First up in cannabis 2.0 news, the Ontario Cannabis Store had a serious case of deja vu when it sold out of its new edible products approximately five hours after they went on sale online Thursday morning with all of the new products gone by 2 p.m.

“In less than half an hour, we were sold out of the soft chew category and other edible products were becoming very limited,” OCS communications director Daffyd Roderick told CBC News. “We now have no edibles available, but still have reasonable stock of vape cartridges and batteries.”

Anyone surprised? No.

You’d think that they’d learn from the mistakes they made last year, but that might be asking too much.

Canopy’s Cannabis 2.0 preparations hit a snag

Canopy Growth (WEED.T) submitted final documentation to Health Canada for its beverage facility late June, 2019, and got the license in late November. Since receiving the license, the company has made progress toward scaling the production process for its cannabis 2.0 beverages from lab scale to commercial scale.

“Canopy has had seven weeks to work with THC in the brand new beverage facility to scale processes and IP it has developed in the R&D environment. In order to deliver products that meet our customer’s high standards we are electing to revise the launch date while we work through the final details,” said David Klein, chief executive officer, Canopy Growth.

There are some wrinkles, though. The company is confident in the science and the method and sure that they’re going to get to the end of this particular scaling race, but they’re not there yet. That’s why they’re putting off their anticipated time to get drinks and other products on shelves so the company can iron out the details. The company doesn’t believe this delay will have any kind of an impact on their fiscal 2020 revenue.

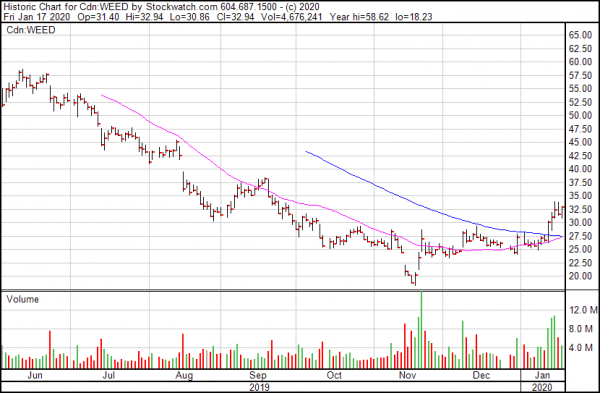

Canopy’s six month chart shows off some of the dips and drops from within the industry, but the real story is their one-year, which shows that this company is down almost by half since June of last year. If you’ve just come out of a coma and are looking for why your weed bet is down—first let me congratulate and welcome you to 2020, and then point at Canopy. This is why.

I understand if you’d prefer to go back to sleep.

No judgments.

Curaleaf acquisitions

Meanwhile, Curaleaf Holdings (CURA.C) recent acquisitions are moving along on track.

- Select – Curaleaf and Select have satisfied all requirements for closing the proposed acquisition of Select by Curaleaf except for the license transfer in Oregon. Both parties are working diligently with state regulators to acquire approval as soon as possible and expect to close no later than February 1, 2020.

- Grassroots – Curaleaf and Grassroots have each submitted certifications of substantial compliance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 regarding the proposed acquisition of Grassroots. The transaction is expected to close in Spring of 2020.

- ATG – ATG has filed its application for change of control with the Massachusetts Cannabis Control Commission in relation to the transaction with Curaleaf. Curaleaf and ATG are working with regulators to secure approvals as soon as possible.

These acquisitions help Curaleaf, one of the largest remaining multi-state operators still swinging after the cannabis market meltdown earlier this year, continue their expansion aims well into 2020. At first glance this company with its $9+ price and $3 billion market cap might seem like a safe place to put your cannabis bucks, but look closer.

This company had a shaky 2019 and their 2020 doesn’t look much rosier. They hopped aboard the CBD train shortly after Mitch McConnell signed the Farm Bill into law, and like so many other companies, were perhaps a little sloppy with their marketing. They regurgitated most of the unsubstantiated claims that were floating around about CBD about it being able to cure everything from cankers to cancer, and got slapped upside the head by the FDA.

Naturally, a class-action suit followed closely.

Here are the particulars:

According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (1) Curaleaf, on its website and social media pages, marketed its CBD products to be used as drugs and dietary supplements, contrary to law; (2) Curaleaf also sold unapproved animal drugs on its website; (3) such conduct would result in a warning letter from the U.S. Food and Drug Administration (“FDA”); and (4) as a result, defendants’ statements about its business, operations, and prospects, were materially false and misleading and/or lacked a reasonable basis at all relevant times.

It’s still going on, of course.

2019 couldn’t end fast enough for Auxly

Like Curaleaf and Canopy, Auxly Cannabis (XLY.C) is probably glad that 2019 is over. For most of 2019, they carried a heavy weight around their neck in the form of warrants and convertible debentures, which they’re in the process of sloughing off while they prepare for cannabis 2.0.

“The repayment of the remaining debentures, together with the expiration of the 2018 warrants, has simplified our capital structure. As we look to continue to lead the derivative cannabis market and increase revenues throughout 2020, our investors can focus on the strengthening fundamentals of our business,” said Hugo Alves, chief executive officer of Auxly.

Auxly settled the remaining 6 per cent unsecured convertible debentures that matured on Jan. 16, 2020, for approximately $2.7-million, and the warrants issued on January 16, 2018, for 32.2 million shares of company stock at a strike price of $1.80 expired on the 16th and were delisted.

Now the company’s looking forward to launching their cannabis 2.0 line, which is going to include vapes, chocolates, soft chews and other products.

Of all the company’s on this short list—this is probably the most promising. For now. Check back in a week or two.

—Joseph Morton