Falcon Gold (FG.V), a company we featured in some detail a few months back, has been busy positioning itself in a region known as the High-Grade Gold Capital of the World—the Red Lake Mining Camp of Ontario.

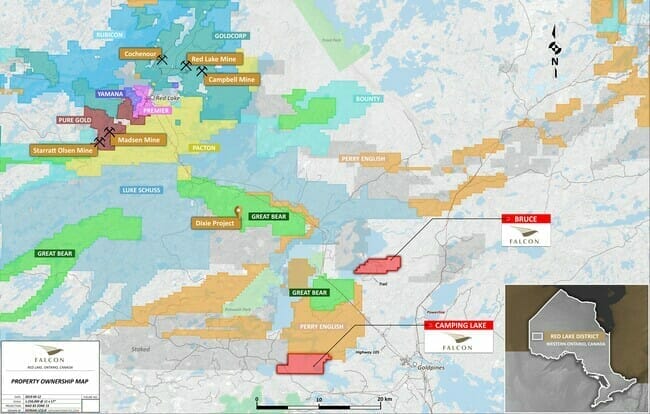

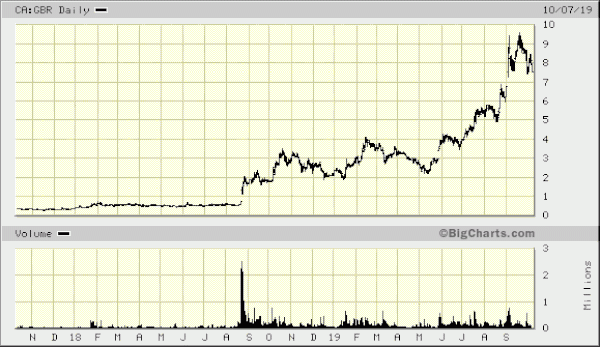

Recent high-grade discoveries at Great Bear’s Dixie Project in the Red Lake camp have generated a remarkable price trajectory for loyal shareholders—the kind of flight path every resource investor should experience at least once in their lifetime.

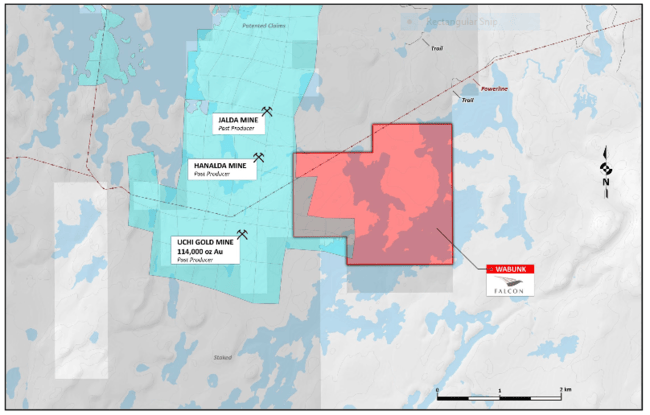

Falcon already had a foothold in the region when we first checked it out. Additional staking around its Wabunk Bay gold and base metal property brought its interest in the region, directly and indirectly, to roughly 625 hectares.

An initial sampling campaign was conducted on the property during the summer…

“Sixteen grab samples were collected. Most samples were taken from the medium to coarse grained intrusive rocks which displayed sulphide content and a few samples were collected from the felsic to intermediate metavolcanics rocks and iron formation which could host gold mineralization.”

Assays from these 16 samples are pending.

“The claims are contained within the Birch-Uchi-Confederation Lakes greenstone belt which hosts the world-renowned Red Lake gold deposits and includes the Dixie project currently being drilled by Great Bear Resources (GBR:V). The Wabunk property appears to be hosted within a similar geological formation to the Dixie project.”

Wabunk Project Highlights:

- Claims adjoin the past-producing Uchi gold mine (114,467 ounces of gold (Au) and 14,345 ounces of silver (Ag)).

- A historic 7-meter chip sample returned 1.08% copper (Cu) and 0.40% nickel (Ni).

- Historic drill results assayed 0.62% Cu with cobalt (Co) values of up to 0.33%.

- Surface trench samples ran 0.33% Co over 1.5 meters and 0.15% Co over 7.6 meters—a separate historic 7-meter chip sample returned 1.08% Cu and 0.40% Ni.

- The project occurs within the same greenstone belt as the Red Lake mining camp.

- Gabbroic host rocks have been traced for a strike of roughly 900 meters.

- The primary Cu and Co showings are composed of massive and disseminated sulphides in zones approx 200 meters long by 7 meters wide.

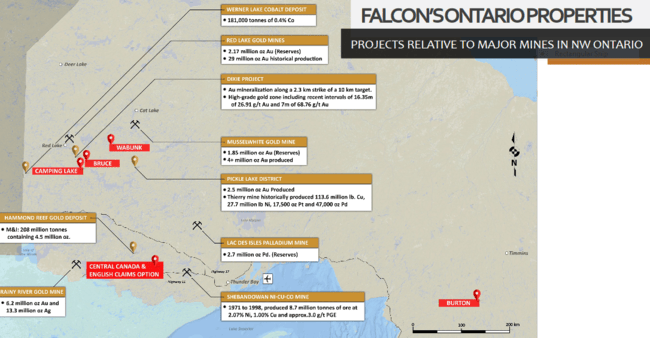

Here’s a falcons-eye view of the company’s project pipeline relative to some of the more notable mines and deposits in the region:

Newsflow…

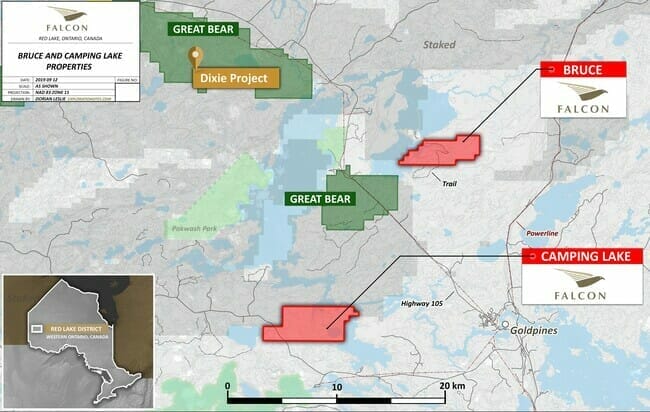

On September 19th, Falcon announced the acquisition of two additional Red Lake properties comprising some 3,642 hectares.

The Camping Lake Property is located roughly 25 kilometers south of Great Bear’s high-grade Dixie gold discoveries.

The Bruce Lake Property is located roughly 20 kilometers southeast of Dixie.

Karim Rayani, Falcon’s CEO:

“We are very pleased to have been able to sign these agreements in the Red Lake Mining District further adding to Falcon’s impressive holding in the area and we look forward to initiating geophysical and prospecting crews shortly.”

Great buy Karim. Nice address.

According to this Sept 19th press release:

“The Falcon claims with their proximity to the Dixie Project are believed to contain excellent targets for Red Lake-style gold mineralization. The Company intends to immediately compile all of the available assessment work to assist in the planning of its inaugural exploration program.”

“The greenstone belt rocks of the Property are Archean-age and may include metamorphosed mafic volcanic and intrusive units, mixed sedimentary rocks and felsic intrusive units. Gold mineralization within the Red Lake camp can reportedly occur in various rock types and can occur in diverse geological settings ranging from stratiform zones to structurally controlled veins. The Company notes that the lack of detailed historical work is as much an opportunity to conduct meaningful programs that may be guided by the successes of neighboring projects.”

CEO Rayani acquired these projects for a song.

Bruce Lake’s price of admission: 500K Falcon commons shares and staged payments totaling $58K.

The Camping Lake deal can get done with 500K Falcon common shares and a mere $65K payment spread out over 4-years.

The vendor will maintain a 1.5% nest smelter return (NSR), on both projects, which Falcon can bring down to .75% at any time up to commencement of production for a payment of $400,000.

It sounds like a great deal to me, especially if Rayani is able to successfully apply the prospect generator biz-model to one or both projects.

This map gives you a much better idea of where Camping Lake and Bruce lie relative to the rest of the Red Lake camp:

This just in…

Management’s deal-making savvy comes to light in this joint venture agreement where International Montoro (IMT.V) can earn a 51 % interest in the company’s 2,200-hectare Camping Lake project.

The Camping Lake properties are located approximately 20kms southerly of Great Bear’s recent Dixie Lake high grade gold discoveries. Great Bear recently reported a series of high-grade targets with mineralized intersections commonly returning bonanza gold intersections in association with coarse visible gold grains.

Between 2010 and 2013, the project was explored by Laurentian Goldfields, Kinross, and Anglo Gold. This work included petrographic studies, diamond drilling, rock-soil-sediment sampling, and IP/Ground Geophysics.

CEO Rayani again:

“We were very fortunate to be able to tie this ground up in one of the most active regions in Ontario. We look forward to working very closely with International Montoro as there success is our success”.

Nicely stated.

This is how it’s done. Take a look at the option terms:

To earn a 51% interest, Montoro will issue 1,000,000 Million common shares upon TSX Venture (Exchange) approval; and 500,000 shares on the first anniversary of Exchange approval for a total of 1.5 million common shares. Montoro will assume Falcon’s staged payment schedule of $ 65,000 over a four-year period.

Montoro agrees to complete a $ 100,000 work program year one in exploration expenditures on or before October 31, 2020; and a further $200,000 (total $300k) in exploration on or before October 30, 2021. Any additional work completed in the first year will be credited to the second – year work commitment.

Upon Montoro acquiring the initial 51%, they have the option to acquire a further 24% interest for a (Total 75 percent) for $ 500,000 in cash.

The agreement contains a 2% NSR, with the original vendor at 1.5 % and Falcon at 0.5%.

Note that Montoro is trading at a slight premium to Falcon, as of yesterday’s close (Oct 22nd).

The 1 million Montoro shares immediately due to Falcon are currently worth $45K. The balance, on the first anniversary of TSX.V approval, is worth another $22.5K.

The staged cash payments due to Falcon completely satisfy the funds owed to the original vendor. Smart.

More importantly, $100K will go directly into the ground over the next 12 months ($300K over the next two years). Very smart.

There’s potential here for the JV to create significant shareholder value over the short to medium term (the generation of high-grade surface samples at a Red Lake project could trigger considerable market interest). And there’s nothing to prevent Montoro from ramping up exploration should early results impress.

Another noteworthy detail of this deal is Montoro taking on the 1.5% NSR due to the original vendor AND giving Falcon a .5% NSR on top of that. Waaay smart.

This deal, aside from curbing the need to raise exploration funds via a dilutive equity financing, puts Falcon, and its shareholders, in a strong position.

Skin in the game

It’s clear Rayani’s interests are aligned right alongside those of current shareholders:

An investment vehicle wholly owned by Rayani—R7 Capital Ventures Ltd—acquired two million units in a private placement dated July 15, 2019. Each unit consists of one Falcon common share and a two-year warrant exercisable at $0.05.

Rayani also waded into the open market in recent sessions taking down an additional 360,000 common shares.

Rayani is now good for roughly 8.9 million shares representing a hefty 14.6% interest in Falcon Gold common.

Skin in the game, y’all.

More…

There’s more to this company than its Red Lake assets. Check out the company’s project page and our recent coverage on the subject.

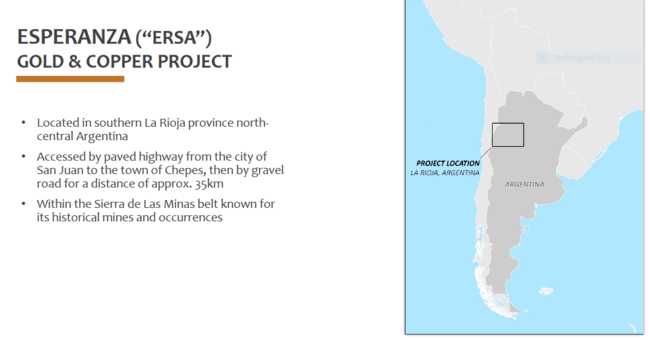

In other recent news, Falcon announced it had executed an amended agreement for the right to acquire a 100% interest in the Esperanza Project in La Rioja Province, Argentina.

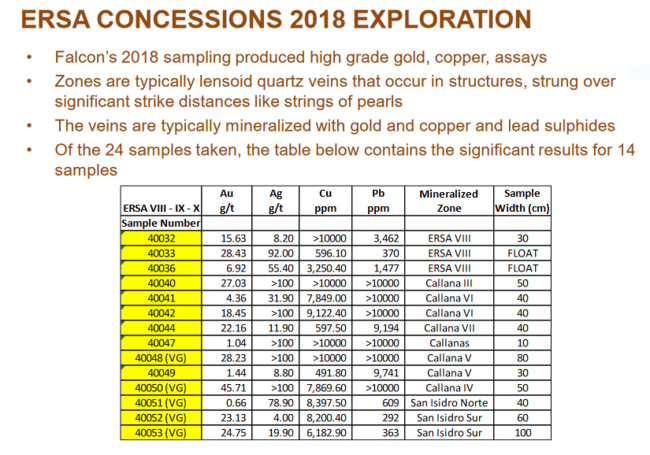

Recent chip sampling along the Callanas zone at Esperanza returned 44.90 g/t Au, 123.2 g/t Ag, and 0.73% Cu over 50 centimeters, plus, 26.07 g/t Au, 424 g/t Ag, and 1.23% Cu over a further 50 centimeters.

An area four kilometers to the east of Callanas returned a 30-centimeter chip sample assaying 15.63 g/t Au. A grab sample in the same area returned 28.43 g/t Au in quartz vein float.

Esperanza is showing some good surface values. Note the Au grades in the table below:

Final thoughts

Falcon has a current market cap of $2.31M based on its recent trading patterns. Its strategic position in the Red Lake camp alone warrants a closer look.

And yes, “we stand to watch.”

END

—Greg Nolan

Full disclosure: Falcon Gold is an Equity Guru marketing client.