When the history books are written on this passage of our lives, under pandemic lockdown and with once-in-three-generations levels of unemployment, they’ll note that in order to save us from economic collapse, the government printed trillions of dollars and just fired it all into the markets out of a bazooka, only to establish a decades-long down drag when the bill for all that money came due.

Here’s the head of the Fed, admiting he’s running out of printer ink and not apologizing for the fact.

This is the most important clip in the world today pic.twitter.com/NG0PGmpczs

— Scheplick (@scheplick) May 18, 2020

There’s probably respect to be given for this from a purely political standpoint, to punt the devastation far enough down the road that the next several US political https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrations will need to dig out from under it, but that makes me far more uneasy than if we’d just let things crash when and where they should have and set about making the market and its participants better going forward.

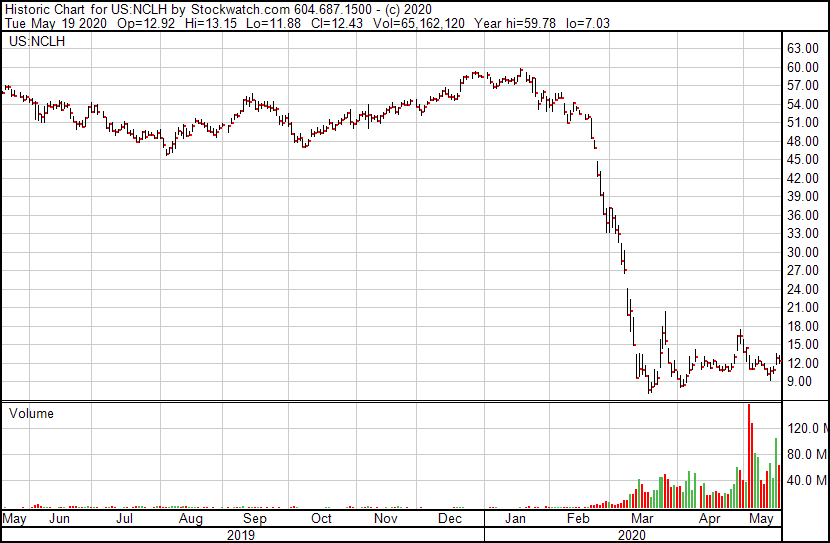

Eventually, the Fed is either going to need to stop being a bagholder, or start selling equities in numbers that will be hard to fathom. Make no mistake, there’s a reckoning on the way. Saving Norwegian Cruise Lines (NCLH.NSE) from doom when nobody is likely to want to take a cruise for the next five years is not a wise use of borrowed funds, but there it is, being bought and bought and bought every time it tries to go down, so people can keep telling themselves that ‘the market is strong’.

In the meantime, folks are enjoying using just-printed money as house winnings. Party hard, boys and girls, but please remember that the ass falls out of an economy much faster than the rises rise – take your profits as you go and don’t be the last one out of the room when the floor cracks.

If I look down my ‘interesting’ list today, it’s a sea of green, which is great for my business, but not so great I’m going to sell y’all out and tell you it’ll never end. We’re in crazytown right now, so make sure to put your safety harnesses on.

Personally, I’m keeping my retirement money in cash right now, as I think we’re a few catastrophic quarterly financials away from dogs and cats living together and zombies climbing over the back wall.

So if you have the stomach for it, and know what a stop loss is, here’s some food for thought.

Revive Therapeutics (RVV.C), is up 70% today on a corporate update that didn’t so much as tell anything new, but did remind a few people that the novel pharma sector chaser has more than one tailwind behind it.

Revive’s jump today can likely be credited to the fact that it’s starting from an ultra-cheap valuation, but also that after a few middling runs at pharma, cannabis, and recently shrooms, there was a boatful of earlier investors looking for an opportunity to get out intact that are now out. What was an investor churn two weeks ago, is rubber hitting the road now.

I’ve said my piece several times before that cycnics can poke holes in RVV all they want, but if you were a company in good shape getting into COVID-19 trials, hiring the right consultants and doing the right things, and getting really strong feedback from the FDA about the likelihood of getting a greenlight quickly, RVV right now is exactly what you would look like.

71% daily jumps do make me nervous, but not so nervous I can’t relish in the fact we told you about this thing when it was grinding to move from $0.05 to $0.10 and being told we were pump-and-dumpers for doing so.

Today’s close: $0.275.

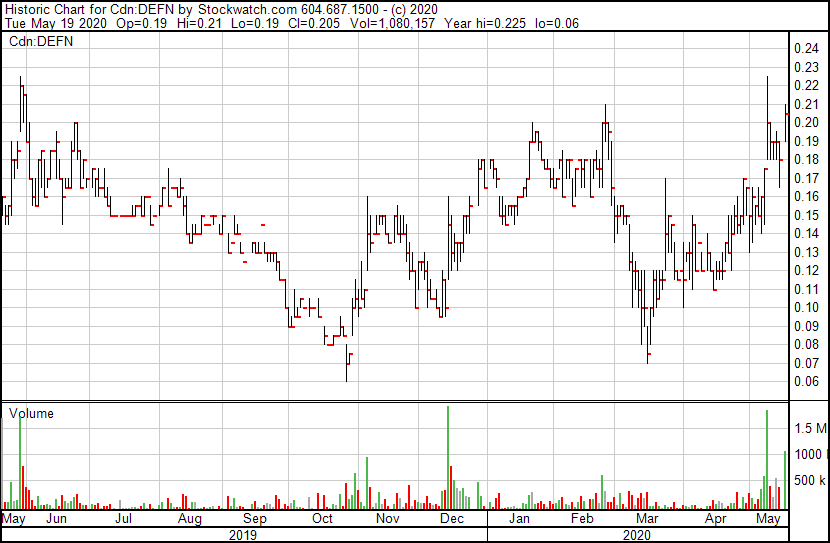

Defense Metals (DEFN.C) just raised some money to move their Wicheda Rare Earths Property in Prince George BC, forward, and if you’re not a mining gal and don’t know what that means, let me break it down for you.

Rare earths are elements used in electronics, green energy components, military use, and national security enterprises. They’re also in short supply and usually imported from places that the US could conceivably be militarily opposed to at any given point.

Defense isn’t yanking rare earths out of the ground in an operational capacity just now, but is quickly working through the process needed to get there, and doing so on the dirt cheap. They literally dropped a new resource estimate with a 49% increase in tonnage and a 30% increase in grade just a few days ago, and the market likes what they see. Up 20% on the day.

DEFN is up a triple since mid-March, yet still just a $6.7 million market cap deal. COVID or not, a lot of smart mining people are impressed with this little play.

Supreme Cannabis (FIRE.V) continues to push hard against the $0.30 line that I’m convinced is an artifical hold point by someone transitioning out of the stock (or trying to keep it down for whatever personal reason).

Every time FIRE headbutts that $0.30 ceiling, for months now, it goes no further and, for mine, we’re far beyond the ‘that’s an interesting coincidence’ point and right into the ‘why is it occuring and when will it end’ question.

In the short term, it means FIRE is a poor day-trade. In the long term, recent financials showing flat sales growth as sector price drops balance out the increase in number of products sold give pause for thought, and the effective writing off of $57 million in value in their Blissco, Truverra, and Khalifa Kush subsidiaries made it a rough, if necessary, quarter. Those charges should make life easier going forward.

If you’re going to buy FIRE right now, buy it and forget it. Watching it trying to claw its way through that price ceiling every day will just frustrate you until you become one with the idea the ceiling is artificial and temporary.

I still believe Supreme’s 7Acres brand is the best in Canada, and if they can start getting edibles to market, and run close to break even before their $20m in hand runs out, a run is real.

Supreme was up 15% today to – you guessed it – $0.30.

We told you last week Nexus Gold (NXS.V) was breaking out after a year-plus of having more than one boot on its own neck, and it has continued to look like that’s the case.

NXS is raising $250k to further its drill program and, with just an $8 million market cap, looks like a good wager on the gold sector. That said, it was a $3 million market cap when we talked about it two months ago, so some of us are already drinking bubbles on the back of this thing.

If the stock is finally being allowed to move with the tides, the pressure is on Alex Klenman to reward the faith many have held in this deal and gear it up into another digit, and fast.

So far, so good:

The phase 1 program will consist of a minimum 1,000-metre diamond drill campaign, with up to 10 drill holes targeted to depths between 100 to 200 metres, at angles ranging from 45 to 60 dips. Phase 1 is designed to test the mineralization potential of several gold targets occurring within a corridor located in the southernmost section of the 1,348-hectare claim block.

It shouldn’t be as cheap as it is, and I don’t believe it’ll be as cheap as it was, any time soon.

Luckbox (not public yet): I just got off a call this morning with the CEO of this online e-sports gambling outfit, and his presentation is flawless. Like watching Jordan dunk. Love the business model: A fully licensed Isle of Man-based e-sports tournament odds outfit that is ramping up revenues fast, has kept its head down rather than try to out-market opponents but, in doing so, has timed its run beautifully into COVID-19 and is prepping to list in July.

I bought in on this thing early because I know the e-sports market really well and these guys are the only ones to have a real means of monetizing it out of hundreds who’ve come and gone, they have a murderer’s row of executives with sector experience and real runs on the board, they have a working system that doesn’t require up-licensing, more dev, or acquisitions to make it work, and they’re being super-careful to ensure they have zero issues with regulators.

It’s a grown up e-sports play, priced respectfully, and not prone to the ups and downs of a given game, which is my big issue with ‘e-sports team’ plays – Enthusiast Gaming’s (EGLX.T) e-sports division just had its entire Overwatch League roster quit on them, btw, which is an example of what can go wrong when you put all your eggs in one game’s basket.

Gravitas Securities is handling the last raise before Luckbox goes public, and it’s filling fast. Talk to your broker.

Don’t look now but Isracann (IPOT.C) is climbing over your back wall and having its way with your girlfriend.

Actually, do look. After a good six months of trying to tell people it was a real Israel-based LP in the making, that story has finally taken root after the company pivoted, streamlined, and finally worked its way through the Israeli system to the final stage of licensing approval.

Today, the Company received notification that the local authorities have completed the mandatory security inspection of the facility. No early reports of any deficiencies were identified, and the certification consultant is preparing the final report to the Ministry of Health for recommendation of final approvals. Subsequent plans to advance to planting are imminent and anticipated to commence next week.

Company CEO Darryl Jones notes, “All reports from Israel are highly favourable and we appear to be days away from having seeds in the ground. This news combined with a growing sense of urgency across the domestic and European marketplace is genuinely exciting.”

We’ve been telling you about these guys for a long time, admittedly to yawns from a lot of you because Israel isn’t a place you could identify on a map. But as an entry to the European market, and an innovator in the cannabis space, and a country with a real history of understanding commercial agriculture with an inexpensive infrastructure, you could do a lot worse than dig into this deal.

IPOT sits on a very nicely valued $42 million market cap and is starting to get the respect it deserves.

World Class Extractions (PUMP.C) has changed its business model to be more focused on its Pineapple Express same day cannabis delivery service and less on building extraction centres for other parties, which might be based on the business decisions of others in this COVID-19 afflicted world than their own, but will go a long way to preserving capital in the short term.

PUMP still takes an unending barrage of shit for its ticker symbol which all but obscures the work actually being done to build a growing business. But in PE, they’ve got something that pretty much any cannabis investor can appreciate:

Pineapple Express Delivery is experiencing significant growth in B2B and B2C deliveries having completed 7,916; 8,935; and 22,478 deliveries in January, February and March (estimate) 2020, respectively, resulting in revenues of $131,179, $154,962, $347,897 in January, February and March (estimate) 2020 respectively, against gross margin of -12% (Jan), 12% (Feb) and 25% (March estimate) over the same period. Pineapple Express Delivery’s impressive revenue growth is demonstrated by March revenues being 265% of those in January as the company’s operations continue to ramp up to satisfy the current demand.

As well, PE is in the process of submitting its evidence package to Health Canada to obtain a medical sales license for its GTA facility, which would give the company “the ability to store inventory for other LPs at its licensed facility, by way of supply agreements.”

My honest belief is that, if Pineapple Express, making $630k per qtr in sales ($2.5 million annualized – compared to $795k in 2019 for Namaste (N.C) owned-competitor CannMart), were to go public under its own banner, it’d be a $20m valuation in the present market.

PUMP picked it for debt, and sits on a market cap of the entire operation of just $15 million.

PS: Today, PUMP announced PE made $819k (unaudited) in April, which is up 49% in gross profit margin.

To reiterate (sales, gross margin):

- January: $131K, -12%

- February: $154k, 12%

- March: $347k, 25%

- April: $819k, 45%

If they only hold that April sales level for the next 12 months, that’s $9.8 million in revenues. And now they’re delivering liquor too.

At $0.02, Imma go ahead and say PUMP is hiding in plain sight, ready for you to take her seriously, and it’s time to get over the damned ticker symbol already… or change it.

PredictMedix (PMED.C) is killing it right now. I’m not going to go into the details on it here because Arth Gupta wrote the thesis on this thing last week, but slot it in as a COVID-friendly play with real world application.

Equipment doesn’t scale. Software does. With a cash burn of ~$45K/month, the current cash on hand gives them ~38 months of runway. You’d think it’d be run like a bad startup that went public too early. Except:

- Product market fit: PredictMedix’s technology is already deployed for COVID-19 testing at hospitals

- The “AI” thing: the reason you know it’s not a buzzword is because Microsoft’s (NASDAQ.MSFT) director for Business Development just joined their advisory board

- Path to Profitability: They just closed a deal with Hindalco. A publicly traded Indian multinational company that brings in close to $19 billion in annual revenue

- They have some big alliances

If your product is software, it can scale. As it scales, it gets better at doing what it’s supposed to do.

PredictMetix has done the smart thing by not going big. They’re not claiming to solve COVID-19. They’re not claiming to eliminate, contain, or cure any type of disease either. They’re simply making it easier and faster to detect problems (if any) in a) drug impairment, b) Infectious disease, and c) mental illness.

The chart tells the story.

American Aires (WIFI.C) promised a lot of things early when it debuted on the public markets and, much like its stablemate company, Drone Delivery Canada (FLT.V), took a little longer than it should have to prove itself out.

But FLT is sitting on a $100m market cap, even after sliding down for much of the last year as it has progressed as a company. Aires is decidedly smaller.

Selling equipment to help folks block the harmful effects of wifi, a struggle you may not personally share but will at least acknowledge a lot of folks out there do, the only metric that really matters in gauging WIFI’s worth is sales – and those are climbing hard.

For the month of April 2020, Aires had record sales of $252,431 CAD (unaudited) compared to sales of $172,672 CAD (unaudited) in March 2020, a 46.2% increase month over month.

With the increasing panic surrounding the rollout of 5G networks, including a large chunk of folks who blame COVID-19 on that tech, American Aries is likely to keep growing at a clip from the $3 million annualized based on the most recent monthly revs.

A marketing spend has recently commenced, which should see sales ramp but will also see costs spike. Management’s ability to manage both the spend and its effectiveness will dictate whether this is a nice little earner, or runs hard. The stock has leveled over the last six weeks, so that tells me there are plenty of folks lying in wait.

Meanwhile, those scared of 5G have taken to burning down cell towers in Canada, New Zealand, and Europe.

All over Europe, 5G telephone towers are being set on fire. At least 16 masts in the Netherlands have gone up in flames. There have been attacks on 5G equipment in Italy, Ireland, Belgium and Cyprus. The United Kingdom, ever-keen to outperform the Continent, has witnessed more than 60 such acts of arson.

Seems to me like folks are looking for what American Aires is selling.

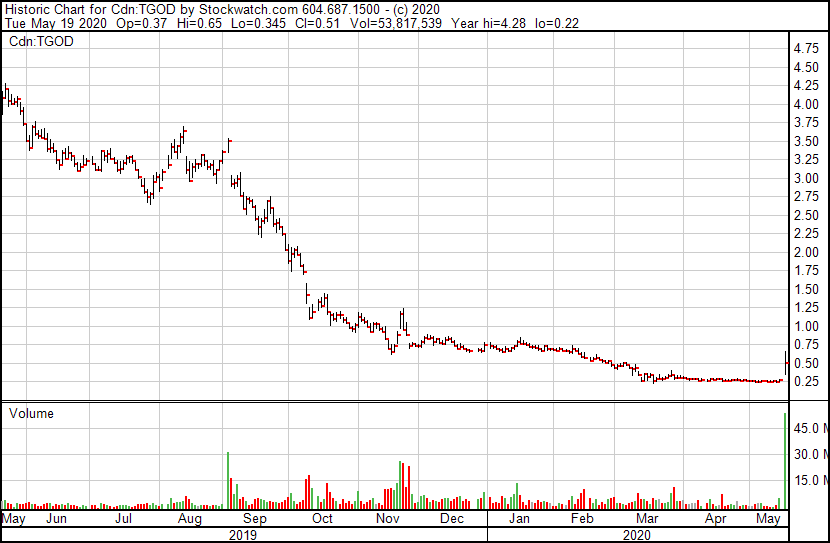

Green Organic Dutchman (TGOD.T) ran 85% today to $0.51, on the back of an announcement it has a supply deal for cannabis products to the giant Canadian pharmacy chain Shoppers Drug Mart’s online cannabis delivery platform.

I couldn’t tell you if anyone actually uses that platform, or how much this deal will bring TGOD, but this is the most positive news that company has put out seemingly since the Boer War ended.

Under the terms of the agreement, Green Organic Dutchman will provide Shoppers with a broad portfolio of certified organic medical cannabis products, including its latest 2.0 offering such as infusers (dissolvable powder), teas and vapes. The agreement is for a three-year term with a renewal clause for an additional two years.

I just received the TGOD dissolvable powder and look forward to putting it through its paces. Internally we’ve been referring to it as TG Fuel, since it appears to mirror the ‘gamer’s energy powder of choice’ format. If it works, if the dosage is consistent, and if the branding resonates with seniors, the Shoppers deal could end up being a nice one for the company. The price jump surprised many on social media, even the most grizzled of TGOD haters.

Hate to say it … but $TGOD could get another double digit bounce going into tomorrow. Short Squeeze and Retail buying is back temporarily. #PotStocks

— Betting Bruiser (@BettingBruiser) May 19, 2020

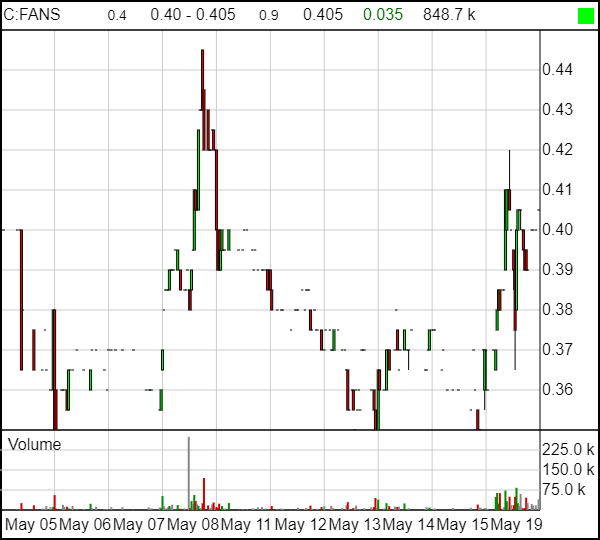

Lastly, newly listed sportsbook with an esports kicker FansUnite (FANS.C) is a daytrader’s wet dream. If you can pick how it’s going to go from day to day, you’re probably the one moving it.

— Chris Parry

FULL DISCLOSURE: Most of the companies mentioned in this piece are either Equity.Guru marketing clients, have been Equity.Guru marketing clients, or are in discussions to be Equity.Guru marketing clients. No promises made, no recommendations given, just noting news and moves. If you’re wondering why your favourite company isn’t mentioned, with this many companies paying for my attention, when exactly do you think I have time to write about your raggedy ass shell for free?