Bitcoin had already begun its ascendancy in September 2017, pushing well over USD$5,000, so it was big news when Frank Giustra-backed HIVE Blockchain Technologies (HIVE.V) inked a strategic partnership with Genesis Mining to operate up to five blockchain data centres for the mining of digital currency.

Genesis Mining touts itself as the world’s largest cloud-based crypto-currency miner. The Mining as a Service (“MaaS”) provider currently lists over two million users.

HIVE purchased a freshly installed data centre in Reykjanes, Iceland for $9.0M. The partners would then operate under a master service agreement (“MSA”) which gave Genesis approximately 30% of HIVE issued and outstanding shares.

But as time went by, relations soured between HIVE and its largest shareholder, with HIVE management accusing Genesis of attempted boardroom coups and material breaches of the MSA.

In April, 2019, HIVE announced it was owed $50 million and made known its right to terminate the MSA with cause, which would force Genesis to repurchase the mining equipment HIVE picked up in the original agreement.

HIVE’s mining rigs in Sweden went dormant as a result of the litigious confrontation and remained that way until today when HIVE announced it had managed to find a resolution outside of the courtroom.

The settlement agreement was reached based on initiatives to improve both communication and transparency and will see the reboot of HIVE’s 20.4 Megawatt facility in Sweden with 14,000 GPUs mining Ethereum.

This new deal comes in the wake of another crypto-currency surge as Bitcoin once again seeks to break the $10,000 mark – the timing couldn’t be better, as long as this isn’t another crypto bubble.

“I am pleased that we have been able to reach a settlement agreement that focuses on peace and prosperity for both companies and enables management to return to creating value for HIVE shareholders,” said Frank Holmes, interim executive chairman and interim CEO of HIVE.

But does this reconciliation mean anything for shareholders or is it just another case of a me-too crypto-miner trying to catch a train that has already left the station?

Further to the deal, HIVE will either assume direct management of its GPU mining assets in Sweden and Iceland, or pass off that responsibility to a new service provider. Genesis will ensure there is a seamless transition.

Genesis is also getting the board shuffle it desired. As part of the agreement, Marco Streng and Bjorn Arzt will resign as directors of HIVE and any of its subsidiaries. Genesis also retains the right to nominate one director over the next three years as long as it continues to hold no less than 10% of HIVE’s issued and outstanding shares.

HIVE continues to pursue its strategic agreement with Argo Mining to bring Argo’s MAS solution to institutions on the heels of the new FAFT regulation passed last week.

Like cannabis, blockchain and crypto-currencies live with one foot in reality and the other in a far off fantasy land where everyone is a millionaire and the possibilities are endless.

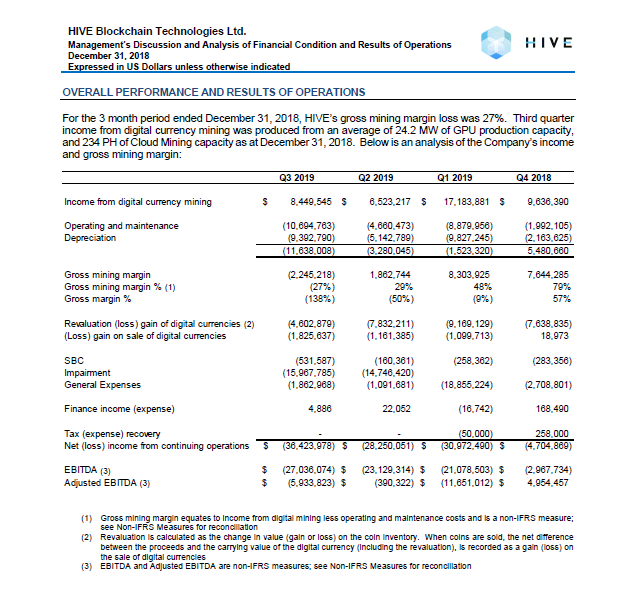

A quick look at HIVE’s bottom line and a different picture comes into focus.

Brackets indicate a negative number, so the bottom line is less than reassuring that this company is able to do anything beyond acquiring other entities. I suppose we should be thankful there aren’t any goodwill lines in this like Aurora Cannabis (ACB.T), but the impairments for the first and second quarter of 2019 don’t bode well, even if you take the Genesis squabble into account.

Since the world switched to International Financial Reporting Standards (“IFRS”) from Generally Accepted Accounting Principles (“GAAP”), financial reporting has become more art than science and continues to fuel the ridiculous disparity between earnings and market cap.

Is this a good deal? Will settling this argument bring value to shareholders or is it just another song and dance to prolong an inevitable market correction? Tough to say.

Rick Rule was quoted in a recent EG podcast as saying that he couldn’t see the value proposition of crypto-currency and since his first foray into the sector has decided to walk away entirely.

Nobody makes money mining crypto-currency. The costs are too great. Miners are dependent on their mined assets gaining value after the fact, which they have absolutely no control over.

HIVE’s model seems to be dependent on this paradigm and no amount of optimism will change that fact. HIVE provides no product, no real service besides exposing you to the risk of crypto-currency valuation.

The other side of the coin is HIVE has tapped into a highly speculative asset class that could, if the world loses its collective mind, surpass all expectations and become the defacto currency, making billionaires while supplanting our current banking system.

Not saying crypto-currency is bunk, but highly overvalued for it actually provides and incredibly speculative. Want a real hedge against an unsure future and a financial safety net if the government/banking system goes south? Buy silver ingots and keep them in your closet.

HIVE Blockchain Technologies bumped CAD$0.02 to settle at $0.47 per share by the end of trading.

Currently the company has 292,752,175 issued and outstanding shares and a market cap of $148 million.

–Gaalen Engen