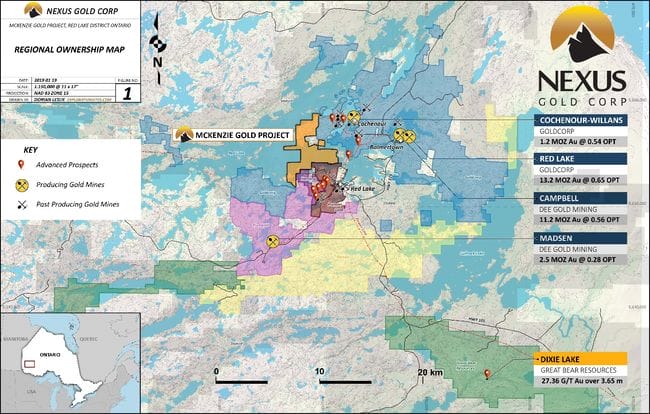

Two weeks back, Nexus Gold (NXS.V) announced it had entered into an LOI (letter of intent) to acquire the McKenzie Gold Project in the prolific Red Lake Mining Camp of northwestern Ontario.

Yesterday, Feb. 12, the company announced that it was satisfied with their due diligence on the project and has moved things forward, signing a definitive agreement to acquire those highly prospective Red Lake acres.

Nexus Gold Acquires McKenzie Gold Project, Red Lake, Ontario

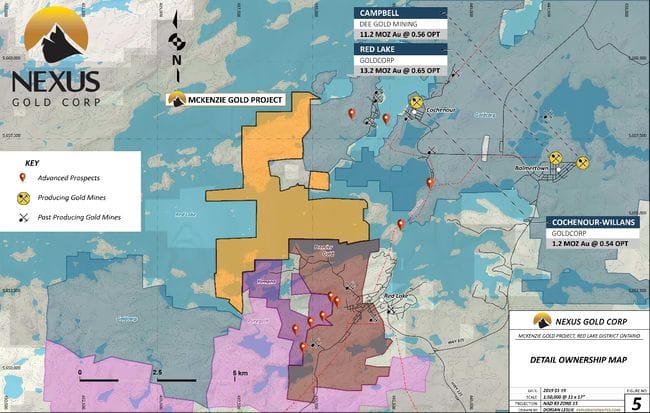

The Mckenzie project is in a good neighborhood – it’s surrounded by the likes of Goldcorp (G.T), Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T).

This was a real heads up move on management’s part, snapping up these 1,348.5 hectares only one week after it was dropped by another junior ExplorerCo.

The price of admission? Four million Nexus common shares and a one-time cash payment of $150,000.

Nexus management are shrewd negotiators: they managed to knock down the stock component of the transaction, announced in their Jan. 20 press release, from six million NXS common to four.

The fact that this deal got done with NXS common representing the bulk of the transaction, speaks volumes – the vendor of the project obviously has tremendous faith in Nexus management, their ability to execute, and the underlying geology of the area.

McKenzie’s exploration history:

Drilling in 2005 by Cypress Development along the southern edge of the property encountered quartz veining accompanied by sphalerite, arsenopyrite, chalcopyrite and free gold. The best hit from this limited program cut 6.0 meters of 2.2 g/t Au.

This 2005 hit occurred within a strongly silicified, sericite-altered, east-west-trending mineralized zone up to 600 meters long and open along strike and at depth.

During a 2017 ground reconnaissance campaign on McKenzie Island, grab samples returned values of up to 313 g/t Au.

In the southwest corner of the island, a new showing – a 12 cm wide, low-angle quartz vein exposed from the shoreline over a length of 2.0 meters – was discovered. High-grade samples from this vein ranged from 9.37 g/t Au to 331 g/t Au.

Although this vein is narrow, and the strike length is unknown, it demonstrates the untapped potential of the island (Red Lake is known for its narrow high-grade veins).

This new discovery lies approximately 100 meters west of a historical showing that assayed up to 212.8 g/t Au.

Sampling along the north shore of McKenzie Island encountered quartz veining and sulphide mineralization which returned up to 18.02 g/t Au in grab samples.

The northeast edge of the Island is bounded by the Cochenour-Gulrock deformation zone, host to the Campbell and Red Lake mines.

From the Feb. 12 press release…

“The highly prospective geological setting is analogous to several past producers. McKenzie hosts nine documented historical gold occurrences with limited exploration.”

We covered the Mckenzie project in detail on Feb. 1 in the following Guru article:

Nexus Gold (NXS.V) expands its jurisdictional scope – enters the prolific Red Lake Gold Mining Camp

Nexus president & CEO, Alex Klenman on the acquisition…

“The acquisition of the McKenzie Gold Project adds a Canadian-based project with high-grade potential, in a marquee district, to our portfolio. Nexus now has a total of six projects on two continents, in prolific and proven gold producing regions. With multiple types of exploration targets and excellent jurisdictional diversity, we feel Nexus is well positioned for growth in 2019 and beyond.”

Nexus Gold to raise up to $2M in Private Placement:

The Company is conducting a non-brokered private placement of up to 17,391,304 units at a price of $0.115 for gross proceeds of up to $2,000,000.

Each unit will consist of one common share and one warrant exercisable at $0.18 for a period of 2-years.

The funds will be put to good use.

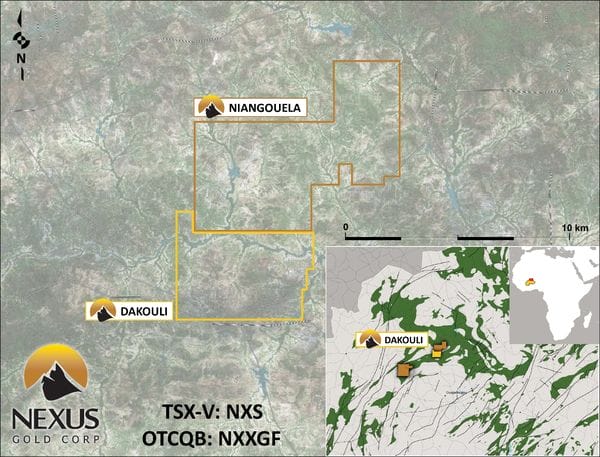

The company plans continue drilling two of its projects in Burkina Faso:

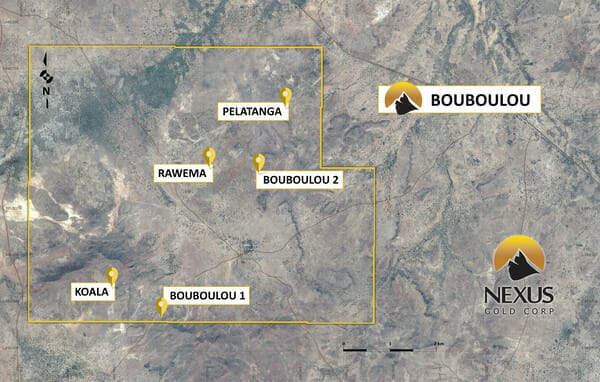

Its Bouboulou Project…

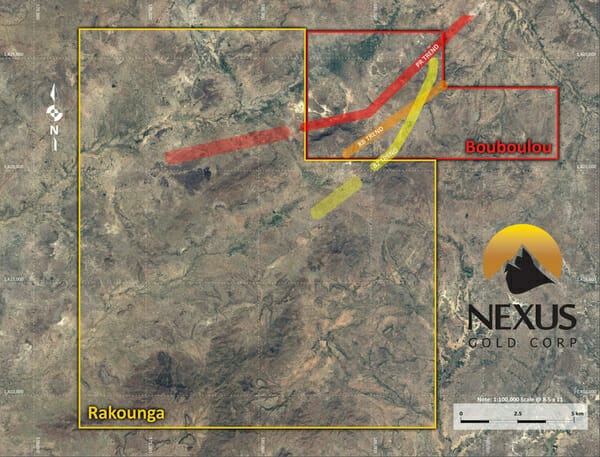

And at it’s Rakounga Project…

The company also plans to advance exploration work at its recently acquired Dakouli 2 Project, also in Burkina Faso…

I like the high-grade nature of Dakouli 2. We covered the project in detail in the following Guru offerings:

Read: Market operators and a new high-grade acquisition for Nexus Gold (NXS.V)

On the other side of the pond, in North America, summer work programs are planned for both the New Pilot Gold Project in BC, and this new acquisition in the Red Lake Camp of Ontario.

Cool beans!

Final thoughts:

The company will be active on at least five geologically prospective fronts this year.

With 42.29 million shares outstanding and a $0.12 share price, Nexus has a market cap of $5.07M.

That strikes me as a rock-bottom valuation for a company stacked with this much potential.

END

~ ~ Dirk Diggler

Full disclosure: Nexus Gold is an Equity Guru client.

Feature image of Red Lake gold-in-quartz courtesy of Wikipedia.