On October 22, 2019 CopperBank Resources (CBK.C) announced that it has established a wholly owned subsidiary, CopperBank Royalties.

CopperBank currently controls four copper projects: Copper Creek, in Arizona, the Contact Copper Project located in Elko Nevada, the Pyramid project on the Alaska Peninsula and San Diego Bay, also in Alaska.

CBK’s plan is to augment this portfolio of established copper projects by diversifying into a royalty model of potential cash generation.

What, you may be asking, is a “Royalty Company”?

Royalty companies give cash to miners in exchange for a share of the mine’s future sales.

It’s like lending someone $10,000 to build a bakery – with the baker agreeing to give you 1% of his bakery revenues.

If the bakery never opens, you lose.

If the bakery produces bread for 30 years, you win.

If the price of bread triples, you win.

If the bakery increases production, you win.

Editor’s Note: a “streaming company” is similar but it gets paid in bread, not cash.

If bankers knew how to read drill logs – “royalty companies” wouldn’t exist.

Lacking the geological expertise to accurately assess risk – big banks typically tremble at the knees when they get close to a proposed mine site.

“If we make a bad loan to a one mine company, we own the mine,” stated David Scott, of CIBC Capital Markets in a 2017 interview, “and we don’t want to own mines.”

CopperBank Royalties will be launched with two royalty assets:

- Contact Copper Project located in Nevada

- Copper Creek Project located in Arizona

CopperBank is currently “evaluating other royalty assets for potential acquisition by CopperBank Royalties.”

The details/mechanics of the Contact Copper and Copper Creek royalty assets are still to be revealed.

“The royalty business model is a proven, cost effective way to significantly grow shareholder value in the natural resource space,” stated CopperBank’s CEO, Gianni Kovacevic – who is a legend in the copper space.

“Segregating these two royalty assets into CopperBank Royalties affords us a near zero cost basis opportunity to unlock tremendous shareholder value,” stated Kovacevic who is considering “spinning out the securities of CopperBank Royalties to shareholders and listing the resulting entity on a Canadian stock exchange.”

“The completion of any further royalty acquisitions, or potential spinout transaction and public listing of CopperBank Royalties will be subject to:

- Completion of definitive agreements

- Regulatory approval

- Approval of CBK’s board of directors.

Building a mine is harder than building a bakery. Which is to say: more things can go wrong.

Franco-Nevada (FNV.T) is the biggest commodity royalty & streaming company. It has a market cap of $17 billion and 2018 revenue of $666 million with an operating margin of 30%.

The operating margin is a diagnostic on the core financial engine of a company. It ignores freak expenses (one-time repayment of debt) or windfalls (sale of a building).

That figure of 30% indicates that metal streaming & royalty can be a very good business model.

By way of comparison, General Electric (GE.NYSE), Sony (SNE.NYSE), Starbucks (SBUX.NASDAQ) and Amazon (AMZN.NASDAQ) have average operating margins of 6%.

Historically, big mining companies like BHP Billiton (BHP.NYSE) and Rio Tinto (RIO.NYSE) have scorned royalty deals, because they can raise money in the capital markets. In recent years, that has started to change.

For instance, Goldcorp (GG.NYSE) signed a streaming deal with Metalla Royalty & Streaming (MTA.V). MTA’s share price has doubled in the last two years.

Copper is not currently a “hot commodity” in the retail investment community.

But it is still a thing.

In fact, it’s a rather big thing.

In July, 2019, the International Copper Study Group stated that copper demand has exceeded supply by 155,000 metric tons in the first four months of this year.

Sixty-five percent of the copper that is mined is used in electrical equipment, 25% is used in industrial machinery and the balance is used in construction.

The U.S. manufacturing economy is crippled, so the story (the driver of copper prices) is mostly about China.

In 2017, China consumed 200% more copper than the rest of Asia and more than 400% more than the U.S.

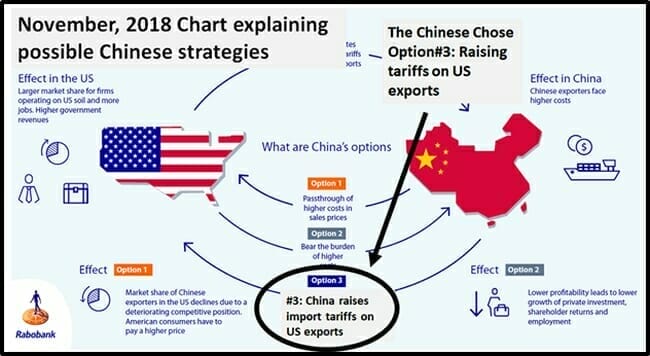

There is a lot of hogwash written about the “U.S-China trade war” – including predictions that the U.S. will “win the trade war” (that ain’t gunna happen).

A 2018 study by Rabobank provides “a forward-looking picture of the detrimental potential economic effects of a U.S-China trade war.”

“China has responded to each imposed US tariff package with a retaliatory package of its own,” explained the report, “The result is that the economic pain that the US inflicts on Chinese exports will be reciprocated by China on US exporters in the same manner.”

When you invest in a royalty company, you are betting that the CEO is a good at shopping (knows how to locate high quality goods at significant discounts).

Kovacevic spoke with Equity.Guru’s Guy Bennett about the wealth-creation opportunity in “the electrification of everything” and his philosophy of “buying from pessimists and selling to optimists.”

A further 5.5% (1.2 million tons) of copper supply disruption is anticipated in 2019. Combined with a “relatively empty global project pipeline”, this may catalyse significantly higher copper prices.

Equity Guru’s Greg Nolan calls CopperBank “a long-term call option on the price of copper”.

Stating that at base metal company is “cheap” is like noting that a cannabis company has “experienced a pull-back”.

ALL base metal companies are cheap.

But at 3.5 pennies, and a market cap of $10 million, CBK is almost free.

Update: on October 22, 2019: 5:20 p.m eastern time, CBK announced that warrants, which were listed on Nov. 7, 2014 had expired the day before. Those warrants are now delisted.

Kovacevic believes that CopperBank’s “organic royalty opportunities within CBK’s existing portfolio of projects” will benefit existing and future shareholders.

Full Disclosure: CopperBank is an Equity Guru marketing client. MTA is a former Equity Guru marketing client.