There are a lot of eyes watching gold right now. A universe of traders—fundamental, technical and the like—are watching the malleable metal for any sign of strength.

To some, this assault on higher ground is inevitable—it’s only a matter of time.

To some, gold is the only safe play out there.

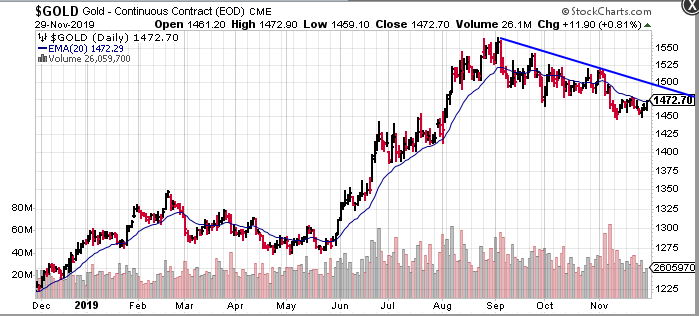

The correction continues, but…

Recent trading patterns put gold squarely in correction mode.

We called this correction correctly back in early September when the metal tagged $1,560 and bullish sentiment screamed extreme.

The market is consolidating those summer gains.

Weak hands are finding the exit, making way for smart money accumulation.

While many of the Mid and Senior Producers have held their ground during this retracement—a good indication of underlying strength—the junior ExplorerCos have been beaten into submission.

Year-end tax-loss selling has exacerbated the situation. The carnage is everywhere in the junior arena.

But I’ve seen this movie before. Though the cast, dialogue, and soundtrack may change, the plot always plays out the same way.

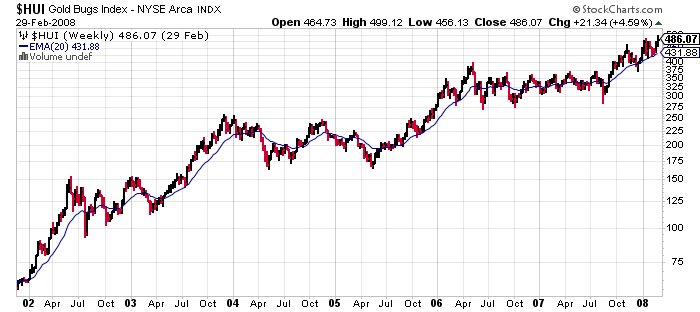

The last bull cycle

I was an eager gold investor in the early 2000s. My timing was a bit off—I was six months too early—but when the uptrend finally kicked in—when sentiment changed from depressed to upbeat—the price trajectory was jaw-dropping.

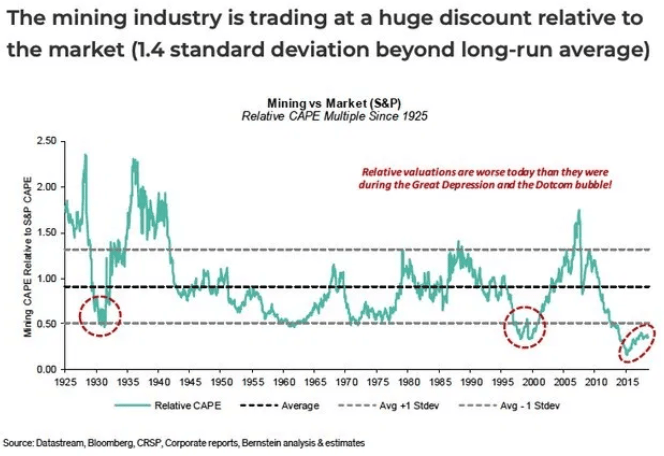

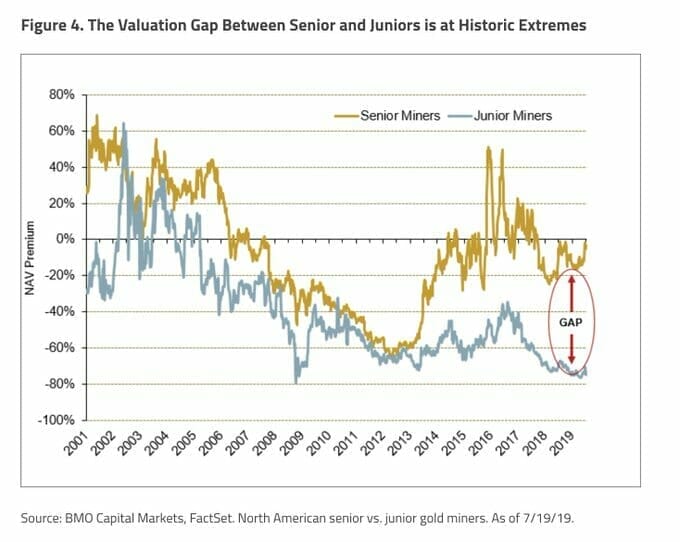

Valuation Gaps

One of the more compelling reasons to own mining stocks RIGHT NOW is the fact that the entire sector is trading at a huge discount relative to general equities—relative valuations today are sicker than they were during the Great Depression and the Dot-Com bubble.

Equally compelling is the valuation gap between the big boys (the Senior Producers) and the junior ExplorerCos.

If pressed for an opinion, I’d say we’re on the cusp of a powerful and sustainable rally in all things gold and silver.

If pressed for an opinion, I’d say we’re on the cusp of a powerful and sustainable rally in all things gold and silver.

But don’t just take my word for it. Hear what the experts are saying:

Hedge fund kingpin Ray Dalio’s recent comments on the subject:

I think these are unlikely to be good real returning investments and that those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold.

Paul Tudor Jones, billionaire and fund manager cast his vote in recent weeks:

We’ve had 75 years of expanding globalization and trade… and now all of a sudden it’s stopped. That would make one think that it’s possible we go into a recession; it would make one think that rates in the United States go back down to the zero bound level; gold in that situation is going to scream. [Gold] will be the antidote for people with equity portfolios.

Equity Guru’s Lukas Kane also weighed in on the subject in recent sessions:

The U.S. government owes about $23 trillion (a lot of it to China), and is plunging another $1 trillion in debt every year.

America’s economic engine is sick. Trump Sr’s mantra: “Make America Great Again” can only be sustained – even as a mirage – with borrowed money.

U.S. debt is based on fiat currency (paper money), and – as Trump Sr. has discovered – it is very easy to manipulate supply.

We believe this manipulation is likely to lead to a devaluation of fiat currency, particularly the U.S. dollar. If that happens, gold may be a powerful defensive strategy to preserve and grow existing wealth.

One more flush?

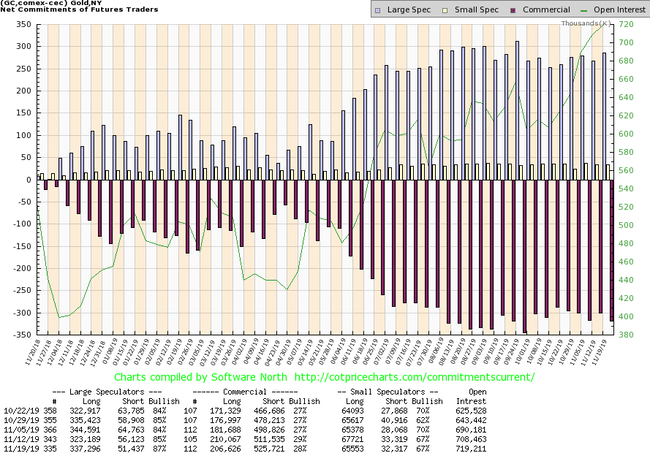

The correction in gold is growing long in the tooth. But there may be additional short-term risk to the downside—the Commercial’s are still heavily short (they’ve been known to wield tremendous pressure at times), plus Large and Small Specs are still clinging to their bullish convictions.

I wouldn’t rule out one more flush to the downside—a move back below $1,450.00 (perhaps as low as $1,400.00)—to ring out the excesses in the market.

Having said that, I wouldn’t bet against gold, or gold stocks, at this juncture.

It’s possible that an upside breakout could occur at any moment—there are a host of potential catalysts that could trigger a sudden rush into precious metals.

Traveling North to Canada’s Yukon

Exploration spending took a severe hit in the Yukon this year.

Yukon based ExplorerCos choose to conserve capital, waiting for the market backdrop to improve before pushing their projects further along the development curve.

I suspect activity in the region will ramp up dramatically in the coming year… if gold behaves as I expect.

Alexco Resources (AXU.TO)

- 118.68 million shares outstanding

- $271.78M market cap based on its recent $2.29 close

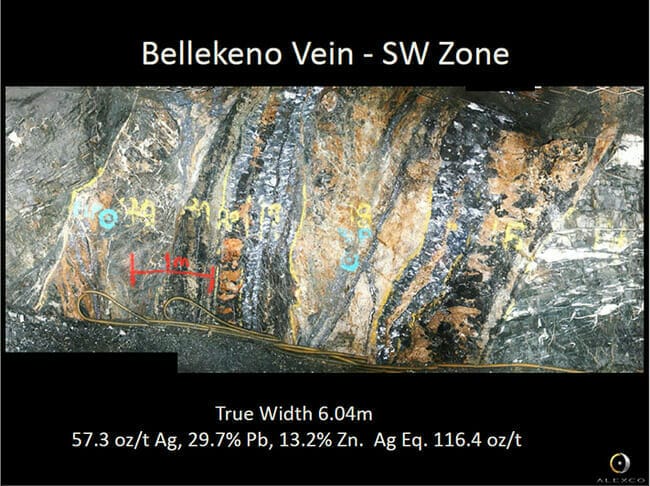

Alexco operates in the Keno Hill Silver District, one of the highest-grade silver destinations on the planet.

According to the Yukon government’s Minefile database, between 1913 and 1989, the Keno Hill Silver District produced in excess of 200 million ounces of silver from over 5.3 million tonnes of ore grading 44 ounces of silver per tonne (1,247 g/t Ag).

That was some uber-rich rock.

Alexco is a company making the transition from Explorer-Developer to Developer-Producer.

I began following Alexco back in 2006 when the story began to unfold (after they successfully consolidated the entire Keno Hills district). It was a good story back then—it’s an even better story now.

The last 13 years has seen a systematic approach to exploration and development.

Current reserves stand at 1.2 million tonnes of material grading 800 g/t silver + a further 7% combined lead (Pb) and zinc (Zn).

Current resources, both Indicated and Inferred, total more than 107 million ounces plus significant zinc and lead credits.

The company is on the cusp of making a production decision to become Canada’s primary’ silver producer (primary in the sense that > 50% of production revenue will be derived from silver itself).

We should have word in Q1 of 2020.

Assuming a positive decision, it will then take another six months before they begin hitting their stride on the production front.

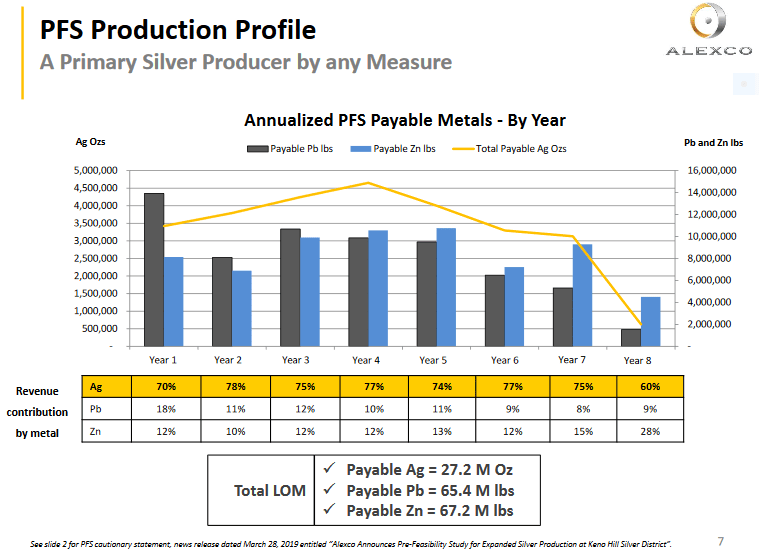

A 2019 Prefeasibility Study (PFS) demonstrates robust economics:

- an after-tax net present value NPV (5%) of $101.2 M;

- an after-tax internal rate of return of IRR of 74%;

- all-in sustaining costs (AISC) between $11 to $12.00;

- capital expenditures (CapEx) a very modest $23M.

The company envisions a 400 tpd (tonne per day) mining scenario.

Two concentrates will be produced from Keno Hills ore:

- a lead concentrate with > 15,000 g/t silver – a highly desirable (premium) product;

- a zinc concentrate.

How’s this for a production profile? (the yellow line drawn across the top shows total payable silver ounces)

Alexco has a secondary business in environmental remediation, one the market is completely oblivious to.

Cleaning up soil and H2O at old mine and industrial sites, this once modest revenue stream generated top-line revenue of $30M in 2019. Gross margin = roughly 35%.

There is currently $250M in contractural backlog on the books. Translation: this remediation gig, with offices across Canada and the US, will generate significant revenue for years to come.

High-grade core

Whenever you hear news of rock assaying out at a kilo-plus per tonne silver, chances are it’s Keno Hills core.

September 10 news: Alexco Intersects 8.1 Meters (true width) at Composite Grade of 1,414 Grams Per Tonne (45.5 oz/t) Silver at “Bermingham Deep” Target

Alexco is not your average ExplorerCo.

This is one to watch when the gold/silver bull kicks back into gear.

There is good leverage—high beta—to rising silver prices in them thar common shares.

Atac Resources (ATC.V)

Investor presentation (scroll down page)

- 158.04 million shares outstanding

- $28.45M market cap based on its recent close at $0.18

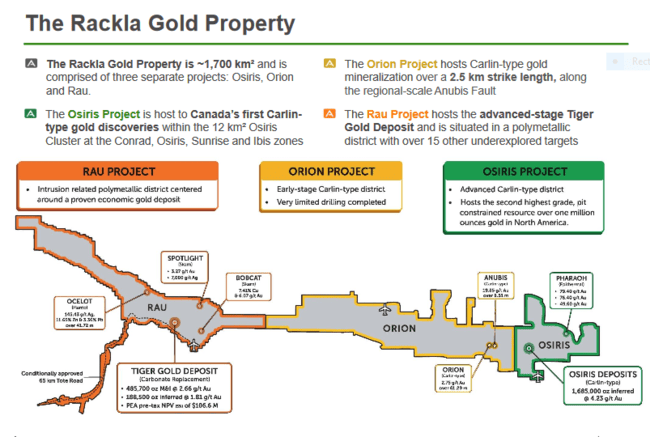

ATAC is focused on its 1,700 square kilometer Rackla Gold Property which is divided into three separate project areas: Osiris, Orion, and Rau.

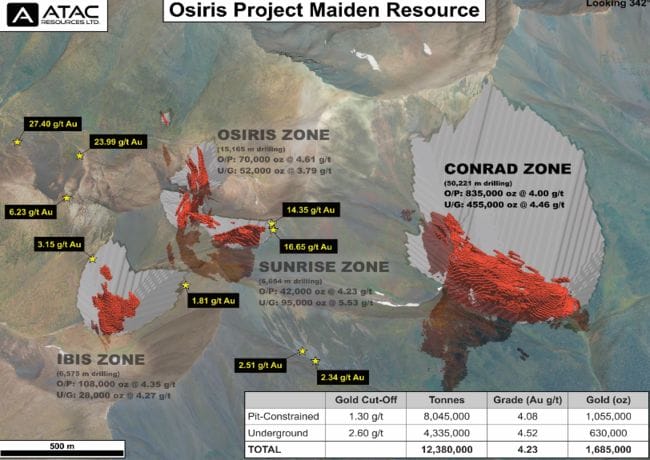

The Osiris Project is the only known Carlin-type setting in Canada and hosts a high-grade Inferred resource of 1,685,000 ounces spread out across 4 separate zones: Conrad, Osiris, Ibis, and Sunrise.

The Conrad zone hosts the bulk of the oz’s.

With the junior gold sector running on fumes for much of 2019, Atac sidelined its capital intensive Osiris project, focusing instead on Rau, and its multiple CAT zones.

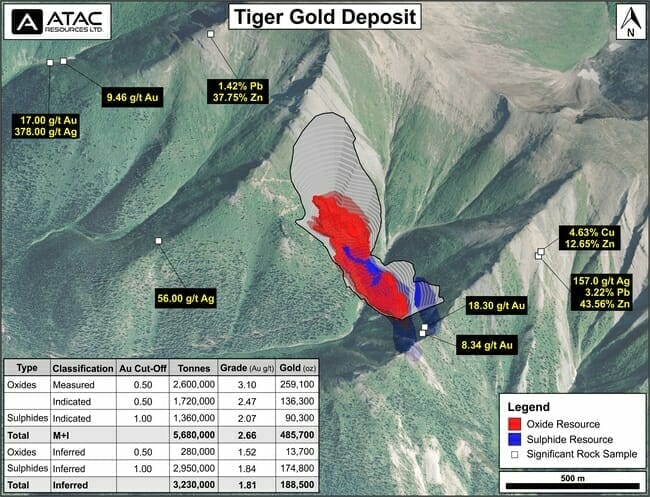

Rau’s Tiger zone hosts Measured and Indicated oxide and sulphide resources of 5,680,000 tonnes at a grade of 2.66 g/t gold for 485,700 ounces of gold.

A PEA tabled back in 2016 demonstrated an NPV (5%) of $75.7 million and an IRR of 28.2% (after tax), with an AISC of US$864/oz.

On July 16th of this year, the company expanded its copper-gold target area at Rau and launched a very modest 395-meter drill program focused on testing oxide material observed at surface south-east of the main deposit.

On November 14th the company released assays from this modest drilling campaign and announced intentions to update Tiger’s resource and PEA.

The updated resource and PEA will incorporate a number of key improvements:

- 13 step-out and in-fill diamond drill holes, completed in 2017 and 2019;

- updated metallurgical test work demonstrating that the upper part of the sulphide facies of the deposit is non-refractory and amenable to direct cyanide leaching (> 87% recovery);

- an advanced geological model that better captures high-grade structures.

When the gold bull reasserts itself, Atac, with its 1,700 square kilometers of prospective terrain, is bound to recapture the market’s imagination**

** I was an early investor in ATAC, establishing an oversized position back in 2009 at approximately $0.45. The ride ATC took me on over the next two years made quite an impression. Note the parabolic gains registered in 2010 and 2011 here.

Golden Predator Mining (GPY.V)

Investor presentation (scroll down page)

- 156.98 million shares outstanding

- $39.25M market cap based on its recent $0.25 close

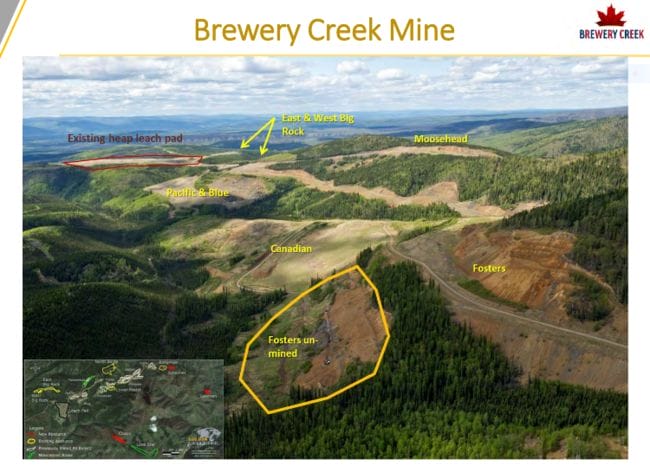

Golden Predator is focused on its past-producing Brewery Creek Mine, and its high-grade 3 Aces Project.

Brewery Creek was in production between 1996 and 2002.

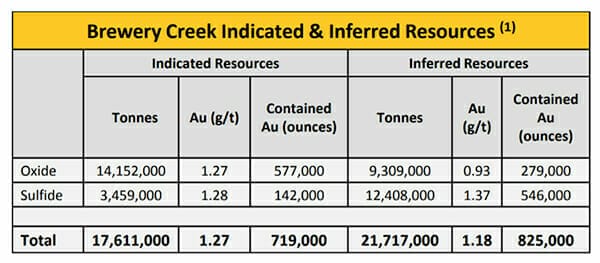

The current resource at Brewery Creek stands at 1.5 million ounces.

A 2014 Brewery Creek PEA demonstrated:

An after-tax NPV at 5% that ranged from $4 million at $1150/oz gold to $69.36 million at $1500/oz gold with IRRs ranging from 7% to 32% with corresponding gold prices.

Obviously, Brewery’s leverage to gold is good.

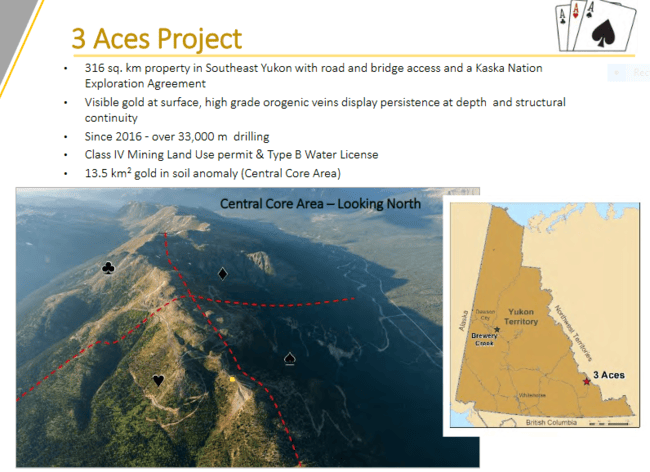

The company’s 357 square kilometer 3 Aces Project boasts an orogenic type setting with at least six mineralized zones extended over a thirty-five-kilometer trend.

At 3 Aces, the company has poked well over 300 holes into the Central Core Area , 37% of which cut grades of 5 g/t Au or better – 27% cut 8 g/t Au or better.

The company has been actively bulk sampling 3 Aces – some 9.800 tonnes – using conventional gravity recovery methods of its own, and more recently, in partnership with EnviroLeach Technologies (ETI.C) using an enviro-friendly water-based extraction process where recoveries in excess of 96 were achieved.

The majority of the company’s newsflow this year updated progress at Brewery Creek where the stated intention is to fast-track the project to the feasibility stage.

Janet Lee-Sheriff, Golden Predator’s Chief Executive Officer:

The best way to begin implementing our three-phase program and create value for our shareholders in the short term is to complete the Feasibility Study by Q1/20 in order to commence the reprocessing of the heap leach pad in advance of mining new material. The Feasibility Study represents a major step towards commercial production and with the significant infrastructure left in place, a cost effective means to a restart of the larger operation. Licenses are in place for Phase 1 and Phase 2. For Phase 3, we have already begun preparation of amendments to be filed early in the new year to incorporate additional resources into the current mine plan through the assessment and licensing process to extend the anticipated mine life.

Current prices may represent a low-risk accumulation opportunity. Eric Sprott appears to think so.

Luckystrike Resources (LUKY.V)

Investor presentation (scroll down page)

- 3.96 million shares outstanding

- $1.07M market cap based on its recent $0.27 close

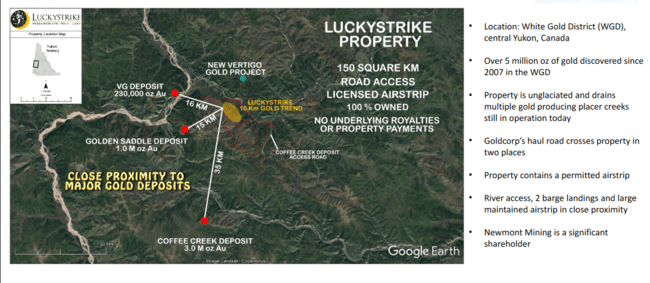

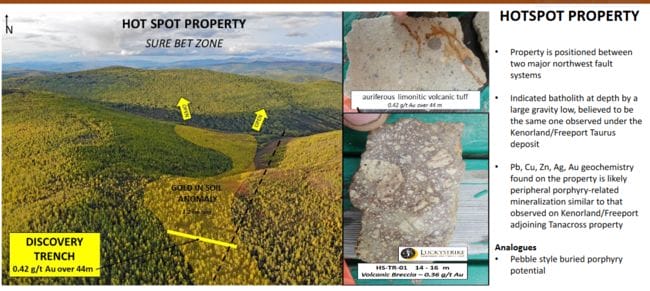

Luckystrike, a recent spinoff from Goldstrike Resources Ltd (GSR.V), is exploring its flagship Luckystrike Property.

I’m intrigued by this one as it shares a common border with White Gold’s Golden Saddle Property.

Luckystrike shares (geological) similarities with both Golden Saddle and the multi-million ounce Coffee Mine Project currently being developed by Newmont-Goldcorp (NGT.TO).

On September 18th the company released assays from a modest 4-hole, 1,100 meter diamond drill program. Results were perhaps best described as ‘encouraging’.

On November 14th the company consolidated its shares ten (old) for one (new).

Don’t rule this one out as its mere location on the map suggests above-average discovery potential.

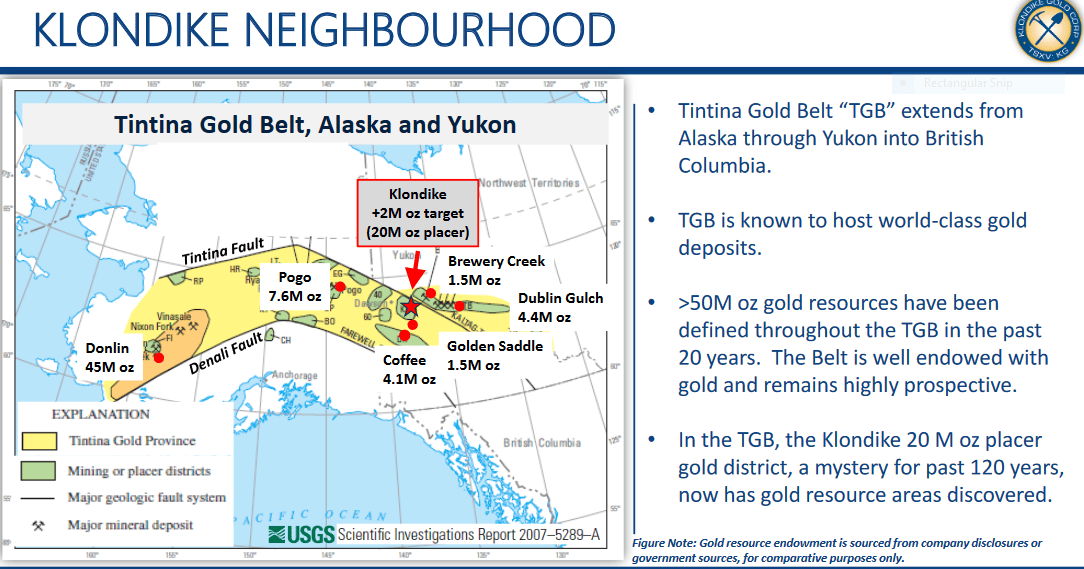

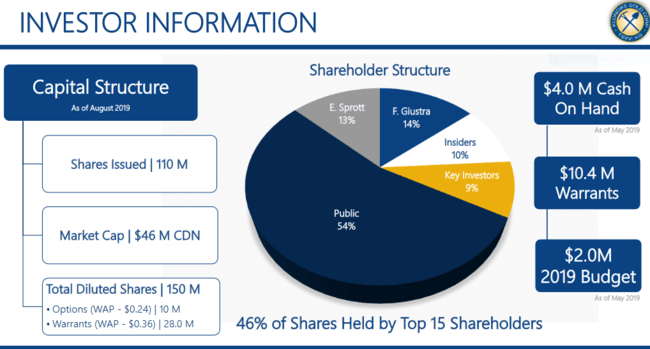

Klondike Gold (KG.V)

- 113.08 million shares outstanding

- $28.27M market cap based on its recent $0.25 close

KG has been kicking rocks in the Yukon for nearly four decades.

The company is focused on exploration and development of its extensive hard rock and placer claims—a region that gave up some 20 million ounces of gold in its day.

The Klondike’s storied alluvial riches have generated heaps of speculative interest. Note the two Canadian billionaires backing this play…

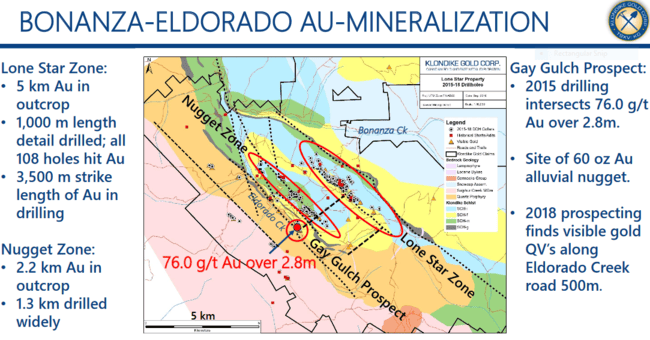

On May 16th the company commenced a $2M exploration program including drilling at its Gay Gulch and Nugget Zones.

The program:

- 6,000 meters of HTW-size diamond drilling in approximately 60 drill holes utilizing two drill rigs commencing in May, with initial results expected in July;

- drilling to target higher grade gold mineralization at Gay Gulch and Nugget Zones;

- drilling to expand zone of disseminated gold at Lone Star Zone;

- the collection of 2,000 soil samples at Eldorado and Bonanza Creek to cover prospective trends;

- the collection of 350 GT-probe bedrock samples to test extensions of the Lone Star Zone;

- a LIDAR airborne survey, spanning the 563 km2 to help identify the surface position of potentially gold mineralized faults.

On August 6th, the company announced the discovery of a new zone of mineralization, the highlights being:

- 1,009 g/t Au with 1,035 g/t Ag over 1.0 meter in drill hole EC19-267;

- 8.9 g/t Au over 10.0 meters in drill hole EC19-256;

- 1.8 g/t Au over 49.6 meters drill hole EC19- 266.

The last reported assays from the Gay Gultch zone dropped on September 25th.

Klondike Gold has just completed the final drill hole of the 2019 season. A total of ninety-four (94) holes were drilled testing a variety showings and targets during the campaign. Core logging, geotechnical work, and core sampling are expected to be wrapped up by mid-October. Assay results from a total of sixteen (16) holes of the 2019 program have been reported to date.

If my math is correct, results from a further 78 holes are pending.

Rockhaven Resources (RK.V)

- 187.64 million shares outstanding

- $23.45M market cap based on its recent $0.125 close

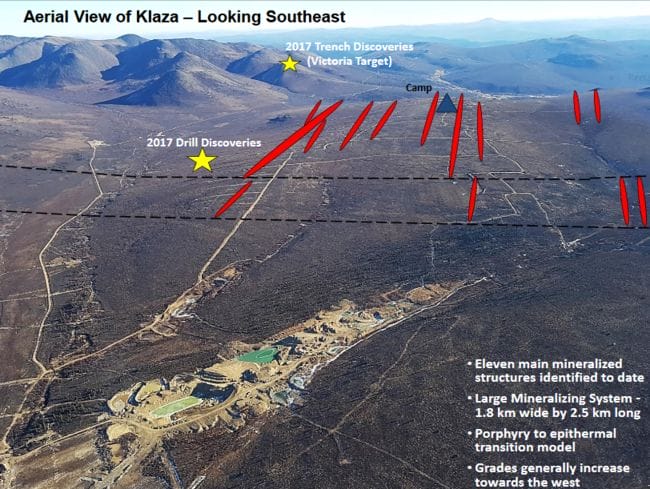

Rockhaven’s 100% owned Klaza Property is located in the Mount Nansen Gold Camp of southwestern Yukon.

Project highlights:

- 100% owned, high-grade gold and silver resource;

- Road accessible in an established mining district;

- No underlying royalties on resource areas;

- Exploration Benefits Agreement signed with local First Nation;

- LOM projected recoveries: 94% gold, 88% silver, 83% lead and 84% zinc;

- Large mineralizing system- 1.8 kilometers wide by 2.5 kilometers long;

- Good potential for resource expansion.

Eleven mineralized vein structures have been discovered to date at Klaza.

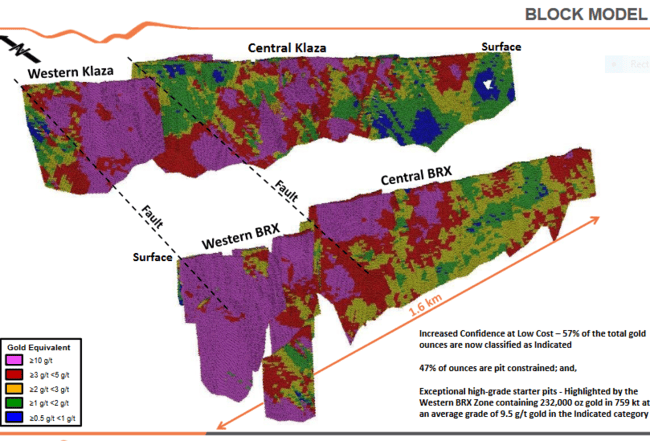

The BRX and Klaza zones, traced along strike for 2,400 meters and to depths exceeding 500 meters, have seen the lions share of exploration.

The Klaza Deposit hosts an Indicated resource of 686,000 oz gold and 14,071,000 oz silver (4.5 Mt grading 4.8 g/t gold and 98 g/t silver) and Inferred resource of 507,000 oz gold and 13,901,000 oz silver (5.7 Mt grading 2.8 g/t gold and 76 g/t silver).

This current mineral resource includes the Klaza and BRX zones, as well as parts of the BYG and Pika zones.

All four of these resource bearing zones are open for expansion along strike and down-dip.

As noted above, metallurgy is looking good. Results from ongoing metallurgical tests demonstrate recoveries in the order of 94.0% for gold, 88% for silver, 84% for zinc and 83% for lead.

Klaza’s grade, scale, easy access, and metallurgy should represent positive inputs for future economic studies.

On October 24th, the company announced the successful completion of a 33 hole, 5,750-meter diamond drilling program at Klaza. Two rigs were utilized to define and evaluate targets lying adjacent to the resource bearing zones highlighted above.

This 2019 drilling campaign represented a major milestone: over 100,000 meters (100 kilometers) of total diamond drilling since the project was acquired back in 2010.

Matt Turner, Rockhaven’s CEO:

The 2019 drilling was completed in only 29 days, and visual inspection of core suggests that the known veins were intersected where expected and that new mineralized structures were discovered in a number of the exploration holes. I wish to congratulate the Rockhaven exploration team, both past and present, as we have just surpassed 100,000 m of total diamond drilling since acquiring the Klaza project in 2010. This milestone is highlighted by an uncommonly high success rate, with better than 16 ounces gold equivalent* per metre drilled and mineralized veins in 95% of the holes.

You know a project has considerable exploration and resource expansion upside when vein structures are discovered by accident.

From the Oct. 24 news release: “In addition to expanding the Pearl Zone, exploration work led to the discovery of the Eastern Chevron Zone, which was first exposed during drill pad construction for a hole designed to test the more northerly Eastern Dickson Zone. Following this discovery, the drill collars were stepped back in order to test the newly identified mineralization. Significant veining was cut in both zones.”

Results from this 33 hole program will be released once assays have been received, compiled and evaluated.

Strategic Metals and Insiders own 37% and 11% of Rockhaven’s common shares, respectively.

Speaking of shares, it wasn’t too many years back when company insiders exercised a large number of OTM (out of the money) warrants in order to stoke company coffers and drive Klaza further along the development curve. This willingness to pay a premium for RK common shares showed real conviction and confidence on management’s part—not something you see every day in this Wild West of a sector.

Rockhaven is one to watch, from a discovery and development POV.

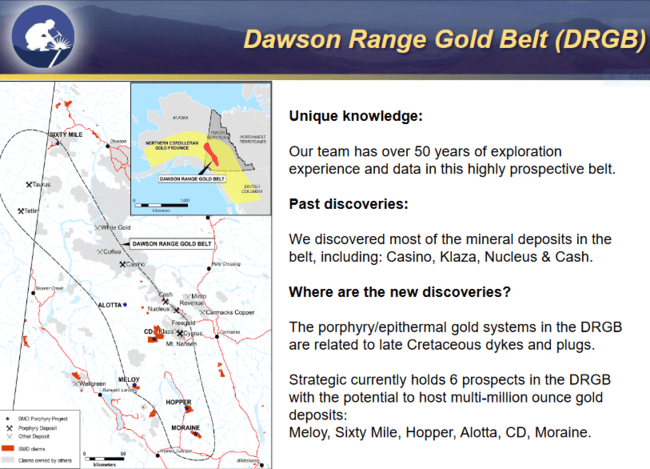

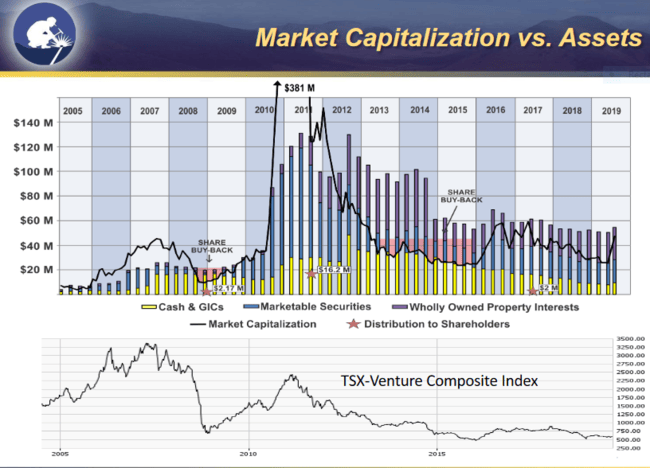

Strategic Metals (SMD.V)

- 96.57 million shares outstanding

- $38.14M market cap based on its recent $0.395 close

Strategic Metals has called the Yukon “home” for decades.

The company’s award-winning team is responsible for numerous significant discoveries in the territory (two of the highest grade 1 million ounce-plus gold deposits and the territory’s largest gold-copper deposit).

This crew knows its Yukon rocks.

Over the years, the company accumulated an impressive project portfolio of over 100 properties representing a diverse suite of metals, most of which are 100% owned with no underlying royalties.

The company has exposure to gold, silver, lead, zinc, copper, tin, tungsten, vanadium and lithium, via an array of deposit types—porphyry, skarn, epithermal vein, orogenic gold, sedex, carbonate replacement, etc.

The company creates shareholder value in a number of ways, deploying the prospect generator business model on the majority of the assets in its project portfolio.

The Company conducts ongoing research, claim staking, and initial exploration to confirm the mineral potential of its targets. Typically, Strategic then seeks purchasers or optionees to advance the projects. The company benefits from property transactions through cash payouts, share issuances and/or royalty interests. The Company holds a number of projects which meet the requirements of a qualifying listing property.

On May 9th, the company laid down its plans for its 2019 exploration season.

Three projects were drilled, and surface work was conducted on several others in order to advance them to the drill-ready stage.

This is how a smart prospect generator operates: advance a project using good science, define a number of prospective drill targets, then bring in a partner to do most of the heavy lifting.

Over the course of the summer, the company’s Hinton Project dominated the headlines with a plethora of high-grade surface values.

Aug. 21 (phase 1) rock sample highlight:

- The discovery of a linear train of vein quartz and brecciated vein, extending 230 meters northeasterly from a talus sample that assayed 2340 g/t gold and 597 g/t silver to an outcrop of altered and oxidized breccia grading 33.3 g/t gold and 654 g/t silver.

Sep. 9 (phase 2) rock sampling highlights:

- A two-meter wide vein, intermittently exposed along a 75 meter strike length, where four widely-spaced rock samples returned: 28.5 g/t gold; 23.5 g/t gold with 1720 g/t silver; 11.6 g/t gold; and 4.44 g/t gold;

- Another outcropping vein, found within a fault zone, graded 12.6 g/t gold and 2100 g/t silver;

- A second exposure within the same vein fault located 50 meters along strike, where chip sampling returned 30.5 g/t gold and 53.1 g/t silver over 1.2 meters and a grab sample assayed 48.5 g/t gold and 74 g/t silver;

- A third, 0.5-meter wide vein in outcrop, which is covered by talus along strike in both directions, assayed 46.9 g/t gold and 446 g/t silver.

Nov. 18 (phase 3) rock sampling and trenching highlights:

- Discovery of two new veins in outcrop on the western side of Granite Creek. One where a chip sample returned 24 g/t gold over 1.25 meters, and another that is up to 1.5 meters wide, where a grab sample yielded 9.67 g/t gold;

- A sample from a large boulder of quartz vein, which assayed 42.4 g/t gold, expanded the main high-grade float train identified in phases one and two, on the east side of Granite Creek;

- A sample from a northeast striking zone of quartz vein float surrounded by oxidized breccia that is located 60 meters west of, and parallel to, the main high-grade zone on the east side of Granite Creek, yielded 12.45 g/t gold;

A 1-meter wide chip sample across a quartz vein and altered quartzite wallrock exposed in a trench on the west side of Granite Creek, returned 9.9 g/t gold; - Float samples from other new areas of mineralization yielded 28.9 g/t gold, 14 g/t gold, 9.68 g/t gold, 8.7 g/t gold with 115 g/t silver, 4.36 g/t gold with 180 g/t silver and 1.83 g/t gold with 328 g/t silver.

During these preliminary phases of exploration, visible gold was encountered in the sampling process, but get this…

More visible gold was identified during phase three; however, keeping with previous phases of work, no samples containing visible gold were sent for analysis.

Most companies would have assayed the visible gold (VG) samples and trotted them all up and down Howe Street with great fanfare. Not this crew. They know the visible gold represents an anomaly that may not be indicative of the overall mineralized zone.

This is a conservative crew. It’s refreshing to see this level of professionalism and discipline.

I’m curious to see how Strategic intends to advance this project further. If they option it out, it likely won’t go cheap.

They may decide to use some of their working capital to drill Hinton solo.

Speaking of working capital, the company has $29M, a combination of cash and marketable securities in its coffers.

Their stock portfolio can be perused here.

The company also holds royalties on a number of projects.

This is another Yukon ExplorerCo to watch.

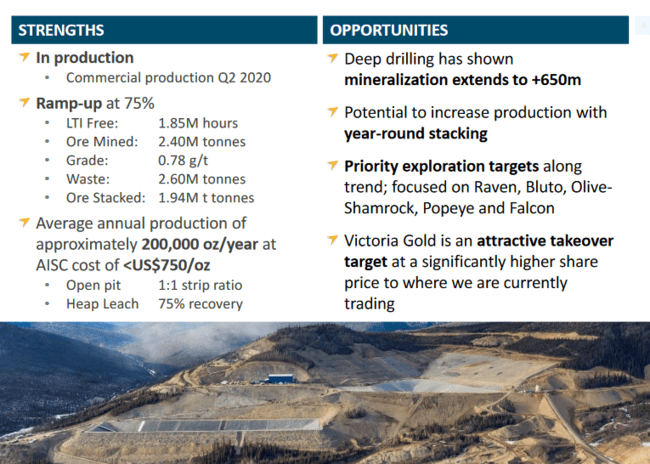

Victoria Gold (VIT.V)

Investor presentation (scroll down, right side of page)

- 57.23 million shares outstanding

- $382.27M market cap based on its recent $6.68 close

Arguably, the biggest event in the Yukon this year, or over the past few years, was the transition of Victoria’s Eagle Gold Project from the development stage to an operating mine.

Construction was completed in early July, one month ahead of schedule, and the ramp up to production began in September.

On Sep. 13, with much fanfare, the company’s first gold pour was captured live. This milestone event can be revisited here.

Exciting times for everyone involved, for sure (I would’ve been tossing back the grape too).

Eagle Gold is expected to produce 200,000 ounces per year at an AISC of less than US$750 per ounce Au.

Reserves stand at 2.7 million ounces of gold. Mine life = 10+ years.

The deposit contains a constrained in-pit Measured and Indicated resource of 3.6 million ounces at a grade of 0.63 g/t Au.

Significantly, the deposit boasts a very favorable stripping ratio of less than 1:1. The lower the ratio, the better the economics.

Interestingly, but not surprisingly, the company chose to consolidate its shares 15 for 1.

The reasons for the consolidation…

Greater investor interest – As a new and growing gold producer, Victoria is expected to appeal to many new investors. The primary motive for the equity consolidation is to expand the eligibility of Victoria common shares for institutional investors, stock exchanges, indexes and investment funds, including exchange traded funds. With the increasing prevalence of passive trading rather than active fundamental investing, we intend to ensure that Victoria is not prohibited due to minimum share price screening.

Just last week, on Nov. 25, the company dropped the following update on production:

Victoria Gold: Eagle Production Surpasses 10,000 Ounces of Gold

If annual production guidance is met, VIT should do well in a rising gold price environment (extremely well).

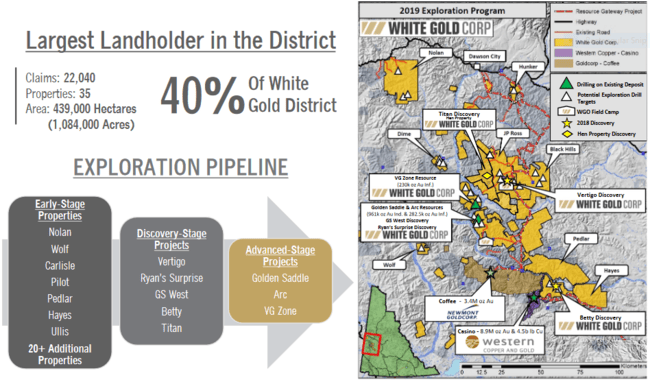

White Gold (WGO.V)

- 122.9 million shares outstanding

- $121.67M market cap based on its recent $0.99 close

The company boasts a portfolio of 35 properties covering over 439,000 hectares, representing over 40% of the Yukon’s White Gold district.

This is a district that has seen roughly 7 million gold discovery ounces in recent years.

Gold resources at the company’s flagship Golden Saddle & Arc deposits contain 1,039,600 ounces Indicated (2.26 g/t Au) and 508,700 ounces Inferred (1.48 g/t Au). Their VG resource contains a further 230,000 oz Inferred ounces grading 1.65 g/t Au.

There’s room to grow ounces here—the Golden Saddle deposit is open for resource expansion at both ends.

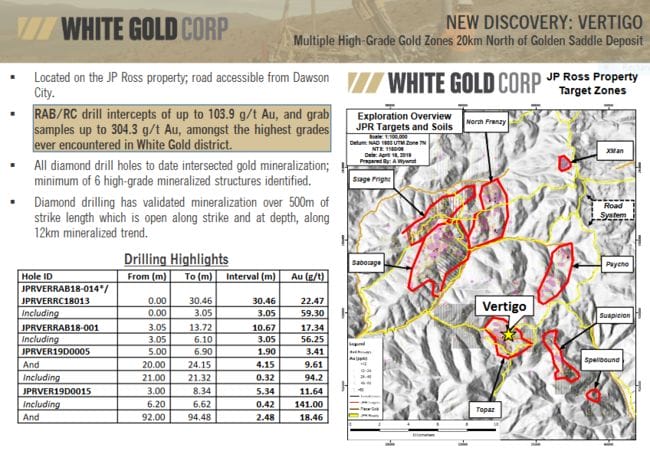

Discovery potential

Multiple high-grade discoveries across the district include:

- Vertigo with 23.44 g/t Au over 24.38 meters;

- Ryan’s Showing with 20.64 g/t Au over 6.09 meters;

- GS West with 2.97 g/t Au over 10.0 meters;

- Betty with 1.08 g/t Au over 50.29 meters.

On March 14th of this year, the company announced a $13M fully funded exploration program focused on probing its Vertigo discovery, increasing its resource ounces at Golden Saddle and VG, and scouring its massive White Gold land package for new discoveries.

Exploration program details:

- Vertigo Target: a 10,000 meter diamond drill program designed to evaluate geometry as well as the lateral and vertical continuity of mineralized structures discovered in 2018. Additional reverse circulation (“RC”) drilling to evaluate strike potential of mineralization based on field mapping, geochemistry and geophysics;

- JP Ross regional activity to include evaluation and initial drill testing of 4 to 5 additional target areas on the 14 km trend;

- Golden Saddle deposit to be expanded with 4,500 meters of diamond drilling conducted on GS West discovery, with 1,500 meters of infill and step-out drilling on the Arc deposit;

- Regional activity on the White Gold property to include evaluation and initial testing of 3 to 4 additional regional targets with RC/RAB drilling;

- Regional exploration activities on other properties to include over 15,000 soil samples, 1,000 GT probe samples, geologic mapping and prospecting, IP-Resistivity, LiDAR and other baseline exploration work for the continued identification and building of targets;

- Initial work including GT Probe sampling set to commence in April 2019 with diamond drilling anticipated to commence in May 2019.

This is an aggressive exploration campaign.

As you can imagine, a large volume of newsflow was generated with all of this exploration activity.

On June 10th, the company announced a 25% increase in its White Gold Property resource – 1,039,600 ounces in the Indicated category, 508,700 in the Inferred category.

On July 11th, the company announced the discovery of (multiple) new—potentially district scale—mineralized trends across its JP Ross property.

On August 8th, Golden Saddle step-out drilling results:

- GS Main zone extended 205 meters down dip from historic drilling.

- Hole D0198 returned 3.59 g/t Au over 68.0 meters from 73 meters depth.

Additional high-grade structures at Vertigo were also highlighted in this news release:

- 11.64 g/t Au over 5.34 meters.

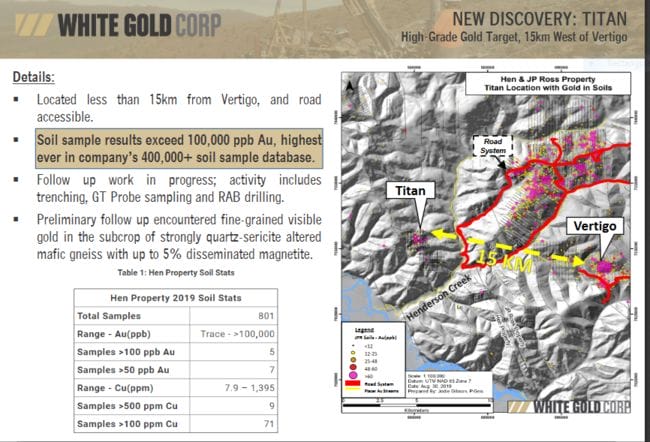

On Sep. 5, the company dropped news of a new high-grade discovery 15 kilometers west of Vertigo.

Highlights:

- New high-grade gold discovery on Titan target, Hen property. Results exceed 100,000 ppb Au, highest ever in the company’s 400,000+ soil sample database; located less than 15km WNW from Vertigo discovery;

- Preliminary follow up exploration encountered fine-grained visible gold in the subcrop of strongly quartz-sericite altered mafic gneiss with up to 5% disseminated magnetite;

- Multiple new high priority targets identified. Soil sample results include; Nolan property up to 525.3 ppb Au, Wolf Property up to 247.2 ppb Au, among others;

- Over 13,300 soil samples have been collected on 12 of the Company’s regional properties this season;

- Follow up work on the Titan and other regional targets is in progress; activity includes trenching, GT Probe sampling and RAB drilling, with results to be released in due course.

The following exploration updates were released between September 25th and November 25th…

72.81 g/t Au over 6 meters is a solid hit (super solid).

There are a lot of moving parts to this story. Know that the White Gold Team has a lot of depth—a lot of geological talent— to move these projects forward.

Clearly, this is one to watch.

That concludes our Yukon coverage.

One final thought

If gold does what I think it will do in H1 of 2020, expect this group to come outta the gate swinging next season.

We stand to watch.

END

Greg Nolan

Full disclosure: none of the ExplorerCos featured above have a marketing relationship with Equity Guru.