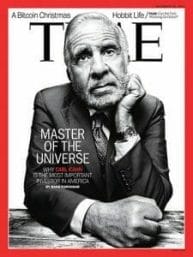

Carl Icahn has spent the better part of his adult life rattling the cages of billion-dollar corporations as an activist investor “looking out” for the interests of shareholders. His continued efforts fed America’s share buyback binge as he pursued the holy grail of value extraction.

The man is a dynamo, jousting with giants like Apple (AAPL.NASDAQ), Time Warner (TWX.NYSE) and Kerr-Mcgee. His skewering of Kerr-Mcgee netted a $4.0 billion share buyback plan. Kinda like David and Goliath, getting the big old bad company to stop being so miserly and unlock some of its value for the little people (stockholders).

However, his defeats with Apple and Time Warner shed light on the dark side of activist investors and the predatory nature of share buyback programs, but the U.S. public markets don’t care and executives continue to stuff themselves at the retail investor’s table.

So, what is this fascination with companies buying up their own stock? To understand why Icahn loves it so much and why retail investors continue to suck it up, let’s delve into the reason, process and history behind share repurchases:

Why would you?

- Valuation – or more importantly undervaluation. You can increase share price by taking shares out of circulation.

- Dividend bump – fewer shares more to spread around.

- Cash – you can’t just let it sit around in today’s low interest world because stagnant cash costs now.

- Shot in the arm – psychologically, that is. If the company is buying shares, the future must be so bright, it’s going to require sunglasses. Probably the worst reason ever to stock up on your position. Sorry, don’t know why this is even considered a pro, but whatever.

- Performance metrics – or lack thereof. By striking a bunch of shares off the list, suddenly your price to earnings ratio goes down, making it look like you performed when you never did.

How would you?

- Tender offer – this is when you put out the offer to shareholders, and whoever is interested offers whatever shares they wish to get rid of according to the tender. There are two types of tender offer: fixed price and Dutch auction. Fixed price repurchases are like they sound. Dutch auction tender offers give a price range and once the company has all the offers, it buys the least expensive of the lot.

- Open Market – this is when the company just buys whatever is available on the boards at market prices. Of course, since this is announced to the public, it can cause the share price to spike on anticipation of the buyback program.

Now for a bit of history:

When a decade of rampant speculation and voodoo analysis disappeared billions on Black Tuesday, 1929, it pitted the market and ransacked the nation. To ensure America would never again be at the fickle mercy of a self-interested ‘free’ market, the 1934 Securities Exchange Act (SEA) christened the formation of the SEC.

The regulatory body was tasked with determining the causes of the crash and make recommendations going forward. In its investigation, the SEC’s five commissioners stated share buybacks held potential liability under several anti-fraud and manipulation statutes of the act. However, nobody came out and said it was either okay or a crime, creating a legal grey area until 1968 when the Williams Act Amendment was attached the SEA, giving the commission the authority to create a legislative system prohibiting share buybacks.

Unlike the SEC, Congress was willing to define buybacks as fraudulent, deceptive or manipulative. The SEC watered down this sentiment so the newly amended Section (2)(e)(1) stated it would be unlawful for issuers to snap up their own shares if their purchase contravened any rules and regulations set forth by the commission.

The SEC was also given the power “… (A) to define acts and practices which are fraudulent, deceptive or manipulative and (B) to prescribe means reasonably designed to prevent such acts or practices.” No matter how hard the SEC tried, it couldn’t make anything stick until the summer of love faded into memory.

In 1970, the SEC had its first successful attempt at adopting a new set of ‘effective’ controls with Rule 13e-2 which outlawed share buybacks if they failed to meet certain criteria:

- One broker per transaction

- No sales before opening bell and a half hour before the end of the trading day

- Price can not exceed highest current independent bid price or last sale price, whichever is higher

- Volume can not exceed 15% of the average daily volume in the four weeks preceding the buyback’s execution.

Of course, it didn’t take long for the 15% to become 25%, creating the safe harbor we see companies sailing into at alarming rates today – $1.2 trillion worth in the last year. Even then, commissioners were leery about the whole affair and stated quite clearly there was a:

“… need for a scheme of regulation that limits the ability of an issuer . . . to control the price of the issuer’s securities.” This need “stems in part from the unique incentives that an issuer . . . [has] to control the price of the issuer’s securities.”

Rule 13e-2 was crafted to keep issuers from leading or dominating the market through share buyback programs. On the surface, it looked like the Commission had put a broad leash on issuers with just enough rope to hang themselves if they engaged in manipulative conduct, but the SEC’s supposed iron hand was as soft as milk.

The commission left a lot of room for interpretation, so that a case-by-case study would supersede any established rule. Corporations were relatively happy, but it wasn’t until the lid came off in 1982 that CEOs really started to grin.

The SEC introduced Rule 10b-18 that year rather than amending Rule 13e-2 to properly control share repurchases. This move was a 180° shift from the commission’s earlier reticence, but in the heady days of Reaganomics, regulations were an insult. So, with both baby and bathwater clearly out the window, the SEC handed issuers a key to the public market pantry.

How executives and directors unfairly benefit

Corporations like Amazon (AMZN.NASDAQ) have never been willing to pay their fair share of taxes. They have armies of corporate lawyers and accountants turning tax avoidance into a high art, so Walmart can continue to fleece the commonwealth without looking like thieves.

A favorite corporate tax dodge is share-based compensation, which is odd because the act arose out of legislation meant to curb CEO salaries.

In 1993, the Clinton Administration pushed through Section 162(m) of the U.S. Tax Code which was meant to address the growing income disparity between CEOs and their average employees.

At the time, any revenue used for salaries and benefits wasn’t considered income and therefore, wasn’t taxed, but the new change created an exemption. Any salaries going toward executives making over a $1.0 million per year would now be taxable.

Of course, if a company paid its CEO a paltry $1.0 but fed them stock options, performance shares and/or restricted stock units worth $20,000,000.00 every year, the corporation would only pay tax on the dollar paycheque while the CEO defers the tax on the $20.0 million.

Once that CEO decides to exercise their options or sell their shares, they are taxed, but the company receives a tax deduction in the same amount and in the same tax year that CEO recognized their compensation income.

Pretty good set up and just one of the ways Bezos and his billionaire buddies avoid their civic duty, but share-based compensation provides ample conflict of interest for directors, who at this point, are the ones with the power to vote a share buyback plan into existence.

The reason? Stock options, performance shares and restricted stock units all do better when share price heads north.

This less-than-altruistic incentive combined with the market’s ridiculous appetite for continual growth and increasing dividends, has created a vicious circle which scoops value off the table and puts it into the pockets of insiders before you realize that value didn’t really exist in the first place.

So how bad is it?

A study released this month by Yardeni Research reported the 4-quarter sum of S&P 500 share buyback plans totaled $797 million with another $476.6 million paid out in dividends. That’s the highest its ever been, and we haven’t even reported Q4 2019 yet.

Yardeni also revealed S&P 500 companies spent 97.9% of their operating earnings on share buyback programs and dividends in the trailing four-quarter – share buyback schemes equal 63% of this total. Wow, no reinvestment with the capital created by your business and halving your dividends, that’s some long-term thinking. But wait, don’t use your own cash.

Hell, why inconvenience yourself with exchange rates and/or tax penalties using your profit when there’s dirt cheap debt hankering to become the albatross around your neck? It’s all about value creation, right? There isn’t a page big enough to inscribe all the laughter resulting from the last question.

Of the $5.0 trillion dollars spent by S&P 500 companies on buybacks since Q1 2009, the major offending verticals were consumer discretionary with a cumulative total of $732.9 million, information technology with a total of $1.34 trillion and financials with $815.8 million. Since banks deserve a good kick in the pants, let’s start there.

Case in point:

Regions Financial (RF.NYSE) is a full-service provider of consumer and commercial banking in the United States which offers wealth management and mortgage products and services. According to the financial institution’s website, it has $129.0 billion in assets and $96.0 billion in deposits.

Regions Financial (RF.NYSE) is a full-service provider of consumer and commercial banking in the United States which offers wealth management and mortgage products and services. According to the financial institution’s website, it has $129.0 billion in assets and $96.0 billion in deposits.

The company announced a $1.37 billion-dollar share buyback program in June which would erase 9.0% of the share float in the open market, through accelerated share repurchase transactions or privately negotiated transactions. RF was trading at $14.58 per share when the buyback was announced.

Regions got itself into some deep do-do when it jumped into the sub-prime auto loan market and as of its last 8K, the company celebrated having a ~$6.4 billion strategic runoff of unsecured consumer loans and auto loans. Strategic runoff is selling your stinky stuff on the QT at the end of the day because you know its toxic and it doesn’t pay to advertise.

Like the film, Margin Call, Regions looks to be one of the first lending institutions to run screaming from their auto loan portfolio and they’ve probably burned the debt market because of it. I’m willing to wager the banks have stopped playing with each other now that everybody’s waiting for the music to stop. Interbank trust is at an all time low, but let’s get back to the business at hand.

RF still isn’t out of the woods, it just started running off its consumer loans at the beginning of the month. This bloated example of wealth mismanagement invested heavily in crappy assets because of massive greed and mind-numbing incompetence and it thinks its time to buy up shares because they’re undervalued? Again, not a page large enough.

If that isn’t enough to get you steamed, the company’s 15, yes 15, directors met seven times last year for board meetings and various committees met another 44 times – that’s at most two meetings a week with a long vacation and only if everyone attended every meeting.

I guess I should be glad that they managed to make it to 75% of the meetings. Makes me feel even better knowing they’ve taken care of themselves with a multimillion-dollar payout. Who knows how much they’ve gifted themselves since 2015? I’d look, but I want to keep my lunch down.

Maybe I’m being too hard on RF, not seeing the whole picture; let’s take a closer look at the numbers.

In Q3 2019, RF reported $1.91 billion in cash. In the same period a year earlier, the company had $1.96 billion in cash. A year ago, RF had $22.67 billion in debt securities held for sale, but increased that to $22.99 billion in Q3 2019. It also went from $331 million in loans for sale in Q3 2018 to $548 million in 2019. The company seems to be adding to its debt assets, but not getting them off its books.

There was also some shuffling in debt structure which didn’t necessary change the story for the better. RF looks to have added almost $3.0 billion in short-term borrowings in 2018 as well as over $3.0 billion in long-term borrowings. In 2019, the company managed to divest itself of just over $2.0 billion in long-term borrowings, but it upped short term borrowings by over $2.0 billion.

Short term loans have higher interest rates and tougher covenants regarding financing and operations which could hamstring efforts to extricate RF from a sticky financial situation if, let’s say, it’s remaining portfolio and the portion it was able to pass off goes radioactive. Let’s hope they didn’t do any swaps.

If you think I’m being Chicken Little about this, then why after running off $6.4 billion of bad debt, did they raise their allowance for loan loss from $840 million last year to $869 million in Q3 2019? What’s still on the books?

If you think I’m being Chicken Little about this, then why after running off $6.4 billion of bad debt, did they raise their allowance for loan loss from $840 million last year to $869 million in Q3 2019? What’s still on the books?

This is the final nail in the coffin: RF netted $409 million in profit during Q3 this year, down from $564 million in Q3 2018. This deserves a reward?

Executives argue as they are slinking out the back door to the bank, that everyone benefits from increased SP, but the cold truth is, it’s only a privileged sliver:

In Q1 2019, the richest 10 percent of households owned 86.8% of corporate equities. The bottom 50% (you and me) has control over 0.8% of the total market value. And yet, we have executives, like the leadership of Walmart, who spent $120 billion on share buybacks in the last decade, claiming they cannot afford to pay their employees, their means of production, a living wage.

But hell, it’s time to put more money into the CEO’s pocket, who in the case of RF, makes 153 times his average employee, glad you’re getting yours John.

Still not convinced you’re being had? Let’s examine the executive and board’s actions post share buyback announcement. I apologize, there’s a lot of detail, but that’s where these devils live.

How RF’s share buyback plan played out:

Since RF’s share buyback announcement in late June, in what could be termed as a challenging year, this is how much each of RF’s titans of commerce enriched themselves by name:

- Eric Fast (director) pumped his portfolio with $93,378.91 worth of phantom stocks and $14,853.13 in common shares.

- Samuel Di Piazza (director) ran home with $56,765.39 worth of phantom shares.

- Ruth Ann Marshall (director) came away with $91,430.42 in phantom shares and $26,439.96 worth of common shares.

- Carolyn Byrd (director) made out with $67,941 in phantom shares and $24,123.69 in common shares.

- John Johns (director) came home with $89,930.32 in phantom shares

- Lee Styslinger (director) grabbed $102,947.03 in phantom shares and $33,104.68 in common shares.

- Jose Suquet (director) took home $58,831.19 in phantom shares.

- Charles McCrary (director) secured $140,175.51 worth of phantom shares and $36,068.17 of common shares in RF.

- Timothy Vines (director) increased his holdings with $55,814.71 worth of phantom shares.

- Hardie Kimbrough (director) bought $3,979.82 in common stock but also sold $404,449.82 worth of common shares as well.

- John Owen (Sr. VP & COO) sold $585,016 of common stock

- Keith Herron (Sr. VP & Head of Corporate Responsibility) sold $1.01 million of common stock

- Matthew Lusco (Sr. VP and chief risk officer) sold $328,522 of common stock

- David Keenan (Sr. VP and chief human resources officer) bought 109,354 common shares at a 56% discount for $765,478 but sold 101,096 common shares at full pop for $1.68 million.

It looks as though RF directors and executives extracted $5.67 million for themselves from the performance created with their share buyback. In the company’s 2019 proxy statement and AGM notice, it celebrated a 97% increase in share repurchases from 2015 and a 30% bump in total dividend payout.

It looks as though RF directors and executives extracted $5.67 million for themselves from the performance created with their share buyback. In the company’s 2019 proxy statement and AGM notice, it celebrated a 97% increase in share repurchases from 2015 and a 30% bump in total dividend payout.

When called to the carpet for repurchase plans, executive fingers typically point at improved share price performance, but a closer examination of RF’s data reveals a darker tale.

When reality doesn’t enter the room

As you can see from the preceding graph, Regions improved stock performance correlates with the start of their insane increase in share buyback programs back in 2015. Of course, as noted by the tail end of the graph, share buybacks are short-termism profit-taking of non-existent value. Eventually the fools are no longer fooled.

As you can see from the preceding graph, Regions improved stock performance correlates with the start of their insane increase in share buyback programs back in 2015. Of course, as noted by the tail end of the graph, share buybacks are short-termism profit-taking of non-existent value. Eventually the fools are no longer fooled.

Tell me again why a share buyback program doesn’t suck

For the last 40 years, we have been robbed on a regular basis by the individuals who are supposed to act as stewards of both our capital and community standards. Share buybacks aren’t anything but a way to pad the pockets of greedy dimwits.

Speaking of which, hey Carl, you got any more no-brainers? Tell me more about the synergy of HP and Xerox. Or is that synergy the billions you’ve blown on this with your naked greed?

Speaking of which, hey Carl, you got any more no-brainers? Tell me more about the synergy of HP and Xerox. Or is that synergy the billions you’ve blown on this with your naked greed?

Icahn’s traveling roadshow is only marginally better than the criminal activities of Bain Capital. These vicious business vultures swoop in, gain control of the shares, get the company to load up on back-breaking debt to commence a share buyback scheme which they sell into and walk away from long before the company’s books explode all over the retail bag holders.

Ms. Warren, if you’re out there, we have a sickness and it’s run deep. The gangrenous flesh of debt-fed zombies like Uber (UBER.NYSE), Lyft (LYFT.NASDAQ) and Walmart (WMT.NYSE) threaten to smother the very system they depend on, and yet executives continue to be protected when they illicitly profit from loopholes in the SEA, it’s time to close the door.

UPDATE: Regions just announced a $1.1 billion senior note debt offering that they managed to fill $740 million of – the madness continues.

–Gaalen Engen