Blue Sky Uranium (BSK.V) has been discussed in the pages here at Equity Guru quite extensively over the past year or so.

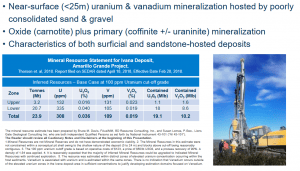

For newbies, I’m sure you were able to divine by the name, Blue Sky is a uranium (U3O8) explorer and developer. But the company is also well endowed with vanadium (V2O5).

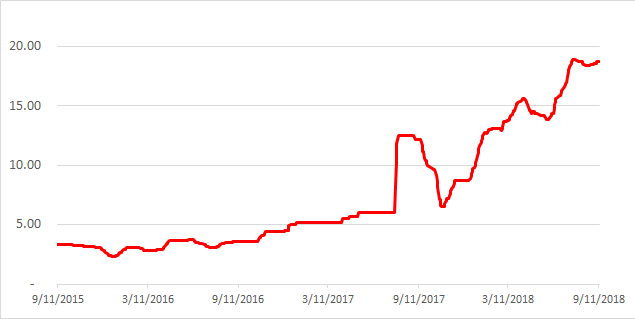

Significantly, both metals have bucked the downtrend in base metals in recent weeks and months. Both metals are trading firm.

Here’s a look at the current slope on uranium…

The price trajectory on vanadium is equally, if not more impressive than that of U3O8…

A refresher on what that the company’s got…

The where…

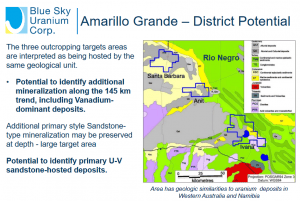

Blue Sky boasts the exclusive rights to over 434,000 hectares (the equivalent of 1,072,437 acres) of property encompassing two provinces in Argentina. Its primary focus is on its flagship Amarillo Grande Project located in central Rio Negro province, in the Patagonia region of southern Argentina.

As per the company’s most recent news release…

The Company’s flagship Amarillo Grande Project was an in-house discovery of a new district that has the potential to be both a leading domestic supplier of uranium to the growing Argentine market and a new international market supplier.

The Company is a member of the Grosso Group, a resource management team that has pioneered exploration in Argentina since 1993.

The Ivana mineralized settings…

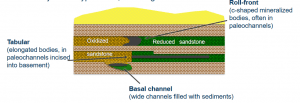

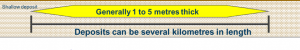

There are two main deposit types at the company’s Ivana project, the first is what’s known as a surficial deposit. Surfical deposits are easy to grasp. Yep… good guess – they lie right at or near surface. What these deposits lack in thickness, they more than make up for in lateral scale. Ivana has the potential to sprawl out significantly.

Here, the mineralization is hosted in the loosely consolidated sediments of an ancient river

Here, the mineralization is hosted in the loosely consolidated sediments of an ancient river

bed (aka a ‘paleo-channel’).

The thing which sets surficial deposits apart from other deposit types? They’re dirt-cheap to explore, mine and process.

The second deposit type found at Ivana is what’s called a sandstone hosted uranium deposit

This deposit type characterizes the lower coordinates at Ivana. This type of mineralization runs deeper – there’s excellent potential for additional discovery at depth here.

The company states that this sandstone-type mineralization is related to a braided fluvial system which indicates district-scale potential. Obviously, there’s a lot we don’t know about what ultimately lies beneath the surface here.

The resources at Ivana…

The Ivana deposit boasts an overall inferred mineral resource of some 23.9 million tonnes averaging 0.036% U308 and 0.019% V2O5. This translates into 19.1 million pounds of U3O8 and 10.2 million pounds of V2O5 (at a 100 ppm uranium cut-off).

Ivana’s resource is low-grade, but it’s important to consider that the mineralization is hosted in poorly consolidated sand and gravel. As we emphasized in a recent Equity Guru article…

Yes, Ivana’s ore is low-grade, but here’s the thing: This shallow U308/V2O5 mineralization is hosted in loosely consolidated sediments. The metals are not bonded or locked into the surrounding rock. The ore breaks apart. Easily. In some cases, it crumbles with only slight pressure. I cannot stress enough how important this feature is to the potential economics of a project.

The exploration potential at Ivana and Anit…

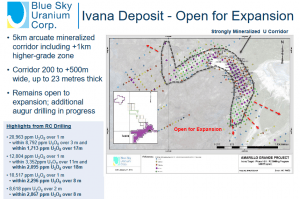

It’s also important to consider that this resource is open for expansion in multiple directions. Note the scale on the map below…

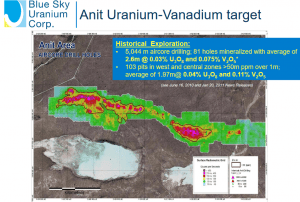

Beyond Ivana, some 50 kilometers to the northwest, lies the Anit uranium-vanadium target. Here, the vanadium grades are more than twice that of uranium…

Concentrating the mineralization, all wet n scrubby like…

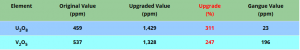

Crucially, the company reported back in May that Ivana’s uranium and vanadium mineralization can be concentrated by a simple wet scrubbing and screening process.

This process removes coarse pebbles which contain little or no uranium in the mineralized material. Ultimately, this has the potential to substantially lower processing and transportation costs.

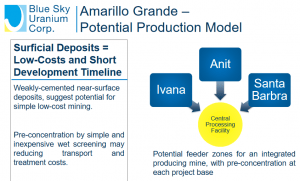

This could bring into play any number of satellite deposits with a production model which factors in a centralized processing facility (more on this idea below).

This scrubbing and screening study demonstrated that the company can upgrade their metal concentration by approximately 300% for uranium and 250% for vanadium. That’s a huge fundamental development for Blue Sky, one which the market isn’t giving the company credit for. That’ll change in the not too distant future (author’s speculation).

The vision…

The potential to concentrate the mineralization from a number of satellite deposits across the company’s massive land package is a game changer.

The company envisions a central processing facility, one which could have a dramatic impact on their bottom line via a reduction in transportation and treatment costs:

It’s this prospective low-cost development scenario which elevates the company’s resource, setting Ivana apart from other deeper, more geologically complex U3O8 – V2O5 deposits.

Cool beans.

For a further in depth study on Blue Sky Uranium, the following articles are recommended reading:

Blue Sky Uranium (BSK.V) confirms largest Argentina uranium discovery in 40 years

Blue Sky Uranium (BSK.V): Unlocking a potential world-class U3O8 district

Blue Sky Uranium (BSK.V) Concentrating U308 with a significant Vanadium kicker

Blue Sky Uranium (BSK.V): Advancing Amarillo Grande to the PEA stage – Update

The September 11th news…

The company has just carried out a 61-hole, 1,029 metre reverse circulation (RC) drilling program at Ivana. The drilling program targetted deposit extensions adjacent to the current mineral resource. These targets, identified by auger drilling and radiometric probe, have the potential to expand the current resource at Ivana, a resource which already boasts impressive scale. Assay results will be released once received and interpreted.

This news release also states…

a team of highly experienced professionals is being assembled to carry out all aspects of a Preliminary Economic Assessment (PEA) on the Ivana deposit. Detailed metallurgical test work on a 40 kg representative composite sample is proceeding at the Saskatchewan Research Council (SRC) laboratory in Saskatoon, Saskatchewan.

Blue Sky’s blue sky (catalysts)…

There are a number of developments to look forward to here. Though a 1,000 meter drilling program may sound modest, don’t forget that much of the mineralization at Ivana is ‘surficial’ – it lies right at, or just below the surface. 1,000 meters could go a long way toward expanding the current resource.

The tabling of a PEA, as noted above, is where the rubber meets the road. It will give us our first peek at Ivana’s untapped economic potential. These are exciting times for the company.

END

~ ~ Dirk Diggler

FULL DISCLOSURE: Blue Sky Uranium is an Equity Guru client. We own the stock.