This Monday has brought big news in the resource sector: Ceylon Graphite (CYL.V) secures DTC eligibility for US shares, Permex Petroleum (OIL.C) earns a high-profile media mention and Nexus Gold (NXS.V) is the subject of a report by a New York consulting firm.

First up, Ceylon Graphite has received its Depository Trust Company (DTC) eligibility under the symbol CYLF. The company’s common shares became DTC eligible under that symbol on November 1.

The move allows for Ceylon Graphite shares to be traded through a wider range of brokerage firms.

“This electronic method of clearing securities expedites the receipt of stock and cash and thus accelerates the settlement process for investors and brokers,” says Bharat Parashar, chairman and CEO of Ceylon Graphite.

The New York-based DTC is one of the world’s largest security depositories. The company safeguards securities balances through electronic record keeping.

The settlement services that the DTC provides are designed to lower costs and risk as well as increase the efficiency of the market. It offers net settlement obligations at the end of each day from trading in equity, debt and money market instruments. The DTC also provides asset servicing, along with a range of services.

-Investopedia

Ceylon Graphite recently submitted an NI43-101 technical report for its Malsipura Graphite project in Sri Lanka. The company’s calculations of the project’s mineral resource shows 159,544.05 tonnes averaging 8.15 percent Cg.

Permex Petroleum gets high-profile media mention

Permex Petroleum announced today that their company will be included in the on Business Television’s CEO Clips program.

The program features a series of short video profiles on innovative, publicly traded companies in North America.

Permex Petroleum’s appearance on CEO Clips will be available on November 10 and 11 on the BNN Bloomberg Channel, Fox Business and Youtube.

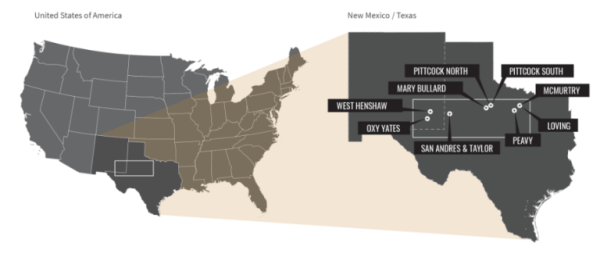

Permex Petroleum is a uniquely positioned junior oil and gas company with interests throughout the West Texas’ Permian Basin and the Delaware sub-basin of southeast New Mexico.

Last month, Permex Petroleum secured a US$5 million lending agreement with R.C. Morris Capital Management to expand their operations in the Permian Basin.

Last month, Permex Petroleum secured a US$5 million lending agreement with R.C. Morris Capital Management to expand their operations in the Permian Basin.

The lending agreement did not dilute Permex Petroleum’s capital structure, a bit of welcome news for the company’s shareholders. To quote Equity Guru’s Greg Nolan, “I’d rather see my company enter into a loan arrangement at 16% than have my stock position diluted by 50%.”

Consulting firm publishes report on Nexus Gold

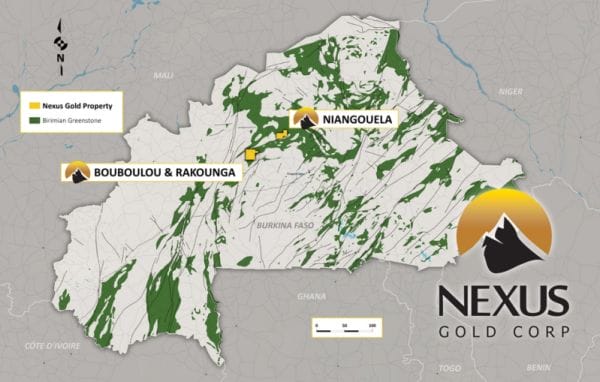

RB Milestone Group, a New York-based consulting firm, has published a detailed report on Nexus Gold’s projects in the West African nation of Burkina Faso and its eponymously named project there.

Highlights from the report:

- Promising resource base should boost Nexus’ potential revenues

- Burkina Faso offers mining-friendly regulations

- Management team has over 100 years of industry experience

The report also goes on to argue that looming conflicts and increasingly uncertain international relationships should support an increase in gold prices.

Year-to-date gold prices have decreased by about 4.9% with a 4% fall in global demand, to 964.3 metric tons in 2Q18. For the second quarter of 2018, demand from gold used in technology, which contributed to 8.6% of global gold demand,increased for the seventh consecutive quarter (Y-o-Y) to 83.3 metric tons (+2.2%) compared to the second quarter of 2017.

-RB Milestone Group

Global uncertainties are expected to increase investments in gold, according to RB Milestone Group. The main source of global instability cited by the report are Brexit negotiations, the US-China trade war and conflict in the Middle East.

Thomson Reuters predicts the price of gold to reach US$1,500 per ounce in late 2018 while averaging $1,360 per ounce for the entire year.

The company’s weaknesses are limited to its negative cash flow: the company has not generated revenue from core operations since its inception and relies on fund-raising activity.

The company’s strengths are the untapped gold deposits of Burkina Faso and a significant demand for gold jewellery from India, China and the US.

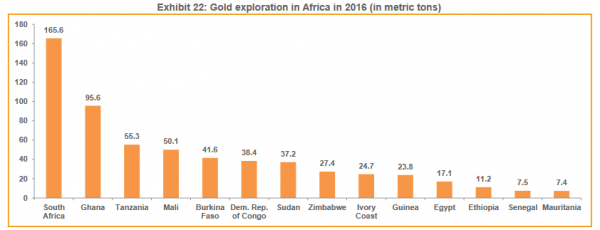

RB Milestone Group writes that the untapped gold reserves of the West African nation of Burkina Faso have the potential to become “one of the largest gold producers in the world.”

Burkina Faso has mineralization which is expected to be on par with its neighboring Ghana and Mali, according to the report. 80 percent of Burkina Faso’s economy stems from gold exports and the nation’s government is largely accommodating to the resource industry.

The World Bank helped develop Burkina Faso’s mining code in 2015, increasing the government’s transparency and accountability.

Additionally, the increase in gold investments around the globe puts Nexus Gold in an excellent position to capitalize on burgeoning demand.

Citing the Word Gold Council, Chinese and American demand for gold jewellery increased by five percent in Q2 reaching nearly 145 metric tonnes.

Furthermore, India accounts for roughly 29 percent of global demand for gold jewellery. During the same period, demand for gold jewellery in India increased eight percent to nearly 148 metric tons.

Sounds like a good time to be in the gold business.

Full disclosure: Ceylon Graphite, Permex Petroleum and Nexus Gold are Equity Guru marketing clients.