Reading this week’s political headlines, you’d think the media had just unearthed hidden-camera footage of Prime Minister Justin Trudeau in a Shanghai strip bar – pockets bulging with gold coins – giving a hand-job to the CEO of the China Petroleum Corporation (中国石油天然气集团公司).

“Will Trudeau take responsibility for ethics breach?” – Ottawa Citizen.

“Trudeau violated the law” – Washington Post

“Ethics watchdog rules against Trudeau” – Taipei Times.

“Conflict of interest violation unprecedented” – Bloomberg

“Trudeau’s political scandal has returned” – Vox.

The salacious “scandal” is this: a Quebec-based engineering firm bribed local business leaders in Libya. They got caught and were due to be tried in a Canadian court under the Corruption of Foreign Public Officials Act.

If found guilty, the firm would be banned from Canadian government contracts, likely resulting in the loss of thousands of Quebec jobs.

Trudeau put pressure on his elected justice officials to go easy on the engineering firm. When they pushed back, he expelled the officials from the liberal caucus. They went to the media and played the victim card. Shit blew up. An ethics commission was formed. Trudeau was expecting to be exonerated. He wasn’t.

They commission said he fucked up big time.

Trudeau-haters hoping to witness a Prime Ministerial melt-down of self-recrimination, were sorely disappointed.

The young Prime Minister, famous for saying “sorry” – told them to go suck it.

“You apologize when you did something wrong,” stated a combative Mr. Trudeau in an interview with The Globe & Mail, “I did my very best to stand up for Canadian jobs.”

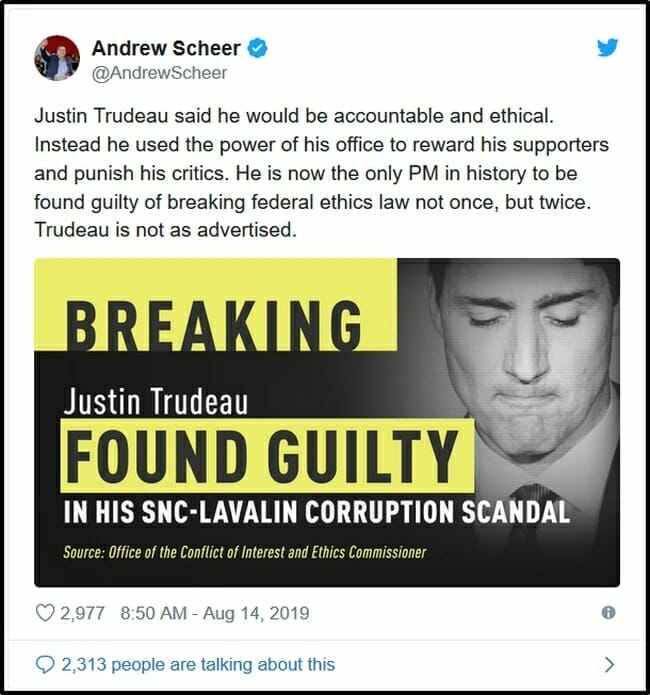

Conservative party leader, Andrew Scheer disagreed.

Was Trudeau really just “standing up for Canadian jobs”?

Probably not.

There is the little matter of votes.

He gets lots of them from Quebecers.

Trudeau’s ill-advised political interference has a whiff of political expediency.

But a true ethics scandal requires a much stronger element of self-dealing.

Luckily, the Canadian junior stock exchanges provide a plethora of authentic ethics scandals – featuring all manner of deception and greed.

So let’s re-acquaint ourselves with some really unethical characters.

Exhibit A: Adam Bierman and Andrew Modlin

MedMen (MMEN.C) is a Canadian-listed cannabis dispensary company founded by two greedy little scoundrals, CEO Adam Bierman and President Andrew Modlin.

On May 28, 2018, Equity Guru principal Chris Parry dug into the company’s financials and revealed the mass-castration of MMEN shareholders.

“This MedMen (MMEN.C) deal is rank AF.” – Chris Parry

The greediness that Parry unearthed foreshadowed a pattern of MMEN execs using the company as an ATM, and generally acting like assholes.

Brent Cox and Omar Mangalji sued MMEN after $179 million dollars worth of shares got locked up by Bierman and Modlin who control most of MedMen’s voting shares.

After facing stalling tactics by MedMen, on June 5, 2019 Cox and Omar Mangalji switched strategies and announced that they had “filed a demand for arbitration in place of its pending lawsuit.”

Ex-CFO James Parker is also suing MMEN claiming that Bierman and Modlin called him “fat and sloppy”, a “pussy-bitch” and also referenced L.A. City Councilman Herb Wesson as a “midget negro” and a rep. of the Drug Policy Alliance as a “fat, black lesbian” and various female foes as “cunts.”

Parry has embarked on multiple Deliverance-style canoe trips, and seen some nasty shit go down in the deep woods.

“The Canadian venture capital markets is a rank pit of vipers that live by sucking on the lifeblood of the foolish,” stated Parry in one of his merry moods, “recycling shit into prettier shit, and tapping grandma on the shoulder repeatedly for a financial refill.”

But even Parry was stunned by the brazenness of these two piglets.

Exhibit B: Anthony Jackson.

The African Spotted Hyena uses an attack-mode called Swarm Intelligence – to disorient and overwhelm its prey before ripping off chunks of its flesh.

The Toronto Venture Exchange (TSX.V) and CSE are a Savannah crawling with their own pack of Spotted Hyenas.

Their name is Bridgemark Financial – a gaggle of villains closely tied to a man named Anthony Jackson (CPA).

Over the years, Jackson has entered and exited CFO positions in a galaxy of publicly traded companies including, Greatbanks Resources, Katipult Technology, Dorex Minerals, Global UAV Technologies, Crystal Exploration, Sandfire Resources America, Coronet Metals, Oil Optimization, Montego Resources, Metropolitan Energy, Kaneh Bosm, Tiller Resources, Mediterranean Resources, Altan Rio Minerals, Eyecarrot Innovations etc.

When Jackson exits, the companies are usually bleeding from mortal wounds.

The investor-rights group, #AllSharesMatter claim that there are 15 more members of the Bridgemark pack, though Jackson is always in the thick of it.

@anon: Why are all of these companies using 1199 West Hastings Street Vancouver? Who is Anthony Jackson? Who founded Bridgemark? Why are social media and websites being scrubbed and erased?

@DogsFerDev: Plenty of snickers about Anthony Jackson and Bridgemark. Their roots in the Vancouver market run deep and the stories of people they’ve fucked over are endless.

Jackson’s MO is to buy zombie companies from his friends with shareholders’ money, and then then split the profits with his friends.

It’s ugly, unethical, but highly lucrative.

Exhibit C: Ben Ward

Newsflash: When you fuck up, the best policy is to say, “Sorry – I fucked up” and move on.

Nine months ago, Wayland Group (WAYL.C) CEO Ben Ward took to social media and accused Equity Guru of tying to extort money from him.

That’s like tweeting that a brain surgeon has the tremors.

“At Equity.Guru, we have spent several years building our reputation as straight shooters, at a cost to our bottom line,” confirmed Parry, “When we sell a stock, we tell you about it first, then give it 24 hours so you can sell first. When we are asked to engage with a potential client, we often refuse if we believe the company has no upside, or the people behind it are thinking ‘short term promote’. That costs us real money, but we consider it an investment in our reputation – and a protection of our readers’ wealth. And that’s important because our reputation is literally our business model.”

Mr. Ward got his wires crossed.

“I’ve never spoken to Ben Ward,” explained Parry, “Had no story about him planned. We don’t work for short sellers. We don’t blackmail. And we don’t extort.”

Ben Ward chose not to apologise and it cost him dearly.

An epic Equity Guru article entitled “Shell Game: How Wayland Group (WAYL.C) built a paper empire and the loan that may drag it under” – put Ben Ward in the spotlight at time when he would’ve been better off hiding in the shadows.

“We pointed out exactly what Ben Ward is, what he does, and why you should care,” stated Parry, “We predicted the stock collapse on the back of the death spiral financing, we reported accurately that work had all but stopped on site over finances, that the Australian deal (now canceled) was bullshit, that the other foreign deals were likewise, that WAYL had no money to move them forward etc.”

Since the publication of that article, Wayland stock has been halted on the Canadian securities exchange, and Ben Ward has been fired.

Fake charities, scam universities, tax fraud – these bad-ass ethics scandals are “as American as apple pie”.

In 1972, CBC radio host Peter Gzowski held a contest to complete the phrase: “As Canadian as…”.

CBC received 30,000 entries.

The winner?

“As Canadian as possible under the circumstances.”

If “Prime Minister breaks rules to save Canadian jobs” is the best ethics scandal we can come up with “under the circumstances” – thank God we’ve got the junior Canadian venture markets to set more ambitious standards for villainy and self-dealing.

– Lukas Kane

Full Disclosure: Equity Guru has no financial relationship with any of the companies mentioned in this article.