In this volatile, hot-boxed, block-chained environment – admitting that you are a “Gold Bug” is like confessing that your financial mentor is a Tarot card reader.

It sounds old-fashioned and flakey.

When the year began we ‘fessed-up’ to a degree of gold-buggedness.

This is the argument in favor of gold:

The Federal Reserve has printed more than $2 trillion since the global economic crisis began in 2008. This has more than tripled the size of its balance sheet.

The Price-to-Earnings ratio of the S&P 500 is double historical levels – and headed exactly where it always goes before a stock market crash. When that crash comes, there will be a stampede to gold.

One of the companies we talked about then was Ashanti Gold (AGZ.V) – a West African-focused gold development company with a hot-shot management team.

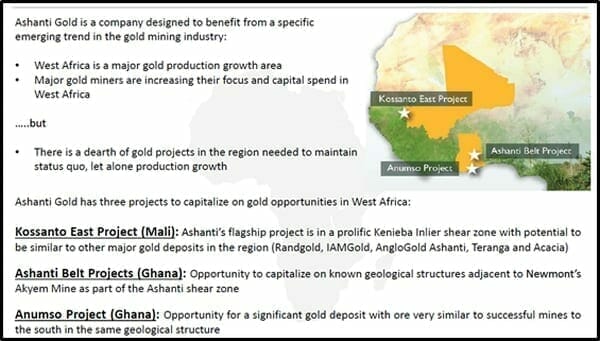

In a nutshell, this is the Ashanti story:

The CEO of Ashanti is Tim McCutcheon, a former investment banker with a track record of finding inefficiencies in financial systems – and exploiting them for profit.

Western Africa has overtaken Southern Africa as the continent’s gold-mining epi-center. New gold projects are coming on stream in Burkina Faso, Ghana, Mali and Sierra Leone.

“We asked ourselves a basic question:‘what do we know that others don’t know?’”, stated McCutcheon. “We put a team together that had a competitive advantage. Because we had been Kinross’s JV exploration partner in Ghana, we had a huge data base from that experience. We identified an opportunity to cherry pick the best assets out of the Kinross portfolio”.

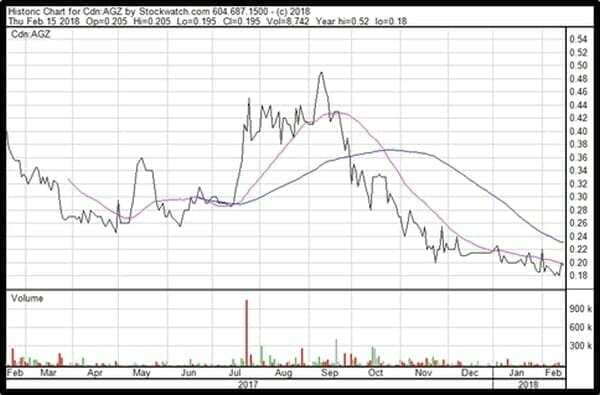

Full disclosure: we thought Ashanti stock was cheap on January 1, 2018

It’s even cheaper now [see 1-year chart below].

Ashanti’s market cap is currently $7.7 million – about the same valuation as Saint Jean Carbon (SJL.V) – a company that proudly unveiled a flagship product which proved to be less useful than a potato.

There are three principal reasons for the current AGZ stock price malaise:

- Macro money-flow into “hotter” sectors [blockchain/weed/energy metals]

- Some (not all) gold-grades that are less than eye-popping.

- It’s early stage [news flow contains words like “trenching” and “soil sample”].

That said, the Ashanti Gold Belt is one of the most prolific gold-bearing belts in the world, hosting Tarkwa (Goldfields), Obuasi (AngloGold/Ashanti) and Akyem (Newmont).

McCutcheon and his team are NOT sitting around “waiting for the market to turn”.

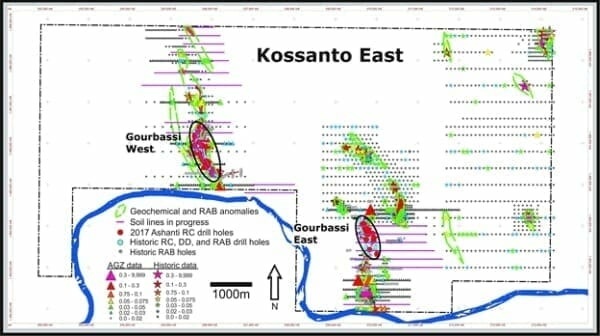

Kossanto East Project Update: (Mali)

On February 13, 2018 Ashanti announced results of its on-going exploration program at Kossanto East, Mali.

Beginning in October 2017 Ashanti began advancing the Gourbassi East and Gourbassi West mineralized areas while evaluating the potential of other targets in the area.

Exploration activities include “re-logging of Reverse Circulation drilling chips and diamond drill core,” along with mapping, soil sampling, rock chip sampling, and resampling of past trenches.

Mapping has identified structural elements important to understanding mineralization and has identified new targets with surface exposures similar to mineralized ones at Gourbassi West and Gourbassi East.

“Our drill program in the summer of 2017 was designed to confirm the attractiveness of the Project,” stated McCutcheon, “The whole team is excited about having the full data set to piece together a clear picture on the known 2.3 kilometers of strike length at Gourbassi East and West, as well as showing the potential beyond that 2.3 kilometers.”

Anumso Project Update (Ghana)

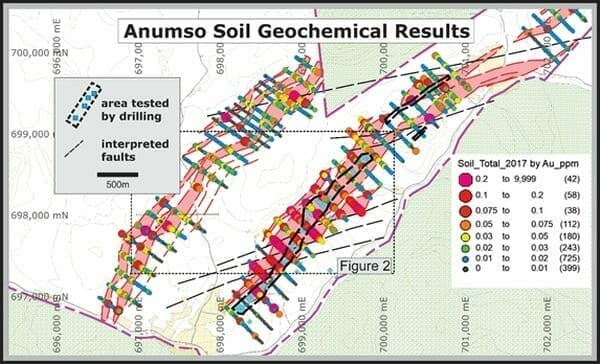

On January 18, 2018 Ashanti announced results from its recent soil sampling program on the Anumso project, Ghana.

As it turns out both the East and West Banket reefs display multiple lines of mineralization rather than a single line of conglomerate as previously understood.

The 29.63 km2 Anumso Gold lies within the highly productive Ashanti Belt of Ghana. The colonial Ntronang Mine, 7 km to the east of Anumso, is “the only location outside of the famous Tarkwaian gold deposits in the southern Ashanti Belt where gold has been produced.”

In previous times, this area was crawling with artisanal miners. In fact, the Anumso gold is “genetically similar” to that in the gold deposits of the 2.8 million-year-old Witwatersrand deposits of South Africa.

But the Anumso rocks are younger.

They are only 2.1 million years old.

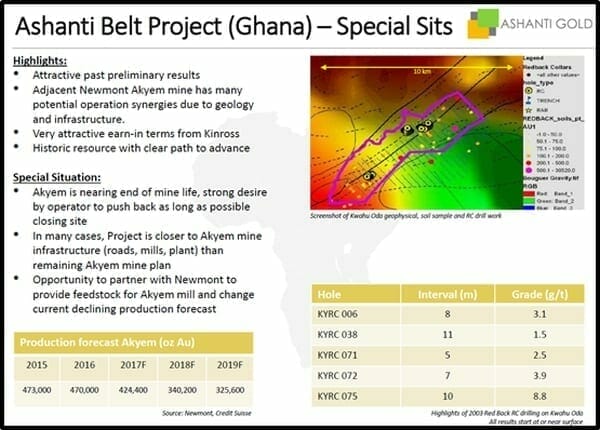

Ashanti Belt Project Update (Ghana)

The Ashanti Belt Project includes three prospecting licenses located in the Ashanti Belt in central Ghana. AGZ has the right to earn 100% of Red Back’s interest in the Project by spending a million bucks on exploration over two years

Targets include shear zone-hosted gold-quartz vein systems and gold in Tarkwaian conglomerates.

What’s a “Tarkwaian Conglomerate” you say?

The explanation involves a description of “fluviatile pebbles”, “acid volcaniclastic matrix”, “sinistral transpressive shearing” and “paragonitic muscovite assemblage”.

Let’s just agree it’s a lively street corner where gold congregates.

The Project consists of three licenses that cover a total area of approximately 68 km2.

These licenses have been selected to build on previous work by Red Back and Newmont. Directly to the south of the Project is Newmont’s Akyem mine, which was commissioned in 2013 and produced 473,000 ounces of gold in 2015, making it one of the largest annual gold producers in the world.

Historical Drill Results include: 10m @ 8.8 g/t, 11m @ 1.5 g/t, 8m @ 3.1 g/t, 7m @ 3.9 g/t, 5m @ 2.5 g/t.

Note to our readers (and our friends at the exchange): “historical drill results” can not be relied on.

Is it bullshit?

We want to say “No”.

But we also want to stay out of jail.

So let’s put it this way: Imagine you are sitting at a bar when a dude on the stool next to you starts relating a self-congratulatory anecdote from his high-school days.

He could be lying.

He might’ve misremembered the event.

He might’ve re-told the story so many times that’s it’s morphed into a fable.

The shit that came out of his boozy mouth: that’s “historical data”.

According to Investopedia: “Contrarian investing involves buying and selling stocks against the grain of investor sentiment.”

The concept is simple: If you purchase stocks when investors are gloomy, and sell the same stocks when your investing peers are euphoric, you’ll make money.

The price of bullion is up $40 USD in the last 5 days and is quietly closing in on the $1400 per ounce level.

That’s not enough to dissolve the gloom.

Even a Gold Bug knows that.

But when junior miners turn upward, the move could be violent.

Full Disclosure: Ashanti Gold is an Equity Guru client, we own stock and we’re not selling it.