With all of the carnage in the broader markets of late—S&P 500 futures are currently off 5%, Crude Oil (WTI) is off a whopping 30%—there are precious few bright spots.

Market volatility is beginning to take on a somewhat surreal quality.

The recent 50-point emergency rate cut offered a glimmer of hope, a move by the Fed—the gatekeeper of the U.S. economy—intended to reassure us that our collective backs are covered.

Not good enough—the market is now expecting a 75 BPS cut from the Fed on March 18th.

The Bank of Canada followed suit with a cut of similar magnitude, stating that they’ll act again to reduce rates if necessary. The Reserve Bank of Australia was actually the first to act, cutting rates early last week by a quarter-point to a record-low 0.50%.

This is turning into a coordinated effort by central banks around the globe to goose what was the longest-running bull market in American history.

Now that we are clearly in correction mode, we need to ask ourselves, “how much in the way of economic stimulation should we expect from further rate cuts?”

Have declining bond and note yields not already factored those cuts in?

U.S 10-year money is now below 1% – yielding 0.50% as I tap away on my keyboard.

Gold

U.S. Treasuries are currently yielding the square root of dick. Should one look to gold?

Tough call—we could see some price weakness in the metal if it can’t break through resistance at $1700.

Longer-term, gold is a no-brainer (IMO).

Nexus…

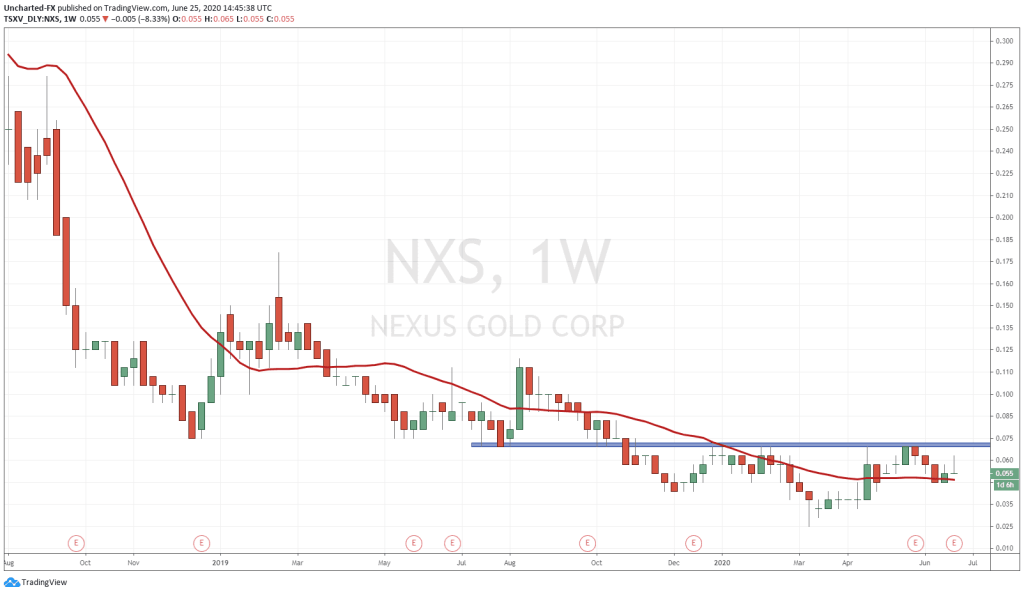

While 2019 was a year of acquisitions, 2020 will be the year to drill for Nexus Gold (NXS.V).

I caught up with Nexus CEO Alex Klenman the other day and was brought up to speed on where things stand with the company.

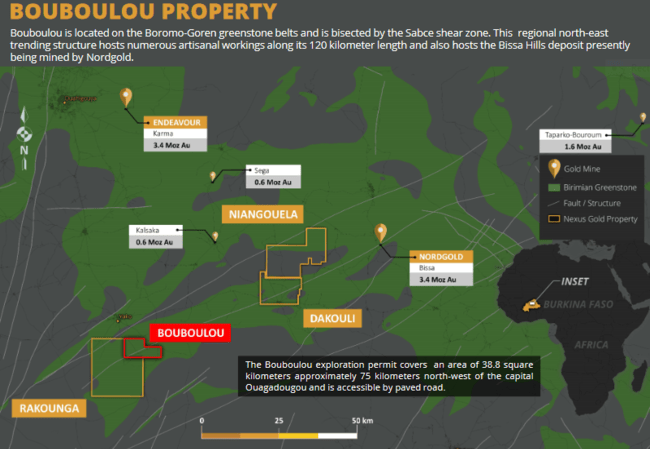

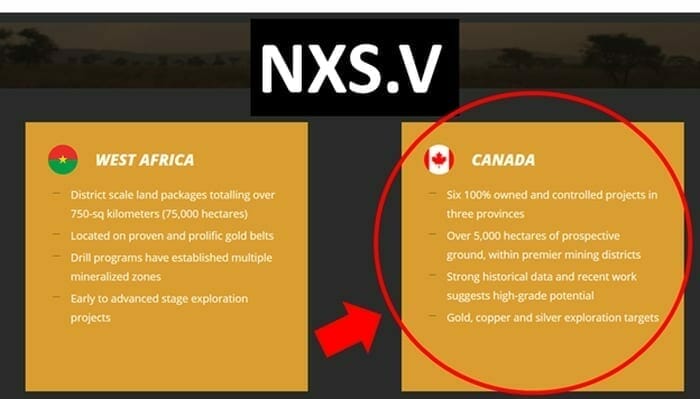

Nexus has a large portfolio of prospective projects divided between West Africa and Canada, some of which are available for joint venture à la the project generator business model. The company’s Rakounga Project was the first domino to fall in that regard.

Nexus Gold (NXS.V) Monetizes Rakounga Gold Project for $2.25 Million in Cash and Work Commitments

Flipping one or more of the projects in their portfolio isn’t out of the question either. The goal is to minimize further dilution as it sets out to drill—the company is examining every available option.

The three projects that bear flagship status—those that will see the lions share of spending this season—are McKenzie, Bouboulou, and Dakouli 2.

We’ll start with McKenzie since it’s fully funded and will be the first to be tested with the drill bit.

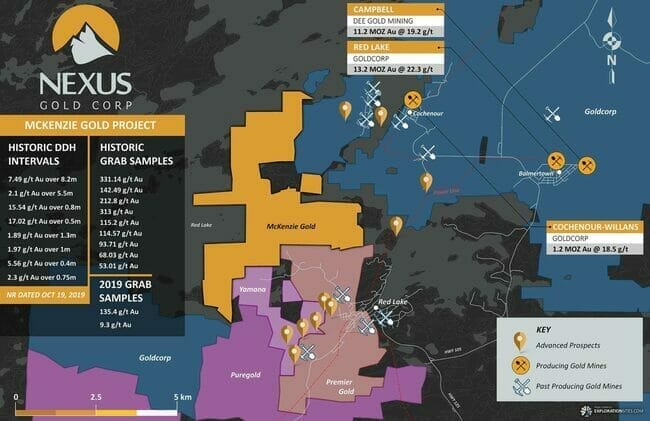

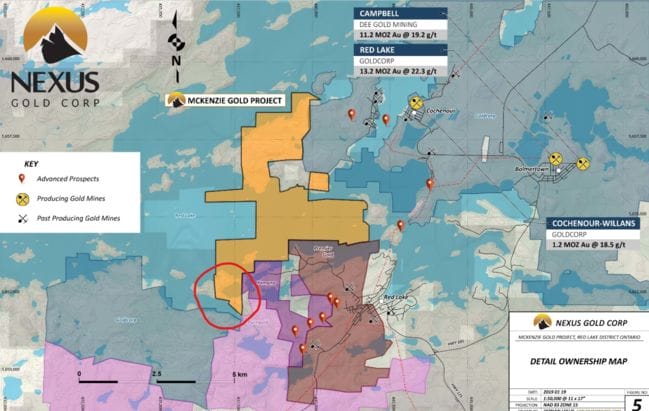

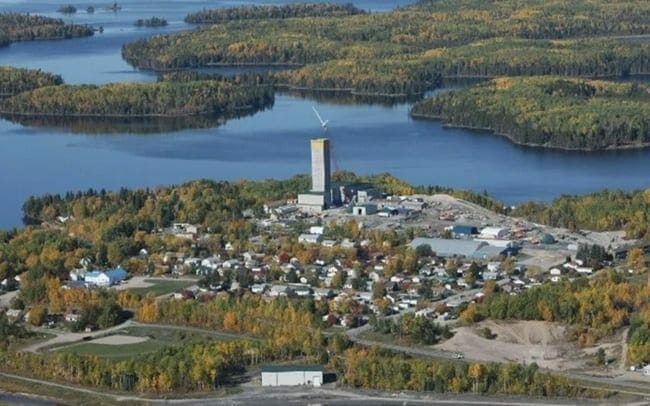

The 1,348.5-hectare Mckenzie Gold Project is located in the heart of the Red Lake Mining District, in a good neighborhood, flanked by the likes of Newmont-Goldcorp (NGT.T), Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T).

The company is ready to go—they’re waiting on a permit.

The timeframe for the receipt of drilling permits is generally between one and two months—we’re well past day 30 right now.

Nexus is currently taking bids from drilling contractors.

Red Lake specialists, Rimini Exploration, will be supervising the drill program.

Once the permits are in hand, the company will mobilize a rig and commence a phase one, 1000-meter diamond drill program to test a corridor occurring along the southern contact of the Dome Stock (with felsic Volcanics) of the Balmer Assemblage.

This southern portion of the McKenzie project is bordered by Premier Gold’s Hasaga property and Pure Gold’s Madsen Gold property.

Historic drilling along this corridor intersected 7.49 g/t Au over 8.2 meters, 15.54 g/t Au over 0.8 meters (includes 23.4 g/t over 0.3 meters), 4.47 g/t gold over 1.4 meters, 17.02 g/t Au over 0.5 meters, 23.87 g/t Au over 0.2 meters, and 2.1 g/t Au across 5.5 meters.

There are multiple high-priority zones further to the north the company intends to drill next. Surface values along these zones include 331.14 g/t Au, 18.02 g/t Au, 212.8 g/t Au, 313 g/t Au, 18.02 g/t Au and 9.37 g/t Au.

A summer-of-2019 reconnaissance program at McKenzie returned assays that included 135.4 g/t Au and 9.3 g/t Au.

On McKenzie Island (North Block), high-grade surface values include 142.49 g/t Au, 115.2 g/t Au, 114.57 g/t Au, 93.71 g/t Au, 68.03 g/t Au, 53.01 g/t Au, and 16.65 g/t Au.

There’s no shortage of drill targets at McKenzie. During this first phase, should the company like what they see coming out of the ground, they’re sufficiently funded to expand the program to 2,000 meters.

Burkina Faso

The company has 10,000 meters of drilling planned for its West African projects in 2020.

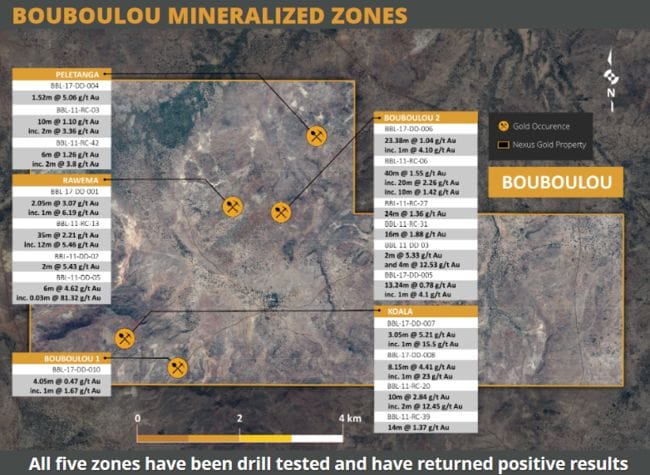

While McKenzie may offer the best shot at a discovery in the short term, the company’s Bouboulou Gold Concession in Burkina Faso is the most advanced project in their portfolio.

Bouboulou offers shareholders the best shot at a resource and an aggressive 8,000-meter, 30 hole drilling campaign could produce one. The company envisions a combination of reverse circulation and diamond drilling.

Any meaningful resource produced here will almost certainly get the attention of Nexus’ neighbors.

When I asked CEO Klenman what his options were in getting the required funds to push Bouboulou further along the development curve, he could only state that they are in talks with potential partners, but nothing is finalized. We should hear more on the Bouboulou funding front soon.

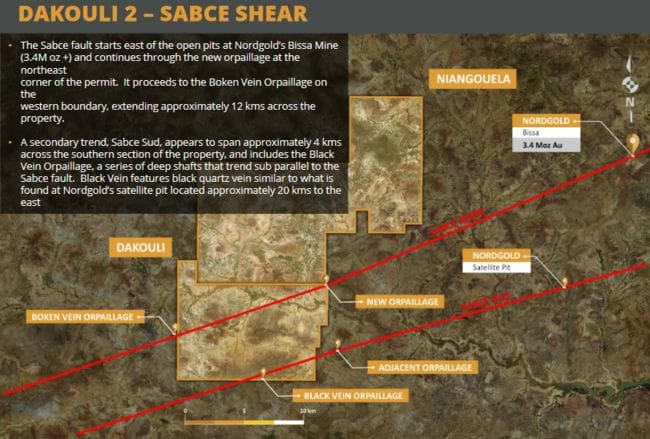

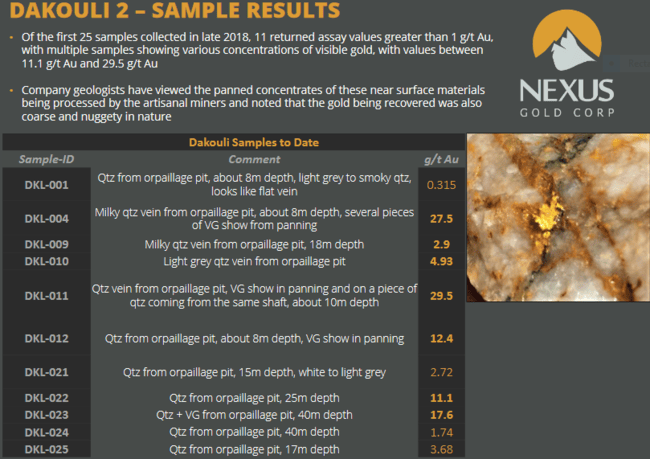

The Dakouli 2 Project will also get a probe with the drill bit this year.

Dakouli is a compelling project.

Warren Robb, Nexus VP of Exploration had his sights set on Dakouli from the get-go. For those unfamiliar with Robb, he was Roxgold’s chief geologist in 2012 where he supervised exploration on the Bissa West and Yaramoko gold projects.

Robb believes Dakouli is ripe for discovery.

Artisanal miners on the property are working a strike of roughly 400 meters and going down 80-plus meters.

In a previous Guru offering, we noted:

The artisanal miners, after doubling the strike length of these veins and going down even deeper, demonstrate that it’s a mature system. Its orientation, its depth, its grade—these are the questions that only the truth machine (drill rig) can answer.

Recent sampling at Dakouli has generated some extraordinary surface values of high grade, nuggety visible gold (20 to 30 g/t).

A new acquisition

On Feb. 4, the company dropped the following headline:

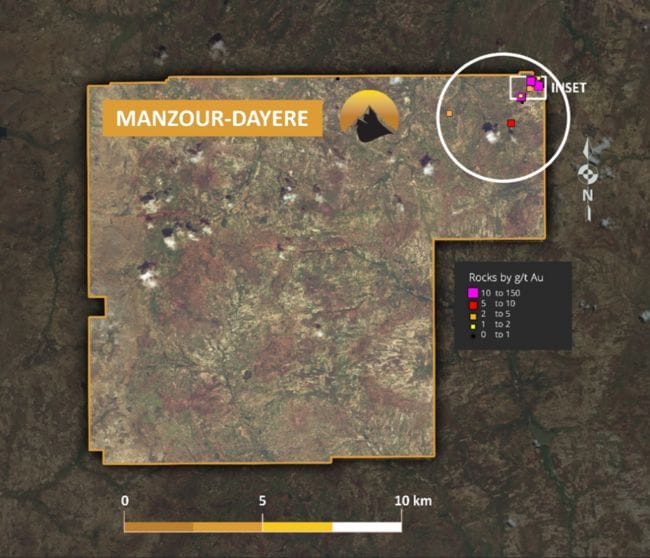

Nexus Gold Acquires Manzour-Dayere Gold Project, Burkina Faso, West Africa

This 19,053-hectare project is located on the Boromo Greenstone belt, near the border with Ghana. This area is home to several producing mines, including Yaramoko (Roxgold), Hounde (Endeavour), Poura (Newmont), Bondi (Sarama) and Gaoua (B2Gold).

“Historical exploration conducted on the property between 2011 and 2014 has identified an area of large artisanal workings (“orpaillage”) located on the property. Sampling* conducted at this time throughout the artisanal workings returned reported high-grade values of 132 grams-per-tonne (“g/t”) gold (“Au”), 85.40 g/t Au, 61.20 g/t Au, and 27.9 g/t Au, from select grab samples of quartz veining at the orpaillage, while select grab samples of the sedimentary host rock have returned values of 103 g/t Au and 21.40 g/t Au, respectively. The workings on the orpaillage are extensive and extend to depths of 60 to 80 meters below surface.”

Following fast on the heels of this recent acquisition, this headline dropped:

Immediately after acquiring the Manzour-Dayere project, company geologists put boots to the ground performing a comprehensive ground reconnaissance program—taking surface samples and mapping active orpaillages (areas of artisanal mining activity).

“Results of the first dozen grab samples have been received from an active artisanal zone in the northeast corner of the concession. Highlights of this initial round of sampling includes 9.60 grams-per-tonne (“g/t”) gold (“Au”), 7.07 g/t Au, 5.73 g/t Au, 3.84 g/t Au and 2.84 g/t Au. These new samples add to the historical data collected to date and will assist Company geologists in determining potential exploration targets for future drilling.”

The company now has nine prospective irons in the fire—five in West Africa, four in Canada.

Final thought

If CEO Klenman has his way, 2020 will be the year of drilling for Nexus.

The next piece of news to drop should be the receipt of drilling permits and the mobilization of a diamond drill rig to their project in Red Lake.

END

—Greg Nolan

Full disclosure: Nexus Gold is an Equity Guru marketing client.