Nexus Gold (NXS.V) management correctly gauged sentiment in the junior exploration arena at the beginning of 2019, sensing a continuation of the pervasive weakness we’ve witnessed over the past eight years.

Electing not to mobilize a drill rig to any one of their highly prospective projects in Burkina Faso likely saved a whole lotta grief (for shareholders) as the market, with very few exceptions, has been stingy in its appreciation of late.

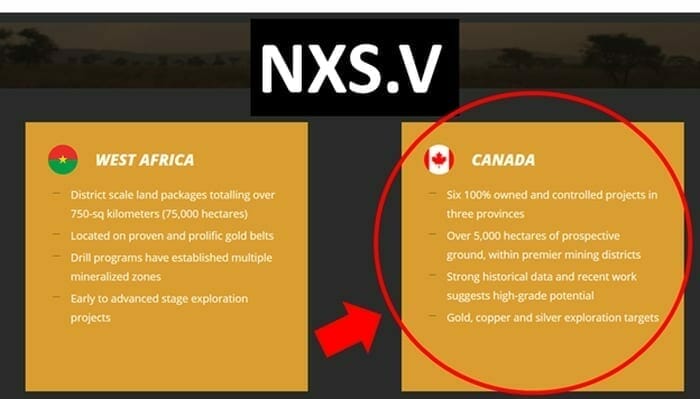

Instead, CEO Klenman and crew scoured the landscape and bulked up the company’s Project Portfolio with high-quality acquisitions on terms that might best be described as ‘friendly’.

On Jan. 10 the company closed the acquisition of its 509-hectare New Pilot Gold Project in the Bridge River Mining Camp of British Columbia.

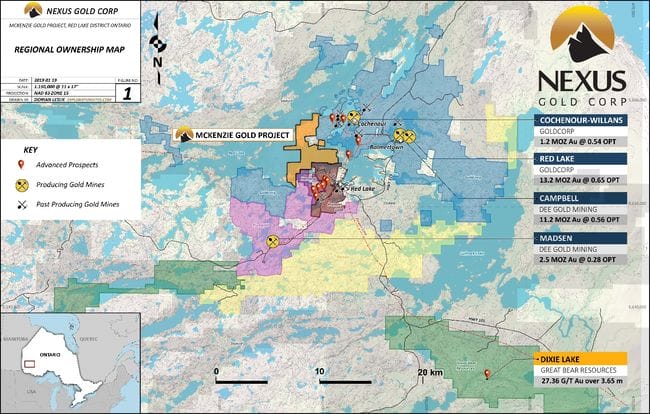

On Jan. 29 Nexus swooped in and acquired 1,348.5 hectares in the heart of the Red Lake Mining Camp only one week after another junior exploration company dropped the ball on the project. This acquisition got done with only 4M Nexus common shares and a one-time cash payment of $150K. The project is called Mckenzie and it was a real heads-up move—a move highlighting management’s business savvy.

On May 28, the company shifted its focus to Central Newfoundland and acquired 2,525 hectares in the Gummy Bear Copper-Gold Project.

On June 21, Nexus expanded its Newfoundland land position by 3,325 hectares with the acquisition of the Black Ridge and Bauline Gold Projects.

On July 22, the company announced a letter of intent (LOI) to acquire 4,000-sq kilometers of gold exploration projects in Gabon, West Africa.

It’s mid-year and the company’s project portfolio is bulging at the seams. It’s clear management’s plan is to monetize—to joint venture or to outright sell—one or more of these assets.

Exploration is a capital intensive endeavor. It can be a veritable black hole for cash, particularly in the pre-discovery phase of development. It took 76 drill holes at a cost of $80.00 to $100.00 per meter (in 1980 dollars) before Hemlo became reality. For Eskay Creek, it took 109 holes at a much steeper cost.

If Nexus management is successful in generating revenue of say, two or three hundred thousand dollars from one or more projects, it will go a long way towards defraying https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative costs.

Generating that kind of annual revenue will help establish a more self-sustaining exploration company. It will reduce shareholder dilution and allow the company to push flagship projects, like McKenzie, further along the development curve.

On Aug 23 we received the first hint of a deal when management signed an LOI with Hawkmoon Resources “to evaluate an acquisition or potential joint venture for the development of one of the Company’s Canadian-based gold projects.”

That was just over three months ago.

On Oct 1, the company continued to execute on the monetization front announcing it had entered into an LOI with Kruger Gold, a privately-held company, “pursuant to which the parties will review a transaction in which the company will assign its interests in one or more of its gold exploration projects located in Burkina Faso, West Africa, to Kruger, in consideration for a series of cash payments. ”

Then yesterday, Dec. 5, Nexus dropped the following headline:

Nexus Gold Options Interest in Rakounga Gold Project for $2.25 Million in Cash and Work Commitments

Don’t let the markets muted reaction hoodwink you.

This is a big deal.

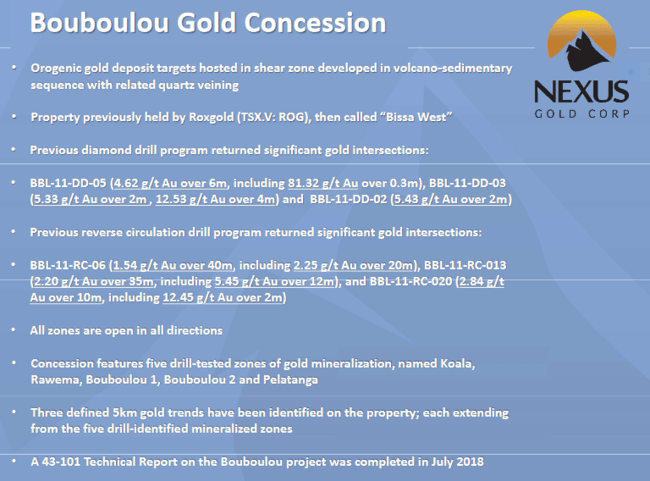

I count nine projects in the company portfolio, three of which might be classified as ‘flagship‘: Bouboulou, Dakouli 2, and McKenzie. The company needs funds to advance these projects—this news is a welcome development.

Transaction details

In previous Guru offerings, we’ve discussed the Prospect Generator Business Model. This is a good example of how it works.

Rakounga is a large project—250 square kilometers large. It sits adjacent to the company’s Bouboulou gold concession and has been subjected to various phases of exploration over the years.

The project will require millions of dollars to advance from its current state.

The deal allows Kruger to acquire a 75% in Rakounga by completing a series of cash payments totaling Cdn$1,000,000 and incurring project expenditures of at least Cdn$1,250,000 over five years.

Kruger will be the operator of the project.

Krugar will now do all of the heavy lifting.

Nexus, with this fresh injection of cash, can now focus on moving one or more of its flagship projects further along while still maintaining a 25% interest in the project. You might say Nexus is ‘carried’ for the next few rounds of exploration at Rakounga.

Alex Klenman, Nexus CEO:

The option with Kruger Gold represents an important milestone for Nexus as it demonstrates the ability to monetize projects in our portfolio. The incubation and monetization of select projects is a strategic objective for us. By generating income streams we can adopt a more self-sustaining business model, one that puts us in a better position to concentrate more of our resources on exploration efforts at our flagship projects.

More deals on deck?

It’s possible we could see another Burkina Faso deal in the not too distant future.

The Bouboulou Project is perhaps the company’s best shot at a NI 43-101 resource over the next 8 to 12 months.

Bouboulou will require a serious drilling commitment—up to 30 diamond drill holes. It would make sense to bring in a company with deep pockets to push it to the next level.

Flagship project progress

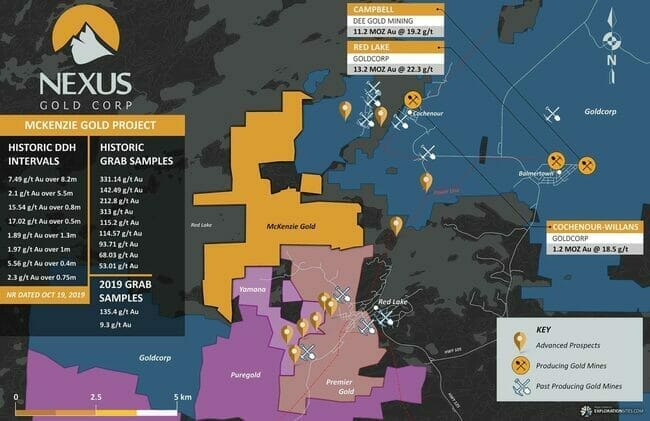

On Nov. 4, Nexus announced the completion of phase II exploration at their Mckenzie project in Red Lake.

The phase two prospecting program, which included approximately 60 grab and chip samples along the southernmost portion of the 1,348.5-hectare property—ground held by Premier Gold (PG.T) and Pure Gold (PGM.T)—advanced the company’s efforts to prioritize drill targets.

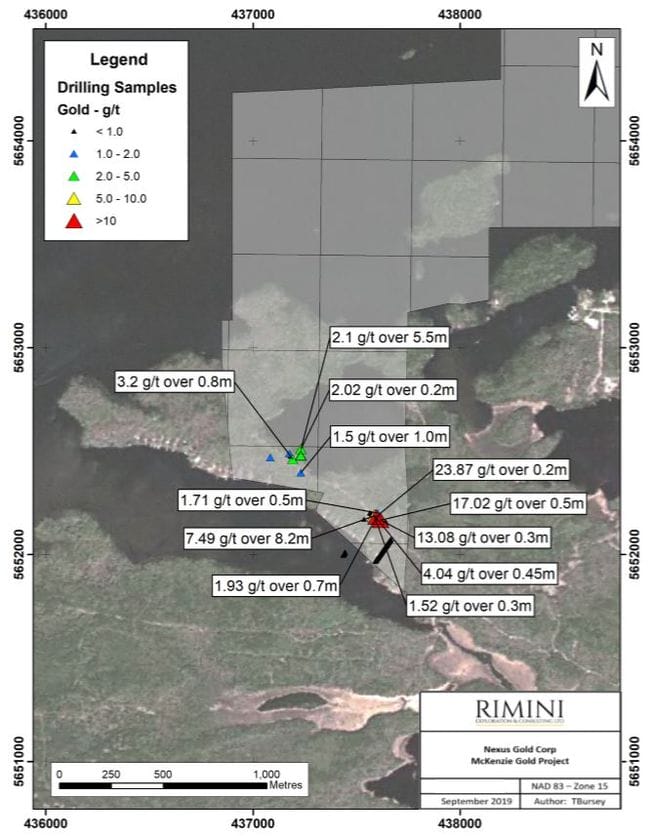

The company presented a good map showing historic drill results in the area—results that included 7.49 g/t Au over 8.2 meters, 2.2 g/t Au over 5.5 meters, 15.54 g/t Au over .8 meters, 17.02 g/t Au over .5 meters, and 23.87 g/t Au over .2 meters.

Curiously, the company’s geological consultants, Rimini Exploration & Consulting, indicated that little to no exploration had been conducted over the actual lake portion of the claim block.

The Company has noted from the regional data that a number of northerly trending geophysical trends extend within the lake itself and is viewing these trends as potential faults or breaks within the Dome Stock.

Preliminary review of lake sediment sampling conducted on the property in 1989 indicates coincidental anomalous gold geochemical values occurring. Historical values obtained from the analysis of +150 mesh screened lake sediment samples returned values of 0.159 ounce-per-ton (5.45 g/t) Au, 0.154 ounce per ton (5.28 g/t) Au, and 0.116 once per ton (3.98 g/t) Au. The Company now intends to conduct more exploration activity within the lake-bound portion of the project area to determine the prospectivity of a large underexplored section of the property.

CEO Klenman:

“The ongoing mapping, sampling, and data compilation Rimini is doing for us is critical in preparing McKenzie for an initial Nexus drill program. McKenzie is a priority for us. It’s right in the middle of a world class district, with prolific production and major success stories in the immediate area. The volume of high-grade samples and even the limited drilling done at McKenzie make it a very compelling exploration target. Drill targets are being determined now and we are eager to begin that phase of development.”

Out of Africa, the company is currently drilling up to 2,000 meters at Dakouli 2, a campaign we detailed in a previous Guru offering.

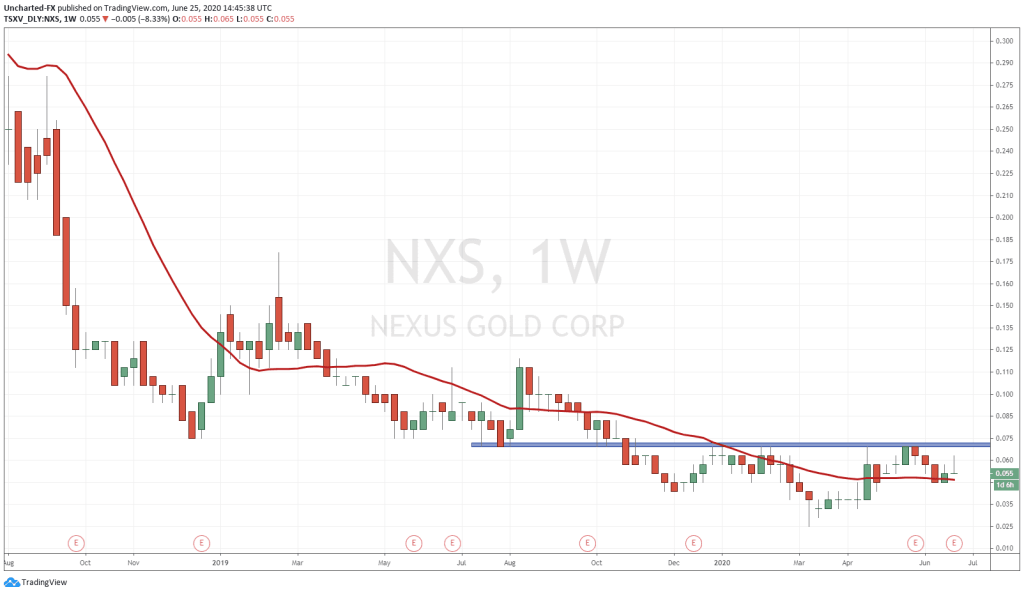

There’s a lot going on here. The market is not giving the company credit for progress made on multiple fronts.

At a $4M market cap, this might be one of the better risk/reward plays in the entire junior exploration sector.

END

—Greg Nolan

Full disclosure: Nexus Gold is an Equity Guru marketing client.