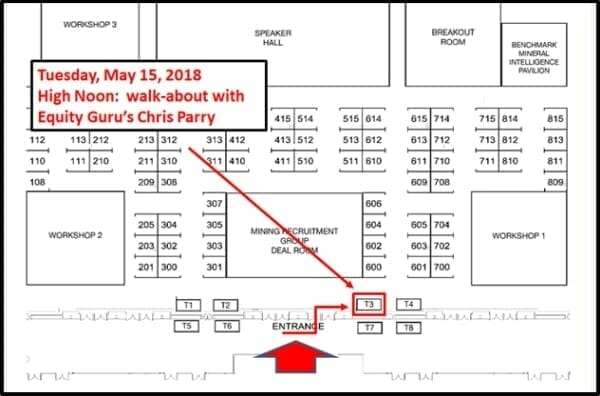

Psst. Did you hear? The International Mining Investment Conference is coming to Vancouver, May 15 & 16, 2018?

It’s at The Vancouver Convention Center – at the foot of Granville Street.

Computers, cars, surgical instruments, bicycle tires, sailboats, cell phones, airplanes, solar panels, medicines, clothes, movies, electric guitars and textbooks – are all made from mined goods.

If resource companies are part of your investment strategy, you should attend one mining conference.

This year, Equity Guru’s Chris Parry is everywhere:

Tuesday, May 15th:

1:40 – 2:20 pm: The Future of Energy

4:30 – 5:00 pm: Where Am I Putting My Cash?

Wednesday, May 16th:

8:30 – 9:30 a.m. Gold vs Crypto vs Cannabis: Where is the Best Return this Year?

1:00 – 1:20pm: Mining for Millennials: 43-101’s for the 45 and under crowd

5:00 – 5:30pm: Energy Metals Forecast

If you have itchy-bum syndrome (can’t sit still and listen to a stranger talk) we recommend the “walking tour” with Chris Parry, Tuesday, May 15th at noon.

Mr. Parry is an aggressive investor who made early calls on weed, blockchain, cobalt, battery technology etc. He’s a risk-taker who has a track record of putting Equity Guru readers into profitable deals.

On Tuesday, Mr. Parry will take you to the booths of five companies he believes in.

You’ll meet the management – and you can listen to Parry’s questions. If history is a guide, they won’t all be softballs.

“Companies pay us to keep them in our attention span, because not doing so means being out of the conversation,” states Parry on the company website, “but those companies have to hit the milestones they’ve laid out. If they don’t, we’ll be the ones hitting first and hardest.

The 5 companies on Parry’s walk-about list:

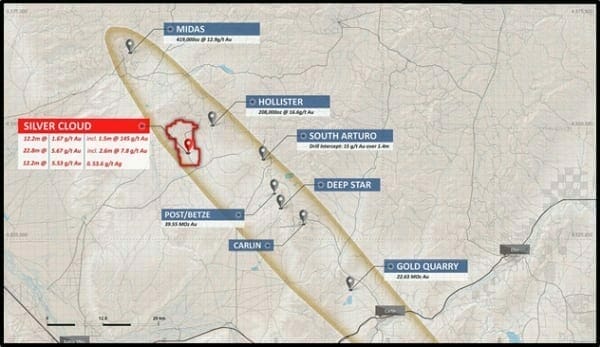

- Black Rock Gold (BRC.V) is developing the 11,210 acres Silver Cloud property in Nevada, near the confluence of the Carlin Trend and the Northern Nevada Rift, the richest gold mining area in North America.

The property is located 8 km west of the Hollister mine of Klondex Mines which has a M&I Resource of 0.43 Mt @ 16.6 g/t gold (for 208,000 oz Au). Klondex’s Midas Mine lies 20 km to the north of Silver Cloud and has an M&I Resource of 1.11Mt @ 12.9 g/t gold (for 419,000 oz Au).

BRC is currently trading at .10 with a market cap of $3.7 million.

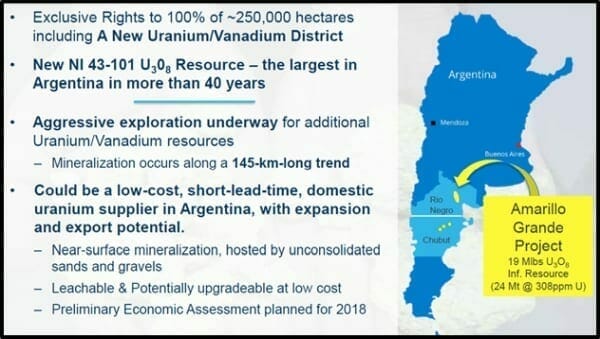

- Blue Sky Uranium (BSK.V) has filed the NI 43-101 Technical Report to support an independent mineral resource estimate for the Ivana Deposit at the Company’s 100% owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province, Argentina.

Highlights

- Inferred mineral resource estimate containing 19.1 million pounds of U3O8 and 10.2 million pounds of V2O5, (Vanadium) at a 100 ppm uranium cut-off.

- The Ivana uranium-vanadium includes an upper zone, comprised mainly of oxidized mineralization, and a lower zone, containing predominantly primary-style mineralization.

- Mineralization is hosted by loosely consolidated sediments potentially amenable to physical beneficiation by simple scrubbing and wet screening

- Preliminary alkaline leaching results of the surficial oxidized mineralization returned recoveries of over 95% for uranium and 60% for vanadium in 3 hours.

- Beneficiation test work for both mineralization types in progress, and leach test work for primary mineralization is in progress.

- The Ivana deposit remains open for “brownfield” expansion for surficial uranium – vanadium mineralization and sandstone-type uranium primary mineralization.

- The Ivana deposit is the southernmost expression of a regional mineralization front that may continue along the Amarillo Grande Project trend.

- Additional uranium and/or vanadium targets exist throughout the 140-km long trend covered by the 100% controlled BSK properties.

BSK is trading at .14 with a market cap of $11.8 million.

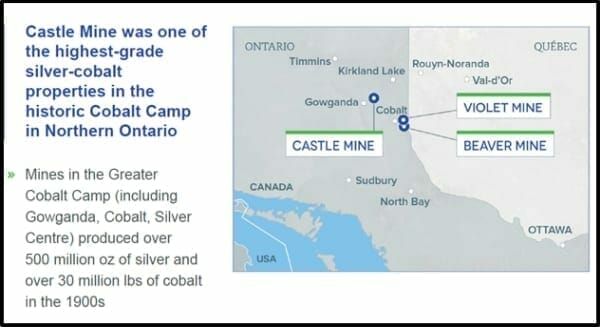

- Canada Cobalt Works (CCW.V), formerly Castle Silver – controls the former cobalt and silver producing Castle cobalt silver mine property located 85 kilometres from the historic Cobalt silver mining camp.

As of December 2017, the Castle Mine site property comprised 19 claims, 34 leases and two licenses of occupation totalling 2,815 ha. This is a significant five-fold increase from the original 564 hectares.

The historic Castle Mine site operated at various times between 1917 and 1989 producing a documented total of 292,686,672 grams (9,410,095 oz.) silver and 376,053 lbs. cobalt

On March 16, 2018 assays 2.46% cobalt and 6,173 g/t silver from a selected bulk sample underground at Castle mine.

CCW is trading at .29 with a market cap of $18 million.

4. Nano One (NNO.V) has developed proprietary technology to build a better-cheaper battery.

NNO has demonstrated that its scaled process can make nickel-rich cathode materials using the cheaper lithium carbonate in place of the more expensive lithium hydroxide.

The battery market is currently about $15 billion and growing $750 million a year.

On February 13, 2018 NNO announced that is has been issued Japanese Patent No. JP6271599.

“This patent strengthens Nano One’s growing portfolio of intellectual property and extends its protection to a country with a major stake in the lithium-ion battery market,” said Dr. Campbell of NNO.

Nano One now has 5 patents and over 30 pending patent applications worldwide,” said Joseph Guy Ph.D., patent counsel and director for Nano One.

NNO is trading at $2.17 with a market cap of $141 million.

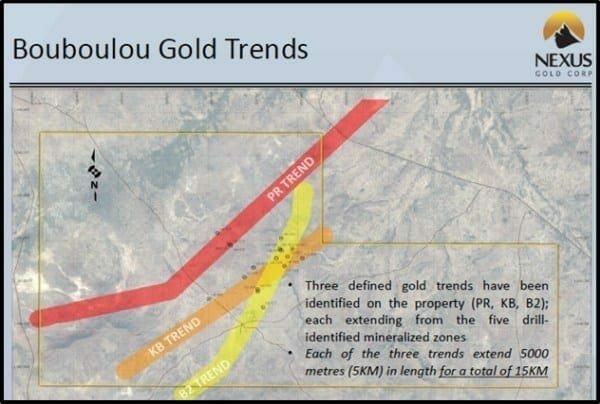

5. Nexus Gold (NXS.V) has 3 gold projects in the African country, Burkina Faso:

- The 178-sq km Niangouela gold concession where the company has delineated a 1km quartz vein and shear strike. Eight of the first nine diamond drill holes on the property returned positive gold results, highlighted by a 4.85m intercept of 26.69 g/t.

- The 38.8-sq km Bouboulou gold concession with historical drill results including 40m of 1.54 g/t. The property contains three distinct gold trends, each extending 5000 metres (5km) in length.

- The 250-sq km Rakounga gold concession contiguous to Bouboulou property, contains many artisanal mines.

On December 13, 2017, Nexus announced that “drill results now outline a trend of gold occurrences extending for 16 kilometres between the Company’s Rakounga and Bouboulou concessions.

Highlights include:

Hole RKG-17-RC-008 intersects 34m of 1.00 g/t Au, including 4m of 5.60 g/t Au

Hole RKG-17-RC-009 intersects 22m of 0.57 g/t Au, including 4m of 2.01 g/t Au

Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned there over the past six years. The country has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

On April 16, 2018 On Friday, Nexus executed a 10-1 roll-back. Bucking the normal trend of post-rollback price softening – NXS stock has risen 40% since then.

NXS is now trading at .31 with a market cap of $4.6 million.

In Canada, mining is an economic monster – responsible for the creation – and destruction – of many fortunes.

Canada sector highlights.

- 400,000 workers employed

- Largest private sector employer of Indigenous peoples

- Contributed about $60 billion to Canada’s GDP in 2017.

- Accounted for 20% of the value of Canadian goods exports in 2017.

- Miners have paid $71 billion in federal taxes over the last 10 years.

The “walk-about” with Chris Parry is a chance to get down into the belly of this beast, chaperoned by a gifted communicator who makes a living assessing the business prospects of junior resource companies.

Full Disclosure: Blue Sky Uranium (BSK.V), Canada Cobalt Works (CCW.V), Nano One Materials (NNO.V) and Nexus Gold (NXS.V) are Equity Guru marketing clients and we own stock. We have no financial arrangement with Blackrock Gold (BRC.V). Some Equity Guru staff do own stock in Blackrock.

Speaking of mining companies… what has happened with LiCo? I’m hearing a lot of angry investors on the yahoo message boards about them becoming Surge mining or something rather… any info on this?

Duane, At Equity Guru, we often talk about ex-marketing clients because we believe in them. Lico has dropped off our radar, but you are right the Surge mining deal is messy and it’s turned into a he (management) said, she (shareholders) said:

According to Lico: “The goal of each financing strategy was to provide the resources to fund the Company’s disclosed exploration programs…given the continued softening / deterioration of junior mining equity financing markets and the relatively large number of Company common shares already issued and outstanding, management believed that seeking project specific option agreements would be the Company’s most readily available financing strategy option.”

Numerous pissed off shareholders have expressed different opinions: “Lico managements such as Tina White, Dwayne Melrose, etc, all cash out their wctxf stocks, causing stock pps rapidly drops from $0.10 down to $0.05 per share and leaving all public stockholder in dark! In a rough estimation, Tina, Tim & execs sold $281,720 in WCTXF One striking thing is now both Lico and Surge share a same office at 789-1220 Ponder Street, Vancouver, BC V6c,1H2, Canada. They both share a secretary, a cfo, and a director.”

To paraphrase His-Orangeness, Lico claims “THERE IS NO COLLUSION!” Until the dust settles, we recommend you steer clear.

Thanks for the update, Mr. Kane. I always appreciate your articles and insights.