26 cannabis companies announced their supply deals with Ontario last week, laying the groundwork for who will be supplying Canada’s largest province with their cannabis of choice.

Ontario, under Doug Ford’s Progressive Conservative government, has long waffled about the expected roll-out of recreational cannabis. First it was all government, then it was private…

The final model will now be a hybridization of public and private retail sectors, with online purchases and delivery promised for day one through Ontario Cannabis Stores (OCS) with private stores expected for April 1, 2019.

An August 2018 report by Statistics Canada found 18 per cent of an estimated 13.6 million Ontarians used cannabis in the past three months, higher than “the estimates for the rest of Canada,” so it is expected the province will be extremely competitive, both in number of potential customers and what they’ll spend.

The OCS is also working to finalize supply agreements with cannabis accessory suppliers. Here is a look at the companies with an opportunity to grab a piece of that market.

Ontario’s selected suppliers

- 7ACRES/ Supreme (FIRE.V)

- AgMedica Bioscience

- Aphria (APH.T)

- Aurora (ACB.T)

- Beleave (BE.C)

- Broken Coast (Subsidiary of ACB.T)

- CannTrust (TRST.T)

- Canopy Growth (WEED.T)

- Emblem (EMC.V)

- Hydropothecary (HEXO.T)

- Hiku (HIKU.C – soon to be subsidiary of WEED.T)

- Maricann (MARI.C)

- MedReleaf (Subsidiary of ACB.T)

- Natural MedCo

- Northern Green Canada

- Organigram (OGI.V)

- Peace Naturals (CRON.T)

- Radicle Medical Marijuana

- RedeCan Pharm

- Solace Health

- Starseed Medicinal

- THC BioMed (THC.C)

- The Flowr Group

- Tilray (TLRY.NASDAQ)

- Up Cannabis

- VIVO Cannabis (VIVO.V, formerly AbCann)

A few notable companies left off the list:

- The Green Organic Dutchman (TGOD.T)

- Invictus (IMH.C)

- Emerald Health (EMH.V)

- Cannaroyalty (CRZ.C)

- WeedMD (WMD.V)

Here is a look at some of the bigger pubcos with supply contracts.

Canopy Growth (WEED.T)

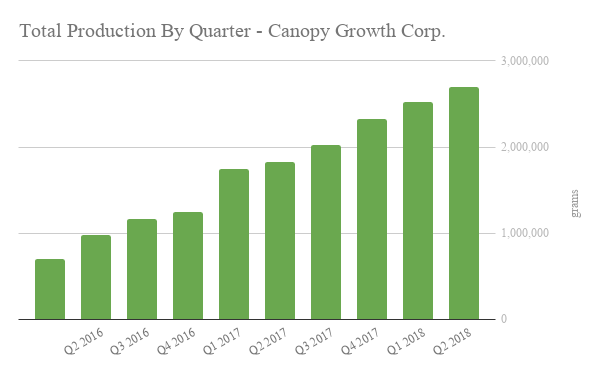

Unsurprisingly, industry giant Canopy Growth is one of the companies contracted to supply cannabis to Ontario, through its subsidiary, Tweed.

It is still unclear how many SKUs Canopy Growth will offer through the OCS, and unclear whether or not we’ll know before counting them online October 17th.

Canopy Growth has signed supply deals with every province and territory, according to its press release, boasts over 100 unique cannabis-product SKUs and has 2.4 million square feet of growing space.

“Today marks another significant milestone for us as we’ve officially ensured Ontarians will have access to a huge variety of Tweed-branded products,” said Mark Zekulin, President & Co-CEO, Canopy Growth. “With our private retail plan being rolled out in other provinces, our attention in Ontario will now turn to bricks and mortar shops in this key market.”

With a market cap of $11,492,479,000, Canopy Growth is by far the biggest player signed on in Ontario. Canopy is much like everyone else: they need to move product to keep the lights on, so they’ll settle for Ontario’s discounted rates. But Canopy clearly has its eyes on the private sector, which is why they keep reminding us that Tweed retail locations could be opened within weeks of the go-ahead from the provincial government.

Hiku Brands (HIKU.C)

Acquired by Canopy Growth in July (though the deal is still churning along towards definitive), Hiku Brands has a portfolio of four brands to its name: DOJA, Tokyo Smoke, Maïtri and the female-focused Van der Pop with which to supply Ontario.

The move is understood to represent Canopy’s attempt to lock down brand-loyalty.

The company presently trades at a market cap of $332,649,000 and prides itself on its “lifestyle” appeal. The aforementioned brands go beyond cannabis products but extend into physical stores, each with unique appeals for different types of cannabis users.

Besides online shopping, its Tokyo Smoke brick-and-mortar locations have high-end storefronts and in-store coffee bars meant to give “sophisticated” customers a premium experience when shopping for cannabis accessories.

The Doja Café, located in Kelowna, British Columbia, is more of a traditional coffee shop, offering spaces for study sessions and parties.

Targeting the Quebec market, Maïtri is a more traditional cannabis retail operation. Besides a blog which discusses the benefits of micro-dosing and compares sativa to indica strains, the company offers grinders trays and pipes.

Van der Pop’s website is geared towards female cannabis users, offering content like “Hot Box: A Guide to Sex and Cannabis,” and how to implement cannabis into one’s sun-care routine.

Hiku Brands is an Equit.guru marketing client.

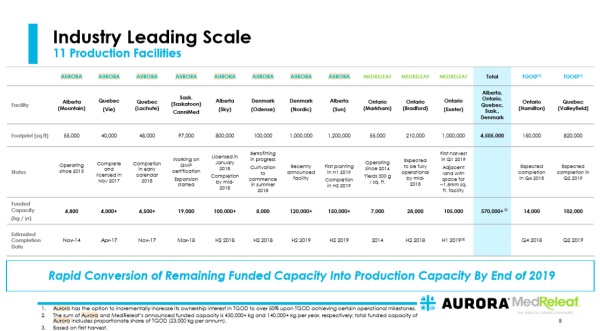

Aurora Cannabis (ACB.T)

With a market cap of $7,224,678,000, Aurora Cannabis is the second largest cannabis company on the board. Along with its subsidiary, MedReleaf, Aurora Cannabis will be supplying the OCS with a variety of products from flower to oils, with further details forthcoming.

Aurora boasts a build of 2,143,200 square feet of cultivation space across Canada and Denmark. Our figures have them currently running just shy of 200,000 square feet of active space at the end of last quarter, and another 265,000 square feet have been added through the acquisition of MedreLeaf.

Aurora Cannabis also plans to establish their own brick-and-mortar locations once a provincial framework is established, according to its press release.

The company recorded revenues of over $16 million in Q1, more than triple the amount recorded during the same period last year.

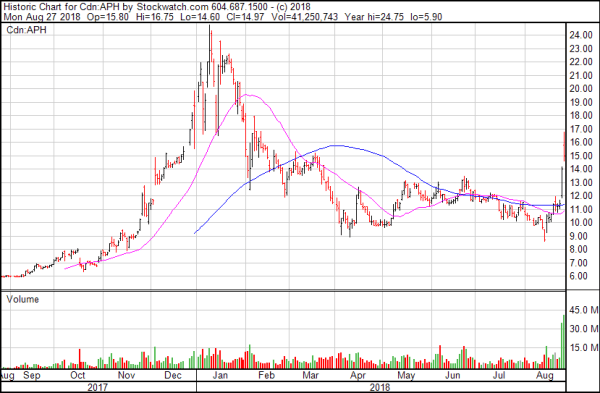

Aphria (APH.T)

Under their supply deal with the Province, Aphria has signed on to supply 59 unique SKUs to the OCS for the first year of the agreement.

Vic Neufeld, chief executive officer of Aphria, stated: The agreement with OCS is an important piece of the puzzle as we get closer to legalization in Canada. Aphria is not only ready for Oct. 17, but we’re also getting ready for the long-term evolution of the industry.

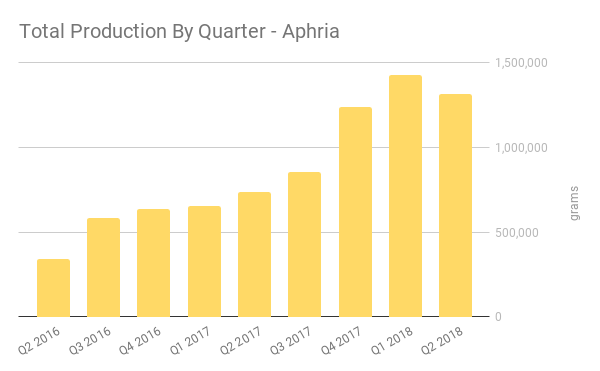

With a market cap of $2,614,895,000, Aphria is just a fraction of Canopy and Aurora at a glance. Their ambitious buildout is designed to produce 1.5 million square feet of growing capacity. Our calculations put APH at 300,000 square feet of active space at the end of their most recent quarter.

Aphria was long rumored to be in talks with Molson Coors, and the market was disappointed when the beer giant ultimately elected to do a deal with HEXO. The development JV that Molson ended up doing isn’t the sort of deal that Aphria is known for. The deal gives Molson Coors the option to make an equity investment in HEXO, but has not made one yet.

Aphria does little to market itself, the latest press release on the company’s website is dated June 2016. Aphria is a perpetual member of the all-undervalued team. A common pick in forums and investor groups that just never gets around to getting off the mat. The tremendous action over the past few days may end up being a good start.

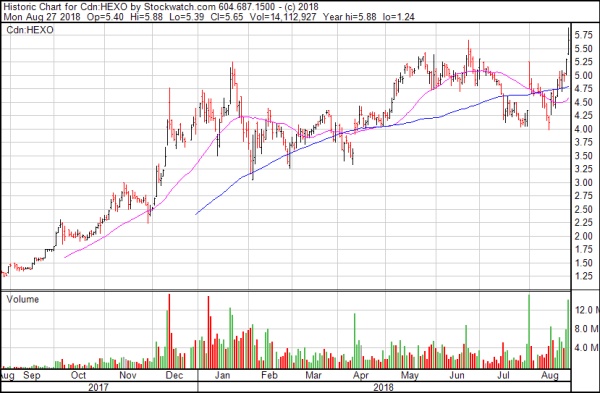

Hydropothecary (HEXO.T)

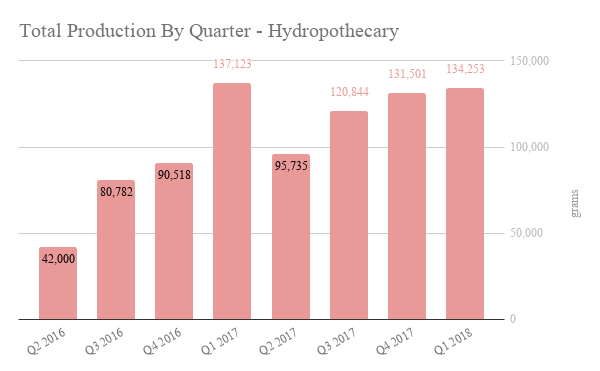

Hydropothecary, with a market cap of $973,509,000, announced their first harvest earlier this month. Their Gatineau, Quebec facility has 250,000 square feet of production space.

Hydropothecary generated CAD$3,523,296 CAD in revenue for 2017 and is clearly on the upswing.

As previously mentioned, the company also announced a JV with Molson Coors Canada to develop a non-alcoholic, cannabis-infused beverage for the Canadian market.

Molson Coors Canada will retain a 57.7% interest in the JV, with Hydropothecary controlling the remaining stake. The transaction is set to close in September.

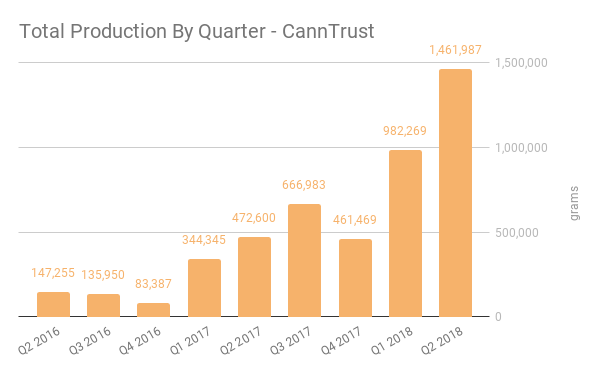

Canntrust (TRS.T)

Canntrust is one of 13 suppliers to the Alberta Gaming, Liquor & Cannabis Commission. The company has a market cap of $851,295,000.

As per their website, the company operates a recently completed 250,000 square feet facility, with an additional 200,000 square feet expected to be completed in Q3. Additionally, an additional 600,000 square feet expansion is also underway.

In July, we examined grams sold per square foot of production space in Q1 for a number of cannabis companies. It was difficult to verify what percentage of Canntrust’s sales were grown in-house, but the sales numbers were there and remain there. In terms of units, CannTrust is punching with companies that have far larger market caps.

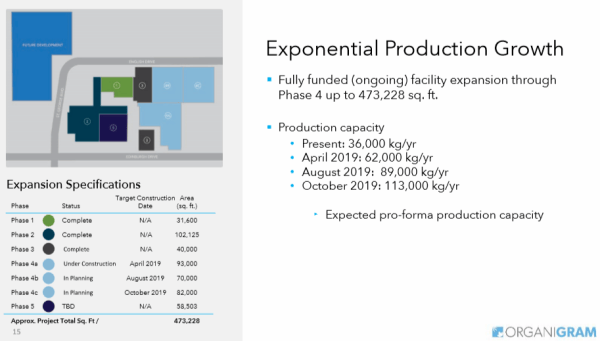

Organigram Holdings (OGI.V)

Organigram Holdings has a market cap not far behind Canntrust at $665,039,000.

Our agreement with the Province [of] Ontario is an important strategic milestone with significant impact for Organigram, but it also further galvanizes our ability to share our tremendous product experience and expertise with an even broader customer base. -Greg Engel, Organigram chief executive officer.

The company has agreed to supply the Province of Ontario with 27 different product SKU, including dried flower, pre-rolled joints and concentrates.

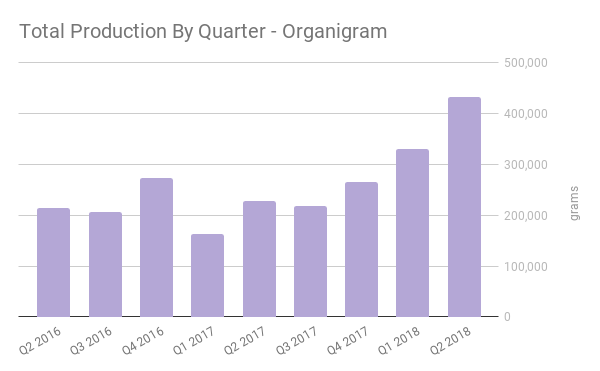

As reported by Braden Maccke, Organigram Holdings recorded dismal sales numbers in 2017 thanks to a recall, but new CEO Galen Engen appears to have them straightened out.

Supreme Cannabis (FIRE.V)

Through its wholly-owned subsidiary 7Acres, Equity Guru client Supreme Cannabis has signed a 24-month supply deal with Ontario. The deal also includes provisions for 7ACRES recreational cannabis to Ontario’s private retailers once legislation allows.

The company has the capability to grow 12,500 kilograms of cannabis annually and a current market cap of just $385,407,000.

Supreme Cannabis does things a little differently. The company expects to have 342,000 square feet of growing space and 50,000 kilograms of growing capacity by December and operates on a largely B2B model, selling to other LPs such as Aurora and Emerald, though the company plans to push their own brands hard through distribution deals.

Newstrike Brands (HIP.V)

Newstrike Brands, the parent company of Up Cannabis, is an interesting company. With a market cap of $371,272,000, Newstrike Bands should be more than it is.

Newstrike Brands got wrapped up in the early stages of the Aurora Cannabis hostile takeover attempt for Cannimed last February. When the dust settled, they walked away with a break fee, and carried on their marry way with what has to be described as an excellent promotion.

Newstrike Brands has benefited from the bump in its market cap ever since. The market is hotly anticipating The Tragically Hip’s favourite weed co’s well-primed branding machine getting a crack at the retail market. Newstrike Brands trades at a market cap right around Supreme Cannabis’, despite not having any sales yet. Supreme Cannabis showed over $2 million in revenue this past quarter.

HIP is building 200 thousand square feet of cultivation space in Niagara where they claim a production capacity of 12,500 kilograms, and a 14,000 square foot facility in Brantford billed as a production capacity of 2,500 kilograms.

We calculate their current active footprint at 42,000 square feet.

Maricann (MARI.C)

Maricann has a market cap of $253,212,000. The company is developing its production space in Canada, and expects to have 217,000 square feet of grow-space by the end of Q4. We’ve pointed out recently that:

Phase 1 of the expansion was to be 217,000 sq/ft of the total “fully funded” 942,000 sq/ft Langton, ON facility. On March 23, 2018 it was announced in a Maricann press release that phase 1 was completed ahead of schedule. That’s an apparent contradiction of their current investors’ deck, which says that “phase 1 will be fully operational in Q4 of 2018.”

The company’s public filings report that they sold 61 kilograms of product to the medical market in Q1 of 2018. That’s down by nearly half from the 112 kgs they report having sold in the same period last year.

In the first instance of its kind that we’re aware of, Maricann posted redacted versions of the Health Canada licenses for its cultivation properties on SEDAR [1, 2, 3].

-Taylor Gavinchuk

The company acquired a Swiss company set up to produce CBD-heavy cigarettes, HAXXON AG, in May 2018 and is currently operating a 60,000 square foot production facility in Switzerland.

Maricann listed $42 million in cash at the end of March and just raised another $37 million through an unconventional pre-financing warrant, set to deliver units to the holders in the event the Securities commission approves their prospectus.

Two Maricann board members resigned in February after being accused of insider trading by the Ontario Securities Commission.

(ED NOTE: When we were adding up Maricann’s quarterly production, we ran into inconsistencies that didn’t make any sense. Effectively, they had produced a negative amount of product in certain quarters. When we called Maricann to follow up, company reps referred us to a number that had been disconnected.)

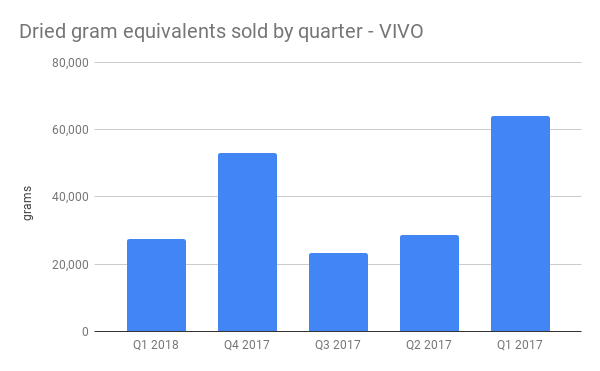

Vivo Cannabis (VIVO.V)

EG marketing client Vivo Cannabis‘ deal with the OCS entails supplying Ontario with 16 unique SKUs for the adult-use recreational market.

The agreement with OCS is a significant milestone and we are confident that cannabis consumers in Ontario will appreciate our high-quality branded products, said Barry Fishman, chief executive officer of Vivo Cannabis.

On Monday, Equity Guru’s Lucas Kane reported that Vivo Cannabis (formerly Abcann Medical) has a healthy balance sheet showing about $110 million in cash. With a market cap of $156,748,000, Vivo Cannabis isn’t the largest cannabis company signed, but its wide range of products and its dedication towards developing viable medical technologies are notable, and its cash holdings make it an interesting value proposition.

Beacon Medical: This standardized pharma-grade cannabis is a superior product that’s clean, consistent and repeatable —qualities sought by physicians and patients.

Fireside Cannabis: Tailored to the social user, this premium cannabis is grown in small batches and undergoes a long curing process to ensure a smooth final product in three varieties to suit every gathering.

Lumina Wellness: An elegantly designed wellness-focused cannabis product line, Lumina was created to enhance mindfulness and self-discovery.

Vivo Cannabis’ recent deal for private E-Retailer Canna Farms was well received in these pages.

Emblem (EMC.V)

Through its subsidiary Emblem Cannabis, Emblem‘s brand of cannabis Symbl is another brand to be featured on the OCS on October 17.

The company has a market cap of $151,537,000. One of the few companies to have secured supply deal with Alberta, our own Braden Maccke considers them to be both undervalued and “one of the tightest run companies out there.”

Unlike most companies their size, Emblem is actually shipping product. EMC sold 123.9 kg of product to Canadian patients and to other LPs last quarter. I’ve considered Emblem undervalued for a while and didn’t think it could get any worse, but in the week following their infection by branditis, Emblem took a beating. -Braden Maccke

Emblem is developing almost 250 million square feet of cultivation space and projects 50,000 square feet to be complete and functional by the end of summer.

(ED NOTE: Braden Maccke presently holds a long position in EMC.V)

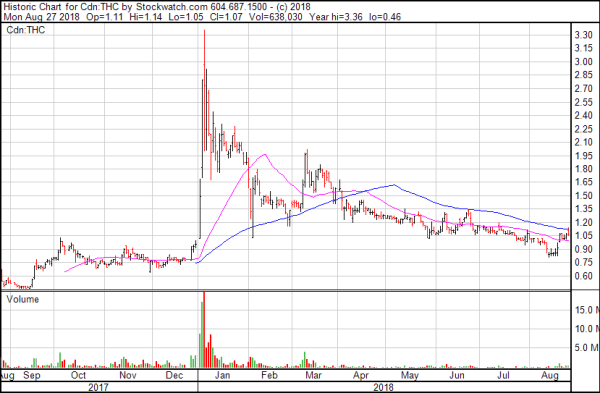

THC BioMed (THC.C)

THC BioMed has a market cap of $126,552,000. In addition to its supply deal with Ontario, the Province of British Columbia selected THC BioMed as one of its official suppliers back in July.

As reported by our own Bo Ramone in April:

The company is finalizing the details of its purchase of a property in Ontario. The new property, which consists of approximately 3.4 hectares (8.5 acres), has approximately 2.8 hectares (7 acres) of growing space, including 6,503 square metres (70,000 square feet) of greenhouse space.

Beleave (BE.C)

Beleave will be supplying cannabis products to the OCS through its Seven Oaks brand.

This is great news for our team here in Ontario,” said Beleave chief executive officer, Andrew Wnek. “OCS has been diligent and thorough in their application and approval processes. Our selection as an official supplier is further evidence of our best-in-class products and responsible leadership.

Straggling the pack, the company has a $82,254,000 market cap, 14,500 square feet of growing space and has announced an additional buildout of 80,000 square feet at their Hamilton facility.

Beleave closed a first tranche of its non-brokered private placement back in June, with 2.5 million units of the company being issued at a price of $2 per unit for gross proceeds of $5 million.

FULL DISCLOSURE: Supreme Cannabis, Vivo Cannabis and HIKU Brands a Equity.Guru marketing clients

Disclaimer: ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

— Ethan Reyes with notes from Taylor Gavinchuk & Braden Maccke