A few days ago, smallcap cannabis company Experion Holdings (EXP.V) lost its CEO (or gained a new one, depending on your outlook). The news of that change didn’t bring much information to the fore, so long term shareholders were left to ponder possibilities going forward. Few sold on the news. Few bought on the news.

Today, the new CEO, former COO Jarrett Malnarick, sent out one of the clearest, simplest, to the point corporate updates I’ve seen in a while, and so I decided to relay it for our readers, with comment, because it’s a really nice example of what most cannabis companies fail to do: Be honest and upfront with investors.

As the Canadian cannabis industry continues to be challenged with inflated financial forecasts, oversupply of low-quality product and delayed licensing of retail outlets to drive sales, investors and financers have lost confidence in the cannabis sector making it difficult to obtain favorable business valuations and to raise capital.

Gotta love this as an opening line. No bullshit, straight to the point.

During this time, cannabis companies must continue to evolve to address the changing conditions of the industry by becoming laser focused, leverage all assets at its disposal and carve a swift path to profitability. Key strategic objectives must center around revenue generation and rightsizing cannabis companies through cost restructuring.

Damn right they must.

The following is a summary of Experion’s efforts to reduce costs while continuing to grow revenue over the quarter:

Cost Reduction Measures

- Reduce office expenditures including closures of certain offices deemed unnecessary

- Terminate roles considered redundant

- Hibernate the clinical trial and related research; to be further reviewed when the market environment improves

- Renegotiate consulting and services fees

- Optimize business processes and functions

- Accumulation of the above actions will result in a 30% reduction (minimum) in SG&A annually

That’s a nice cost clean-up. As someone who has been a consultant for EXP, that whole ‘renegotiate consulting fees’ bit I could personally do without, but the other moves make sense in line with the realistic assessment that the cannabis industry needs to demonstrate it can be a real grown up business going forward.

The clinical trial pause is disappointing, because I really liked that EXP was prepared to further the industry as a whole by making these happen, but when you’re one of the smaller players in the space and the big guys with fat banks are doing none of that heavy lifting at all, it’s obviously a luxury to put good money towards a long term ambition like this. Respectable decision.

Revenue Growth Initiatives

- Increase current facility’s cultivation footprint by 20% by mid 2020 with minimal capital expenditure

- Unlock increased processing space with Health Canada which doubles manufacturing capacity by mid 2020 (renovations completed in FY2019)

- Improve cultivation capacity with quality grow partners

- Become an efficient premium Consumer Packaging Goods processor

- Open additional distribution channels across Canada

- Increase product diversity by offering additional strains and introducing pre-rolls

These are all smart, low cost moves that, realistically, won’t excite the market a whole lot, but will bring EXP’s finances to a place where the company’s future isn’t at risk. That’s important right now, because not every company is capable of doing that. Every competitor Experion can outlast makes Experion closer to profitable and, eventually, large scale market growth.

There’s one other growth initiative and I think it’s the most important, and honest, one mentioned.

- Explore M&A opportunities with another licensed producer to achieve increased cultivation and further economies of scale

THIS. MAKES. SENSE.

There shouldn’t be a single cannabis producer out there that isn’t looking to bring aboard partners and friends, to share costs and infrastructure, and to become bigger, better players by virtue of their combined heft.

Hell, I think the bottom 15 market caps in the entire space should be looking to put together a mass roll-up of small brands, to combine efforts at strong facilities and sell off anything that can’t be streamlined. Have one marketing and sales team, one logistics operation, one combined online sales site, one elite team of head growers working together, avoid repetition on strains being produced and max out IP by sharing it internally.

You wanna compete with Canopy and Aurora? Let them sell you their massive facilities for pennies on the dollar, and fill the room with smart, agile little guys who’ll bring real innovation and energy.

Experion saying out loud that it’s looking for M&A opps is a balls out move. It’s not a sign of weakness or hubris, but common sense.

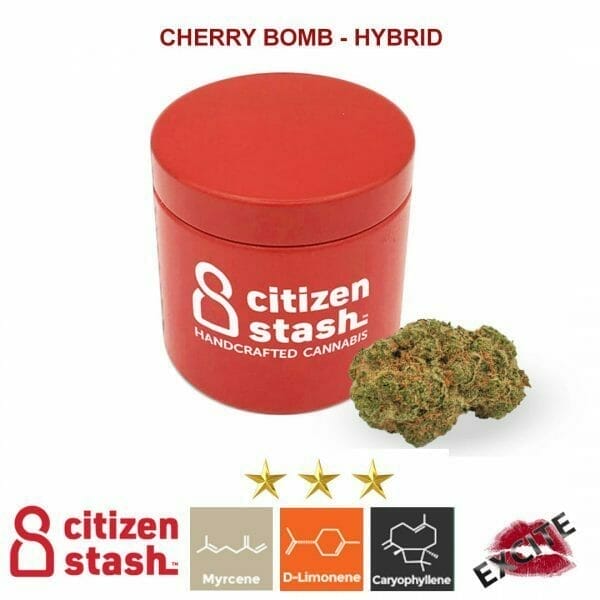

Despite a difficult market and some early disappointments with certain sector leaders, there remains a tremendous opportunity for cannabis companies on the path to profitable growth. This is the future that we see for Experion as it continues to develop strong brands (Citizen Stash and Kanabe) backed by premium Consumer Packaged Goods distributed across the Canadian market generating high margin revenue. This strategy will ultimately build a foundation for long term profits.

Kudos to the new guy. Keep telling the story loud.

— Chris Parry

FULL DISCLOSURE: Experion has been an Equity.Guru marketing client but isn’t currently.