Cannabis investors are a different breed. They’re amped way higher on positivity, cynicism, self belief, and sorrow, prone to the sort of mania that baseball card, Cabbage Patch Kid, and tulip enthusiasts know in their plums.

When cannabis investors love a stock, there’s almost no amount of negative due diligence, blown up market cap, or profit there for the taking that can sway the HODL outlook.

And when they’re not into a stock, be it for reasons real or imagined, even years of good news can sometimes struggle to break through.

This pack mentality ultimately saved Aphria (APHA.T) back when it was alleged to have been paying absurdly high valuations for marginal assets CEO Vic Neufeld had a financial involvement in, allegations that the company never fully refuted and which, eventually, took the CEO out of a job.

That situation, when Aphria stock pulled out of its nose-dive and faced no regulatory penalties for its largesse, leading investors with a gambler’s risk tolerance to make solid gains, has given some retail investors a sense that big LPs are ‘too big to fail’, no matter what they’re caught doing.

That has some basis in fact.

In the spring of 2014, RCMP officers in Kelowna, B.C. prepared a press release about a big drug bust at the local airport. It described how investigators had intercepted two shipments of marijuana of “unfathomable quantity” that were bound for a couple of licensed cannabis producers in Ontario. The press release, however, was never sent.

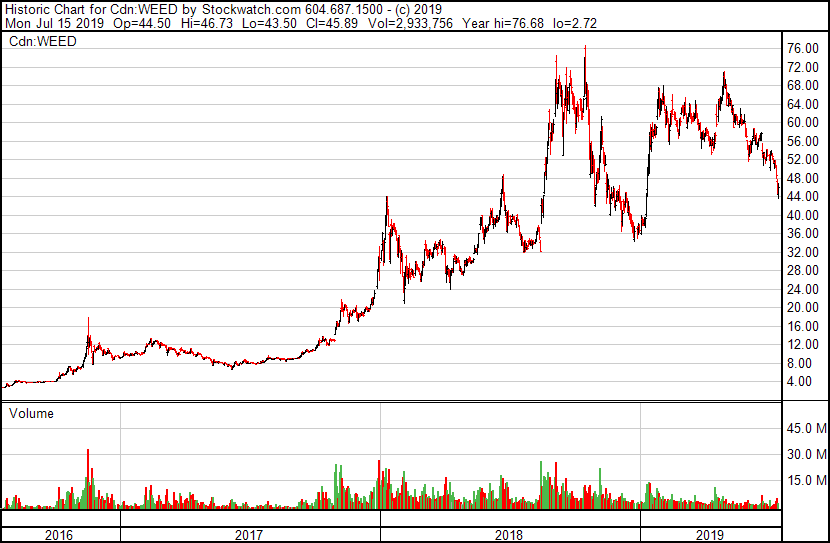

Days went by with a virtual information blackout over what the Mounties had seized and why, even after one of the companies — Tweed Marijuana Inc., now Canopy Growth Corp. (WEED.T) — decided to release its own public statement, containing what some RCMP members perceived to be “brutally misleading” information about the seizure.

And then there was Organigram (OGI.V):

A class action lawsuit targeting Canadian licensed medical marijuana grower Organigram has been approved to proceed to trial by the Nova Scotia Supreme Court.

The suit stems from product recalls that took place between Dec. 28, 2016, and Jan. 9, 2017, in which Organigram said banned pesticides, myclobutanil and/or bifenazate, were discovered in some of its medical cannabis.

Other than the forced recall, Organigram pretty much skated.

As did Mettrum, which was busted after Canopy had bought it and, essentially, shelved.

A federally licensed medical-marijuana company recently caught selling cannabis that contained a banned pesticide had used the dangerous chemical on its plants as far back as 2014, which it hid from Health Canada, says a former employee of Mettrum Ltd.

Thomas McConville, who worked as a grower at Mettrum from early 2014 to August, 2015, told The Globe and Mail he witnessed employees at the company illegally applying myclobutanil to plants, despite knowing the controversial pesticide – which produces hydrogen cyanide when heated – was prohibited for use on cannabis.

To evade detection when Health Canada inspectors visited the operation, an employee at Mettrum hid the chemical inside the ceiling tiles of the company’s offices, Mr. McConville said.

The established habit of Health Canada letting large licensed producers slide for doing things that would land you and I in prison has arguably had two effects, neither of which are good outcomes.

They’ve managed to convince executives it’s okay to break the law, and ask for forgiveness rather than permission. And they’ve managed to convince investors that a company doing the wrong thing – even for six months, even in the most egregious way – will eventually get away scot-free and can be invested in as a bargain buy.

That’s why TRST stock was up 19.2% today, to $3.98 from $3.27.

The dead cat bounce, when a company has a day of green following a substantial fall as folks take a stance that it dropped too hard previously, is a real thing. But this was more than an ex-kitty hitting the pavement from the 8th floor, this was a wall of roulette gamblers going all in on red because it’s come up black the last two times.

Yes, TRST may rally from here. And yes, they may not lose their license for hanging fake walls to disguise the fact they were growing, and packaging, and selling unlicensed weed. Yes, the CEO and President may even skate by without being fired, let alone jailed. Sure, the class action lawsuits may never go forward.

But they might. And that license may well end up disappearing.

If Health Canada takes this as the affront it damn well is, if they notice how bad it makes them look, and how crappy it makes the system they oversee look, and what damage it may do to the share price of every TRST competitor – if they realize their previous actions haven’t brought about the industry-policing-itself answer they were apparently hoping for, TRST simply MUST lose its license.

And if it does, investors will get CREAMED.

If CannTrust is told to move a license or lose the license, as happened with Ascent Industries (ASNT.C) and privately held Bonify, investors will get CREAMED.

If it is even given a window in which it is told to explain why it shouldn’t lose its license, investors will get CREAMED.

Let’s be clear: If CannTrust doesn’t lose its license, every LP should IMMEDIATELY assume the rules don’t matter, and simply do as they damn well please.

Because this current mindset that bigger LPs get a free pass while the little guys die, and that we can’t kill an LP because the market is undersupplied, absolutely penalizes the companies that spend extra time, money, effort, IP, and sweat playing by the rules Health Canada says are essential.

My suspicion is, Health Canada will use this most recent corner cutting by TRST as a teachable moment for other LPs, and when that happens, there will be no warning. If there’s one thing Health Canada does well, it’s operational silence.

It also drops news on a Friday afternoon, so if you’re stuck in TRST at the wrong time, you’re going to have a whole weekend to sweat.

Back when I had a restaurant a few years back, we asked the local liquor inspector what paperwork we needed to do in order to be able to run a trivia quiz once a week, after he informed us our license didn’t allow for such things.

“A ten foot sign out front for three months, a door knocking campaign telling neighbours you’re changing your license and inviting them to object, and two full page newspaper ads. Non-refundable deposit.”

I then asked what would happen if we just went ahead and ran trivia quizzes without all that.

“I dunno,” said our inspector. “Someone who gives a shit might object or something..”

It would be nice if Health Canada gave a shit or something, and we got back to a place where following the rules was rewarding, and not a waste of time and energy.

Either that or just deregulate the whole damn market and be done with already.

— Chris Parry

FULL DISCLOSURE: Supreme Cannabis is an Equity.Guru marketing client