I’ve noticed a subtle change in the order of things lately that, while it may seem a small thing, it’s actually a sign of something much bigger.

Normally, I see on social media groups about investing some form of the following:

“I’ve sold out of Company X, does anyone have a tip for where I can put my money next?”

More recently, I’ve started to see this:

“I have a small amount of money to invest – anyone know of a good company to put it in?”

The difference is subtle but important. The former, which we’ve seen for several years now, is recirculating money from one company to another, or one sector to another. The latter is money added to the market. It’s guys with a few hundred bucks at the end of the month desperately looking for somewhere to put it, instead of putting a little something extra on the mortgage or into the RRSP, or hiring a girlfriend for a few hours.

This means the market is growing. The big guys are buying into big ass bought deals, like the $40 million financing Supreme Pharma (FIRE.V) just closed (Good grief, John, how much walking around money do you need?), and the $34.5 million bought deal HIVE Blockchain (HIVE.V) just closed, even as they were pulling the handbrake on a big run.

But the little guys are also diving in heavier than usual, as is evidenced by the Green Organic Dutchman (TGOD) $36 million pre-listing raise, which has been delivered using the much-ignored Offering Memorandum, which allows non-accredited investors to join in through a broker. TGOD is approaching a total of 4000 investors in this way, building a massive investor base before it’s even on the market, and welcoming guys with $5000 instead of chasing a handful of whales.

When the average Joe is putting every available cent into the market, and their due diligence is ‘a guy on the internet said it was a good bet’, you know you’re deep into a bull run.

If we put on our self promotion hat, we could claim we’re a golden ticket to Win Town.

- We talked about Hempco (HEMP.V) last week and it’s gone from $1.00 to $2.84.

- We’re the only ones that have been covering QMC Quantum Minerals (QMC.V), which we’ve watched from $0.10 to $0.75 today.

- We talked up DOJA Cannabis (DOJA.C) last week and it popped from $0.78 to $1.14 before profit taking today.

- We wrote about Stony Hill (STNY:OTC), which is going to be demoing its CBD product lines [seen right] at tomorrow’s Marijuana Business Conference in Vegas, and it jumped from $2.25 to $3.00 in a day.

- We just kicked in a marketing program with Calyx Bio-Ventures (CYX.V) and it’s up from $0.095 to $0.20 in less than a week.

- Our good friends at Tinley (TNY.C) have launched from $0.28 to $0.47 since we reminded folks that any beverage/weed combo shift might be wise to look at them first since they’re, you know, actually combining weed and beverages.

- We’ve covered Reliq Health Technologies (RHT.V) for some time, and it’s launched from $0.20 to $0.80 these past few weeks.

But is it us or is the market just chasing everything?

Hell, folks who held Cannabix (BLO.C) yesterday are up 40.8% today on the least important news they’ve ever released – that they made a ’50 BC Innovations to watch’ list. Are those investors geniuses, or is the market spotting a 10% run and turning it into a 40% run by chasing its own tail?

Wildflower Marijuana (SUN.C) put out a ‘hey, remember us?‘ press release and jumped 18.6% today. Nutritional High (EAT.C) has jumped every time an executive has farted over the last few weeks, which was definitely unearned but has now put the company in a position where it can raise funds at a decent valuation and actually do the business it’s only talked about for the last year. Some of the weed stocks running are total nothing-burgers, and from social media chatter I’m seeing, even those buying in are aware what they’re buying is bullshit – but it’s bullshit that’s caught a wave for a moment so “Cowabunga..”

The simple answer to all of this is, legitimacy-seeking market forces have been overrun by ‘greater fool’ market forces, which watch for any 10% uptick and jump on it, knowing that others will follow as that 10% moves to 15 and 20 and beyond. These investors don’t care if a news release is real or vapour, they don’t care if a CEO is a stock promoter or a company builder, and won’t be saddened nor shocked if something they buy today implodes next week, as long as they’re out of it before the greater fools are.

What we saw with HIVE a few weeks back, with double digit climbs every day, was an example of this in motion. HIVE should be where HIVE is right now (and I say this as someone who owns the stock), and its move to release escrowed stock, to add volatility to the market, which brought it back from $6.50+ to $3.40 was smart. By doing what it did, it shook off a thousand day traders who were going to, at some point, cash out of the company anyway, and they killed an impossible to justify run in order to bring common sense back to their stock chart.

The big money wasn’t fazed by that, and has since bought into its big $34.5 million financing, which will allow it to do more deals and continue its tendency to rise. The only ones pissed at the move? The daytraders who got caught out by it. And, frankly, fuck those guys. They’ll chew on the carcass of something else.

It’s fine to make money in an insane market, and that’s what this is, but you have to understand exactly where you sit in the pecking order. If you’re buying anything on a rise, you are the greater fool. If you’re watching what the daytrader jackals feast on and moving in as they leave, you’re the value investor.

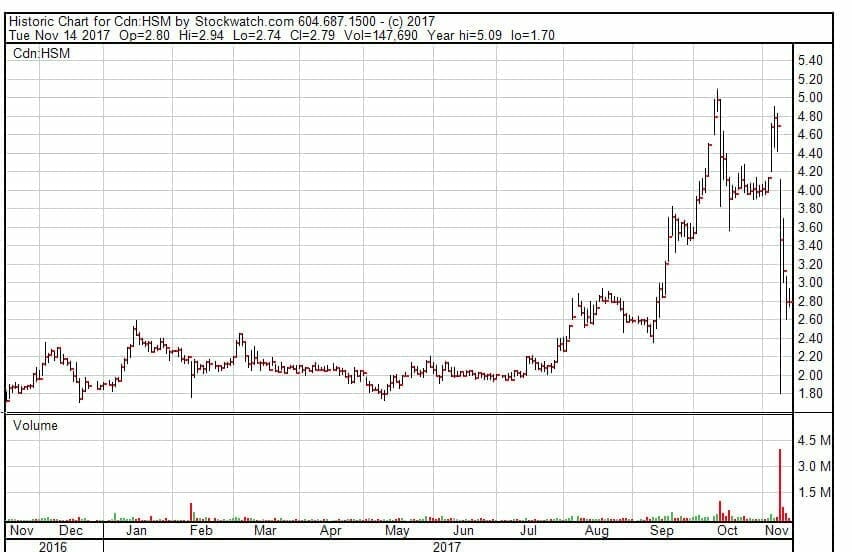

A great case in point, I think (we’re actually having a biotech expert analyze things this week and hope to have a detailed report ready for you soon) is Helius Medical Technologies (HSM.T). We’ve written about Helius a fair amount over the last few years, and think it’s an interesting deal. For a while it was cheap and the market had passed it by, but in August it suddenly caught the daytrader wave and flew, from a longstanding $2 level to $5 and beyond.

It’s going through the process of trialling its tech and, last week, released an update that the market read as negative, even though the company sees it otherwise – and people with medical knowledge that I’ve talked to agree.

Didn’t matter. The daytraders saw a negative term or two and pulled out, and soon enough stop loss triggers were being hit, and then it was ‘timberrrrrrr’ from $4.80 down to $1.80.

The value investors have jumped on since, and it’s back to $2.80, which I suspect is still cheap (we’ll know for sure soon), but the company is now left with a black mark on its stock chart that the less informed investor going forward will go running from, even with future positive news at the ready.

Be careful out there, brothers and sisters. While it’s been a long time since multiple sectors were on a bull run at the same time, when one of weed, blockchain, crypto, energy metals, real estate, and whatever else is going nutty currently experiences a rapid decline, those declines will be far more rapid than you can imagine.

Understand how to set up a stop loss trigger. Understand that bigger forces than you will kick a stock downward to trigger your stop losses and support a short sale. Understand that half of what you’re seeing is temporary and that your wins do not make you a ‘trading genius’. Understand that you are bad at this, and that the strong market is obscuring that fact from you. Understand your rent or mortgage payments come first. Understand that the market can only keep rising if new money is entering it, and that when new money dries up, a lot of what you’re seeing as winners will run out of walking around money quickly, and shoot to the bottom.

It’s okay to put money on vapourware if you can afford to lose your stake and think the risk of that is justified by the money being made on it today. Just keep your wits, stomp your ego, and be that guy who is first out rather than the one sticking around, averaging down, who is ‘totes certain’ that it’ll all come back tomorrow.

— Chris Parry

FULL DISCLOSURE: QMC Quantum Minerals, Stony Hill, Calyx, Tinley, and Green Organic Dutchman are Equity.Guru marketing clients. The author owns stock in Calyx, QMC, HIVE Blockchain, TGOD and Stony Hill.

NB:

1. Doja Cannabis (“DOJA”) announced a name and symbol change on January 30th, 2018 as a result of its merger with TS Brandco Holdings Inc. (“Tokyo Smoke”). Effective 31 January 2018, the company trades as Hiku Brands under the ticker symbol HIKU.C

2. Pursuant to a resolution passed by the directors dated Nov. 27, 2017, Calyx Bio-Ventures Inc. changed its name to Calyx Ventures Inc. effective as at Feb. 5, 2018. The ticker symbol CYX is unchanged.

3. BEVERLY HILLS, CA / ACCESSWIRE / March 7, 2018 / Stony Hill Corp. (OTCQB: STNY), a diversified cannabinoid therapeutics company focused on the medical, bioceutical, and pet health industries, announced today that it will change its name to Applied BioSciences Corp., to better reflect the focus and resources of the Company.

Hi Chris,

Great article!

I remember back in the fall when you sold all/most of your weed stocks and moved to cash positions, do you see a similar pattern emerging that people will move on to the next thing?

A bunch of us used to enjoy your streams on Twitch and it help us get a good understanding of how things worked, without reading endless financial data.

Thanks for doing what you do.

James