A fun pair of linked announcements from HIVE Blockchain (HIVE.C). In the morning they announced they had secured the last $65M of their $115M financing agreement with a group of large investors. In the afternoon they announced a big purchase of gear for their Swedish mining centre.

Deal or No Deal?

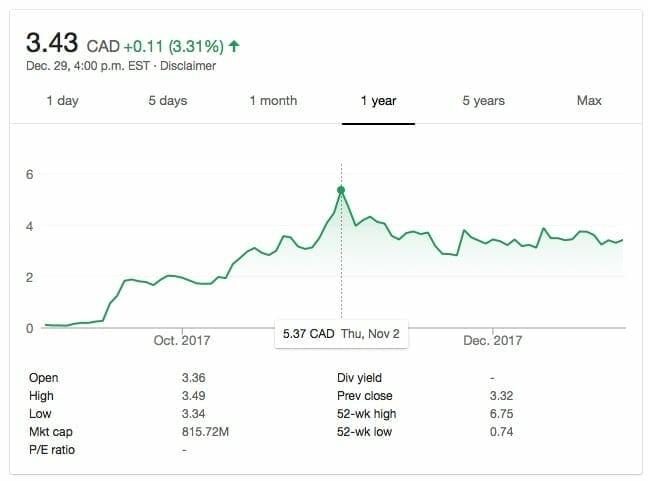

The deal sold share warrants to investors giving an option to buy shares in the company at $3.90 until November 14, 2019. Is this a good deal?

As you can see right now, $3.90 seems far of on the horizon. And yet in November, during the first craze, they crested above $5. So if that was gassy hype, why pony up the dough?

I think these investors recognize, like my fearless leader (Who is the only person I know who is into HIVE in a big way) that HIVE is going places and they’re willing to white-knuckle this ride a little bit because the destination should be very nice.

Vould You Like a Nice Computer Centre to Buy Ya?

So like any young brash upstart flush with cash, HIVE turns around and later the same day announces they are off to close a $22M deal with Genesis systems for their new Swedish data centre.

Sure, the optics of pissing away a third of your money on day one are bad, but if you’ve been following the company, it’s the right move. This deal is more the result of a restless management team that just wants to GO already.

Once the Swedish centre joins their existing Icelandic centre, they will have an awesome amount of mining power available to them. That means revenue from mining, trading and blockchain transactions.

Death and the Other Thing

Really, the only thing keeping me from jumping in with both feet is some of the bigger questions around Crypto itself.

We had quite the internal spirited debate about this yesterday at EGHQ, on the one hand were the fusty old schoolers who insist crypto works like any other asset. On the other were the shining paladins of truth who insisted a lot of the legal and political issues needed to be clarified. (you can guess which side I was on).

I scare people with questions like – Where is BTC taxed? Where it’s mined? Where the company or sub exist? Is cryptocurrency revenue, or is it a product to be sold and the profits counted as revenue.

Everyone has an opinion, not a lot of legal facts on the ground yet.

The Taxman Sayeth

Here’s a rundown of how the Canada Revenue Agency sees BTC and by extension, Cryptocurrency overall. CRA Views 2013-0514701I7 lays out their position. Cryotocurrency is a commodity, not a foreign currency. The CRA sees transfers as ‘Barter’ transactions not as an exchange of legal currency.

Businesses who accept crypto will have to account for it’s fair market value on the day of the transaction. So if you buy my Mace Windu Force FX Lightsaber(tm) for 1 BTC, I pay tax on the $5k it’s worth today (arbitrary number). I hope the BTC market doesn’t crash between now and tax day, or I will be pooched.

The CRA also does not view cryptocurrency as a Canadian Security which exempts this activity from a lot of rules and safeguards other investments may enjoy.

Finally because cryptocurrency is considered a commodity, you get to pay GST/HST/PST when you buy it! Fun!

Some of us here at HQ have been going back and forth on this. On the one hand the cryptocurrency markets will evolve, but maybe the central bankers have enough political clout to keep the regulatory reforms necessary to really get things going.

We got so into the potential range of outcomes, a couple of us decided to collaborate on a piece exploring these questions. Look for it when we can get together long enough to put it down on paper.

Now I’m Scared.

BTC and Crypto is a scary new bleeding-edge investment area. Lots of balls are up in the air. Companies such as HIVE have lots of smart lawyers ensuring they don’t get caught with their pants down.

Even as a commodity, your return on BTC is way better than pork bellies. If you can hack the possibility of a roller-coaster of emotion, then lean into the unknown my friends.

Uncertainty is scary, but it’s a huge opportunity. It was scary to bet on the Telegraph, railroad or Internet, and some folks lost their shirts. A lot of smart people don’t think there’s going to be a huge crazy meltdown in the crypto sector. There are always bumps in the road, an investor with nerves of steel has to be prepared for it.

The current crop of investors are pretty sure HIVE is going to be work $3.90 in 36 months. It’s trading significantly below that right now. So you gotta ask yourself if this isn’t a nice opportunity to get in early.

As always, you need to pick what works best for your comfort zone. I would say that any company making moves like HIVE is one worth exploring.