Last week, after telling investors they weren’t going to release their quarterly financials until 8pm Eastern, Canopy Growth Corp (WEED.T) pulled a fast one and tossed them out early, likely expecting we weed investor types would be home asleep, stoned, trying to figure out which Indian joint could deliver a biryani to our laps,when their numbers actually dropped.

Like, maybe they could just sneak them out and we’d be all like, “Hey, weren’t there supposed to be Canopy financials around here somewhere? Oh look, Invictus got rid of Gene Simmons – CANOPY WHO?!”

But that’s not what happened. We weren’t fooled. We were waiting for the punchline, and boy did we get one.

CANOPY GROWTH DRIVES REVENUE WITH 94% INCREASE IN RECREATIONAL DRIED CANNABIS SALES IN FIRST QUARTER OF FISCAL 2020

That’s the headline they went with. Here’s what they followed that with:

- Harvested 40,960 kilograms exceeding expectations in the quarter

- On track to unveil portfolio of value-add, higher-margin products in various form factors in October, 2019

- Increased international medical cannabis revenue by 209 per cent

- Filed 56 patent applications in the quarter,

- Generated net revenue of $90.5-million in Q1 2020

A-MA-ZING! So much good stuff! Thank god nothing bad happened that might be worth mentioning as a negative.

I mean, look at all this text to the right: That’s the second page of the Canopy news release, and it’s all amazing guidance from the CEO about how wonderful next year will be and how great they’re doing.

I mean, look at all this text to the right: That’s the second page of the Canopy news release, and it’s all amazing guidance from the CEO about how wonderful next year will be and how great they’re doing.

That’s a full page of CEO quotes from Mark Zekulin. Not one paragraph, not two, a full page of him going on and on about how it’s wonderful times at Canopy and there’s nothing to see here.

“Fiscal 2020 is going to be another exciting time for the cannabis industry as we close in on the launch of new product formats,” said Zekulin. “Our recent harvests are proof that our focus on operational excellence is working,” he added, NOT BOTHERING TO FUCKING MENTION THE $8M OF WEED THAT HAD TO BE DESTROYED THIS QUARTER.

That’s right: $8m in inventory was just obliterated.

Why? Maybe because this:

$CGC $WEED ♀️ THIS is why you’re sitting on inventory. People have had enough of garbage, and you can’t hide it in capsules/oils either@CanopyGrowth y’all better get your product looking better, and quick https://t.co/EuWtkAREuZ

— Jacqui (@HonieeBean) August 16, 2019

OOPS.

Anything else you want to tell us, Mark? Losing $8m in weed in a quarter is like losing an entire iAnthus (IAN.C) revenue line every quarter. It’s like taking every dollar that company earns and setting fire to it, and then not bothering to mention it when you tell investors how things are going.

IS THERE NOTHING ELSE YOU MIGHT WANT TO NOTIFY US OF, MARK?

ARE YOU SURE?

REALLY?

ARE YOU SURE, MARK?

“In the United States market, Canopy’s team has been actively developing a range of high-quality CBD products and..”

MARK! FUCKING, JUST SAY IT! HOW MUCH DID YOU LOSE?

“This press release is intended to be read in conjunction with the company’s condensed interim consolidated financial statements and management discussion and analysis for the three months ended June 30, 2019”

GAAAH! He’s going to make us read the balance sheet ourselves.

God damn it.

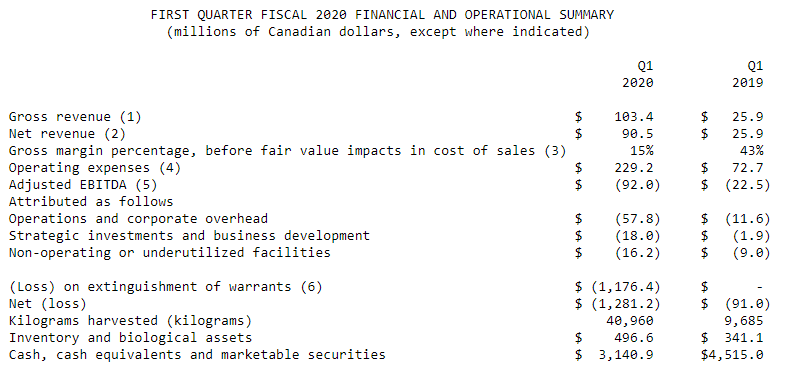

There it is. Gross revenue $103.4 million, adjusted EBITDA, which is a bullshit metric created to make shit look better than it is, is a $92 million loss.

That’s the ‘fireworks’ line, they hope will make you stop looking deeper but you gotta go down page to Net (loss) and find the $1.2 billion figure in brackets next to it and THEN you can properly lose your lunch in disgust.

The Globe notes, “Canopy subtracted $6.4-million from its revenue because it expects cannabis oil and softgel products to be returned unsold.”

It also noted, “Quarterly revenue fell to $90.5-million, down 4 per cent from the previous quarter.”

Canopy SUUUUUCKS. Their finances have always sucked. Their quality has always sucked. The amount they spend on bullshit assets acquired to sell their market cap to ETFs and grandpas has always sucked. Their business plan, to just get big, no matter what, has always sucked because it’s not based on the need to grow, but the greed behind gambling investors, who’ll make their profits on the way up, leaving an unfixable, underwater mess on the way back down.

Canopy is a big stupid loss, every quarter, since inception.

“Revenues are up!” the bagholders say. Losses are up more, say everyone else.

“So many facilities!” the bagholders say. Well, Canopy execs would like you to know its slim gross margins came, in part, from “having to run the facilities while they were not producing product.”

“Most of the billion was in one-time losses stemming from adjustments made to the Constellation Brands deal, the bagholders say. “So you guys take the loss so Constellation doesn’t have to?” asks everyone else.

Canopy sucks. I used to say it back in 2013, and for much of the same reasons, and it still applies today. Linton should have been dethroned the day the Constellation deal was announced, but nothing changes at Canopy until the last person in the room agrees it’s on fire.

Here’s my only problem with that: Canopy hurts everyone else.

Let’s not pretend the sector didn’t need the break up with Bruce Linton/$CGC.

The time has arrived where cannabis stocks should begin trading on their own merit, not up or down depending on which way $CGC is moving.

Buy quality not hype.

— Troll of Weed St. (@WallStTroll) August 14, 2019

Sure, you can claim they built the sector, that many of the big valuation runs in weed have stemmed from Canopy driving up hardest in the #1 spot. But that’s not a feature, that’s a bug.

[contextly_sidebar id=”GKAny9ayOdt0ZaiBG2WSxCbHDPDqaRxd”]As Canopy rose and grandpa and First Time Fred, and I’m a Genius Now Gerry, and Daytrader Donna, and Institutional Ian, all ran their portfolios up on the rise of Canopy’s bubble, Aurora (ACB.T) decided they had to keep up, and got in their own financial quagmire. And Aphria (APHA.T) grabbed at foreign assets that they’ve admitted they overpaid for, and CannTrust (TRST.T) clearly felt the pressure to perform, to the point where they unintentionally put their entire company at risk while intentionally breaking the law, and others in the gutter end of things – what’s up, Wayland Group – literally bought fresh air dressed as assets to keep their valuation moving.

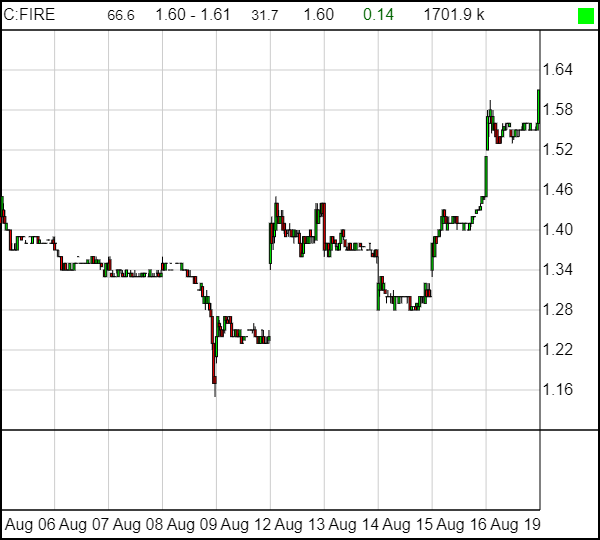

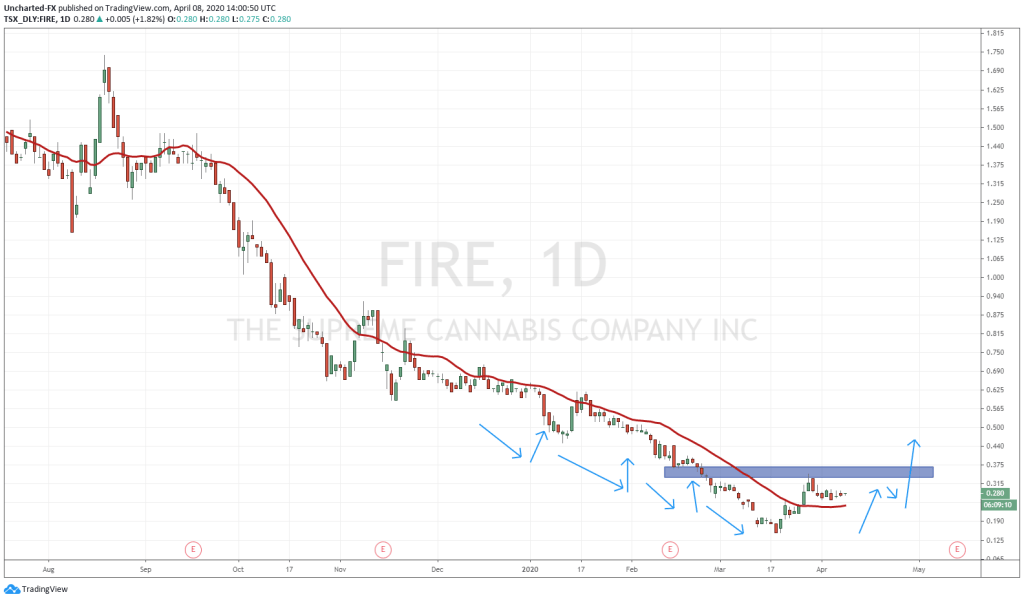

Others still – such as Supreme Cannabis (FIRE.T) took their own lumps because they WEREN’T playing the same game as Canopy and building shit they didn’t need, at prices that would one day hurt them.

That’s been the weed scene for the last few years; You were either juicing your stats and using your share count as play money, or you were being beat up for not juicing your stats and using your share count a play money.

Now, things are turning the other way. The figurative cheques that were being written by LPs that their asses couldn’t cash are now literal cheques that you might not want to present for a few weeks, perhaps just give Anita in accounting a call before you go to the bank, no big deal, thanks.

You know what IS a big deal?

GROWN UPS WITH GROW OPS.

Supreme Cannabis is fucking you up, marijuana red scare.

From $1.15 a week ago to $1.60 as I write this, Supreme, which has made its reputation as the guys who WON’T spend big money on an asset they might not need, that raised money cheap and still have the money today, which has long been run by one of the most knowledgeable, amiable, intelligent guys in the business and just recently added more of the same to the C-suite, a company that DOMINATES on the quality front in a way few can match… yeah, that Supreme, which runs numbers that are close enough to profitable that Canopy’s ‘lost weed’ inventory would turn them green in one fell swoop.. That Supreme is on a run.

And:

I told ya, boy. I said it straight up, even got chewed out on Twitter for it.

I said it TO THE DAY.

With the weekend upon us for folks to look at that share price and see some opportunity, it’d be smart to watch the early Monday morning trading as investors decide whether they’re smarter than the robot buying up all the TRST stock, putting a 50% jump on its formerly depressed share price, even though it may be worth a lot less if they lose their Health Canada licensing in the coming days.

If you did this, if you took us at our word, you’re having a monster month.

Because, this:

Supreme is a company we at Equity.Guru believe in, and have since its inception. In a short term sense, today was a terrible beat down. But if you believe this is a company that has built a reputation, and a team, and a facility that is worth well more than the $343 million assigned to it currently, then warrants shouldn’t give you pause for thought.

This too shall pass. Quality always wins.

That $343 million market cap I referenced above?

It’s $435 million today, just one week later.

— Chris Parry

FULL DISCLOSURE: Supreme Cannabis is an Equity.Guru marketing client.

Nice article Chris.

Held this for a few years now. Happy to stay with solid companies.

On another note, VINERGY has finally started trading again with little/no news….would love to hear your views on this.

Cheers

I was told there’d be news. I”m annoyed there isn’t.

What’s going on with my investiments!

Why has Canopy Growth lost 50%?

Carlo, Canopy’s Q4, 2019 financials revealed a net loss of $323 million Canadian dollars – which is about $41 loss per second. That could be one reason. Another reason is that lots of investors bought shares of Canopy just because it was big. That made it bigger. $22 billion valuation? There was nowhere to go but down.