The Tinley Beverage Company (TNY.C) raised $5,567,219 in a recently closed unbrokered private placement.

This cash infusion will help push out the backlog of Tinley products held back in November for repackaging, as well as the completion of their phase three facility in Long Beach, California, and their intended expansion into Canada and Nevada.

“This financing enables the Company to create and grow market share as we continue to innovate. We can deliver cannabis beverages on a cost-efficient, scaled basis to new and existing consumers in North America’s largest beverage and cannabis market,” said Ted Zittell, a director of Tinley.

In Q3 2018, Tinley shipped over $100,000 worth of beverages to distributors before the California regulators released their packaging requirements for 2019.

The company responded by holding back over $200,000 of their products, including their next-generation Margarita and their Moscow Mule-inspired beverages.

Despite the production halt, nearly all the stores that had stocked Tinley products prior to the shutdown placed new orders, and the company has had to scale up to meet the increased demand.

They started by expanding their phase two Coachella facility in March, raising their bottling capacity to three million units a year.

The company’s facility upgrades at their phase three facility in Long Beach, California, will boost their bottling capacity to 12 million bottles annually, and also provide enough space for two extra bottling lines and beverage formats.

Tinley is looking forward to the future now that the regulatory headache is nearly over by pushing out their inaugural batch of single-serve Tinley Tonics and multi-serve Tinley ’27 cannabis-infused cocktails to dispensaries in California.

Tinley’s goal with their cannabis-infused products is faster onset and more predictable results, according to Rick Gillis, president of Tinley.

Here is Gillis, discussing the Margarita Lime and Moscow Mule products.

Cannabis beverages affect the body in a different way than edibles do.

On average, a pot brownie takes about 45-minutes to kick in, because it’s processed by the body in a different way than a beverage. Both go straight to the liver, but edibles take a detour through the digestive tract. Cannabis-infused beverages act just like alcohol, arriving at the liver faster and then entering the bloodstream.

Tinley anticipates that the onset time for their beverages is roughly five minutes and an off-set time close to two hours. That means that someone could theoretically come home from work and have a few of Tinley’s beverages after dinner, get a nice microdose buzz from 10 milligrams of THC, and be completely sober in time for bed.

The price of their single serve beverages sits between US$3-US$4 per bottle and their multi-serve drinks are US$15-US$17.

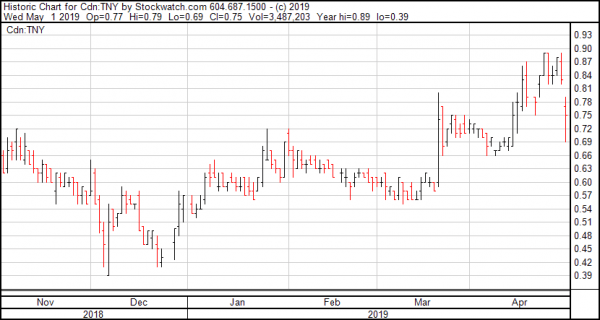

Tinley’s performance to date in 2019 suggests that the market has been forgiving of their regulatory hiccup. Today, though, their stock price dropped $0.08 to close at $0.75.

At present Tinley has 91,427,034 shares issued and outstanding and a market cap of $75.8 million.

—Joseph Morton

Full disclosure: The Tinley Beverage Company is an Equity.Guru marketing client.