now, there are a lot of optimistic investors piling into corporate junk bonds.

High demand for junk bonds makes it easier for weak companies to borrow money.

Junk Bond Primer:

“Junk bonds carry a higher risk of default than other bonds, but they pay higher returns to make them attractive to investors,” stated The Corporate Finance Institute.

When you buy a bond, you are lending to the issuer in exchange for periodic interest payments. Once the bond matures, the issuer is required to repay the principal.

If the issuer’s credit rating improves prior to the bond’s maturity, the value of the bond goes up. If the issuer goes bankrupt, during liquidation, bond-holders get paid before stockholders.

Still confused?

This dude uses an elegant spark-plug metaphor to explain the financial mechanics of a junk bond:

Ford Motor Company (F.NYSE) has $160 billion of maturing corporate debt on its books. Ford has a market cap of $35 billion, $13 billion revenue, -2% earnings growth, and putrid operating margin of 2%. Ford also booked a $2.2 billion “accounting charge” last year to retired factory workers.

“I’m bursting with pride – I just bought a brand-new Ford Fiesta!” – said Nobody Ever.

Last September, Moody’s downgraded the Detroit automaker’s credit rating to junk.

There are gems suspended in the sewage.

“This week, Tesla’s (TLSA.NYSE) junk bond surged to an all-time high, trading at face value for the first time since its issuance in 2017,” reported The Wall Street Journal.

The $1.8 billion debt offering reached a low of .81 on the dollar in May, as Tesla faced production delays, feverish cash burn, and anxiety over Elon Musk’s public hissy fits.”

A bond’s face value is the amount due to the bondholder once the debt reaches maturity. The 5.3% Tesla bond is scheduled to mature in 2025.

Tesla stock continued its winning streak this week, rising to 10% to $564 by market close on Friday. Tesla shares are up an astonishing 33% so far in 2020, shipping 112,000 cars in Q4, while opening the doors to a new Gigafactory in Shanghai.

China-built cars could help the company avoid trade-war tariffs and can sell at a lower price than imported, US-built models.

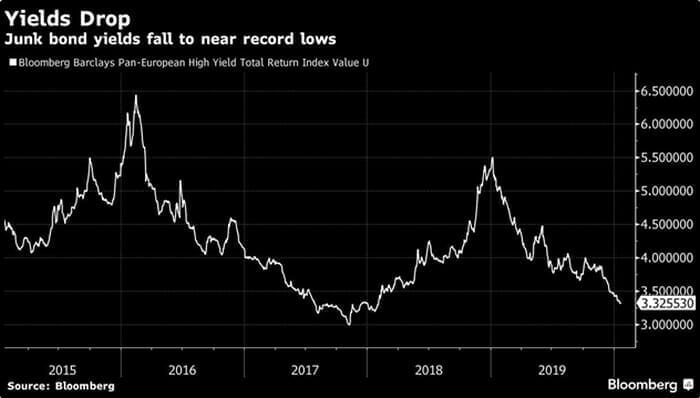

“The yield on an index of U.S. corporate junk bonds hit a low of 3.47% this week,” reported Bloomberg.

The $100 trillion global bond market has now reached peak-complacency.

“Bull markets don’t end when everyone is on high alert for what could go wrong,” Bloomberg reminded its clients, “It’s when everyone willfully chooses to ignore those warning signs that the cycle inevitably turns”.

Historically low yields on high-risk corporate debt is a bright red flag.

It’s not just unprofitable corporations that are borrowing money at low rates.

According to a New York Federal Reserve Report U.S. household debt increased 0.7% during Q3, 2019, to $14 trillion.

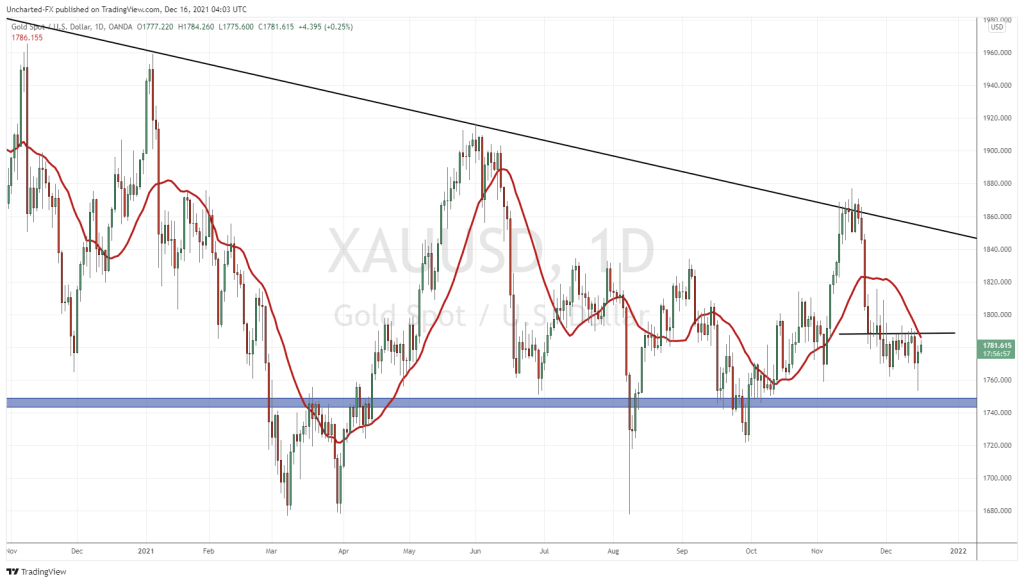

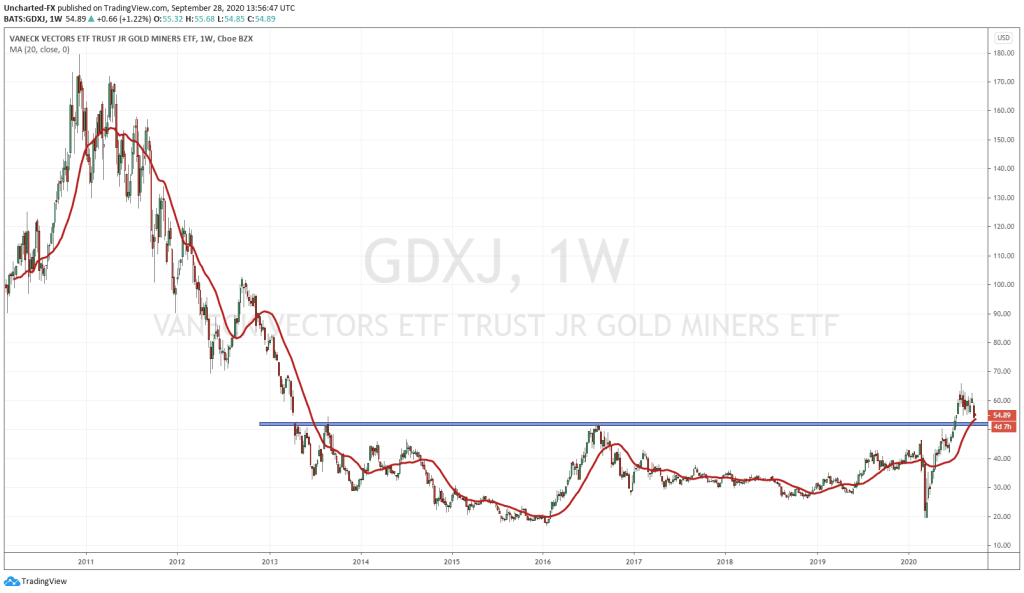

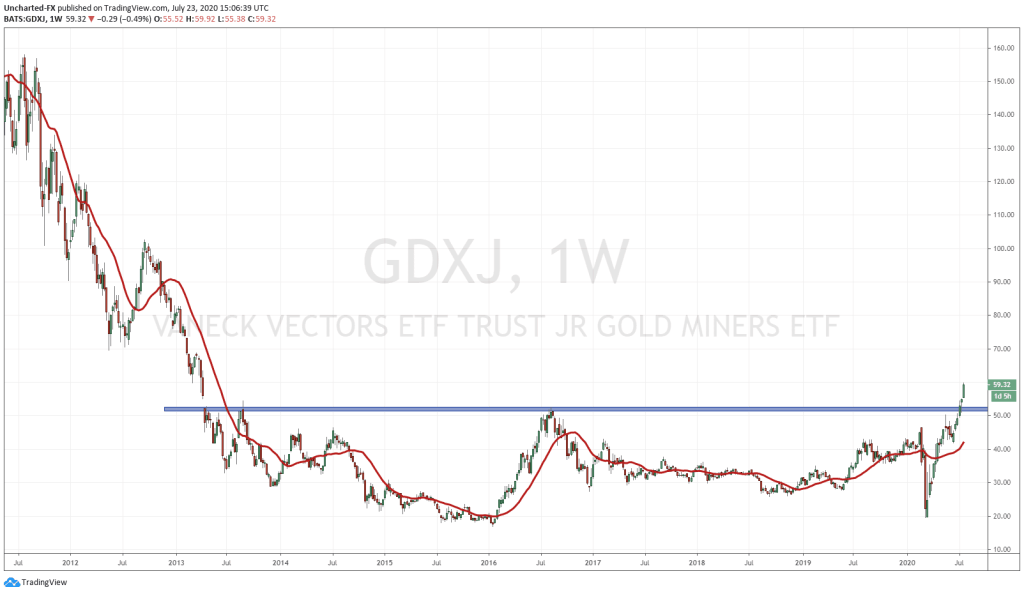

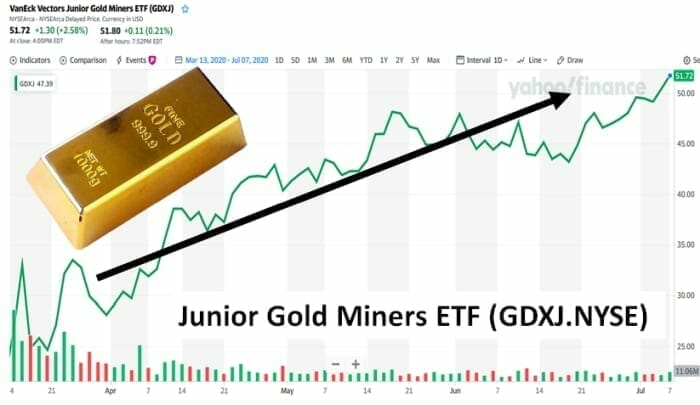

If you think equity and bond holder complacency is a risk, you may want to diversify into gold. If the geology is daunting, you can buy shares of the gold junior ETF (GDXJ.NYSE).

According to the World Gold Council, Central banks added 156 tons of gold to their reserves in Q3, 2019

Equity Guru’s mining expert Greg Nolan covers a basket of Yukon gold explorers here.

And here’s another gold company we like, called Euro Sun Mining (ESM.T).

– Lukas Kane