On October 11, 2019 Barrian Mining (BARI.V) announced that it has staked an additional 40 contiguous mineral claims at its ”early-stage Troy Canyon gold and silver project” located in Nye county, Nevada, about 230 kms north of Las Vegas.

The expansion of the project is part of the option agreement with Brocade Metals, bringing the size of the Troy Canyon project to 493 hectares, which is about the size of Manhattan.

Regular Equity Guru readers know that we have a few gold bulls on the writing staff.

I won’t “out” the others.

The “Bolo Gold Project” is Barrian’s flagship asset, located 90 kilometers northeast of Tonopah Nevada (pop. 2,478). It hosts Carlin type gold mineralization and is fully funded and permitted.

Both the Bolo asset and its feisty little brother Troy Canyon are located in Nevada.

Mining investors like to say, “Grade is King”.

True enough.

But if the King’s castle is located in hostile (anti-mining) territory, the King’s subjects will be dressed in rags.

For all mining projects, location is critical.

Owning a 10-million-ounce gold asset in Venezuela and thinking you are about to be rich, is like learning to play the flute while anticipating being a rock star.

It only happened once – and that was 50 years ago.

In Venezuela the “political discount” is so high that it will render any mineral asset worthless.

Nevada sits on the opposite side of this risk spectrum.

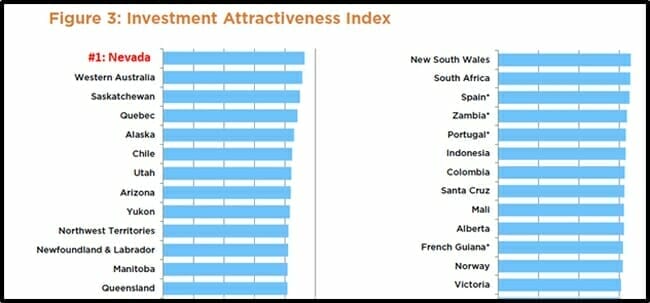

“Saskatchewan displaced Ireland from the top spot this year,” stated the 2018 Fraser Institute Mining Survey, “Saskatchewan was followed by Nevada in second.”

The top jurisdiction in the world for investment based on the Investment Attractiveness Index is Nevada.

Nevada Gold Investment Highlights:

- 225 million ounces of gold mined to date

- 80% of USA gold production

- Home of multiple 20-million ounce gold deposits

- Transparent, predictable and established permitting rules/guidelines

- 22 processing facilities

- Nevada juniors recently bought-out by gold majors

- Modern highway network

- Accessible 12-months a year

Barrian’s staking of 40 new claims is designed to secure the upside of “gold-in-soil geochemical anomalies” observed in 2017 by a previous operator, which were never publicly released.

In total, 791 soil samples were collected at 60-meter intervals. Of the 791 samples, a total of 41 samples returned greater than 20 parts per billion gold (ppb Au), and up to 2.02 grams per tonne (g/t) Au in soil, and up to 36.6 g/t Ag in soil.

“Barrian’s initial data compilation and review efforts have successfully highlighted the potential of the Troy asset,” stated Maximilian Sali, CEO of Barrian, “Encouraged by these results we immediately took steps to secure additional claims.”

The Troy gold-silver project has seen “limited modern exploration” effort by a former small producer.

Small-scale mining began at Troy in 1869. The most recent mining took place from 1948-1950 where 643 ounces of gold and 660 ounces of silver were reportedly produced from 1,859 tons of mineralized rock, at an average grade of 11.83 grams per tonne gold and 12 grams per tonne silver.

“One of the things we’ve been yakking about for months – nay years – is the need for the mining and resource sectors to start speaking to the younger investor crowd,” stated Equity Guru’s Chris Parry in a podcast with Sali.

Parry explained that the short attention spans of millennials, can make it challenging to sell them on the longer time horizons involved in developing a mine.

“I like getting things done fast and I hate waiting,” replied Sali, “The Bolo asset is fully permitted for drilling. We’re not going to have to apply for anything. We have the permits. We have the drill rig ready. We have the water rights. We are ready to go.”

In August, 2011 a new fad called “planking – went viral. That same month, gold hit an all-time high of USD $1,917 an ounce. Over the next half-decade gold plummeted to a 2016 low of $1,100.

Gold has now clawed back to USD $1,500.

In Northern Pesos (CND) it’s close to an all time high of $2,000/ounce.

The planking trend is moving in the opposite direction.

On September 27, 2019 Barrian completed its summer drill program at Bolo, comprising 10 reverse circulation drill holes totaling 1,838 metres. All drill samples are now with ALS Global for gold fire assay and multi-element analysis.

“Drill hole logging by our geological team identified encouraging zones of alteration and mineralization in all ten holes,” stated Sali, “We are confident that it will translate into positive results essential to advancing the Project.”

“Previous RC drill intercepts at the South Mine Fault area include drill hole BL-38 that graded 3.24 grams-per-tonne gold over 30.5 metres within a broader zone of mineralization averaging 1.28 grams-per-tonne gold over 133 metres.

Gold has been roughed the past month, dropping about $50/ounce.

On September 10, 2019, the mini pull-back was called with eerie precision by Equity Guru’s mining expert, Greg Nolan

“A correction back to the $1,400 to $1450 level…would NOT be unusual,” stated Nolan, “It’s only a matter of time—days, weeks, months at most—before gold reasserts itself and tests significantly higher ground.”

“Barrian is a brand-new company trading at .12 with a market cap of $5 million,” we wrote on June 26, 2019, “It’s a little guy with a delineated pathway to being a big guy. The summer drill program is the first step”.

Then this stock – and numerous other gold juniors – started to run.

BARI is now trading at .18 with a market cap of $8 million.

The Troy Canyon “soil sample grades” aren’t mind-blowing, but they aren’t discouraging either.

It’s a bit like wet-fly fishing, when a juvenile trout suddenly jumps right in front of you.

There is an inevitable swell of excitement, but the reality is, your lure is set deeper.

‘Cause that’s where the big fish are likely to be.

– Lukas Kane

Full Disclosure: Barrian Mining is an Equity Guru mining client.